444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The household side by side refrigerator market represents a significant segment within the global home appliance industry, characterized by robust growth and evolving consumer preferences. These premium appliances feature dual vertical compartments with the refrigerator section on one side and freezer on the other, offering enhanced accessibility and storage organization. Market dynamics indicate substantial expansion driven by rising disposable incomes, urbanization trends, and increasing demand for energy-efficient appliances.

Consumer preferences have shifted dramatically toward larger capacity refrigerators with advanced features, positioning side by side models as preferred choices for modern households. The market demonstrates strong growth momentum with a projected CAGR of 6.2% through the forecast period, reflecting increasing adoption across both developed and emerging markets. Technological innovations including smart connectivity, advanced cooling systems, and eco-friendly refrigerants continue to drive market expansion.

Regional market distribution shows North America maintaining the largest market share at approximately 38%, followed by Asia-Pacific with 32% market share, driven by rapid urbanization and changing lifestyle patterns. The market landscape features intense competition among established manufacturers focusing on product differentiation through innovative features, energy efficiency improvements, and premium design aesthetics.

The household side by side refrigerator market refers to the commercial ecosystem encompassing the manufacturing, distribution, and sales of residential refrigeration appliances featuring vertical dual-compartment designs. These appliances are characterized by their distinctive configuration where the refrigerator and freezer compartments are positioned side by side vertically, providing equal access to both sections at eye level.

Market participants include manufacturers, distributors, retailers, and service providers involved in bringing these premium appliances to end consumers. The market encompasses various product categories ranging from basic models to high-end smart refrigerators with advanced features such as water dispensers, ice makers, digital displays, and IoT connectivity. Consumer segments span from middle-income households seeking functional upgrades to affluent consumers demanding luxury features and premium aesthetics.

Market scope extends beyond simple appliance sales to include complementary services such as installation, maintenance, extended warranties, and smart home integration services. The ecosystem also involves component suppliers, technology providers, and after-sales service networks that collectively support the market infrastructure.

Market performance demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer behavior and technological advancement. The household side by side refrigerator segment has emerged as a premium category within the broader refrigeration market, capturing significant market share through superior functionality and aesthetic appeal.

Key growth drivers include increasing consumer preference for larger capacity appliances, rising awareness of energy efficiency benefits, and growing adoption of smart home technologies. Market penetration rates show 45% adoption among households upgrading from traditional top-freezer models, indicating substantial conversion potential. Innovation trends focus on connectivity features, with smart-enabled models representing 28% of total sales volume.

Competitive dynamics reveal market consolidation among leading manufacturers who leverage economies of scale, advanced manufacturing capabilities, and extensive distribution networks. Premium positioning strategies have proven successful, with high-end models commanding significant price premiums while maintaining strong demand elasticity. Market outlook remains highly positive, supported by demographic trends, technological innovation, and expanding global middle-class populations seeking lifestyle upgrades.

Consumer behavior analysis reveals several critical insights shaping market dynamics and future growth trajectories:

Urbanization trends represent the primary catalyst driving market expansion, as city-dwelling households increasingly adopt modern appliances to optimize limited kitchen space. Side by side refrigerators offer superior space utilization compared to traditional models, making them ideal for urban living environments where efficiency and functionality are paramount.

Rising disposable incomes across emerging markets enable broader consumer access to premium appliances previously considered luxury items. Middle-class expansion in developing economies creates substantial demand for lifestyle upgrades, with refrigerator replacement cycles accelerating as households seek enhanced features and improved aesthetics.

Technological advancement continues driving market growth through innovative features that enhance user experience and operational efficiency. Smart connectivity, advanced temperature control systems, and energy-saving technologies create compelling value propositions that justify premium pricing and encourage early replacement of functional units.

Changing lifestyle patterns including increased home cooking, bulk purchasing behaviors, and entertainment hosting drive demand for larger capacity refrigeration solutions. Modern households require enhanced food storage capabilities, making side by side models attractive alternatives to traditional configurations with limited freezer space.

High initial costs present significant barriers to market penetration, particularly in price-sensitive segments where consumers prioritize affordability over advanced features. Premium pricing strategies, while supporting healthy margins, limit accessibility for budget-conscious households and slow replacement cycles in established markets.

Space constraints in smaller kitchens and apartments restrict adoption potential, as side by side models typically require more width than traditional top-freezer configurations. Urban housing trends toward compact living spaces may limit market expansion in certain demographic segments and geographic regions.

Energy consumption concerns among environmentally conscious consumers create hesitation despite efficiency improvements. Larger capacity appliances inherently consume more energy than compact alternatives, potentially conflicting with sustainability goals and increasing operational costs for price-sensitive households.

Maintenance complexity associated with advanced features and dual cooling systems may deter consumers seeking simple, reliable appliances. Technical sophistication increases potential failure points and service requirements, creating long-term ownership concerns that influence purchasing decisions.

Smart home integration presents substantial growth opportunities as IoT adoption accelerates across residential markets. Connected refrigerators offering inventory management, energy monitoring, and remote control capabilities align with broader home automation trends, creating premium positioning opportunities and recurring service revenue streams.

Emerging market expansion offers significant untapped potential as developing economies experience rapid urbanization and income growth. Countries with expanding middle-class populations represent attractive targets for market entry strategies focused on localized product offerings and competitive pricing structures.

Sustainability initiatives create opportunities for manufacturers to differentiate through eco-friendly designs, renewable energy compatibility, and circular economy principles. Environmental regulations and consumer consciousness drive demand for sustainable appliances, supporting premium pricing for green technology implementations.

Customization trends enable manufacturers to capture higher margins through personalized design options, custom finishes, and modular configurations. Consumer desire for unique aesthetics and functional customization creates opportunities for premium product lines and direct-to-consumer sales channels.

Supply chain dynamics significantly influence market performance, with global component sourcing creating both opportunities and vulnerabilities. Manufacturers increasingly focus on supply chain resilience through diversified sourcing strategies and regional production capabilities to mitigate disruption risks and optimize cost structures.

Competitive intensity drives continuous innovation and pricing pressure across market segments. Established players leverage brand recognition and distribution advantages while emerging manufacturers compete through aggressive pricing and feature differentiation strategies. Market consolidation trends indicate potential for strategic acquisitions and partnerships to strengthen competitive positions.

Regulatory environment shapes product development through energy efficiency standards, environmental regulations, and safety requirements. Compliance costs influence pricing strategies while creating barriers to entry for smaller manufacturers lacking regulatory expertise and certification capabilities.

Consumer financing options increasingly influence purchasing decisions, with retailers and manufacturers offering flexible payment terms to expand market accessibility. Buy-now-pay-later programs and appliance financing solutions reduce upfront cost barriers while maintaining healthy transaction values.

Primary research methodologies employed comprehensive consumer surveys, manufacturer interviews, and retail channel analysis to gather firsthand market insights. Direct engagement with industry stakeholders provided qualitative perspectives on market trends, competitive dynamics, and future growth projections essential for accurate market assessment.

Secondary research incorporated extensive analysis of industry publications, regulatory filings, trade association data, and historical sales information to establish baseline market parameters and validate primary findings. Cross-referencing multiple data sources ensured research accuracy and comprehensive market coverage.

Data validation processes included triangulation of information sources, statistical analysis of survey responses, and expert review of findings to ensure research reliability. Quality assurance measures maintained data integrity throughout the research process, supporting confident market projections and strategic recommendations.

Analytical frameworks utilized advanced statistical modeling, trend analysis, and scenario planning to develop robust market forecasts. Quantitative analysis combined with qualitative insights provided comprehensive understanding of market dynamics and growth potential across different segments and regions.

North America maintains market leadership with approximately 38% market share, driven by high household penetration rates, frequent replacement cycles, and strong preference for premium appliances. The region benefits from established distribution networks, competitive retail environments, and consumer willingness to invest in advanced features and energy-efficient models.

Asia-Pacific represents the fastest-growing regional market with 32% market share and accelerating adoption rates across major economies. Rapid urbanization, rising disposable incomes, and changing lifestyle preferences drive substantial demand growth, particularly in China, India, and Southeast Asian markets where modern appliance adoption continues expanding.

Europe demonstrates steady market growth with 22% market share, characterized by strong environmental consciousness and preference for energy-efficient appliances. Regulatory emphasis on sustainability and consumer awareness of environmental impact support premium positioning for eco-friendly models with advanced efficiency features.

Latin America shows emerging growth potential with 5% market share, driven by economic development and urbanization trends. Brazil and Mexico lead regional adoption, while smaller markets demonstrate increasing interest in modern appliances as middle-class populations expand and living standards improve.

Middle East and Africa represent developing markets with 3% market share but significant long-term potential. Urban development projects, rising incomes, and modernization initiatives create opportunities for market expansion, particularly in Gulf Cooperation Council countries and major African urban centers.

Market leadership is concentrated among established appliance manufacturers who leverage brand recognition, manufacturing scale, and distribution capabilities to maintain competitive advantages. The competitive environment features both global corporations and regional specialists competing across different market segments.

Strategic initiatives focus on product differentiation through smart technology integration, energy efficiency improvements, and premium design aesthetics. Manufacturers invest heavily in research and development to maintain competitive positioning while expanding into emerging markets through localized product offerings.

By Capacity: Market segmentation reveals distinct consumer preferences across different capacity ranges, with larger models gaining market share as household sizes and storage needs evolve.

By Price Range: Pricing segmentation reflects diverse consumer needs and purchasing power across different market segments.

By Distribution Channel: Multi-channel distribution strategies serve diverse consumer shopping preferences and market access requirements.

Smart Refrigerators represent the fastest-growing category with 28% adoption rate among new purchases, driven by consumer interest in connectivity features and home automation integration. These models command premium pricing while offering enhanced functionality through mobile app control, inventory management, and energy monitoring capabilities.

Energy Star Certified Models demonstrate strong market performance with 72% consumer preference rates, reflecting growing environmental consciousness and long-term cost considerations. Manufacturers prioritize efficiency improvements to meet regulatory requirements while satisfying consumer demand for sustainable appliances.

Counter-Depth Models gain popularity among design-conscious consumers seeking built-in aesthetics without custom installation costs. These models sacrifice some capacity for improved kitchen integration, appealing to households prioritizing visual appeal over maximum storage space.

Water and Ice Dispensers remain highly desired features with 78% consumer preference rates, despite increased complexity and maintenance requirements. External dispensers provide convenience while internal systems offer cleaner aesthetics, creating distinct market segments with different value propositions.

Manufacturers benefit from premium positioning opportunities that support healthy profit margins while driving innovation investments. The market rewards technological advancement and design excellence, enabling differentiation strategies that justify higher pricing and build brand loyalty among quality-conscious consumers.

Retailers enjoy strong consumer demand and healthy transaction values that support profitable operations. Side by side refrigerators typically generate higher margins than basic models while creating opportunities for complementary sales including extended warranties, installation services, and accessory products.

Consumers gain access to advanced functionality, improved energy efficiency, and enhanced convenience features that justify investment costs through long-term value creation. Modern side by side refrigerators offer superior organization, accessibility, and aesthetic appeal compared to traditional alternatives.

Service Providers benefit from increased complexity and advanced features that create ongoing maintenance and support opportunities. Smart connectivity and sophisticated systems generate recurring service revenue while building long-term customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity emerges as the dominant trend reshaping market dynamics, with manufacturers integrating IoT capabilities, mobile app control, and voice assistant compatibility. Connected refrigerators enable remote monitoring, inventory management, and energy optimization while creating platforms for ongoing customer engagement and service revenue generation.

Sustainability focus drives product development toward eco-friendly refrigerants, improved energy efficiency, and recyclable materials. MarkWide Research analysis indicates growing consumer preference for environmentally responsible appliances, supporting premium positioning for sustainable designs despite higher initial costs.

Customization options expand as manufacturers offer diverse finishes, handle styles, and interior configurations to meet individual preferences. Custom panel compatibility, multiple finish options, and modular interior systems enable personalization while commanding premium pricing for unique aesthetic solutions.

Health and wellness features gain prominence through air purification systems, humidity control, and specialized storage zones for different food types. Advanced preservation technologies extend food freshness while supporting healthy lifestyle trends among health-conscious consumers.

Technological innovations continue advancing through improved compressor efficiency, advanced insulation materials, and sophisticated temperature control systems. Manufacturers invest heavily in research and development to enhance performance while meeting increasingly stringent energy efficiency requirements and consumer expectations.

Manufacturing automation enables cost reduction and quality improvements while supporting competitive pricing strategies. Advanced production techniques and robotics integration enhance manufacturing efficiency, enabling manufacturers to maintain margins while offering competitive pricing in challenging market conditions.

Distribution channel evolution reflects changing consumer shopping preferences with online sales growing rapidly alongside traditional retail channels. E-commerce platforms provide competitive pricing and convenient delivery options while specialty retailers focus on expert consultation and comprehensive service support.

Strategic partnerships between manufacturers and technology companies accelerate smart appliance development and market adoption. Collaborations with home automation providers, mobile app developers, and IoT platform companies create comprehensive ecosystem solutions that enhance consumer value propositions.

Market entry strategies should focus on differentiation through innovative features, competitive pricing, and strong distribution partnerships. New entrants must establish brand credibility while offering compelling value propositions that justify consumer switching costs from established brands.

Investment priorities should emphasize smart technology development, energy efficiency improvements, and manufacturing automation to maintain competitive positioning. Companies must balance innovation investments with cost management to support sustainable growth and profitability.

Geographic expansion opportunities exist in emerging markets where urbanization and income growth drive appliance adoption. Successful expansion requires localized product offerings, competitive pricing strategies, and appropriate distribution channel partnerships.

Customer engagement strategies should leverage smart connectivity capabilities to build ongoing relationships beyond initial purchases. Connected appliances create opportunities for service revenue, brand loyalty development, and valuable consumer data collection for future product development.

Market growth projections remain highly positive with continued expansion expected across all major regions. MWR forecasts indicate sustained demand growth driven by urbanization trends, technological advancement, and increasing consumer preference for premium appliances with advanced functionality.

Innovation acceleration will continue driving market evolution through artificial intelligence integration, advanced materials, and sustainable design principles. Future models may incorporate predictive maintenance, automated inventory management, and seamless smart home ecosystem integration.

Market maturation in developed regions will shift focus toward replacement cycles and feature upgrades rather than first-time purchases. Manufacturers must adapt strategies to capture upgrade demand while expanding into emerging markets for volume growth.

Sustainability requirements will increasingly influence product development and consumer purchasing decisions. Environmental regulations and consumer consciousness will drive continued improvements in energy efficiency, recyclability, and sustainable manufacturing practices throughout the industry.

The household side by side refrigerator market demonstrates exceptional growth potential and strategic importance within the global appliance industry. Strong consumer demand, technological innovation, and expanding global markets create favorable conditions for sustained expansion and profitability across the value chain.

Market dynamics favor manufacturers who successfully balance innovation with cost management while building strong brand recognition and distribution capabilities. Smart connectivity, energy efficiency, and premium design aesthetics represent key differentiation factors that support healthy margins and competitive positioning.

Future success will depend on adaptability to changing consumer preferences, regulatory requirements, and technological advancement. Companies that invest in innovation, expand into emerging markets, and develop comprehensive customer engagement strategies are positioned to capture significant market opportunities and achieve sustainable growth in this dynamic and evolving market segment.

What is Household Side By Side Refrigerator?

A Household Side By Side Refrigerator is a type of refrigerator that features two vertical compartments, one for refrigeration and one for freezing, allowing easy access to both sections. This design is popular for its convenience and efficient use of kitchen space.

What are the key players in the Household Side By Side Refrigerator Market?

Key players in the Household Side By Side Refrigerator Market include Whirlpool, Samsung, LG Electronics, and Frigidaire, among others. These companies are known for their innovative designs and energy-efficient models.

What are the growth factors driving the Household Side By Side Refrigerator Market?

The growth of the Household Side By Side Refrigerator Market is driven by increasing consumer demand for energy-efficient appliances, advancements in refrigeration technology, and the rising trend of smart home integration.

What challenges does the Household Side By Side Refrigerator Market face?

The Household Side By Side Refrigerator Market faces challenges such as high competition among manufacturers, fluctuating raw material prices, and changing consumer preferences towards more compact and multifunctional appliances.

What opportunities exist in the Household Side By Side Refrigerator Market?

Opportunities in the Household Side By Side Refrigerator Market include the growing demand for smart refrigerators with IoT capabilities, the expansion of e-commerce platforms for appliance sales, and increasing awareness of energy-efficient products.

What trends are shaping the Household Side By Side Refrigerator Market?

Trends shaping the Household Side By Side Refrigerator Market include the rise of eco-friendly materials, the integration of advanced cooling technologies, and the popularity of customizable features that cater to individual consumer needs.

Household Side By Side Refrigerator Market

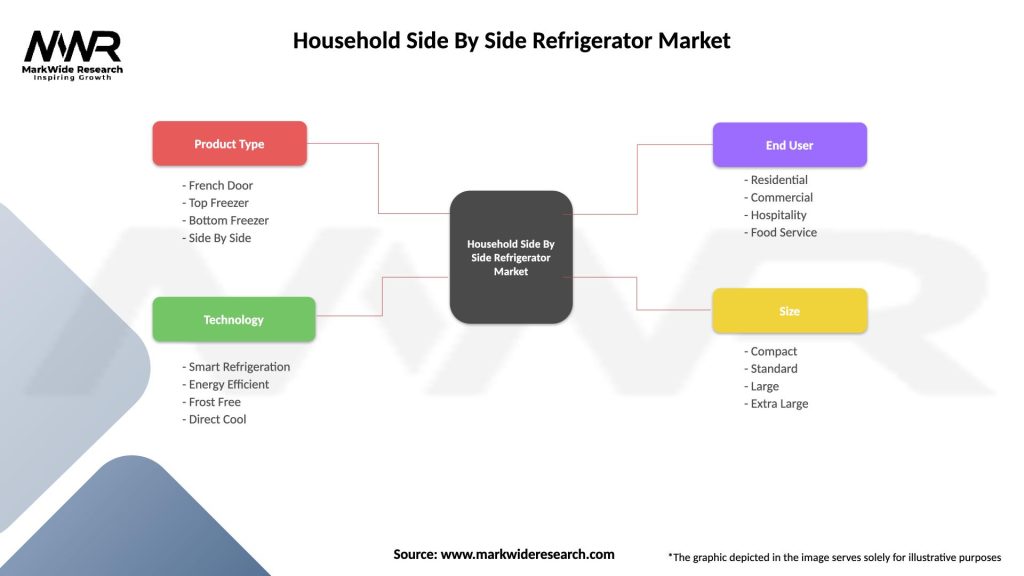

| Segmentation Details | Description |

|---|---|

| Product Type | French Door, Top Freezer, Bottom Freezer, Side By Side |

| Technology | Smart Refrigeration, Energy Efficient, Frost Free, Direct Cool |

| End User | Residential, Commercial, Hospitality, Food Service |

| Size | Compact, Standard, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Household Side By Side Refrigerator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at