444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The hotel TV casting market represents a rapidly evolving segment within the hospitality technology industry, focusing on wireless streaming solutions that enable guests to cast content from their personal devices to in-room televisions. This innovative technology has transformed the traditional hotel entertainment experience by allowing seamless connectivity between smartphones, tablets, laptops, and hotel room displays. Market dynamics indicate substantial growth driven by increasing guest expectations for personalized entertainment and the widespread adoption of streaming services.

Industry transformation has accelerated significantly as hotels recognize the importance of providing modern, tech-savvy amenities to remain competitive. The integration of casting technology addresses the growing demand for flexible entertainment options while reducing operational costs associated with traditional cable and satellite services. Growth projections suggest the market is expanding at a robust CAGR of 12.8%, reflecting strong adoption across various hotel segments from budget accommodations to luxury resorts.

Regional adoption patterns show North America leading market penetration with approximately 38% market share, followed by Europe and Asia-Pacific regions experiencing rapid implementation. The technology’s appeal stems from its ability to enhance guest satisfaction while providing hotels with valuable data insights and cost-effective entertainment solutions.

The hotel TV casting market refers to the comprehensive ecosystem of wireless streaming technologies, hardware solutions, and software platforms that enable hotel guests to project content from their personal mobile devices directly onto in-room television screens. This technology eliminates the need for physical connections while providing seamless integration with popular streaming platforms and personal media libraries.

Core functionality encompasses various casting protocols including Chromecast, AirPlay, Miracast, and proprietary solutions designed specifically for hospitality environments. These systems typically feature secure network protocols to protect guest privacy while maintaining hotel network integrity. Implementation models range from simple plug-and-play devices to fully integrated smart TV solutions with built-in casting capabilities.

Value proposition extends beyond basic entertainment, incorporating features such as hotel service integration, local information delivery, and promotional content distribution. The technology serves as a bridge between traditional hospitality services and modern digital expectations, creating enhanced guest experiences while providing operational benefits for hotel management.

Market evolution in the hotel TV casting sector demonstrates remarkable momentum as hospitality providers increasingly prioritize guest-centric technology solutions. The convergence of consumer streaming habits and hotel modernization initiatives has created a compelling growth environment characterized by rapid adoption and continuous innovation. Key market drivers include the proliferation of personal streaming subscriptions, with 78% of travelers expecting to access their content during hotel stays.

Technology advancement has simplified implementation processes while enhancing security features crucial for hospitality environments. Modern casting solutions offer seamless integration with existing hotel infrastructure, reducing deployment complexity and operational disruption. Competitive landscape features established technology providers alongside specialized hospitality-focused companies developing tailored solutions for diverse accommodation types.

Investment trends reflect strong confidence in market potential, with hotels allocating increased budgets toward guest technology upgrades. The shift from traditional entertainment models to flexible, personalized solutions represents a fundamental change in hospitality service delivery. Future projections indicate continued expansion as technology costs decrease and guest expectations for digital amenities intensify across all market segments.

Strategic insights reveal several critical factors driving market expansion and shaping competitive dynamics within the hotel TV casting sector:

Primary growth catalysts propelling the hotel TV casting market stem from fundamental shifts in consumer behavior and technological advancement. The widespread adoption of streaming services has created guest expectations for accessing personal content libraries during travel, with 85% of business travelers reporting frustration with traditional hotel entertainment options. This demand has prompted hotels to seek flexible solutions that accommodate diverse guest preferences without significant infrastructure investments.

Technological convergence has simplified implementation while reducing costs associated with casting system deployment. Modern solutions leverage existing Wi-Fi infrastructure and smart TV capabilities, minimizing hardware requirements and installation complexity. Operational benefits include reduced licensing fees for traditional cable services, lower maintenance requirements, and improved guest satisfaction metrics contributing to positive review scores and repeat bookings.

Competitive differentiation drives adoption as hotels seek distinctive amenities to stand out in crowded markets. Casting technology provides a modern, tech-forward image appealing to younger demographics while offering practical benefits for all guest segments. Cost-effectiveness compared to traditional entertainment systems makes the technology accessible to properties across various budget ranges, from economy hotels to luxury establishments.

Industry digitization trends accelerate adoption as hotels embrace comprehensive technology upgrades encompassing guest services, operations, and marketing capabilities. Casting systems often serve as entry points for broader digital transformation initiatives, providing immediate guest-facing benefits while establishing foundations for advanced hospitality technology implementations.

Implementation challenges present significant barriers to widespread adoption despite growing market interest. Network infrastructure limitations in older properties often require substantial upgrades to support reliable casting functionality, creating unexpected costs and deployment delays. Technical complexity associated with ensuring consistent performance across diverse device types and operating systems can overwhelm hotel IT resources, particularly in smaller properties lacking dedicated technical staff.

Security concerns remain paramount in hospitality environments where guest privacy and network integrity are critical. Hotels must balance accessibility with protection against potential security vulnerabilities introduced by guest device connectivity. Compliance requirements vary across jurisdictions, adding complexity to implementation planning and ongoing operations, particularly for international hotel chains operating in multiple regulatory environments.

Guest education needs create operational overhead as staff must be trained to assist guests with casting setup and troubleshooting. Varying levels of technical proficiency among guests can lead to support requests and potential dissatisfaction when systems don’t perform as expected. Bandwidth limitations during peak usage periods may result in degraded streaming quality, negatively impacting guest experiences and potentially damaging hotel reputations.

Integration complexities with existing hotel systems can create unexpected challenges during implementation. Legacy infrastructure may require significant modifications or replacements to support modern casting technologies effectively. Ongoing maintenance requirements and software updates demand continuous attention and resources that some properties may struggle to provide consistently.

Emerging opportunities within the hotel TV casting market present substantial potential for growth and innovation across multiple dimensions. The integration of artificial intelligence and machine learning capabilities offers possibilities for personalized content recommendations and automated system optimization based on guest preferences and usage patterns. Smart hotel initiatives create synergies between casting technology and other connected amenities, enabling comprehensive guest experience platforms that differentiate properties in competitive markets.

Revenue diversification through advanced casting platforms enables hotels to explore new income streams via targeted advertising, premium content partnerships, and enhanced service delivery. Partnership opportunities with streaming service providers could create exclusive content offerings or promotional packages that add value for both guests and hotels while generating additional revenue.

Market expansion into underserved segments presents significant growth potential, particularly in emerging markets where hotel modernization efforts are accelerating. Technology advancement continues to reduce implementation costs while improving functionality, making casting solutions accessible to broader property types and budget ranges. The growing trend toward extended-stay accommodations creates demand for enhanced entertainment options that casting technology addresses effectively.

Integration possibilities with emerging technologies such as voice control, augmented reality, and Internet of Things (IoT) systems offer opportunities for innovative service delivery models. Data monetization through anonymized guest preference analytics could provide valuable insights for hotel operations optimization and marketing strategy development while respecting privacy requirements.

Dynamic market forces shape the hotel TV casting landscape through complex interactions between technology evolution, consumer expectations, and industry transformation. The rapid pace of consumer technology adoption creates continuous pressure for hotels to maintain current capabilities while planning for future enhancements. Competitive pressures intensify as casting technology transitions from differentiating amenity to standard expectation, requiring hotels to focus on implementation quality and additional value-added features.

Supply chain dynamics influence market development through hardware availability, pricing trends, and technology standardization efforts. The consolidation of casting protocols and improved interoperability reduce implementation complexity while expanding compatibility across device ecosystems. Regulatory influences affect deployment strategies, particularly regarding data privacy, network security, and accessibility compliance requirements that vary by jurisdiction.

Economic factors impact adoption rates as hotels balance technology investments against operational priorities and financial constraints. The demonstrated return on investment through improved guest satisfaction and operational efficiency helps justify implementation costs. Seasonal variations in hotel occupancy affect system utilization patterns and performance requirements, influencing infrastructure planning and capacity management decisions.

Innovation cycles drive continuous improvement in casting technology capabilities, with manufacturers regularly introducing enhanced features and improved performance characteristics. Market maturation leads to standardization of core functionalities while creating opportunities for specialized solutions targeting specific hotel segments or unique operational requirements.

Comprehensive research approach employed in analyzing the hotel TV casting market incorporates multiple data collection methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with hotel executives, technology vendors, and industry consultants to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies target hotel operators across various property types and geographic regions to understand adoption patterns, implementation experiences, and future planning considerations.

Secondary research components encompass analysis of industry reports, financial statements, patent filings, and regulatory documentation to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling techniques to project market growth trends and identify key performance indicators driving industry development. Data triangulation methods ensure consistency across multiple information sources while identifying potential discrepancies requiring additional investigation.

Market segmentation analysis employs clustering techniques to identify distinct customer groups and their specific requirements, preferences, and adoption patterns. Competitive intelligence gathering includes monitoring of product launches, partnership announcements, and strategic initiatives by key market participants. Technology assessment methodologies evaluate emerging solutions and their potential market impact through expert evaluation and pilot program analysis.

Validation processes include peer review by industry experts and cross-referencing with established market research databases to ensure accuracy and completeness of findings. Continuous monitoring systems track market developments and update research findings to reflect evolving conditions and emerging trends affecting the hotel TV casting market landscape.

North American dominance in the hotel TV casting market reflects the region’s advanced hospitality technology adoption and strong consumer demand for streaming services. The United States leads implementation with approximately 42% regional market share, driven by major hotel chains’ technology modernization initiatives and high guest expectations for digital amenities. Canadian adoption follows similar patterns with particular strength in urban markets and business-focused properties where technology amenities significantly influence booking decisions.

European market development demonstrates strong growth momentum with 28% regional market penetration, led by the United Kingdom, Germany, and France where hospitality digitization initiatives align with casting technology capabilities. Regulatory compliance requirements, particularly regarding data privacy under GDPR, influence implementation approaches while creating opportunities for specialized solutions addressing European market needs. Nordic countries show particularly high adoption rates reflecting strong technology acceptance and advanced digital infrastructure.

Asia-Pacific expansion represents the fastest-growing regional market with 15.7% annual growth rate, driven by rapid hotel development in China, India, and Southeast Asian markets. Technology leapfrogging enables new properties to implement advanced casting solutions from initial construction, avoiding legacy system constraints common in established markets. Japan and South Korea demonstrate sophisticated implementation approaches incorporating local technology preferences and unique hospitality service standards.

Emerging market opportunities in Latin America, Middle East, and Africa show increasing interest as hotel modernization efforts accelerate. Infrastructure development and growing middle-class populations create demand for enhanced hospitality experiences that casting technology addresses effectively. Regional variations in technology preferences and regulatory requirements create opportunities for customized solutions targeting specific market needs.

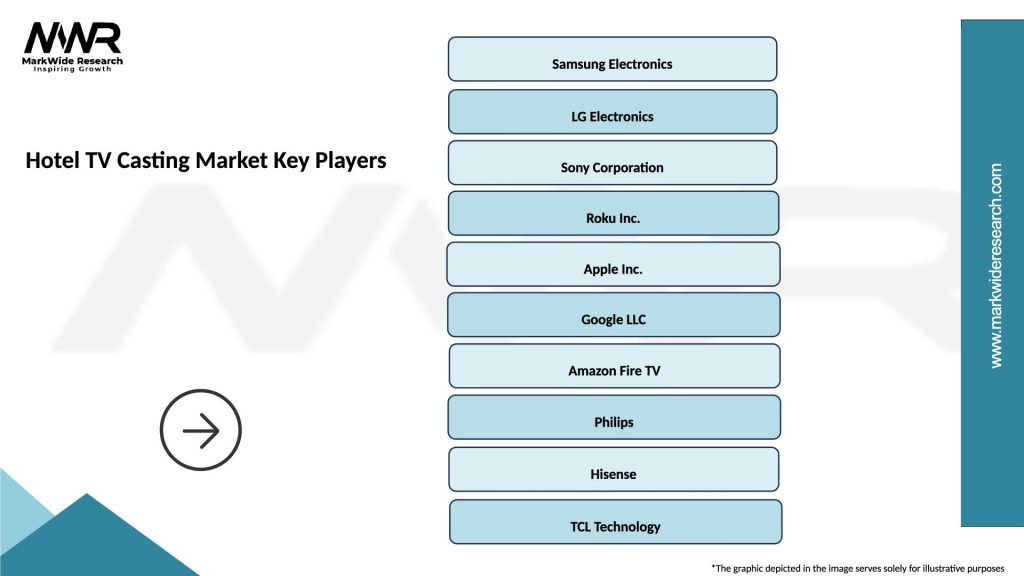

Market leadership in the hotel TV casting sector features a diverse mix of established technology companies and specialized hospitality solution providers competing across different market segments and geographic regions. Key competitive factors include technology reliability, ease of implementation, security features, and integration capabilities with existing hotel systems.

Competitive strategies focus on differentiation through specialized features, superior customer support, and comprehensive integration capabilities. Partnership approaches with hotel management companies and technology integrators create distribution advantages while ensuring proper implementation and ongoing support services.

Market segmentation within the hotel TV casting sector reveals distinct categories based on technology type, hotel segment, implementation model, and geographic focus. Technology-based segmentation differentiates between protocol-specific solutions, universal casting platforms, and integrated smart TV systems with built-in capabilities.

By Technology Type:

By Hotel Segment:

By Implementation Model:

Luxury hotel segment demonstrates the highest adoption rates with 67% implementation rate among five-star properties, driven by guest expectations for cutting-edge amenities and willingness to invest in premium technology solutions. Implementation approaches in this segment emphasize seamless integration with existing high-end amenities, white-glove guest support, and advanced features such as personalized content recommendations and concierge service integration.

Business hotel category shows strong growth momentum as corporate travelers increasingly expect familiar technology experiences during business trips. Feature priorities include reliable connectivity, quick setup processes, and integration with business productivity tools. This segment particularly values solutions that enable presentation capabilities and video conferencing support through room displays.

Extended stay properties represent an emerging high-potential segment where casting technology addresses the unique needs of longer-term guests seeking comprehensive entertainment options. Usage patterns in this category show higher engagement rates and more diverse content consumption compared to traditional short-stay accommodations. Properties report 23% increase in guest satisfaction scores following casting system implementation.

Budget accommodation segment increasingly recognizes casting technology as a cost-effective amenity that can differentiate properties without significant operational overhead. Implementation strategies focus on simple, reliable solutions that provide essential functionality while minimizing support requirements and ongoing maintenance costs. This segment shows particular interest in solutions that reduce traditional cable and satellite service expenses.

Resort and leisure properties utilize casting technology to enhance guest entertainment options while reducing operational complexity associated with managing diverse content libraries. Integration opportunities with resort activities, local attractions, and promotional content create additional value beyond basic entertainment functionality.

Hotel operators realize substantial benefits from casting technology implementation including enhanced guest satisfaction, reduced entertainment-related operational costs, and improved property differentiation in competitive markets. Operational advantages include simplified content management, reduced licensing fees for traditional television services, and decreased maintenance requirements compared to complex cable and satellite systems. Properties report 31% reduction in entertainment-related guest complaints following casting system deployment.

Guest experience enhancement represents the primary value proposition, enabling travelers to access familiar content libraries and personal entertainment preferences during hotel stays. Convenience factors include elimination of unfamiliar remote controls, access to personal streaming subscriptions, and ability to continue viewing content across multiple devices. Surveys indicate 89% guest satisfaction with casting capabilities when properly implemented and supported.

Technology vendors benefit from expanding market opportunities as hotel modernization efforts accelerate globally. Revenue streams include initial system sales, ongoing software licensing, support services, and potential advertising platform partnerships. The recurring nature of software updates and support services creates sustainable business models for solution providers.

Hotel management companies leverage casting technology as a standardized amenity across property portfolios, creating operational efficiencies and brand consistency. Procurement advantages include volume discounts, standardized implementation processes, and centralized support arrangements that reduce individual property management overhead.

Guests and travelers experience improved satisfaction through access to personalized entertainment options, familiar user interfaces, and seamless connectivity with personal devices. Value perception increases as casting capabilities become expected amenities rather than premium features, influencing booking decisions and property selection criteria.

Strengths:

Weaknesses:

Opportunities:

Threats:

Integration sophistication represents a dominant trend as casting solutions evolve beyond basic screen mirroring to comprehensive guest experience platforms. Advanced implementations incorporate hotel service integration, local information delivery, and personalized content recommendations based on guest preferences and stay history. According to MarkWide Research analysis, properties with integrated casting platforms report 26% higher guest engagement rates compared to basic implementations.

Security enhancement continues as a critical trend with manufacturers developing hospitality-specific security protocols addressing unique hotel environment requirements. Network isolation techniques protect hotel infrastructure while enabling guest device connectivity, and advanced encryption methods safeguard personal information during casting sessions. Biometric authentication and device verification systems add additional security layers for premium implementations.

Artificial intelligence integration emerges as casting platforms incorporate machine learning algorithms for content recommendation, system optimization, and predictive maintenance capabilities. Smart features include automatic quality adjustment based on network conditions, personalized interface customization, and intelligent troubleshooting systems that reduce support requirements.

Voice control compatibility expands as casting systems integrate with popular voice assistants and smart speaker platforms. Hands-free operation appeals to guests seeking convenient control methods while enabling accessibility features for travelers with mobility limitations. Multi-language voice support addresses international guest needs in diverse hotel markets.

Sustainability focus drives development of energy-efficient casting solutions that reduce power consumption compared to traditional entertainment systems. Green technology initiatives align with hotel sustainability goals while providing cost savings through reduced energy usage and extended hardware lifecycles.

Strategic partnerships between casting technology providers and major hotel chains accelerate market adoption while driving solution standardization across property portfolios. Recent collaborations focus on developing hospitality-specific features, streamlined implementation processes, and comprehensive support services tailored to hotel operational requirements. These partnerships often include volume pricing agreements and co-marketing initiatives that benefit both technology vendors and hotel operators.

Product innovation cycles introduce enhanced capabilities addressing specific hospitality challenges such as guest privacy protection, network security, and multi-language support. Next-generation platforms incorporate cloud-based management systems enabling centralized monitoring and configuration across multiple properties. Advanced analytics capabilities provide insights into guest usage patterns and system performance metrics.

Regulatory compliance developments shape product design as manufacturers adapt solutions to meet evolving privacy and security requirements across different jurisdictions. GDPR compliance features in European markets and similar privacy-focused enhancements in other regions demonstrate industry responsiveness to regulatory changes. Accessibility compliance improvements ensure casting solutions meet disability accommodation requirements.

Market consolidation activities include acquisitions of specialized hospitality technology companies by larger technology providers seeking to expand their hotel market presence. Integration efforts combine casting capabilities with broader hospitality technology platforms creating comprehensive guest experience solutions. These developments often result in enhanced product offerings and improved customer support capabilities.

Standardization initiatives work toward universal casting protocols and improved interoperability across different device types and operating systems. Industry collaboration efforts aim to reduce implementation complexity while ensuring consistent guest experiences regardless of personal device preferences or hotel technology choices.

Implementation strategy recommendations emphasize the importance of comprehensive planning that addresses network infrastructure requirements, staff training needs, and guest education programs. Successful deployments typically involve phased rollouts starting with pilot programs in select properties to identify potential challenges and optimize implementation processes before broader deployment. Hotels should prioritize solutions offering robust technical support and clear escalation procedures for addressing guest issues.

Technology selection criteria should emphasize security features, device compatibility, and integration capabilities with existing hotel systems. Evaluation processes should include testing with diverse device types and operating systems to ensure consistent performance across guest technology preferences. Long-term vendor viability and ongoing support capabilities represent critical factors given the evolving nature of casting technology standards.

Staff preparation requires comprehensive training programs covering basic troubleshooting, guest assistance procedures, and escalation protocols for complex technical issues. Support infrastructure should include clear documentation, quick reference guides, and direct access to technical support resources. Regular training updates ensure staff remain current with system enhancements and new features.

Guest communication strategies should clearly explain casting capabilities during check-in processes while providing simple setup instructions and troubleshooting guidance. Marketing approaches can highlight casting amenities in booking platforms and promotional materials to attract tech-savvy travelers. Feedback collection systems help identify improvement opportunities and demonstrate responsiveness to guest suggestions.

Performance monitoring systems should track usage patterns, technical issues, and guest satisfaction metrics to optimize system performance and identify enhancement opportunities. Data analysis can reveal insights into guest preferences and behavior patterns valuable for service optimization and marketing strategy development while respecting privacy requirements.

Market evolution projections indicate continued robust growth as casting technology transitions from premium amenity to standard expectation across hotel segments. Adoption acceleration is expected to reach 58% market penetration within the next five years, driven by decreasing implementation costs and increasing guest demand for personalized entertainment options. MWR forecasts suggest particularly strong growth in emerging markets where hotel modernization efforts align with casting technology capabilities.

Technology advancement will focus on enhanced integration capabilities, improved security features, and artificial intelligence-powered optimization systems. Next-generation solutions are expected to incorporate augmented reality interfaces, advanced voice control, and seamless integration with smart hotel ecosystems. Cloud-based management platforms will enable more sophisticated monitoring and configuration capabilities across multi-property portfolios.

Market consolidation trends suggest continued merger and acquisition activity as larger technology companies seek to expand hospitality market presence through specialized solution providers. Partnership evolution will likely include deeper integration between casting platforms and streaming service providers, creating exclusive content offerings and enhanced guest value propositions.

Regulatory landscape changes will continue influencing product development with increased focus on privacy protection, security enhancement, and accessibility compliance. International expansion opportunities remain strong as global hotel chains standardize technology amenities across diverse geographic markets with varying regulatory requirements.

Innovation directions include integration with emerging technologies such as 5G networks, edge computing, and Internet of Things platforms that will enable new service delivery models and enhanced guest experiences. Sustainability initiatives will drive development of more energy-efficient solutions aligned with hotel environmental responsibility goals while reducing operational costs.

Market transformation in the hotel TV casting sector reflects broader hospitality industry evolution toward guest-centric technology solutions that enhance experiences while improving operational efficiency. The convergence of consumer streaming habits, technology advancement, and hotel modernization initiatives has created a compelling growth environment characterized by strong adoption rates and continuous innovation. Strategic positioning of casting technology as both guest amenity and operational tool demonstrates its value proposition across diverse hotel segments and geographic markets.

Future prospects remain highly positive as market fundamentals continue strengthening through decreasing implementation costs, improving technology reliability, and expanding guest expectations for digital amenities. The evolution from basic casting functionality toward comprehensive guest experience platforms creates opportunities for enhanced service delivery and revenue generation. Industry participants who embrace strategic implementation approaches while prioritizing guest satisfaction and operational excellence are well-positioned to capitalize on continued market expansion and technological advancement in the dynamic hotel TV casting market landscape.

What is Hotel TV Casting?

Hotel TV Casting refers to the technology and services that allow guests in hotels to stream content from their personal devices to the in-room television. This includes casting services for various platforms, enhancing the guest experience by providing access to personal media libraries and streaming services.

What are the key players in the Hotel TV Casting Market?

Key players in the Hotel TV Casting Market include companies like Google, with its Chromecast technology, and Apple, known for AirPlay. Other notable companies include Samsung and LG, which provide integrated solutions for hotel televisions, among others.

What are the growth factors driving the Hotel TV Casting Market?

The growth of the Hotel TV Casting Market is driven by increasing demand for personalized guest experiences and the proliferation of streaming services. Additionally, the rise in mobile device usage among travelers contributes to the market’s expansion.

What challenges does the Hotel TV Casting Market face?

Challenges in the Hotel TV Casting Market include concerns over data security and privacy, as well as the need for reliable internet connectivity in hotels. Furthermore, the integration of diverse devices and platforms can complicate the user experience.

What opportunities exist in the Hotel TV Casting Market?

Opportunities in the Hotel TV Casting Market include the potential for partnerships with streaming service providers and the development of advanced casting technologies. Additionally, as hotels seek to enhance guest satisfaction, innovative features can be introduced to attract tech-savvy travelers.

What trends are shaping the Hotel TV Casting Market?

Trends in the Hotel TV Casting Market include the increasing adoption of smart TVs and the integration of voice control features. Moreover, the focus on sustainability is leading hotels to invest in energy-efficient technologies that support casting solutions.

Hotel TV Casting Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart TVs, Streaming Devices, Set-Top Boxes, Projectors |

| Technology | Wi-Fi, Bluetooth, HDMI, Miracast |

| End User | Hotels, Resorts, Motels, Vacation Rentals |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Hotel TV Casting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at