444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Hungary ICT market represents a dynamic and rapidly evolving sector within Central Europe’s technology landscape. Hungary’s information and communication technology industry has experienced remarkable transformation over the past decade, driven by digital transformation initiatives, government support, and increasing enterprise adoption of advanced technologies. The market encompasses a comprehensive range of services including software development, telecommunications infrastructure, cloud computing, cybersecurity solutions, and emerging technologies such as artificial intelligence and Internet of Things applications.

Market dynamics indicate that Hungary’s strategic position within the European Union has significantly contributed to its ICT sector growth, with the country serving as a regional hub for multinational technology companies. The Hungarian government’s commitment to digitalization, evidenced through various national digital strategies and EU funding programs, has created a favorable environment for ICT market expansion. Growth projections suggest the market is experiencing robust development at approximately 8.2% CAGR, positioning Hungary as one of the fastest-growing ICT markets in the Central and Eastern European region.

Infrastructure development has been a key catalyst for market growth, with significant investments in fiber-optic networks, 5G deployment, and data center facilities. The market benefits from a highly skilled workforce, competitive operational costs, and strong educational institutions producing qualified ICT professionals. Enterprise adoption of digital technologies has accelerated, particularly in manufacturing, financial services, and public sector organizations, driving demand for comprehensive ICT solutions and services.

The Hungary ICT market refers to the comprehensive ecosystem of information and communication technology products, services, and solutions operating within Hungary’s economic framework. This market encompasses hardware manufacturing, software development, telecommunications services, IT consulting, system integration, cloud computing platforms, cybersecurity solutions, and emerging technology implementations across various industry sectors.

ICT market components include traditional technology services such as enterprise software licensing, hardware procurement, and network infrastructure management, alongside modern digital solutions including artificial intelligence applications, blockchain implementations, and Internet of Things deployments. The market serves both domestic Hungarian enterprises and international organizations leveraging Hungary’s strategic location and competitive advantages for regional technology operations.

Market participants range from global technology giants establishing regional headquarters and development centers to innovative local startups developing specialized solutions for niche markets. The ecosystem includes telecommunications providers, software development companies, system integrators, cloud service providers, and technology consultancies serving diverse client requirements across public and private sectors.

Hungary’s ICT market demonstrates exceptional growth momentum, characterized by strong government support, increasing enterprise digitalization, and strategic positioning within the European technology landscape. The market has evolved from a traditional IT services provider to a comprehensive digital innovation hub, attracting significant foreign investment and fostering local entrepreneurship in emerging technology sectors.

Key market drivers include accelerated digital transformation initiatives across industries, with approximately 72% of Hungarian enterprises actively implementing digital technologies to enhance operational efficiency and competitive positioning. The telecommunications sector has experienced substantial modernization, with 5G network deployment reaching 45% coverage in major urban areas, supporting advanced applications and services.

Software development represents a particularly strong segment, with Hungarian companies gaining international recognition for innovative solutions in fintech, healthcare technology, and industrial automation. The market benefits from a skilled workforce, with over 85,000 ICT professionals employed across various technology disciplines, supported by robust educational programs and continuous professional development initiatives.

Investment trends indicate sustained growth potential, with venture capital funding for Hungarian technology startups increasing significantly, while established multinational corporations continue expanding their regional operations. The market’s strategic importance within the European Union’s digital agenda positions Hungary for continued growth and technological advancement.

Market segmentation reveals diverse growth opportunities across multiple technology domains, with cloud computing services experiencing the highest adoption rates among Hungarian enterprises. MarkWide Research analysis indicates that digital transformation initiatives are driving comprehensive technology modernization across traditional industries, creating substantial demand for integrated ICT solutions.

Digital transformation imperatives across Hungarian industries represent the primary catalyst for ICT market expansion. Organizations are recognizing the critical importance of technology modernization for maintaining competitive advantages, improving operational efficiency, and meeting evolving customer expectations. This transformation encompasses comprehensive technology stack upgrades, process automation, and data-driven decision-making capabilities.

Government support initiatives have created a favorable environment for ICT market growth through strategic funding programs, regulatory frameworks, and digital infrastructure investments. The Hungarian government’s commitment to achieving EU digital targets has resulted in substantial public sector technology procurement and modernization projects, generating significant opportunities for ICT service providers and solution developers.

European Union integration benefits continue driving market expansion, with Hungary serving as an attractive destination for international technology companies seeking cost-effective operations within the EU framework. Access to EU funding programs, regulatory harmonization, and single market advantages position Hungarian ICT companies for regional and international growth opportunities.

Skilled workforce availability represents a significant competitive advantage, with Hungarian universities and technical institutions producing qualified ICT professionals across diverse technology disciplines. The combination of technical expertise, competitive labor costs, and strong English language proficiency makes Hungary an attractive location for technology development and service delivery operations.

Infrastructure modernization investments in telecommunications networks, data centers, and digital connectivity have created the foundation for advanced ICT service delivery. Fiber-optic network expansion, 5G deployment, and cloud infrastructure development enable organizations to implement sophisticated technology solutions and support digital business models.

Talent shortage challenges pose significant constraints on market growth, as demand for qualified ICT professionals consistently exceeds supply across specialized technology domains. Competition for experienced developers, cybersecurity experts, and data scientists has intensified, resulting in increased recruitment costs and project delivery challenges for technology companies and service providers.

Cybersecurity concerns have become increasingly prominent as organizations expand their digital footprints and face sophisticated threat landscapes. The need for comprehensive security measures, compliance requirements, and risk management capabilities requires substantial investments and specialized expertise, potentially limiting technology adoption among smaller organizations with constrained resources.

Legacy system integration complexities present ongoing challenges for organizations seeking to modernize their technology infrastructure. Many Hungarian enterprises operate legacy systems that require careful migration strategies, compatibility considerations, and substantial integration efforts, potentially slowing digital transformation initiatives and increasing implementation costs.

Regulatory compliance requirements across data protection, financial services, and industry-specific regulations create additional complexity for ICT implementations. Organizations must navigate evolving regulatory frameworks while ensuring technology solutions meet compliance standards, potentially extending project timelines and increasing development costs.

Economic uncertainty factors including inflation pressures, supply chain disruptions, and geopolitical tensions may impact technology investment decisions and market growth trajectories. Organizations may defer non-essential technology projects or reduce discretionary ICT spending during periods of economic volatility.

Emerging technology adoption presents substantial growth opportunities as Hungarian organizations explore artificial intelligence, machine learning, blockchain, and Internet of Things applications. These technologies offer significant potential for operational improvement, new business model development, and competitive differentiation across various industry sectors.

Smart city initiatives across Hungarian municipalities create extensive opportunities for ICT solution providers specializing in urban technology systems. Projects encompassing intelligent transportation, energy management, public safety, and citizen services require comprehensive technology integration and ongoing support services.

Industry 4.0 transformation in Hungary’s manufacturing sector drives demand for advanced automation technologies, predictive analytics, and integrated production systems. The country’s strong manufacturing base provides substantial opportunities for ICT companies developing industrial technology solutions and digital transformation services.

Cross-border expansion opportunities enable Hungarian ICT companies to leverage their EU market access and competitive positioning for regional growth. The combination of technical expertise, cost advantages, and cultural compatibility creates favorable conditions for expansion into neighboring markets and international client acquisition.

Fintech innovation represents a rapidly growing opportunity as financial services organizations modernize their technology platforms and develop digital banking solutions. Hungary’s developing fintech ecosystem offers opportunities for specialized solution development, regulatory technology, and financial services digitalization.

Healthcare digitalization initiatives present significant opportunities for ICT companies specializing in medical technology, electronic health records, telemedicine platforms, and healthcare analytics solutions. The sector’s modernization requirements create demand for comprehensive technology integration and specialized healthcare IT services.

Competitive landscape evolution reflects the market’s maturation, with established international technology companies competing alongside innovative local providers and emerging startups. This dynamic environment fosters innovation, drives service quality improvements, and creates diverse solution options for Hungarian organizations across various technology requirements and budget considerations.

Technology convergence trends are reshaping market dynamics as traditional boundaries between telecommunications, software development, and IT services continue blurring. Organizations increasingly seek integrated solutions combining multiple technology domains, creating opportunities for comprehensive service providers and strategic partnerships between specialized companies.

Customer expectations have evolved significantly, with organizations demanding faster implementation timelines, scalable solutions, and ongoing support services. This shift requires ICT providers to develop agile delivery methodologies, flexible service models, and comprehensive customer success programs to maintain competitive positioning.

Investment patterns indicate sustained growth momentum, with both domestic and international investors recognizing Hungary’s ICT market potential. Venture capital funding, private equity investments, and strategic acquisitions continue supporting market expansion and innovation development across various technology sectors.

Regulatory environment developments, particularly regarding data protection, cybersecurity, and digital services, continue shaping market dynamics and solution requirements. ICT providers must maintain compliance expertise and adapt their offerings to meet evolving regulatory standards while supporting client compliance objectives.

Comprehensive market analysis methodology incorporates multiple research approaches to ensure accurate and reliable insights into Hungary’s ICT market dynamics. Primary research activities include structured interviews with industry executives, technology leaders, and key stakeholders across various market segments, providing firsthand perspectives on market trends, challenges, and growth opportunities.

Secondary research components encompass extensive analysis of industry reports, government publications, regulatory documents, and financial statements from publicly traded technology companies operating in the Hungarian market. This approach ensures comprehensive coverage of market dynamics, competitive positioning, and regulatory influences affecting market development.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews with industry experts, and applying statistical analysis techniques to ensure data accuracy and reliability. Market sizing and growth projections are developed using established econometric models and validated through expert consultation.

Quantitative analysis incorporates statistical modeling techniques to identify market trends, growth patterns, and correlation factors affecting ICT market performance. Survey data from technology users, service providers, and industry associations provides quantitative insights into adoption rates, spending patterns, and technology preferences.

Qualitative research methods include focus group discussions, expert panels, and case study development to understand market nuances, implementation challenges, and success factors. This approach provides contextual understanding of market dynamics beyond quantitative metrics and statistical analysis.

Budapest metropolitan area dominates Hungary’s ICT market landscape, accounting for approximately 65% of total market activity and serving as the primary hub for technology companies, service providers, and innovation centers. The capital region benefits from concentrated infrastructure, skilled workforce availability, and proximity to government decision-makers and major enterprise clients.

Western Hungary regions including Győr, Székesfehérvár, and Pécs demonstrate strong ICT market growth driven by manufacturing sector digitalization and proximity to Austrian and German markets. These areas benefit from automotive industry presence, creating demand for industrial automation, supply chain technologies, and manufacturing execution systems.

Eastern Hungary development initiatives are gradually expanding ICT market presence through government-supported digitalization programs and infrastructure investments. Cities such as Debrecen and Szeged are emerging as secondary technology hubs, supported by university partnerships and regional development funding.

Northern Hungary regions are experiencing gradual ICT market expansion, primarily driven by public sector modernization projects and small-to-medium enterprise digitalization initiatives. Government programs supporting rural digitalization and broadband infrastructure development are creating new opportunities for ICT service providers.

Cross-border collaboration with neighboring countries creates additional market opportunities, particularly in areas near Slovak, Austrian, and Romanian borders. Regional cooperation initiatives and EU funding programs support technology development projects spanning multiple countries, benefiting Hungarian ICT companies with international capabilities.

Market leadership is distributed among various categories of technology providers, each serving distinct market segments and client requirements. The competitive environment includes multinational corporations, regional service providers, specialized solution developers, and emerging technology startups, creating a diverse and dynamic marketplace.

Competitive differentiation strategies focus on specialized expertise, industry knowledge, and comprehensive service delivery capabilities. Companies are investing in emerging technology competencies, strategic partnerships, and talent development to maintain competitive advantages in the evolving market landscape.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand capabilities, enter new market segments, and achieve operational efficiencies. Strategic partnerships between complementary service providers are becoming increasingly common to deliver comprehensive solutions.

By Technology Category:

By Industry Vertical:

By Organization Size:

Software development sector demonstrates exceptional growth momentum, with Hungarian companies gaining international recognition for innovative solutions across fintech, gaming, and enterprise applications. The segment benefits from strong technical education, competitive development costs, and increasing demand for custom software solutions from both domestic and international clients.

Cloud computing adoption has accelerated significantly, with organizations recognizing the benefits of scalable infrastructure, reduced capital expenditure, and enhanced operational flexibility. MWR data indicates that cloud migration projects have increased by 78% year-over-year, driven by digital transformation initiatives and remote work requirements.

Cybersecurity services represent a rapidly expanding category as organizations face increasingly sophisticated threat landscapes and regulatory compliance requirements. Demand for managed security services, threat intelligence, and incident response capabilities continues growing across all industry sectors and organization sizes.

Telecommunications infrastructure modernization, particularly 5G network deployment and fiber-optic expansion, creates substantial opportunities for technology providers specializing in network equipment, installation services, and network management solutions. The segment supports advanced applications including IoT implementations and edge computing deployments.

Artificial intelligence and analytics applications are gaining traction across various industries, with organizations implementing machine learning algorithms, predictive analytics, and automated decision-making systems. The category shows particular strength in manufacturing optimization, financial services risk management, and healthcare diagnostics applications.

Enterprise resource planning and business application modernization continue driving significant technology investments as organizations replace legacy systems with integrated platforms supporting digital business processes. The segment benefits from regulatory requirements, operational efficiency objectives, and competitive positioning needs.

Technology providers benefit from Hungary’s strategic position within the European Union, offering access to a large single market while maintaining competitive operational costs. The country’s skilled workforce, supportive government policies, and modern infrastructure create favorable conditions for technology company establishment and expansion.

Enterprise clients gain access to comprehensive ICT solutions from both international technology leaders and innovative local providers, ensuring competitive pricing and specialized expertise. The diverse supplier ecosystem enables organizations to select optimal technology partners based on specific requirements, budget constraints, and strategic objectives.

Government organizations benefit from extensive digitalization support through EU funding programs, private sector expertise, and proven implementation methodologies. Public sector modernization initiatives receive comprehensive support from experienced technology providers with government sector specialization and compliance expertise.

International investors find attractive opportunities in Hungary’s growing ICT market, supported by stable regulatory environment, skilled workforce availability, and strategic market positioning. The combination of growth potential and operational advantages creates favorable conditions for technology investment and expansion strategies.

Educational institutions benefit from industry partnerships, research collaboration opportunities, and practical training programs that enhance curriculum relevance and graduate employability. Technology companies actively engage with universities to develop talent pipelines and support research initiatives.

Economic development stakeholders benefit from ICT sector growth through job creation, tax revenue generation, and innovation ecosystem development. The technology sector’s contribution to economic diversification and competitiveness enhancement supports broader national development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration across business processes represents a transformative trend affecting multiple industry sectors. Organizations are implementing AI-powered solutions for customer service automation, predictive maintenance, fraud detection, and decision support systems, creating substantial opportunities for specialized AI solution providers and integration services.

Edge computing deployment is gaining momentum as organizations seek to reduce latency, improve data processing efficiency, and support real-time applications. The trend particularly affects manufacturing, telecommunications, and smart city implementations where immediate data processing capabilities provide competitive advantages and operational improvements.

Sustainability technology focus is driving demand for energy-efficient IT solutions, green data centers, and environmental monitoring systems. Organizations are prioritizing technology investments that support sustainability objectives while reducing operational costs and meeting regulatory requirements.

Remote work technology solutions continue evolving beyond basic video conferencing to comprehensive collaboration platforms, virtual reality meeting environments, and advanced productivity tools. The permanent shift toward hybrid work models creates ongoing demand for sophisticated remote work enablement technologies.

Cybersecurity automation is becoming essential as organizations face increasingly sophisticated threats requiring rapid response capabilities. Automated threat detection, incident response, and security orchestration platforms are experiencing strong adoption across all organization sizes and industry sectors.

Low-code development platforms are democratizing application development, enabling business users to create solutions without extensive programming expertise. This trend is reshaping software development approaches and creating new opportunities for platform providers and implementation specialists.

Government digitalization initiatives have accelerated significantly, with comprehensive programs supporting public sector modernization, citizen service digitalization, and administrative process automation. These initiatives create substantial opportunities for ICT providers specializing in government solutions and regulatory compliance.

5G network deployment by major telecommunications providers is enabling advanced applications including autonomous vehicles, industrial IoT, and augmented reality implementations. The infrastructure investment supports ecosystem development and creates opportunities for application developers and service providers.

International technology company expansions continue, with major global providers establishing regional headquarters, development centers, and service delivery operations in Hungary. These investments bring advanced capabilities, employment opportunities, and knowledge transfer benefits to the local market.

Startup ecosystem development has gained momentum through government support programs, international investment, and accelerator initiatives. The growing entrepreneurial community is developing innovative solutions across fintech, healthtech, and industrial technology sectors.

University-industry partnerships are expanding to address talent development needs and support research initiatives. Collaborative programs between educational institutions and technology companies are enhancing curriculum relevance and creating pathways for graduate employment.

Regulatory framework evolution continues adapting to technological advancement and European Union directives. New regulations affecting data protection, cybersecurity, and digital services are shaping solution requirements and compliance considerations for ICT providers.

Strategic positioning recommendations emphasize the importance of developing specialized expertise in emerging technology domains while maintaining comprehensive service capabilities. ICT providers should focus on building competencies in artificial intelligence, cybersecurity, and cloud computing to capture growing market opportunities and differentiate from competitors.

Talent development initiatives should receive priority attention given the ongoing shortage of qualified ICT professionals. Companies should invest in training programs, university partnerships, and international recruitment strategies to build sustainable workforce capabilities supporting long-term growth objectives.

Market expansion strategies should leverage Hungary’s strategic position for regional growth opportunities. ICT providers should consider establishing partnerships with companies in neighboring countries and developing solutions that address common challenges across Central and Eastern European markets.

Innovation investment in research and development activities will be critical for maintaining competitive positioning as the market matures. Companies should allocate resources to emerging technology exploration, solution development, and intellectual property creation to support differentiation and premium pricing strategies.

Customer relationship management approaches should evolve to support longer-term partnerships and comprehensive solution delivery. ICT providers should develop account management capabilities, customer success programs, and value-added services that strengthen client relationships and increase revenue per customer.

Regulatory compliance expertise should be developed as a core competency given the evolving regulatory landscape affecting technology implementations. Companies should invest in compliance knowledge, certification programs, and specialized personnel to support client requirements and reduce implementation risks.

Market growth trajectory indicates sustained expansion over the next five years, driven by continued digital transformation initiatives, emerging technology adoption, and government support for ICT sector development. MarkWide Research projections suggest the market will maintain robust growth momentum with expanding opportunities across multiple technology domains and industry verticals.

Technology evolution will continue reshaping market dynamics as artificial intelligence, quantum computing, and advanced automation technologies mature and achieve broader commercial adoption. Organizations will increasingly seek integrated solutions combining multiple emerging technologies to achieve comprehensive digital transformation objectives.

Workforce development initiatives will become increasingly critical as demand for specialized ICT professionals continues exceeding supply. Educational institutions, government programs, and private sector training initiatives will need to collaborate more effectively to develop the skilled workforce required for sustained market growth.

International competitiveness will depend on Hungary’s ability to maintain cost advantages while developing advanced technology capabilities and specialized expertise. The market’s future success will require balancing competitive positioning with innovation development and value-added service delivery.

Regulatory environment evolution will continue influencing market development as European Union digital initiatives and national policies shape technology adoption patterns and solution requirements. ICT providers must maintain agility to adapt to changing regulatory frameworks while supporting client compliance objectives.

Investment patterns are expected to remain strong, with both domestic and international investors recognizing Hungary’s ICT market potential. Continued investment in infrastructure, talent development, and innovation will support market expansion and competitive positioning within the regional technology landscape.

Hungary’s ICT market represents a dynamic and rapidly evolving sector with substantial growth potential driven by digital transformation initiatives, government support, and strategic positioning within the European Union. The market has successfully transitioned from a traditional IT services provider to a comprehensive digital innovation hub, attracting significant international investment while fostering local entrepreneurship and technological advancement.

Market fundamentals remain strong, supported by skilled workforce availability, modern infrastructure, competitive operational costs, and favorable regulatory environment. The combination of these factors positions Hungary as an attractive destination for technology companies seeking European market access while maintaining operational efficiency and cost competitiveness.

Growth opportunities across emerging technologies, industry digitalization, and regional expansion create favorable conditions for sustained market development. Organizations that develop specialized capabilities, invest in talent development, and maintain customer-focused service delivery will be well-positioned to capitalize on expanding market opportunities and achieve long-term success in Hungary’s evolving ICT landscape.

What is ICT?

ICT stands for Information and Communication Technology, encompassing a range of technologies used to handle telecommunications, broadcast media, audio-visual processing and transmission systems, intelligent building management systems, and more.

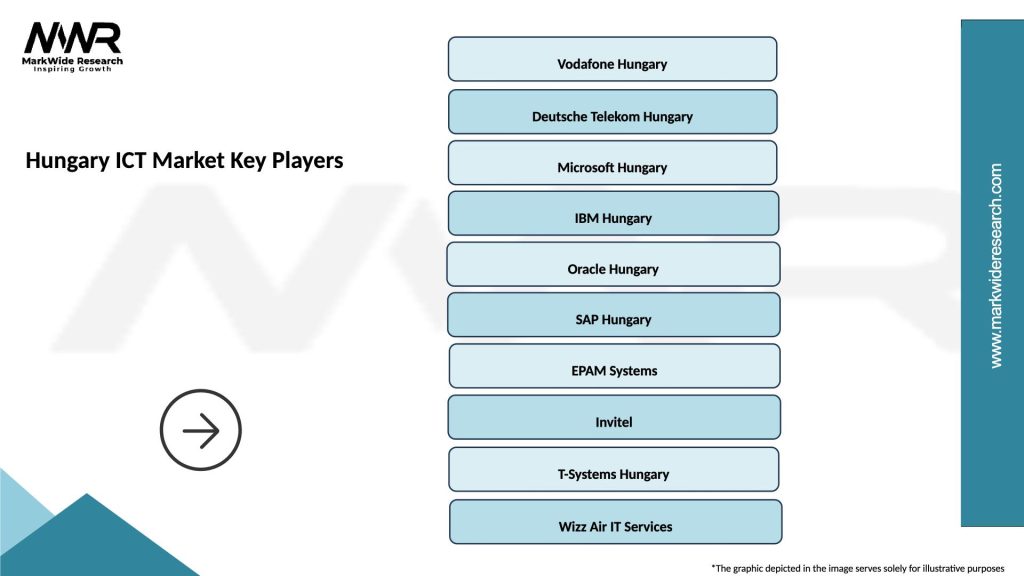

What are the key players in the Hungary ICT Market?

Key players in the Hungary ICT Market include companies like T-Systems Hungary, Vodafone Hungary, and EPAM Systems, which provide various services such as software development, telecommunications, and IT consulting, among others.

What are the growth factors driving the Hungary ICT Market?

The Hungary ICT Market is driven by factors such as increasing digital transformation initiatives, the rise of cloud computing, and the growing demand for cybersecurity solutions across various sectors.

What challenges does the Hungary ICT Market face?

Challenges in the Hungary ICT Market include a shortage of skilled IT professionals, rapid technological changes that require constant adaptation, and regulatory compliance issues that can hinder innovation.

What opportunities exist in the Hungary ICT Market?

Opportunities in the Hungary ICT Market include the expansion of e-commerce, the growth of smart city projects, and the increasing adoption of artificial intelligence and machine learning technologies.

What trends are shaping the Hungary ICT Market?

Trends shaping the Hungary ICT Market include the rise of remote work solutions, the integration of Internet of Things (IoT) devices, and a focus on sustainable technology practices to reduce environmental impact.

Hungary ICT Market

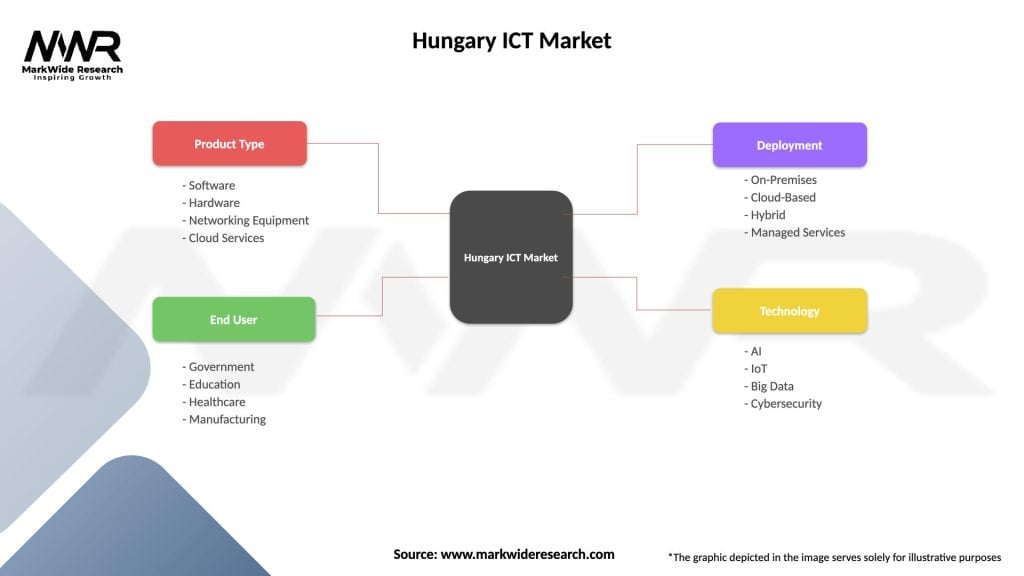

| Segmentation Details | Description |

|---|---|

| Product Type | Software, Hardware, Networking Equipment, Cloud Services |

| End User | Government, Education, Healthcare, Manufacturing |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Technology | AI, IoT, Big Data, Cybersecurity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Hungary ICT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at