444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The horse insurance market is a specialized sector within the insurance industry that caters to the unique needs of horse owners, breeders, trainers, and riders. This niche market provides coverage for various risks associated with horses, including mortality, medical expenses, theft, and liability. Horse insurance offers financial protection and peace of mind to individuals and businesses involved in the equine industry.

Meaning

Horse insurance refers to the policies and coverage options designed to safeguard horses and their owners against potential risks and losses. It provides financial compensation in case of events like accidents, illnesses, injuries, or even death of the insured horse. Horse insurance policies can vary widely in terms of coverage, premiums, and exclusions, depending on the specific needs and requirements of the policyholder.

Executive Summary

The horse insurance market has witnessed steady growth in recent years, driven by the increasing value of horses, growing awareness about risk management, and the need to protect significant investments in the equine industry. The market offers a wide range of insurance products tailored to meet the specific needs of different stakeholders within the horse industry. These products include equine mortality insurance, medical coverage, loss of use insurance, and liability insurance.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The horse insurance market is a dynamic industry influenced by various factors, including the overall performance of the equine industry, changes in regulations, advancements in veterinary medicine, and emerging risks. Understanding these market dynamics is crucial for insurers, industry participants, and horse owners to make informed decisions regarding coverage and risk management strategies.

Regional Analysis

The horse insurance market exhibits regional variations based on factors such as the concentration of equestrian activities, the value of horses, and local regulations. Some regions with a strong equestrian culture and industry, such as North America and Europe, have a more mature horse insurance market compared to developing regions.

Competitive Landscape

Leading Companies in the Horse Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

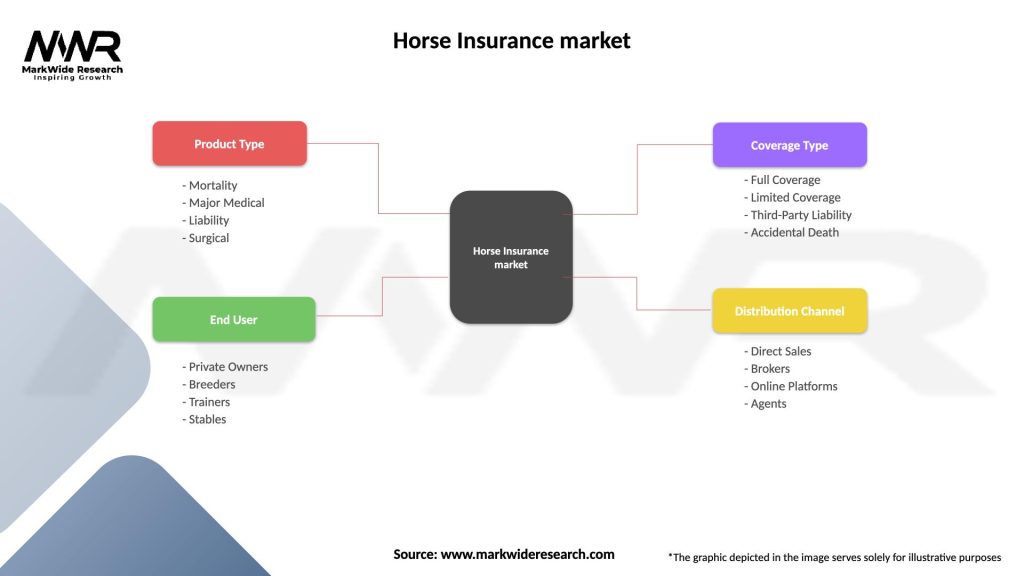

Segmentation

The horse insurance market can be segmented based on various factors, including type of coverage, horse value, geographical location, and type of policyholder. Common segments include equine mortality insurance, medical coverage, loss of use insurance, and liability insurance.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the horse insurance market. The temporary suspension of equestrian events, travel restrictions, and economic uncertainties have affected the demand for insurance coverage. However, as the industry gradually recovers, the importance of risk management and financial protection through insurance is likely to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The horse insurance market is expected to witness steady growth in the coming years, driven by the increasing value of horses, growing awareness about risk management, and the need to protect significant investments. Technological advancements and the expansion into emerging markets present opportunities for innovation and market expansion.

Conclusion

The horse insurance market plays a vital role in providing financial protection and risk management solutions for horse owners, breeders, trainers, and riders. With the increasing value of horses and growing awareness about the need for insurance, the market offers a wide range of coverage options tailored to meet the specific needs of different stakeholders within the equine industry. The industry is evolving to embrace technology, expand coverage options, and promote responsible horse ownership. As the horse industry continues to thrive, the demand for horse insurance is expected to grow, making it an essential aspect of the equine ecosystem.

What is Horse Insurance?

Horse insurance is a type of coverage designed to protect horse owners from financial losses related to their horses. This can include medical expenses, theft, and liability for injuries caused by the horse.

What are the key players in the Horse Insurance market?

Key players in the Horse Insurance market include companies like The Hartford, Markel, and Hallmark Insurance. These companies offer various policies tailored to the needs of horse owners, including mortality and medical coverage, among others.

What are the main drivers of growth in the Horse Insurance market?

The growth of the Horse Insurance market is driven by increasing awareness of animal welfare, rising veterinary costs, and the growing popularity of equestrian sports. Additionally, more horse owners are recognizing the financial benefits of having insurance coverage.

What challenges does the Horse Insurance market face?

The Horse Insurance market faces challenges such as high premiums, the complexity of policy terms, and the risk of fraud. Additionally, varying regulations across regions can complicate the insurance process for horse owners.

What opportunities exist in the Horse Insurance market?

Opportunities in the Horse Insurance market include the development of customized insurance products and the integration of technology for better policy management. There is also potential for growth in emerging markets where equestrian activities are gaining popularity.

What trends are shaping the Horse Insurance market?

Trends in the Horse Insurance market include the increasing use of telemedicine for veterinary care and the rise of specialized insurance products that cater to specific equestrian disciplines. Additionally, there is a growing emphasis on sustainability and ethical treatment of horses.

Horse Insurance market

| Segmentation Details | Description |

|---|---|

| Product Type | Mortality, Major Medical, Liability, Surgical |

| End User | Private Owners, Breeders, Trainers, Stables |

| Coverage Type | Full Coverage, Limited Coverage, Third-Party Liability, Accidental Death |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Horse Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at