444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Hong Kong OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape that combines traditional out-of-home advertising with cutting-edge digital out-of-home technologies. This vibrant market serves as a crucial bridge between conventional billboard advertising and innovative digital display solutions, catering to Hong Kong’s dense urban environment and tech-savvy population. Market growth has been particularly robust, with digital transformation driving significant adoption rates across various advertising formats.

Hong Kong’s unique geography and high population density create an ideal environment for both OOH and DOOH advertising solutions. The market encompasses traditional billboards, transit advertising, street furniture, and increasingly sophisticated digital displays that leverage real-time data and interactive capabilities. Digital adoption rates have reached approximately 68% penetration across major advertising locations, reflecting the market’s rapid technological advancement.

Key market characteristics include strong advertiser demand for premium locations, increasing integration of programmatic advertising capabilities, and growing emphasis on data-driven campaign optimization. The market benefits from Hong Kong’s status as a major financial and commercial hub, attracting both local and international brands seeking effective advertising reach. Growth projections indicate continued expansion at a compound annual growth rate of 9.2%, driven by technological innovation and increasing advertiser sophistication.

The Hong Kong OOH and DOOH market refers to the comprehensive advertising ecosystem encompassing traditional out-of-home advertising formats and digital out-of-home advertising solutions specifically within Hong Kong’s territory. OOH advertising includes static billboards, transit advertising, street furniture, and traditional poster sites, while DOOH advertising encompasses digital billboards, LED displays, interactive kiosks, and programmatically-enabled digital advertising networks.

This market definition covers all forms of advertising that reach consumers outside their homes, leveraging Hong Kong’s high-traffic locations, transportation networks, and commercial districts. The integration of traditional and digital formats creates a hybrid advertising environment that maximizes reach and engagement opportunities. Market participants include media owners, advertising agencies, technology providers, and brands seeking effective consumer engagement through location-based advertising strategies.

Technological convergence within this market enables sophisticated targeting capabilities, real-time content optimization, and measurable campaign performance metrics. The market serves diverse industry verticals including retail, finance, tourism, entertainment, and consumer goods, providing comprehensive advertising solutions that leverage Hong Kong’s unique urban landscape and consumer behavior patterns.

Market dynamics in Hong Kong’s OOH and DOOH sector demonstrate strong growth momentum driven by digital transformation and increasing advertiser demand for measurable, location-based advertising solutions. The market has experienced significant evolution from traditional static displays to sophisticated digital advertising networks that offer real-time optimization and programmatic buying capabilities.

Key growth drivers include Hong Kong’s high population density, extensive public transportation network, and strong commercial activity that creates numerous high-value advertising opportunities. Digital transformation rates have accelerated, with approximately 72% of premium advertising locations now featuring digital capabilities, enabling enhanced targeting and campaign flexibility.

Market segmentation reveals strong performance across multiple categories, including transit advertising, retail environments, commercial districts, and entertainment venues. The integration of data analytics and programmatic advertising has enhanced campaign effectiveness, with performance improvements reaching 45% better engagement rates compared to traditional static formats.

Competitive landscape features established media owners alongside innovative technology providers, creating a dynamic ecosystem that supports both traditional and digital advertising formats. Market consolidation trends indicate increasing focus on integrated solutions that combine multiple advertising formats and advanced technological capabilities.

Strategic market insights reveal several critical trends shaping Hong Kong’s OOH and DOOH advertising landscape. The market demonstrates strong resilience and adaptability, with digital formats gaining significant traction among advertisers seeking measurable and flexible campaign solutions.

Market maturity indicators suggest continued growth potential, with increasing sophistication in both technology deployment and advertiser strategies. The market benefits from Hong Kong’s advanced telecommunications infrastructure and high smartphone penetration rates that support integrated advertising campaigns.

Primary market drivers propelling Hong Kong’s OOH and DOOH market growth include urbanization trends, technological advancement, and evolving consumer behavior patterns. These fundamental factors create sustained demand for innovative advertising solutions that effectively reach Hong Kong’s diverse and mobile population.

Urban density advantages provide exceptional advertising reach opportunities, with Hong Kong’s compact geography ensuring high exposure rates for strategically placed advertising displays. The extensive public transportation network creates captive audiences with extended exposure times, particularly beneficial for both traditional and digital advertising formats. Transit advertising effectiveness has improved by approximately 38% engagement rates through strategic digital integration.

Technological infrastructure supports advanced DOOH capabilities, including high-speed internet connectivity, robust power systems, and sophisticated content management platforms. The widespread adoption of mobile devices and social media creates opportunities for integrated campaigns that bridge physical and digital advertising touchpoints.

Economic factors including Hong Kong’s status as a major financial center and tourist destination drive consistent advertiser demand across multiple industry verticals. Strong retail activity, international business presence, and cultural events create diverse advertising opportunities that support market growth and innovation.

Regulatory environment provides stable operating conditions while encouraging technological innovation and fair competition among market participants. Government support for smart city initiatives and digital infrastructure development creates favorable conditions for DOOH market expansion.

Market constraints affecting Hong Kong’s OOH and DOOH sector include regulatory limitations, space availability challenges, and high operational costs associated with premium location advertising. These factors require strategic planning and innovative solutions to maintain market growth momentum.

Regulatory restrictions on advertising placement, content guidelines, and digital display specifications can limit deployment options and increase compliance costs. Zoning regulations and building codes may restrict certain types of advertising installations, particularly in residential areas and heritage districts. Permit processing times can extend project timelines and impact campaign launch schedules.

Real estate constraints in Hong Kong’s limited geographic area create intense competition for premium advertising locations, driving up rental costs and limiting expansion opportunities. High property values and space scarcity make new installation development challenging and expensive for market participants.

Technical challenges include weather resistance requirements for outdoor displays, maintenance complexity in dense urban environments, and power infrastructure limitations in certain locations. The tropical climate and seasonal weather patterns require robust equipment specifications and regular maintenance protocols.

Market saturation concerns in certain high-traffic areas may limit effectiveness and create visual pollution issues that could prompt additional regulatory oversight. Competition for consumer attention requires increasingly sophisticated and creative advertising approaches to maintain engagement levels.

Emerging opportunities in Hong Kong’s OOH and DOOH market include technological innovation, programmatic advertising expansion, and integration with smart city initiatives. These developments create new revenue streams and enhanced value propositions for market participants.

Smart city integration presents significant opportunities for DOOH networks to provide public information services alongside commercial advertising, creating additional revenue streams and community value. Integration with traffic management systems, weather information, and emergency communications enhances the utility and acceptance of digital advertising infrastructure.

Programmatic advertising growth enables more efficient campaign management and improved targeting capabilities, attracting advertisers seeking data-driven solutions. Automated buying platforms are expected to capture approximately 55% market share within the next three years, representing substantial growth potential for technology-enabled advertising solutions.

Cross-border advertising opportunities leverage Hong Kong’s position as a gateway to mainland China and broader Asian markets. International brands seeking regional exposure create demand for sophisticated advertising campaigns that can effectively reach diverse audiences through strategic location placement.

Technology advancement opportunities include artificial intelligence integration, augmented reality experiences, and interactive advertising formats that enhance consumer engagement. These innovations differentiate DOOH offerings and command premium pricing from advertisers seeking cutting-edge campaign solutions.

Sustainability initiatives create opportunities for energy-efficient display technologies and environmentally responsible advertising practices that appeal to conscious consumers and corporate sustainability programs.

Market dynamics in Hong Kong’s OOH and DOOH sector reflect the interplay between traditional advertising approaches and digital innovation, creating a complex ecosystem that serves diverse advertiser needs while adapting to changing consumer behaviors and technological capabilities.

Supply and demand balance demonstrates strong advertiser interest in premium locations, with occupancy rates exceeding 85% in prime commercial districts. This high demand drives innovation in advertising formats and pricing strategies, while encouraging investment in new display technologies and location development.

Competitive dynamics feature established media companies expanding digital capabilities alongside technology-focused newcomers introducing innovative advertising solutions. This competition drives continuous improvement in service offerings, measurement capabilities, and campaign effectiveness.

Technology adoption cycles show accelerating integration of advanced features including real-time content optimization, audience measurement, and programmatic buying capabilities. Digital upgrade rates have reached approximately 62% annually for premium advertising locations, indicating rapid market evolution.

Pricing dynamics reflect the premium value of Hong Kong’s high-traffic locations, with digital formats commanding price premiums due to enhanced targeting and measurement capabilities. Market maturation is leading to more sophisticated pricing models based on audience delivery and campaign performance metrics.

Integration trends show increasing coordination between OOH and DOOH campaigns with mobile advertising, social media, and e-commerce platforms, creating comprehensive marketing ecosystems that maximize campaign reach and effectiveness.

Research approach for analyzing Hong Kong’s OOH and DOOH market employs comprehensive primary and secondary research methodologies to ensure accurate market assessment and reliable growth projections. The methodology combines quantitative analysis with qualitative insights from industry stakeholders.

Primary research components include structured interviews with media owners, advertising agencies, technology providers, and brand advertisers to gather firsthand insights into market trends, challenges, and opportunities. Survey data collection from industry participants provides quantitative validation of market dynamics and growth patterns.

Secondary research analysis incorporates industry reports, regulatory filings, company financial statements, and trade association data to establish comprehensive market baseline information. Historical performance analysis enables accurate trend identification and future growth modeling.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification of key findings. Market sizing methodologies employ bottom-up analysis combined with top-down validation to ensure reliable market estimates.

Analytical frameworks include competitive landscape mapping, technology adoption modeling, and regional market comparison to provide comprehensive market understanding. MarkWide Research analytical capabilities ensure thorough examination of market dynamics and accurate growth projections.

Regional market distribution within Hong Kong reveals distinct patterns based on commercial activity, population density, and transportation infrastructure. Each region offers unique advertising opportunities and challenges that influence market development strategies.

Hong Kong Island represents the premium advertising market segment, featuring the highest concentration of digital displays and commanding premium pricing due to intense commercial activity and affluent demographics. Central and Admiralty districts account for approximately 35% of total advertising inventory value, reflecting their status as primary business and financial centers.

Kowloon Peninsula provides diverse advertising opportunities across commercial, retail, and residential areas, with strong performance in shopping districts and transportation hubs. The region benefits from high foot traffic and diverse demographic profiles that appeal to various advertiser categories.

New Territories offer emerging opportunities as residential and commercial development expands, creating new advertising locations and audience reach possibilities. Growing suburban commercial centers and improved transportation connectivity enhance the attractiveness of these markets.

Transportation networks including MTR stations, bus terminals, and major roadways provide consistent high-traffic advertising opportunities across all regions. Transit advertising maintains approximately 28% market share across regional segments, demonstrating the importance of transportation-based advertising placements.

Airport and border crossings create specialized advertising opportunities targeting international travelers and cross-border commerce, representing unique market segments with distinct advertiser requirements and premium pricing structures.

Competitive environment in Hong Kong’s OOH and DOOH market features established media companies, international advertising networks, and innovative technology providers competing across traditional and digital advertising segments. Market leadership requires combination of prime location access, technological capabilities, and comprehensive service offerings.

Market consolidation trends indicate increasing integration between traditional media owners and technology providers, creating comprehensive advertising solutions that combine location assets with advanced technological capabilities. Strategic partnerships and acquisitions enable market participants to offer enhanced value propositions to advertisers.

Innovation competition drives continuous advancement in display technologies, measurement capabilities, and campaign optimization tools, benefiting advertisers through improved performance and expanded creative possibilities.

Market segmentation analysis reveals diverse categories within Hong Kong’s OOH and DOOH market, each serving specific advertiser needs and audience targeting requirements. Segmentation enables precise market analysis and strategic planning for industry participants.

By Format Type:

By Technology Integration:

By Location Category:

Category performance analysis reveals distinct growth patterns and opportunities across different segments of Hong Kong’s OOH and DOOH market. Each category demonstrates unique characteristics that influence advertiser strategies and investment decisions.

Digital Billboard Category shows the strongest growth momentum, driven by advertiser demand for flexible campaign management and measurable performance metrics. Digital adoption rates have reached approximately 74% in premium commercial locations, reflecting rapid technology integration and advertiser preference for dynamic content capabilities.

Transit Advertising Category maintains stable performance with consistent advertiser demand due to Hong Kong’s extensive public transportation usage. The category benefits from captive audiences and extended exposure times, particularly effective for brand awareness campaigns and product launches targeting commuter demographics.

Retail Environment Category demonstrates strong correlation with consumer spending patterns and seasonal shopping behaviors. Shopping mall displays and retail-focused advertising show enhanced performance during peak shopping periods and holiday seasons, with engagement rates improving by 42% during promotional periods.

Street Furniture Category provides consistent performance across diverse locations, offering pedestrian-level engagement opportunities that complement larger format advertising. The category serves local businesses effectively while providing broad reach for national and international brands.

Interactive Format Category represents emerging growth opportunity with premium pricing potential, as advertisers seek innovative ways to engage consumers through technology-enhanced experiences. Early adoption indicators suggest strong performance potential as technology costs decrease and creative capabilities expand.

Industry participants in Hong Kong’s OOH and DOOH market realize substantial benefits through strategic positioning in this dynamic advertising ecosystem. These advantages create value for media owners, advertisers, technology providers, and supporting service companies.

For Media Owners:

For Advertisers:

For Technology Providers:

For Supporting Services:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping Hong Kong’s OOH and DOOH market reflect broader technological advancement and changing consumer behavior patterns. These trends influence strategic planning and investment decisions across the advertising ecosystem.

Programmatic Advertising Integration represents the most significant trend, with automated buying platforms enabling real-time campaign optimization and improved targeting precision. Programmatic adoption rates are projected to reach 58% market penetration as advertisers seek data-driven campaign management and performance measurement capabilities.

Interactive Technology Adoption includes touch-screen displays, augmented reality experiences, and mobile integration that enhance consumer engagement beyond traditional advertising exposure. These technologies create memorable brand interactions and measurable consumer response metrics.

Data Analytics Enhancement provides sophisticated audience measurement, traffic pattern analysis, and campaign performance optimization that enables precise targeting and improved ROI measurement. Advanced analytics platforms integrate multiple data sources to provide comprehensive campaign insights.

Sustainability Focus drives adoption of energy-efficient display technologies, renewable power sources, and environmentally responsible advertising practices. Green advertising initiatives appeal to conscious consumers and support corporate sustainability objectives.

Cross-Channel Integration creates comprehensive marketing ecosystems that coordinate OOH and DOOH campaigns with mobile advertising, social media, and e-commerce platforms. Integrated campaigns maximize reach and create consistent brand messaging across multiple touchpoints.

Artificial Intelligence Implementation enables automated content optimization, predictive audience targeting, and real-time campaign adjustment based on performance data and environmental factors.

Recent industry developments demonstrate continued innovation and market evolution within Hong Kong’s OOH and DOOH sector. These developments indicate strong growth momentum and increasing sophistication in advertising technology and campaign management capabilities.

Technology Infrastructure Upgrades include widespread deployment of 5G connectivity that enables enhanced content delivery, real-time optimization, and interactive advertising experiences. High-speed connectivity supports advanced DOOH applications and improves campaign performance measurement capabilities.

Strategic Partnership Formation between traditional media owners and technology companies creates integrated solutions that combine location assets with advanced digital capabilities. These partnerships enable comprehensive advertising offerings and enhanced value propositions for advertisers.

Regulatory Framework Updates provide clearer guidelines for digital advertising deployment while maintaining urban planning objectives and community standards. Updated regulations support innovation while ensuring responsible advertising practices and visual environment protection.

Market Consolidation Activities include acquisitions and mergers that create larger, more capable advertising companies with comprehensive service offerings and enhanced technological capabilities. Consolidation trends indicate market maturation and increasing competition for premium locations.

International Expansion Initiatives by Hong Kong-based companies leverage local market expertise to expand into regional markets, while international companies increase their Hong Kong presence to access Asian markets and cross-border advertising opportunities.

Innovation Laboratory Establishment by major market participants creates testing environments for emerging technologies including artificial intelligence, augmented reality, and advanced measurement systems that will shape future market development.

Strategic recommendations for Hong Kong OOH and DOOH market participants focus on technology integration, location optimization, and service enhancement to maintain competitive advantages in this rapidly evolving advertising landscape.

Technology Investment Priorities should emphasize programmatic advertising capabilities, advanced analytics platforms, and interactive display technologies that differentiate offerings and command premium pricing. MarkWide Research analysis indicates that technology-enabled advertising solutions achieve 43% higher engagement rates compared to traditional formats.

Location Strategy Optimization requires careful analysis of traffic patterns, demographic profiles, and competitive positioning to maximize advertising effectiveness and revenue potential. Strategic location development should consider future urban development plans and transportation infrastructure improvements.

Service Portfolio Expansion should include comprehensive campaign management, creative services, and performance measurement capabilities that provide complete advertising solutions. Integrated service offerings create stronger client relationships and higher revenue per client.

Partnership Development with technology providers, creative agencies, and international advertising networks enables access to advanced capabilities and expanded market reach. Strategic alliances create competitive advantages and enhanced value propositions for advertisers.

Sustainability Integration should include energy-efficient technologies, renewable power sources, and environmentally responsible practices that appeal to conscious advertisers and support corporate sustainability objectives.

Market Expansion Opportunities include cross-border advertising services, regional campaign coordination, and specialized targeting capabilities that leverage Hong Kong’s strategic position in Asian markets.

Future market prospects for Hong Kong’s OOH and DOOH sector indicate continued growth driven by technological innovation, increasing advertiser sophistication, and expanding integration with digital marketing ecosystems. Long-term trends support sustained market development and enhanced advertising effectiveness.

Growth projections suggest robust market expansion with digital formats expected to represent 78% of total advertising inventory within five years, reflecting continued technology adoption and advertiser preference for flexible, measurable advertising solutions. Traditional formats will maintain relevance through strategic positioning and cost-effective broad reach capabilities.

Technology evolution will drive enhanced capabilities including artificial intelligence optimization, augmented reality experiences, and sophisticated audience measurement that create premium advertising opportunities and improved campaign performance. Advanced technologies will enable personalized advertising experiences and real-time content optimization.

Market integration trends indicate increasing coordination between OOH and DOOH campaigns with mobile advertising, social media, and e-commerce platforms, creating comprehensive marketing ecosystems that maximize advertiser ROI and consumer engagement.

Regulatory development is expected to support continued innovation while maintaining urban planning objectives and community standards. Smart city initiatives will create opportunities for public-private partnerships and integrated advertising infrastructure that serves both commercial and public information needs.

International expansion opportunities will leverage Hong Kong’s expertise and strategic position to access broader Asian markets and cross-border advertising opportunities, creating additional revenue streams and market diversification benefits.

Hong Kong’s OOH and DOOH market represents a dynamic and rapidly evolving advertising ecosystem that successfully combines traditional out-of-home advertising with cutting-edge digital technologies. The market demonstrates strong growth momentum driven by technological innovation, strategic location advantages, and increasing advertiser demand for measurable, flexible advertising solutions.

Key success factors include Hong Kong’s unique geographic advantages, advanced infrastructure capabilities, and strategic position as a major Asian commercial hub that attracts both local and international advertisers. The market’s high population density and extensive transportation network create exceptional advertising reach opportunities that support premium pricing and consistent demand.

Technology integration continues to drive market evolution, with digital formats gaining significant market share and programmatic advertising capabilities enabling sophisticated campaign management and optimization. These technological advances create enhanced value propositions for advertisers while supporting sustainable revenue growth for market participants.

Future prospects remain positive, with continued growth expected across multiple market segments and increasing integration with broader digital marketing ecosystems. The market’s resilience and adaptability position it well for sustained development despite potential challenges from economic volatility and competitive pressures from digital advertising alternatives.

Strategic positioning for market success requires continued investment in technology capabilities, location optimization, and comprehensive service offerings that meet evolving advertiser needs. Companies that successfully integrate traditional advertising expertise with advanced digital capabilities will be best positioned to capitalize on future growth opportunities in this vibrant and strategically important advertising market.

What is Hong Kong OOH And DOOH?

Hong Kong OOH And DOOH refers to Out-Of-Home and Digital Out-Of-Home advertising in Hong Kong, encompassing various advertising formats such as billboards, transit ads, and digital screens in public spaces.

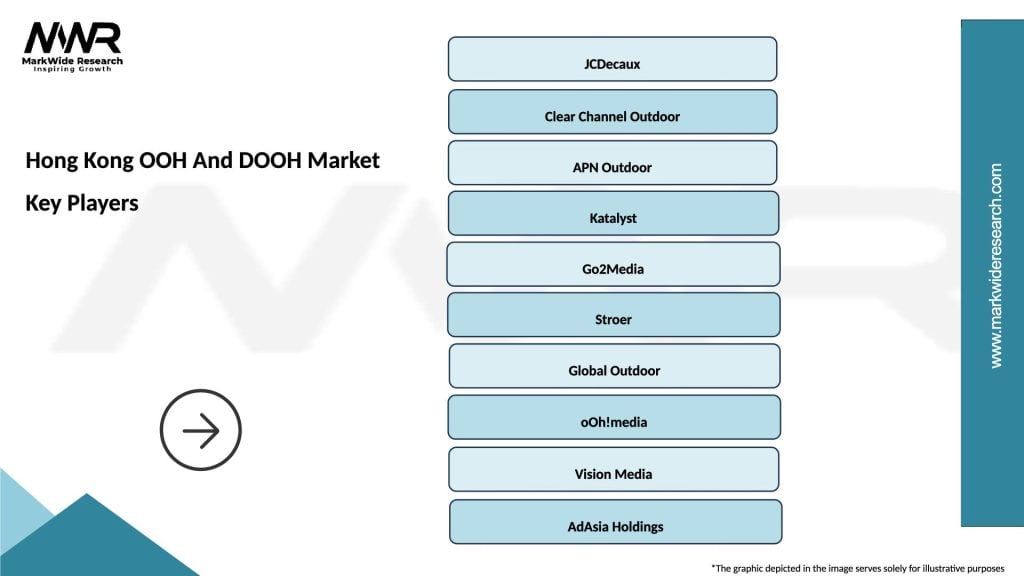

What are the key players in the Hong Kong OOH And DOOH Market?

Key players in the Hong Kong OOH And DOOH Market include JCDecaux, Clear Channel, and APN Outdoor, among others.

What are the growth factors driving the Hong Kong OOH And DOOH Market?

The growth of the Hong Kong OOH And DOOH Market is driven by increasing urbanization, the rise of digital technology, and the growing demand for targeted advertising solutions.

What challenges does the Hong Kong OOH And DOOH Market face?

Challenges in the Hong Kong OOH And DOOH Market include regulatory restrictions, competition from digital media, and the need for continuous innovation to engage consumers effectively.

What future opportunities exist in the Hong Kong OOH And DOOH Market?

Future opportunities in the Hong Kong OOH And DOOH Market include the integration of augmented reality, enhanced data analytics for audience targeting, and the expansion of interactive advertising formats.

What trends are shaping the Hong Kong OOH And DOOH Market?

Trends shaping the Hong Kong OOH And DOOH Market include the increasing use of programmatic advertising, the shift towards sustainable advertising practices, and the growing popularity of mobile integration in campaigns.

Hong Kong OOH And DOOH Market

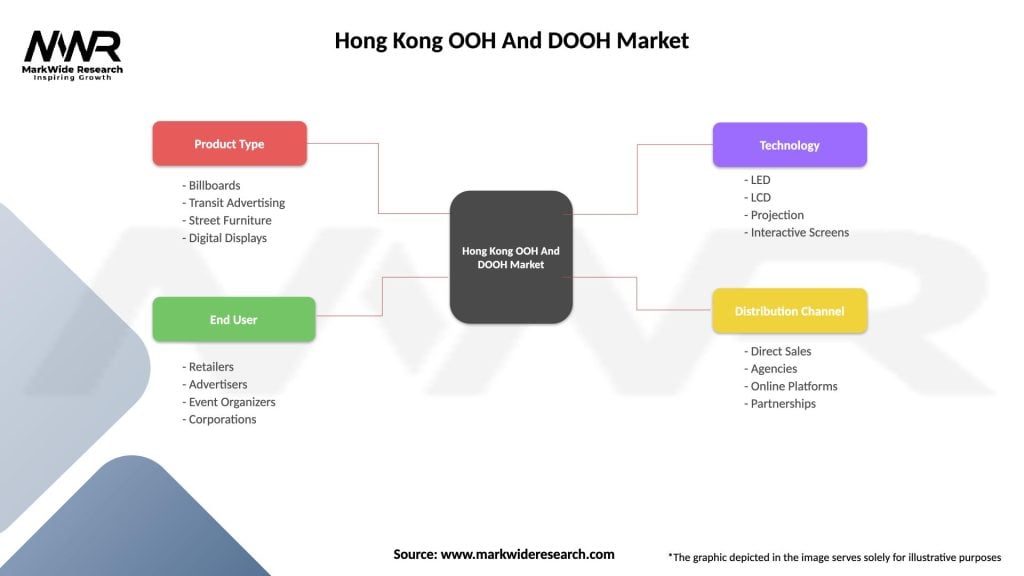

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Displays |

| End User | Retailers, Advertisers, Event Organizers, Corporations |

| Technology | LED, LCD, Projection, Interactive Screens |

| Distribution Channel | Direct Sales, Agencies, Online Platforms, Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Hong Kong OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at