444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Illinois freight and logistics market stands as one of the most strategically positioned transportation hubs in North America, serving as a critical gateway for goods movement across the continental United States. Illinois’s central location and extensive multimodal transportation infrastructure have established the state as a dominant force in the national supply chain ecosystem. The market encompasses a comprehensive range of services including trucking, rail transport, air cargo, warehousing, distribution, and third-party logistics operations.

Market dynamics in Illinois are driven by the state’s unique geographical advantages, with Chicago serving as a major transportation nexus connecting the East and West coasts. The region benefits from robust infrastructure investments and technological advancements that continue to enhance operational efficiency. Current market trends indicate sustained growth at a 6.2% CAGR, reflecting the increasing demand for sophisticated logistics solutions and e-commerce fulfillment capabilities.

Industrial diversification across manufacturing, agriculture, retail, and technology sectors has created a resilient demand base for freight and logistics services. The market’s evolution toward digital transformation and automation technologies is reshaping traditional logistics operations, with companies investing heavily in smart warehousing, predictive analytics, and sustainable transportation solutions. Regional connectivity through major interstate highways, Class I railroads, and O’Hare International Airport positions Illinois as an indispensable component of North American trade flows.

The Illinois freight and logistics market refers to the comprehensive ecosystem of transportation, warehousing, distribution, and supply chain management services operating within Illinois state boundaries. This market encompasses all activities related to the movement, storage, and handling of goods from origin to destination, including multimodal transportation services, third-party logistics providers, freight forwarding, customs brokerage, and value-added logistics solutions.

Freight operations include trucking companies, rail carriers, air cargo services, and intermodal transportation providers that facilitate the physical movement of goods. Logistics services encompass warehousing, distribution center operations, inventory management, order fulfillment, and supply chain optimization solutions. The market also includes supporting services such as freight brokerage, logistics technology platforms, and specialized handling for industries like automotive, agriculture, pharmaceuticals, and consumer goods.

Geographic scope extends throughout Illinois, with major concentration areas in the Chicago metropolitan region, the Quad Cities, Rockford, Peoria, and along key transportation corridors. The market serves both intrastate commerce and serves as a critical hub for interstate and international trade flows, leveraging Illinois’s strategic position in the North American logistics network.

Illinois maintains its position as a premier freight and logistics hub, capitalizing on strategic geographic advantages and comprehensive transportation infrastructure. The state’s logistics sector demonstrates remarkable resilience and adaptability, with companies increasingly adopting advanced technologies and sustainable practices to meet evolving customer demands. Market performance reflects strong fundamentals driven by diverse industry sectors and robust e-commerce growth.

Key market drivers include the continued expansion of e-commerce fulfillment operations, nearshoring trends bringing manufacturing closer to consumer markets, and infrastructure modernization initiatives. The market benefits from 65% of North American consumers being reachable within a day’s drive from Chicago, creating significant competitive advantages for logistics operations. Technology adoption rates have accelerated, with warehouse automation and transportation management systems becoming standard operational components.

Competitive landscape features a mix of global logistics giants, regional specialists, and emerging technology-driven providers. The market’s evolution toward integrated supply chain solutions has created opportunities for companies offering comprehensive service portfolios. Sustainability initiatives are increasingly influencing operational decisions, with companies investing in alternative fuel vehicles, energy-efficient facilities, and carbon reduction programs to meet corporate and regulatory requirements.

Strategic positioning within the North American logistics network provides Illinois with sustained competitive advantages that continue to attract investment and expansion activities. The state’s multimodal transportation capabilities enable seamless integration between trucking, rail, air, and water transportation modes, creating operational efficiencies that benefit shippers and logistics providers alike.

E-commerce expansion continues to serve as a primary catalyst for Illinois freight and logistics market growth, with online retail sales driving unprecedented demand for fulfillment and last-mile delivery services. The shift toward omnichannel retail strategies has created complex logistics requirements that favor Illinois’s sophisticated infrastructure and service capabilities. Consumer expectations for faster delivery times have accelerated investment in distribution center networks and transportation optimization technologies.

Nearshoring trends are reshaping global supply chains, with manufacturers relocating production closer to North American consumer markets to reduce transportation costs and improve supply chain resilience. Illinois benefits significantly from this trend due to its central location and established manufacturing base. Supply chain diversification strategies adopted by companies seeking to reduce dependency on single-source suppliers have increased demand for flexible logistics solutions.

Infrastructure modernization initiatives at federal, state, and local levels continue to enhance Illinois’s transportation capabilities. Major projects including highway improvements, rail capacity expansions, and airport upgrades strengthen the state’s competitive position. Technology advancement in areas such as autonomous vehicles, artificial intelligence, and blockchain technology creates new opportunities for operational efficiency and service innovation. Regulatory changes including hours-of-service modifications and environmental regulations are driving adoption of new technologies and operational practices throughout the logistics sector.

Driver shortage represents a significant challenge for the Illinois freight and logistics market, with the trucking industry experiencing persistent difficulties in recruiting and retaining qualified drivers. This shortage impacts service capacity and increases operational costs across the logistics sector. Aging workforce demographics compound this challenge, as experienced drivers approach retirement without sufficient new entrants to replace them.

Infrastructure congestion in key corridors, particularly around the Chicago metropolitan area, creates operational inefficiencies and increased transportation costs. Traffic congestion during peak periods can significantly impact delivery schedules and fuel consumption. Maintenance backlogs on critical transportation infrastructure pose risks to operational reliability and long-term competitiveness.

Regulatory compliance requirements continue to increase operational complexity and costs for logistics providers. Environmental regulations, safety standards, and hours-of-service rules require ongoing investment in compliance systems and training programs. Economic volatility in key customer industries can create demand fluctuations that challenge capacity planning and resource allocation. Rising real estate costs in prime logistics locations are pressuring facility expansion plans and operational margins, particularly for smaller logistics providers.

Automation technologies present substantial opportunities for Illinois logistics providers to enhance operational efficiency and address labor challenges. Warehouse robotics, automated sorting systems, and autonomous vehicles offer potential solutions to capacity constraints while improving service quality. Investment opportunities in these technologies are attracting both established companies and venture capital funding.

Sustainable logistics initiatives create competitive advantages for companies adopting environmentally responsible practices. Electric vehicle fleets, renewable energy systems, and carbon-neutral operations are becoming important differentiators in customer selection processes. Green building certifications for warehouse and distribution facilities are increasingly valued by tenants and investors alike.

Data analytics and artificial intelligence applications offer opportunities to optimize route planning, inventory management, and predictive maintenance programs. Companies leveraging advanced analytics can achieve significant cost reductions and service improvements. Blockchain technology applications in supply chain transparency and documentation are creating new service opportunities for logistics providers. Cross-border trade facilitation through improved customs processing and documentation systems presents growth opportunities as international commerce continues expanding.

Competitive forces within the Illinois freight and logistics market are intensifying as companies seek to differentiate their service offerings and capture market share in high-growth segments. The market exhibits characteristics of both consolidation among larger players and fragmentation in specialized service niches. Technology disruption is reshaping traditional competitive boundaries, with new entrants leveraging digital platforms to challenge established providers.

Customer demands are evolving toward more sophisticated service requirements including real-time visibility, predictive analytics, and integrated supply chain solutions. This evolution favors providers with advanced technological capabilities and comprehensive service portfolios. Pricing pressures remain significant, particularly in commoditized transportation segments, driving companies to seek operational efficiencies and value-added services.

Supply chain resilience has become a critical consideration following recent global disruptions, with companies prioritizing flexibility and redundancy in their logistics networks. This trend benefits Illinois providers due to the state’s diverse transportation options and strategic location. Regulatory environment continues evolving with new safety, environmental, and labor regulations impacting operational practices and cost structures. Investment flows into logistics infrastructure and technology are accelerating, with both private equity and strategic investors actively pursuing opportunities in the Illinois market.

Comprehensive analysis of the Illinois freight and logistics market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes extensive interviews with industry executives, logistics managers, and transportation professionals across various market segments. Secondary research incorporates analysis of government statistics, industry reports, and academic studies related to transportation and logistics trends.

Data collection processes utilize both quantitative and qualitative approaches, including surveys of logistics providers, analysis of transportation statistics, and examination of infrastructure utilization patterns. Market segmentation analysis considers various dimensions including service type, industry vertical, geographic region, and company size to provide detailed market insights.

Validation procedures include cross-referencing multiple data sources, expert review panels, and statistical verification of key findings. Trend analysis incorporates historical data patterns, current market conditions, and forward-looking indicators to develop comprehensive market projections. Stakeholder input from industry associations, government agencies, and academic institutions provides additional perspective on market dynamics and future developments.

Chicago Metropolitan Area dominates the Illinois freight and logistics landscape, accounting for approximately 78% of state logistics activity due to its exceptional transportation infrastructure and strategic location. The region benefits from the convergence of major interstate highways, extensive rail networks, and O’Hare International Airport’s cargo capabilities. Suburban corridors including the I-55, I-80, and I-94 corridors have experienced significant warehouse and distribution center development.

Northern Illinois regions including Rockford and the I-90 corridor serve as important secondary logistics hubs, particularly for automotive and manufacturing supply chains. These areas offer cost advantages compared to the Chicago metropolitan region while maintaining good transportation connectivity. Quad Cities region leverages its Mississippi River access and rail connections to serve agricultural and industrial customers throughout the Midwest.

Central Illinois markets including Peoria, Bloomington-Normal, and Springfield provide logistics services primarily for agricultural products, manufacturing, and regional distribution. These markets benefit from lower operating costs and strategic positioning for serving rural and small urban markets. Southern Illinois regions focus on agricultural logistics, coal transportation, and river barge operations, with growing opportunities in intermodal transportation. Market share distribution shows Chicago metro area maintaining dominance while secondary markets capture 22% of total activity through specialized services and cost-competitive operations.

Market leadership in the Illinois freight and logistics sector is characterized by a diverse mix of global corporations, regional specialists, and emerging technology-driven companies. The competitive environment reflects both the scale advantages of large integrated providers and the specialized expertise of niche service companies.

Competitive strategies focus on technology differentiation, service integration, and geographic expansion to capture market opportunities. Companies are investing heavily in automation, data analytics, and sustainable operations to maintain competitive advantages.

Service-based segmentation reveals the diverse nature of the Illinois freight and logistics market, with each segment serving distinct customer needs and operational requirements. Transportation services represent the largest segment, encompassing trucking, rail, air cargo, and intermodal operations that facilitate goods movement throughout the region and beyond.

By Service Type:

By Industry Vertical:

Trucking operations maintain the largest market presence within Illinois freight and logistics, handling approximately 72% of freight tonnage moved within and through the state. This segment benefits from flexibility, door-to-door service capabilities, and extensive highway infrastructure. Long-haul trucking leverages Illinois’s central location for efficient cross-country transportation, while regional and local operations serve intrastate commerce and last-mile delivery requirements.

Rail transportation plays a critical role in heavy freight movement, particularly for bulk commodities, intermodal containers, and automotive products. Illinois’s position as a major rail hub enables efficient connections between East and West coast markets. Intermodal facilities in the Chicago area handle significant container volumes, facilitating international trade flows and domestic distribution.

Warehousing and distribution services have experienced rapid expansion driven by e-commerce growth and supply chain optimization strategies. Modern facilities incorporate advanced automation technologies, climate control systems, and sophisticated inventory management capabilities. Third-party logistics providers offer comprehensive supply chain solutions including transportation management, inventory optimization, and value-added services. Specialized logistics segments including cold chain, hazardous materials, and oversized cargo handling serve specific industry requirements with specialized equipment and expertise.

Logistics providers operating in Illinois benefit from exceptional geographic advantages that enable efficient service delivery across North American markets. The state’s central location reduces transportation distances and costs while providing access to diverse customer bases. Infrastructure quality including highways, railroads, and airports supports reliable operations and service consistency.

Shippers and manufacturers gain access to comprehensive transportation options and competitive pricing through Illinois’s robust logistics ecosystem. The concentration of service providers creates competitive market conditions that benefit customers through improved service levels and cost efficiency. Supply chain flexibility is enhanced through multiple transportation modes and routing options available within the state.

Economic development benefits extend throughout Illinois communities through job creation, tax revenue generation, and business attraction. The logistics sector provides employment opportunities across skill levels from entry-level warehouse positions to specialized technical and management roles. Investment attraction in logistics infrastructure and operations contributes to long-term economic growth and competitiveness. Innovation opportunities in logistics technology and sustainable operations position Illinois as a leader in next-generation supply chain solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping the Illinois freight and logistics landscape, with companies investing heavily in technology platforms that provide real-time visibility, predictive analytics, and automated decision-making capabilities. Internet of Things sensors and connected devices are becoming standard equipment in vehicles and warehouses, enabling unprecedented operational insights and optimization opportunities.

Sustainability focus has emerged as a critical trend, with logistics providers adopting electric vehicles, renewable energy systems, and carbon-neutral operations to meet customer requirements and regulatory expectations. Green building standards are increasingly applied to new warehouse and distribution center developments, with 42% of new facilities incorporating sustainable design elements.

Last-mile delivery innovations including drone technology, autonomous delivery vehicles, and micro-fulfillment centers are being tested and implemented to meet growing consumer expectations for rapid delivery. Omnichannel fulfillment strategies require sophisticated logistics capabilities to support seamless integration between online and physical retail channels. Supply chain resilience has become a priority, with companies diversifying their logistics networks and building redundancy into their operations to mitigate disruption risks.

Infrastructure investments continue transforming Illinois’s logistics capabilities, with major projects including highway expansions, rail capacity improvements, and airport cargo facility upgrades. The CREATE program addressing rail congestion in the Chicago area represents one of the most significant transportation infrastructure initiatives in the region’s history.

Technology partnerships between logistics providers and technology companies are accelerating innovation adoption throughout the market. MarkWide Research analysis indicates that strategic alliances between traditional logistics companies and tech startups are becoming increasingly common as companies seek to enhance their digital capabilities.

Workforce development initiatives including apprenticeship programs, community college partnerships, and technology training are addressing skill gaps in the logistics sector. Automation implementation in major distribution centers is creating new job categories while transforming traditional warehouse operations. Sustainability certifications and environmental compliance programs are becoming standard requirements for logistics facilities and operations, driving investment in clean technologies and efficient systems.

Strategic positioning for Illinois logistics providers should focus on leveraging the state’s geographic advantages while investing in technology differentiation and service integration. Companies should prioritize automation investments to address labor challenges and improve operational efficiency. Sustainability initiatives will become increasingly important for competitive positioning and customer retention.

Infrastructure utilization optimization through advanced analytics and predictive modeling can help companies maximize asset efficiency and reduce operational costs. Workforce development programs should emphasize technology skills and cross-functional capabilities to prepare for evolving industry requirements. Partnership strategies with technology providers, educational institutions, and government agencies can accelerate innovation adoption and market expansion.

Market expansion opportunities exist in specialized logistics segments including cold chain, pharmaceutical, and e-commerce fulfillment services. Companies should consider geographic diversification within Illinois to capture growth in secondary markets while maintaining cost competitiveness. Customer relationship strategies should emphasize value-added services and integrated solutions rather than competing solely on price in commoditized transportation segments.

Growth projections for the Illinois freight and logistics market remain positive, with continued expansion expected at a 5.8% annual rate over the next five years. E-commerce fulfillment and last-mile delivery services are anticipated to drive the highest growth rates, while traditional transportation segments will experience more moderate expansion.

Technology integration will accelerate, with autonomous vehicles, artificial intelligence, and blockchain applications becoming mainstream within the next decade. MWR projections suggest that 35% of logistics operations will incorporate significant automation technologies by 2028. Sustainability requirements will intensify, with carbon-neutral operations becoming standard expectations rather than competitive differentiators.

Infrastructure development will continue supporting market growth, with planned investments in transportation systems, intermodal facilities, and technology infrastructure. Workforce evolution will emphasize technical skills and data analysis capabilities as traditional manual operations become increasingly automated. Market consolidation is expected to continue in some segments while new market entrants leverage technology platforms to create innovative service offerings. Regional competitiveness will depend on continued investment in infrastructure, technology, and workforce development to maintain Illinois’s advantages in the evolving logistics landscape.

Illinois freight and logistics market maintains its position as a critical component of North American supply chain infrastructure, benefiting from strategic geographic location, comprehensive transportation networks, and diverse industry base. The market demonstrates resilience and adaptability in responding to evolving customer demands, technological disruption, and economic challenges.

Future success will depend on continued investment in technology, infrastructure, and workforce development to address current challenges while capitalizing on emerging opportunities. The market’s evolution toward integrated, technology-enabled logistics solutions positions Illinois providers to serve increasingly sophisticated customer requirements while maintaining competitive advantages in cost and service delivery.

Strategic focus on sustainability, automation, and supply chain resilience will determine long-term market leadership as the logistics industry continues transforming in response to digital commerce growth, environmental regulations, and changing consumer expectations. Illinois’s established strengths provide a solid foundation for continued growth and innovation in the dynamic freight and logistics sector.

What is Freight And Logistics?

Freight and logistics refer to the processes involved in the transportation, storage, and management of goods and materials. This includes various activities such as shipping, warehousing, and inventory management, which are essential for supply chain efficiency.

What are the key players in the Illinois Freight And Logistics Market?

Key players in the Illinois Freight and Logistics Market include companies like C.H. Robinson, XPO Logistics, and Schneider National. These companies provide a range of services from freight brokerage to transportation management, among others.

What are the growth factors driving the Illinois Freight And Logistics Market?

The growth of the Illinois Freight and Logistics Market is driven by factors such as the increasing demand for e-commerce, advancements in technology, and the strategic location of Illinois as a transportation hub. These elements enhance logistics efficiency and service delivery.

What challenges does the Illinois Freight And Logistics Market face?

Challenges in the Illinois Freight and Logistics Market include rising fuel costs, regulatory compliance issues, and infrastructure limitations. These factors can impact operational efficiency and service reliability.

What opportunities exist in the Illinois Freight And Logistics Market?

Opportunities in the Illinois Freight and Logistics Market include the expansion of last-mile delivery services, the adoption of automation and AI technologies, and the growth of sustainable logistics practices. These trends can lead to improved service offerings and operational efficiencies.

What trends are shaping the Illinois Freight And Logistics Market?

Trends shaping the Illinois Freight and Logistics Market include the rise of digital freight platforms, increased focus on sustainability, and the integration of IoT technologies for real-time tracking. These innovations are transforming how logistics services are delivered.

Illinois Freight And Logistics Market

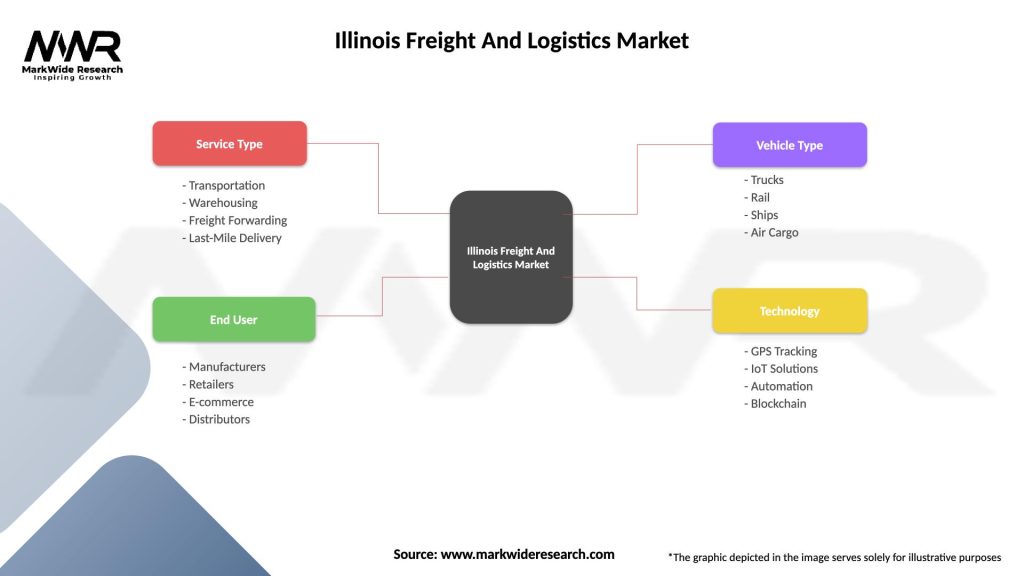

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Last-Mile Delivery |

| End User | Manufacturers, Retailers, E-commerce, Distributors |

| Vehicle Type | Trucks, Rail, Ships, Air Cargo |

| Technology | GPS Tracking, IoT Solutions, Automation, Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Illinois Freight And Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at