444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Hong Kong warehousing market represents a critical component of Asia-Pacific’s logistics infrastructure, serving as a strategic gateway between mainland China and global markets. Hong Kong’s unique position as an international financial center and free port has established it as one of the world’s most important logistics hubs, with warehousing facilities playing a pivotal role in supporting trade flows worth trillions of dollars annually.

Market dynamics in Hong Kong’s warehousing sector are characterized by intense competition for limited space, with the territory’s geographical constraints driving innovation in vertical storage solutions and automated systems. The market has experienced consistent growth of 6.2% annually over the past five years, driven by e-commerce expansion, cross-border trade facilitation, and increasing demand for sophisticated cold chain storage facilities.

Strategic location advantages continue to attract multinational corporations seeking regional distribution centers, despite higher operational costs compared to neighboring markets. The integration of advanced technologies, including IoT sensors, robotics, and AI-powered inventory management systems, has enhanced operational efficiency by approximately 35% across major facilities, positioning Hong Kong as a leader in smart warehousing solutions.

The Hong Kong warehousing market refers to the comprehensive ecosystem of storage, distribution, and logistics facilities operating within Hong Kong’s Special Administrative Region, encompassing traditional warehouses, modern distribution centers, cold storage facilities, and specialized logistics hubs that support both domestic consumption and international trade flows.

This market encompasses various facility types including general cargo warehouses, temperature-controlled storage units, bonded warehouses, container freight stations, and specialized facilities for high-value goods such as electronics and pharmaceuticals. The sector serves multiple functions from simple storage to complex value-added services including packaging, labeling, quality control, and cross-docking operations.

Modern warehousing operations in Hong Kong integrate sophisticated technology platforms that enable real-time inventory tracking, automated sorting systems, and seamless integration with global supply chain networks. These facilities serve as crucial nodes in international trade routes, particularly for goods moving between China and global markets, leveraging Hong Kong’s established legal framework and efficient customs procedures.

Hong Kong’s warehousing sector continues to demonstrate remarkable resilience and adaptability despite facing significant challenges including land scarcity, rising operational costs, and increasing competition from neighboring logistics hubs. The market has successfully transformed from traditional storage-focused operations to sophisticated, technology-driven logistics centers that provide comprehensive supply chain solutions.

Key market drivers include the rapid expansion of e-commerce activities, which now account for 18% of total retail sales, growing demand for cold chain logistics driven by pharmaceutical and food sectors, and increasing adoption of omnichannel retail strategies by major brands. The integration of artificial intelligence and automation technologies has become a critical differentiator, with leading operators investing heavily in smart warehouse solutions.

Competitive landscape analysis reveals a market dominated by both international logistics giants and local operators, each leveraging unique strengths to capture market share. The sector benefits from Hong Kong’s strategic advantages including its world-class airport, efficient port facilities, and robust telecommunications infrastructure, which collectively support seamless integration with global supply chains.

Strategic positioning within the Asia-Pacific region continues to drive demand for Hong Kong warehousing services, with the territory serving as a preferred location for regional headquarters and distribution centers. MarkWide Research analysis indicates several critical insights shaping market development:

E-commerce growth represents the most significant driver of warehousing demand in Hong Kong, with online retail sales experiencing robust annual growth of 22% over the past three years. This expansion has created unprecedented demand for fulfillment centers capable of handling high-volume, small-parcel shipments with rapid turnaround times.

Cross-border trade facilitation continues to drive demand for bonded warehousing facilities, particularly as Hong Kong maintains its role as a preferred transshipment hub for goods moving between China and international markets. The implementation of streamlined customs procedures and digital documentation systems has enhanced the territory’s competitive position in regional trade flows.

Pharmaceutical sector expansion has created substantial demand for specialized cold chain storage facilities, with temperature-controlled warehousing capacity increasing by 28% over the past two years. This growth reflects Hong Kong’s emergence as a regional hub for pharmaceutical distribution, supported by stringent quality standards and regulatory compliance frameworks.

Technology adoption acceleration is driving modernization of existing facilities and development of smart warehouses equipped with advanced automation systems. The integration of Internet of Things sensors, artificial intelligence, and robotics is enabling operators to achieve higher efficiency levels while reducing operational costs and improving service quality.

Land scarcity challenges represent the most significant constraint facing Hong Kong’s warehousing market, with limited availability of suitable industrial land driving up real estate costs and restricting expansion opportunities. The territory’s geographical constraints have resulted in some of the world’s highest warehouse rental rates, impacting operational viability for certain business models.

Labor cost pressures continue to challenge warehouse operators, with skilled logistics personnel commanding premium wages in Hong Kong’s competitive employment market. The shortage of qualified warehouse management professionals and technical specialists has prompted increased investment in automation technologies as a strategic response to labor constraints.

Regulatory compliance requirements impose additional operational costs and complexity, particularly for facilities handling specialized goods such as pharmaceuticals, chemicals, or food products. While these regulations ensure high safety and quality standards, they also create barriers to entry for smaller operators and increase overall operational expenses.

Competition from neighboring markets poses ongoing challenges as logistics operators evaluate cost-benefit considerations of Hong Kong versus alternative locations in the Pearl River Delta region. The development of competing logistics hubs in Shenzhen, Guangzhou, and other mainland Chinese cities has intensified competition for certain types of warehousing business.

Smart warehouse development presents significant opportunities for operators willing to invest in cutting-edge technology solutions. The integration of artificial intelligence, machine learning, and advanced robotics can deliver operational efficiency improvements of up to 40%, creating competitive advantages and justifying premium service pricing.

Cold chain expansion opportunities are emerging across multiple sectors including pharmaceuticals, premium food products, and biotechnology. The growing demand for temperature-controlled storage and distribution services creates opportunities for specialized operators to develop niche market positions with higher profit margins.

Regional distribution hub development offers opportunities for large-scale operators to establish comprehensive logistics platforms serving the broader Asia-Pacific region. Hong Kong’s strategic location, combined with its world-class infrastructure and business-friendly environment, positions it favorably for companies seeking regional headquarters locations.

Sustainability initiatives are creating opportunities for operators to differentiate their services through green building certifications, renewable energy adoption, and environmentally responsible operations. Corporate clients increasingly prioritize sustainability considerations in their logistics partner selection processes, creating market opportunities for environmentally conscious operators.

Supply and demand dynamics in Hong Kong’s warehousing market are characterized by persistent supply constraints meeting growing demand from multiple sectors. The limited availability of developable industrial land has created a structural supply shortage, supporting strong rental rates and encouraging innovative space utilization solutions.

Technology disruption is fundamentally reshaping operational models across the warehousing sector, with automation and digitalization enabling operators to maximize efficiency within space-constrained environments. The adoption of vertical storage systems, automated guided vehicles, and AI-powered inventory management has improved space utilization by approximately 30% in modernized facilities.

Customer expectations evolution is driving demand for more sophisticated service offerings beyond basic storage functions. Clients increasingly require value-added services including packaging, quality control, product customization, and seamless integration with their own enterprise resource planning systems.

Competitive intensity continues to increase as both international logistics giants and local operators compete for market share in Hong Kong’s lucrative but constrained market. This competition is driving innovation in service delivery, technology adoption, and operational efficiency while maintaining pressure on profit margins.

Comprehensive market analysis was conducted through a multi-faceted research approach combining primary data collection, secondary research, and industry expert consultations. The methodology incorporated both quantitative and qualitative research techniques to ensure accurate representation of market conditions and trends.

Primary research activities included structured interviews with warehouse operators, logistics service providers, real estate developers, and key customers across various industry sectors. Survey data was collected from over 150 market participants to validate findings and ensure representative coverage of different market segments.

Secondary research sources encompassed government statistics, industry association reports, academic studies, and corporate financial disclosures from publicly listed companies operating in Hong Kong’s warehousing sector. This comprehensive approach ensured triangulation of data sources and validation of key findings.

Data analysis techniques included statistical modeling, trend analysis, and comparative benchmarking against regional markets to provide context for Hong Kong’s market performance. Industry expert validation sessions were conducted to ensure accuracy and relevance of research conclusions and market projections.

Hong Kong Island operations are characterized by premium facilities serving high-value goods and specialized logistics requirements. Despite higher operational costs, the island’s proximity to financial centers and luxury retail districts supports demand for sophisticated warehousing services, particularly for electronics, fashion, and pharmaceutical products.

Kowloon district facilities serve as major distribution hubs leveraging excellent connectivity to Hong Kong International Airport and container terminals. This region accounts for approximately 35% of total warehousing capacity and specializes in air cargo handling, cross-docking operations, and time-sensitive logistics services.

New Territories development represents the primary growth area for large-scale warehousing operations, offering more affordable land costs and space for expansion. Modern logistics parks in areas such as Tsing Yi, Kwai Chung, and Tuen Mun provide state-of-the-art facilities with direct access to major transportation networks.

Border area facilities near Shenzhen capitalize on cross-border trade opportunities, providing specialized services for goods moving between Hong Kong and mainland China. These locations offer unique advantages for companies requiring both Hong Kong’s regulatory environment and proximity to Chinese manufacturing centers, capturing approximately 25% of cross-border logistics volume.

Market leadership is shared among several categories of operators, each leveraging distinct competitive advantages to serve different market segments. The competitive landscape includes international logistics giants, regional specialists, and local operators with deep market knowledge.

Competitive differentiation strategies focus on technology adoption, service quality, geographic coverage, and specialized industry expertise. Leading operators are investing heavily in automation, sustainability initiatives, and value-added services to maintain competitive positioning in this dynamic market.

By Facility Type:

By End-User Industry:

By Service Level:

E-commerce fulfillment facilities represent the fastest-growing segment, driven by online retail expansion and changing consumer expectations for rapid delivery. These specialized facilities require advanced sorting systems, high-speed picking operations, and seamless integration with last-mile delivery networks, commanding premium rental rates due to their sophisticated requirements.

Cold chain warehousing has emerged as a high-value segment with annual growth rates exceeding 15%, supported by pharmaceutical industry expansion and premium food product distribution. These facilities require significant capital investment in refrigeration systems and temperature monitoring technology but generate higher profit margins through specialized service offerings.

Bonded warehousing operations continue to benefit from Hong Kong’s free port status and efficient customs procedures, serving as preferred locations for companies managing international trade flows. These facilities provide unique value propositions including duty deferral, re-export facilitation, and compliance with international trade regulations.

Smart warehouse solutions are gaining traction across all segments as operators seek to maximize efficiency within space-constrained environments. The integration of robotics, artificial intelligence, and IoT sensors is enabling productivity improvements of 25-30% while reducing labor dependency and operational costs.

Warehouse operators benefit from Hong Kong’s strategic location, world-class infrastructure, and business-friendly regulatory environment. The territory’s position as a regional hub enables operators to serve multiple markets from a single location while leveraging efficient transportation networks and established trade relationships.

Corporate clients gain access to sophisticated logistics capabilities that enhance supply chain efficiency and reduce total cost of ownership. Hong Kong’s warehousing facilities offer advanced technology integration, high service quality standards, and seamless connectivity to global markets, enabling companies to optimize their regional distribution strategies.

Real estate investors benefit from stable rental income streams supported by strong demand fundamentals and limited supply availability. Industrial properties in Hong Kong have demonstrated resilient performance with occupancy rates consistently above 95%, providing attractive risk-adjusted returns for institutional investors.

Government stakeholders benefit from the warehousing sector’s contribution to Hong Kong’s economy through employment generation, tax revenue, and support for the territory’s position as an international trade and logistics hub. The sector’s continued development reinforces Hong Kong’s competitive advantages in the global economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration is transforming warehouse operations across Hong Kong, with operators investing heavily in robotics, artificial intelligence, and automated storage and retrieval systems. This trend is driven by labor cost pressures and the need to maximize efficiency within space-constrained environments, resulting in productivity gains of up to 35% in modernized facilities.

Sustainability integration has become a critical consideration for warehouse development and operations, with green building certifications, renewable energy adoption, and environmentally responsible practices becoming standard requirements. Corporate clients increasingly prioritize sustainability in their logistics partner selection, creating competitive advantages for environmentally conscious operators.

Omnichannel fulfillment capabilities are becoming essential as retailers adopt integrated online and offline strategies. Warehouses must now support diverse order profiles including bulk distribution to retail stores, individual consumer shipments, and same-day delivery requirements, necessitating flexible operational models and advanced technology integration.

Data analytics utilization is enabling operators to optimize inventory management, predict demand patterns, and enhance operational efficiency through predictive maintenance and performance optimization. The integration of big data analytics and machine learning algorithms is providing competitive advantages through improved decision-making and operational excellence.

Major infrastructure investments are reshaping Hong Kong’s warehousing landscape, with significant developments including the expansion of Hong Kong International Airport’s cargo facilities and the construction of modern logistics parks in the New Territories. These investments are enhancing the territory’s capacity to handle growing cargo volumes and support advanced logistics operations.

Technology partnerships between warehouse operators and technology providers are accelerating the adoption of innovative solutions including autonomous vehicles, drone technology, and blockchain-based supply chain tracking systems. MWR analysis indicates that these partnerships are enabling smaller operators to access advanced technologies previously available only to large multinational companies.

Cross-border integration initiatives are improving connectivity between Hong Kong and mainland China through streamlined customs procedures, digital documentation systems, and enhanced transportation links. The Greater Bay Area development strategy is creating new opportunities for integrated logistics operations spanning Hong Kong, Macau, and southern China.

Regulatory modernization efforts are updating Hong Kong’s logistics and warehousing regulations to accommodate new technologies and business models while maintaining high safety and security standards. These updates are facilitating innovation while ensuring compliance with international best practices and trade requirements.

Technology investment prioritization should focus on solutions that deliver measurable returns on investment through improved efficiency, reduced labor costs, and enhanced service quality. Operators should conduct thorough cost-benefit analyses before implementing expensive automation systems, ensuring alignment with their specific operational requirements and customer demands.

Market positioning strategies should emphasize unique value propositions that differentiate operators from competitors while addressing specific customer needs. Specialization in high-value segments such as pharmaceuticals, electronics, or e-commerce fulfillment can provide competitive advantages and justify premium pricing structures.

Partnership development with technology providers, real estate developers, and logistics service providers can enable smaller operators to access advanced capabilities and expand their service offerings without significant capital investment. Strategic alliances can provide access to new markets, technologies, and customer segments.

Sustainability initiatives should be integrated into long-term strategic planning as environmental considerations become increasingly important for corporate clients and regulatory compliance. Investment in green technologies and sustainable operations can provide competitive differentiation and support long-term business viability.

Market evolution over the next five years will be characterized by continued technology integration, sustainability focus, and adaptation to changing customer requirements. The warehousing sector is expected to maintain steady growth rates of 5-7% annually, supported by e-commerce expansion, cross-border trade growth, and increasing demand for sophisticated logistics services.

Technology transformation will accelerate with broader adoption of artificial intelligence, robotics, and Internet of Things solutions across warehouse operations. These technologies will enable operators to achieve higher efficiency levels, reduce operational costs, and provide enhanced service quality to increasingly demanding customers.

Capacity expansion will focus on vertical development and space optimization solutions due to continued land scarcity constraints. New facilities will incorporate advanced design concepts that maximize storage density while supporting efficient operations and future technology integration requirements.

Market consolidation trends may emerge as smaller operators face increasing pressure from rising costs and technology investment requirements. This consolidation could create opportunities for well-positioned companies to expand market share through strategic acquisitions and partnerships while maintaining service quality standards.

Hong Kong’s warehousing market continues to demonstrate remarkable resilience and adaptability in the face of significant challenges including land scarcity, rising operational costs, and intensifying regional competition. The sector’s ability to maintain its competitive position through technology adoption, service innovation, and strategic positioning reflects the fundamental strengths of Hong Kong’s logistics ecosystem.

Future success in this dynamic market will depend on operators’ ability to embrace technological transformation while maintaining the high service quality standards that differentiate Hong Kong from competing regional hubs. The integration of automation, artificial intelligence, and sustainable practices will be critical for achieving operational efficiency and meeting evolving customer expectations in an increasingly competitive environment.

Strategic opportunities remain abundant for companies willing to invest in advanced capabilities and specialized service offerings. The continued growth of e-commerce, expansion of cold chain requirements, and development of the Greater Bay Area initiative provide multiple avenues for market expansion and revenue growth, positioning Hong Kong’s warehousing sector for continued success in the evolving global logistics landscape.

What is Hong Kong Warehousing?

Hong Kong Warehousing refers to the storage and management of goods in facilities located in Hong Kong. This sector plays a crucial role in logistics, supporting industries such as retail, e-commerce, and manufacturing by providing essential space for inventory management.

What are the key players in the Hong Kong Warehousing Market?

Key players in the Hong Kong Warehousing Market include companies like Goodman Group, ESR Cayman, and Prologis. These firms are known for their extensive logistics networks and modern warehousing solutions, catering to various sectors such as e-commerce and retail, among others.

What are the growth factors driving the Hong Kong Warehousing Market?

The growth of the Hong Kong Warehousing Market is driven by the rise of e-commerce, increasing demand for efficient supply chain solutions, and the strategic location of Hong Kong as a logistics hub in Asia. Additionally, advancements in technology and automation are enhancing operational efficiencies.

What challenges does the Hong Kong Warehousing Market face?

The Hong Kong Warehousing Market faces challenges such as high real estate costs, limited space availability, and regulatory hurdles. These factors can impact the expansion and operational capabilities of warehousing facilities in the region.

What opportunities exist in the Hong Kong Warehousing Market?

Opportunities in the Hong Kong Warehousing Market include the growth of cold storage facilities due to the demand for perishable goods and the integration of smart warehousing technologies. Additionally, the increasing focus on sustainability presents avenues for eco-friendly warehousing solutions.

What trends are shaping the Hong Kong Warehousing Market?

Trends shaping the Hong Kong Warehousing Market include the adoption of automation and robotics to improve efficiency, the rise of omnichannel logistics strategies, and a growing emphasis on sustainability practices. These trends are transforming how warehousing operations are conducted in the region.

Hong Kong Warehousing Market

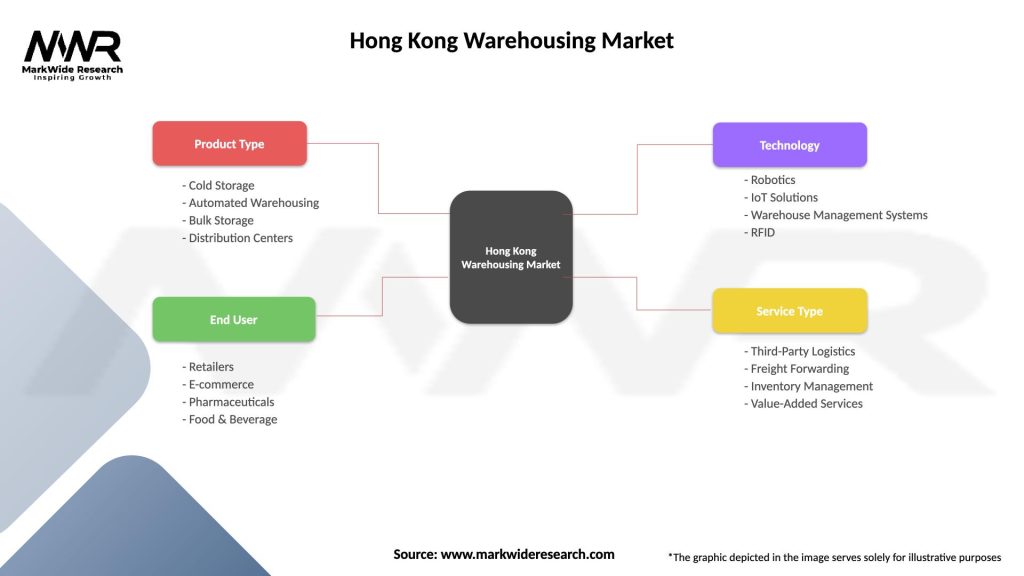

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Storage, Automated Warehousing, Bulk Storage, Distribution Centers |

| End User | Retailers, E-commerce, Pharmaceuticals, Food & Beverage |

| Technology | Robotics, IoT Solutions, Warehouse Management Systems, RFID |

| Service Type | Third-Party Logistics, Freight Forwarding, Inventory Management, Value-Added Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Hong Kong Warehousing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at