444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global immunoglobulin market has been growing rapidly in recent years due to an increase in the prevalence of various immunodeficiency disorders. Immunoglobulins, also known as antibodies, are proteins produced by the immune system to help fight off infections and other foreign substances. These proteins are used in the treatment of a variety of disorders, including primary immunodeficiency diseases, autoimmune diseases, and some neurological disorders.

The market for immunoglobulin products is expected to continue to grow in the coming years due to a number of factors, including advancements in biotechnology and an increasing number of clinical trials for new treatments.

Immunoglobulins are a group of proteins that are produced by the immune system to help defend the body against infection and other harmful substances. There are five types of immunoglobulins, or antibodies, that are commonly found in the human body: IgA, IgD, IgE, IgG, and IgM.

Executive Summary

The global immunoglobulin market is expected to continue to grow in the coming years due to an increase in the prevalence of various immunodeficiency disorders. The market is driven by advancements in biotechnology, an increasing number of clinical trials for new treatments, and an expanding patient pool. However, the market is also facing some challenges, including high costs and regulatory hurdles.

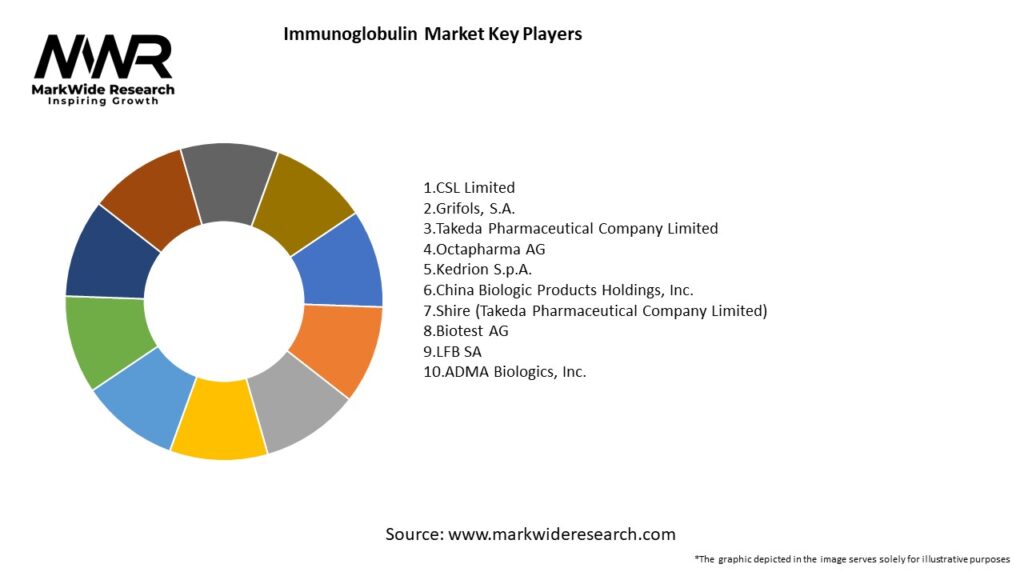

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The immunoglobulin market is driven by a number of factors, including an increase in the prevalence of immunodeficiency disorders, advancements in biotechnology, and an expanding patient pool. However, the market is also facing some challenges, including high costs and regulatory hurdles.

The market is also experiencing a number of opportunities, including the development of new treatments, increased R&D investment, and the potential for growth in emerging markets.

Regional Analysis

The global immunoglobulin market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America and Europe are the largest markets for immunoglobulin products, due to high levels of healthcare spending and a large patient pool.

Asia-Pacific is expected to be the fastest-growing market in the coming years, due to an increase in the prevalence of immunodeficiency disorders, rising healthcare expenditure, and an expanding patient pool.

Competitive Landscape

Leading Companies in the Immunoglobulin Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

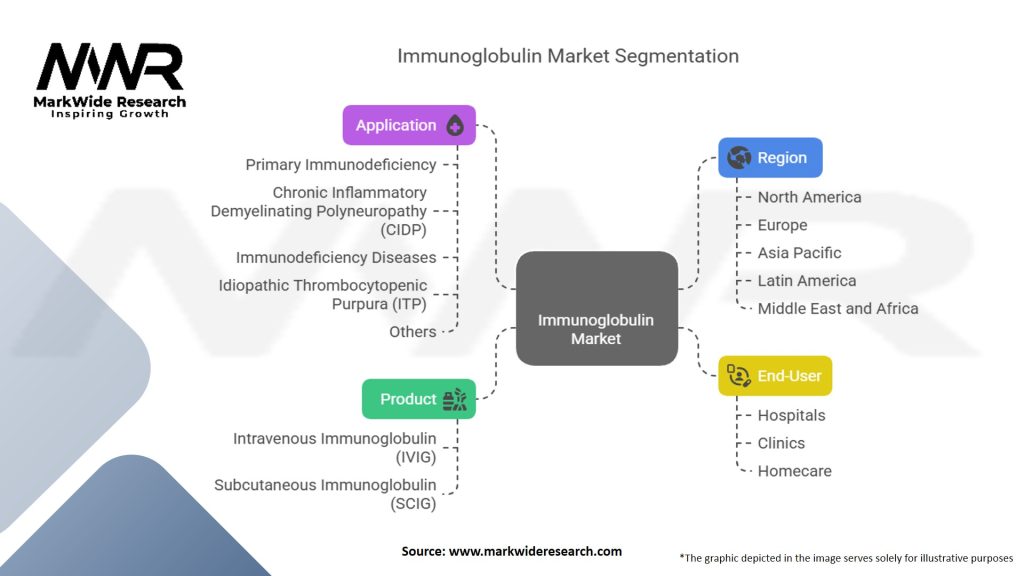

The global immunoglobulin market is segmented by product type, application, and end-user.

By product type, the market is segmented into:

IVIG is the most commonly used form of immunoglobulin and is administered through intravenous infusion. SCIG is a newer form of immunoglobulin that can be self-administered through subcutaneous injection.

By application, the market is segmented into:

PIDD is the largest application segment, accounting for the majority of immunoglobulin sales. Autoimmune diseases are also a significant application segment, with a growing number of indications being approved for treatment with immunoglobulin products.

By end-user, the market is segmented into:

Hospitals are the largest end-user segment, due to the high demand for immunoglobulin products in the treatment of various diseases.

Category-wise Insights

IVIG is the most commonly used form of immunoglobulin, with a market share of around 75%. The demand for IVIG is driven by an increase in the prevalence of primary immunodeficiency diseases and autoimmune diseases.

SCIG is a newer form of immunoglobulin that is gaining popularity due to its ease of administration and reduced side effects compared to IVIG. The demand for SCIG is expected to continue to grow in the coming years, due to an increasing number of patients who prefer self-administration at home.

PIDD is the largest application segment for immunoglobulin products, accounting for over 50% of the market share. The demand for immunoglobulin products in PIDD is driven by an increase in the prevalence of the disease and a growing number of patients being diagnosed.

The demand for immunoglobulin products in autoimmune diseases is driven by an increase in the number of indications being approved for treatment with these products. This includes diseases such as multiple sclerosis, myasthenia gravis, and lupus.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the immunoglobulin market, with an increase in the demand for these products due to the development of severe respiratory symptoms in some patients.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global immunoglobulin market is expected to continue to grow in the coming years, driven by an increase in the prevalence of immunodeficiency disorders, advancements in biotechnology, and an expanding patient pool. The market is also facing some challenges, including high costs and regulatory hurdles, but there are also opportunities for growth in emerging markets and the development of new treatments.

The trend toward consolidation in the market is expected to continue, with larger companies acquiring smaller ones in order to gain access to new technologies and markets.

The demand for subcutaneous immunoglobulin products is expected to continue to grow, due to their ease of administration and reduced side effects compared to intravenous products. The use of home infusion therapy is also expected to increase, providing more convenience for patients and reducing healthcare costs.

Conclusion

In conclusion, the global immunoglobulin market presents significant opportunities for growth in the coming years, driven by an increase in the prevalence of various diseases and advancements in biotechnology. However, the market is also facing some challenges, including high costs and regulatory hurdles, which will need to be addressed in order to ensure continued growth and success.

Additionally, companies should prioritize developing cost-effective products, which will be key to driving growth in emerging markets and meeting the needs of patients in developed markets who are facing increasing healthcare costs.

What is immunoglobulin?

Immunoglobulin refers to a class of proteins that function as antibodies in the immune system, playing a crucial role in identifying and neutralizing pathogens such as bacteria and viruses. They are essential for immune response and are used in various therapeutic applications.

What are the key companies in the immunoglobulin market?

Key companies in the immunoglobulin market include Grifols, CSL Behring, Takeda Pharmaceutical Company, and Octapharma, among others.

What are the growth factors driving the immunoglobulin market?

The immunoglobulin market is driven by increasing prevalence of immunodeficiency disorders, rising awareness of immunoglobulin therapies, and advancements in production technologies. Additionally, the growing geriatric population contributes to the demand for immunoglobulin treatments.

What challenges does the immunoglobulin market face?

The immunoglobulin market faces challenges such as high production costs, potential supply shortages, and regulatory hurdles. These factors can impact the availability and pricing of immunoglobulin therapies.

What opportunities exist in the immunoglobulin market?

Opportunities in the immunoglobulin market include the development of new therapies for autoimmune diseases and the expansion of applications in personalized medicine. Additionally, increasing investments in research and development present avenues for growth.

What trends are shaping the immunoglobulin market?

Trends in the immunoglobulin market include the rise of subcutaneous immunoglobulin therapies, which offer greater convenience for patients, and the focus on improving product safety and efficacy. Furthermore, there is a growing emphasis on sustainable sourcing of plasma for immunoglobulin production.

Immunoglobulin Market

| Segmentation | Details |

|---|---|

| Product | Intravenous Immunoglobulin (IVIG), Subcutaneous Immunoglobulin (SCIG) |

| Application | Primary Immunodeficiency, Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), Immunodeficiency Diseases, Idiopathic Thrombocytopenic Purpura (ITP), Others |

| End-User | Hospitals, Clinics, Homecare |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Immunoglobulin Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at