444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The identity theft insurance market is experiencing significant growth in recent years, driven by the rising instances of identity theft and fraud across the globe. Identity theft occurs when an unauthorized person gains access to an individual’s personal information, such as their social security number, credit card details, or bank account information, and uses it for fraudulent purposes. This has led to an increased demand for identity theft insurance, which provides financial protection and assistance to individuals in the event of identity theft. This comprehensive report provides insights into the key factors driving the market, the challenges faced, and the opportunities that lie ahead.

Meaning:

Identity theft insurance refers to a type of insurance coverage designed to protect individuals from the financial losses and damages resulting from identity theft. It typically covers expenses related to legal assistance, credit monitoring, reimbursement for stolen funds, and other related costs. Identity theft insurance aims to provide peace of mind to individuals by offering financial protection and assistance in the event of identity theft.

Executive Summary:

The executive summary of the identity theft insurance market provides a concise overview of the key findings and insights covered in the report. It highlights the market’s growth potential, key trends, and competitive landscape. The summary serves as a quick reference guide for industry participants and stakeholders, offering a snapshot of the market’s current state and future prospects.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

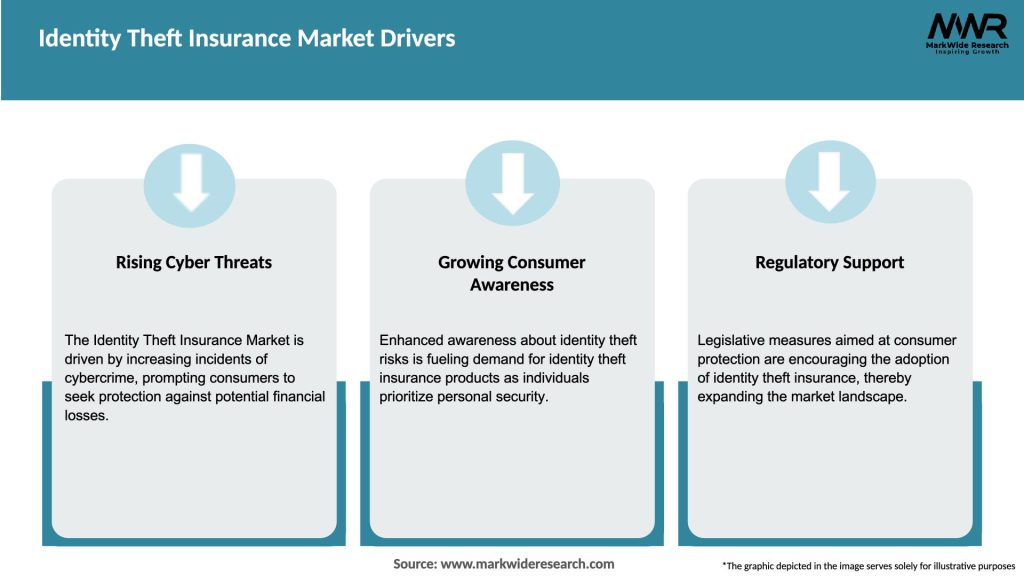

Market Drivers

Several factors are driving the growth of the Global Identity Theft Insurance Market:

Market Restraints

Despite its growth, the Global Identity Theft Insurance Market faces several challenges:

Market Opportunities

The Global Identity Theft Insurance Market presents several opportunities for growth:

Market Dynamics

The Global Identity Theft Insurance Market is shaped by several dynamic factors:

Regional Analysis

The Global Identity Theft Insurance Market exhibits regional variations in adoption and market maturity, with key markets being:

Competitive Landscape

Leading Companies in the Identity Theft Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Global Identity Theft Insurance Market can be segmented based on various factors, including:

Category-wise Insights

Each category of identity theft insurance offers distinct benefits tailored to different consumer needs:

Key Benefits for Industry Participants and Stakeholders

The Global Identity Theft Insurance Market offers several benefits for stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the Global Identity Theft Insurance Market include:

Covid-19 Impact

The Covid-19 pandemic has led to an increase in online activity, creating more opportunities for identity theft and fraud. This has driven a surge in demand for identity theft insurance as individuals seek protection against the rising risk of digital identity theft. Furthermore, the global economic uncertainty has increased the focus on financial security, further accelerating the adoption of insurance products that offer protection against identity theft.

Key Industry Developments

Recent industry developments in the Global Identity Theft Insurance Market include:

Analyst Suggestions

Analysts recommend the following strategies for stakeholders in the Global Identity Theft Insurance Market:

Future Outlook:

The future outlook section offers insights into the anticipated growth trajectory of the identity theft insurance market. It discusses market projections, potential opportunities, and challenges that may arise in the coming years. This section assists market players in formulating long-term strategies and making informed investment decisions.

Conclusion:

In conclusion, the identity theft insurance market is witnessing significant growth due to the increasing instances of identity theft and fraud. The market offers ample opportunities for companies to expand their customer base and gain a competitive advantage. By understanding the market dynamics, addressing key challenges, and capitalizing on emerging trends, market players can navigate the evolving landscape and thrive in the identity theft insurance industry.

What is Identity Theft Insurance?

Identity Theft Insurance is a type of insurance that helps individuals recover from the financial losses and expenses associated with identity theft. It typically covers costs related to legal fees, lost wages, and the expenses incurred in restoring one’s identity.

What are the key players in the Identity Theft Insurance Market?

Key players in the Identity Theft Insurance Market include companies like LifeLock, IdentityGuard, and Experian, which offer various identity protection services and insurance products. These companies focus on providing comprehensive solutions to safeguard consumers against identity theft, among others.

What are the main drivers of growth in the Identity Theft Insurance Market?

The growth of the Identity Theft Insurance Market is driven by increasing incidents of identity theft, rising consumer awareness about data security, and the growing reliance on digital transactions. Additionally, the expansion of e-commerce and online banking has heightened the need for protective measures.

What challenges does the Identity Theft Insurance Market face?

The Identity Theft Insurance Market faces challenges such as the lack of awareness among consumers regarding the benefits of such insurance and the complexity of claims processes. Additionally, the evolving nature of cyber threats poses a continuous challenge for insurance providers.

What opportunities exist in the Identity Theft Insurance Market?

Opportunities in the Identity Theft Insurance Market include the development of innovative insurance products tailored to specific demographics and the integration of advanced technology for fraud detection. As more individuals seek protection, there is potential for growth in personalized insurance offerings.

What trends are shaping the Identity Theft Insurance Market?

Trends in the Identity Theft Insurance Market include the increasing use of artificial intelligence for fraud detection and the rise of subscription-based identity protection services. Additionally, partnerships between insurance companies and technology firms are becoming more common to enhance service offerings.

Identity Theft Insurance Market

| Segmentation | Details |

|---|---|

| Type | Credit Card Fraud, Bank Fraud, Phone/Utility Fraud, Others |

| Distribution | Insurance Companies, Online Platforms |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Identity Theft Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at