444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Honduras construction market represents a dynamic and evolving sector that plays a crucial role in the country’s economic development and infrastructure modernization. This Central American nation has experienced significant growth in construction activities, driven by both public infrastructure investments and private sector development initiatives. The market encompasses residential, commercial, industrial, and infrastructure construction segments, each contributing to the overall expansion of the built environment across Honduras.

Market dynamics indicate robust growth potential, with the construction sector experiencing a 6.2% annual growth rate over recent years. This expansion reflects increased government spending on infrastructure projects, foreign investment in commercial developments, and growing demand for housing solutions. The construction industry has become a vital economic driver, contributing approximately 8.5% to the national GDP and providing employment opportunities for thousands of Hondurans.

Infrastructure development remains a primary focus, with significant investments in transportation networks, energy facilities, and urban development projects. The government’s commitment to improving the country’s infrastructure has created substantial opportunities for construction companies, both domestic and international. Additionally, the growing tourism sector has spurred demand for hospitality and commercial construction projects, particularly in coastal regions and major urban centers.

The Honduras construction market refers to the comprehensive ecosystem of building and infrastructure development activities within the Republic of Honduras, encompassing all phases of construction from planning and design to completion and maintenance. This market includes residential housing projects, commercial buildings, industrial facilities, transportation infrastructure, and public works initiatives that collectively shape the country’s physical and economic landscape.

Construction activities in Honduras span multiple sectors, including traditional building construction, civil engineering projects, and specialized infrastructure development. The market encompasses both new construction and renovation projects, serving diverse stakeholders from individual homeowners to large-scale government infrastructure initiatives. This sector integrates various professional services, materials supply chains, and construction technologies to deliver projects that meet the growing needs of Honduras’s developing economy.

Market participants include local construction companies, international contractors, engineering firms, architects, material suppliers, and equipment providers. The sector operates within a regulatory framework established by government agencies and follows building codes and safety standards designed to ensure quality construction practices. The market’s significance extends beyond immediate construction activities to include long-term economic impacts through job creation, skill development, and infrastructure enhancement.

Honduras construction market demonstrates strong growth momentum, supported by strategic government investments in infrastructure and increasing private sector participation in commercial and residential developments. The market benefits from favorable economic conditions, including improved political stability and enhanced foreign investment climate. MarkWide Research analysis indicates that infrastructure projects account for approximately 42% of total construction activity, highlighting the sector’s focus on foundational development needs.

Key growth drivers include substantial government infrastructure spending, expanding tourism industry requirements, and growing urbanization trends that increase demand for housing and commercial facilities. The construction sector has attracted significant international attention, with foreign companies establishing partnerships with local firms to capitalize on emerging opportunities. Regional development initiatives and international funding support have further accelerated market expansion.

Market challenges include skilled labor shortages, material cost fluctuations, and regulatory compliance requirements that impact project timelines and budgets. Despite these obstacles, the overall market outlook remains positive, with construction companies adapting through technology adoption, workforce development programs, and strategic partnerships. The sector’s resilience and adaptability position it well for continued growth in the coming years.

Market insights reveal several critical trends shaping the Honduras construction landscape:

Government infrastructure investment serves as the primary driver of construction market growth in Honduras. Substantial public spending on transportation networks, including highways, bridges, and port facilities, creates significant opportunities for construction companies. The government’s commitment to infrastructure modernization reflects recognition of construction’s role in economic development and competitiveness enhancement.

Tourism sector expansion drives demand for hospitality and commercial construction projects, particularly in coastal regions and areas with natural attractions. Hotel developments, resort facilities, and supporting infrastructure create substantial construction opportunities. The tourism industry’s growth trajectory directly correlates with increased construction activity in related sectors.

Urbanization trends fuel residential and commercial construction demand as populations migrate to urban centers seeking employment and improved living standards. This demographic shift creates ongoing demand for housing developments, commercial facilities, and supporting infrastructure. Urban growth patterns influence construction market dynamics and investment priorities.

Foreign direct investment brings capital and expertise to the construction sector, enabling larger and more complex projects. International companies partner with local firms, transferring knowledge and technology while accessing local market opportunities. This investment flow supports market expansion and capability development.

Economic stability improvements create favorable conditions for construction investment and development. Enhanced political stability and improved business climate encourage both domestic and international investment in construction projects. Economic growth supports increased construction activity across multiple sectors.

Skilled labor shortages present significant challenges for construction companies, limiting project capacity and potentially affecting quality standards. The construction industry requires specialized skills that take time to develop, creating bottlenecks in project execution. Workforce development initiatives address this challenge but require sustained investment and time to show results.

Material cost volatility impacts project budgets and profitability, particularly for companies with fixed-price contracts. Fluctuating prices for steel, cement, and other essential materials create financial uncertainty and complicate project planning. Import dependencies for certain materials expose the market to international price fluctuations and supply chain disruptions.

Regulatory complexity can slow project approval processes and increase compliance costs. Navigating building codes, environmental regulations, and permitting requirements requires expertise and time investment. Regulatory changes or unclear requirements can create project delays and additional expenses for construction companies.

Access to financing remains challenging for smaller construction companies and some project types. Limited availability of construction loans and high interest rates can constrain market participation and project feasibility. Financial institutions’ risk assessment practices may limit lending to construction projects, particularly for newer companies or innovative project types.

Weather and natural disasters pose ongoing risks to construction projects and completed structures. Honduras’s geographic location exposes construction activities to hurricanes, flooding, and other natural hazards. These risks require additional planning, insurance costs, and potentially impact project schedules and budgets.

Infrastructure modernization programs present substantial opportunities for construction companies capable of handling large-scale projects. Government initiatives to upgrade transportation networks, energy systems, and telecommunications infrastructure create long-term construction demand. These projects often involve international funding and technical assistance, providing access to advanced construction methods and technologies.

Sustainable construction practices offer differentiation opportunities for forward-thinking companies. Growing environmental awareness and international sustainability standards create demand for green building technologies and eco-friendly construction methods. Companies investing in sustainable practices can access new market segments and potentially qualify for international funding programs.

Public-private partnerships enable construction companies to participate in large infrastructure projects while sharing risks and rewards with government entities. These partnerships can provide stable, long-term revenue streams and opportunities to develop expertise in complex project management. PPP models are increasingly used for major infrastructure developments.

Technology adoption creates opportunities for efficiency improvements and competitive advantages. Construction companies implementing modern project management software, building information modeling, and advanced construction equipment can improve productivity and quality while reducing costs. Technology integration supports market differentiation and operational excellence.

Regional expansion allows successful construction companies to leverage their expertise in neighboring markets. Central American regional integration creates opportunities for companies to expand beyond Honduras while building on their local market knowledge and capabilities.

Supply and demand dynamics in the Honduras construction market reflect the interplay between government infrastructure spending, private sector investment, and available construction capacity. Demand consistently exceeds supply in certain segments, particularly for specialized construction services and skilled labor. This imbalance creates opportunities for companies that can scale their operations effectively.

Competitive dynamics involve both local and international construction companies competing for projects across different market segments. Local companies often have advantages in smaller projects and government relations, while international firms bring advanced capabilities and financial resources to larger projects. Strategic partnerships between local and international companies are increasingly common.

Price dynamics reflect material costs, labor availability, and competitive pressures. Construction companies must balance competitive pricing with profitability requirements while managing cost volatility. Project pricing strategies increasingly incorporate risk management approaches to address material and labor cost uncertainties.

Technology dynamics drive efficiency improvements and capability enhancements across the construction sector. Companies adopting modern construction technologies report 15-25% productivity improvements compared to traditional methods. Technology integration affects competitive positioning and project delivery capabilities.

Regulatory dynamics continue evolving as government agencies modernize building codes and safety standards. Construction companies must adapt to changing requirements while maintaining compliance and project efficiency. Regulatory evolution generally supports improved construction quality and safety standards.

Primary research methods employed in analyzing the Honduras construction market include comprehensive interviews with industry stakeholders, including construction company executives, government officials, and project developers. These interviews provide insights into market trends, challenges, and opportunities from multiple perspectives. Field visits to active construction sites offer direct observation of construction practices and technology adoption.

Secondary research sources encompass government construction statistics, industry association reports, and economic development data. Analysis of building permits, project announcements, and infrastructure spending provides quantitative foundation for market assessment. International development organization reports contribute regional context and comparative analysis.

Data validation processes ensure accuracy and reliability of market information through cross-referencing multiple sources and stakeholder verification. Statistical analysis methods identify trends and patterns in construction activity data. Market modeling techniques project future growth scenarios based on current trends and planned developments.

Industry expert consultations provide specialized knowledge on technical aspects of construction projects and market dynamics. These consultations include architects, engineers, and construction managers with extensive Honduras market experience. Expert insights help validate research findings and identify emerging trends.

Quantitative analysis methods process construction activity data, economic indicators, and project pipeline information to identify market patterns and growth drivers. Statistical modeling supports market size estimation and growth projections while accounting for various market factors and uncertainties.

Tegucigalpa metropolitan area represents the largest construction market within Honduras, accounting for approximately 35% of total construction activity. As the capital city, Tegucigalpa attracts significant government infrastructure investment and commercial development projects. The region benefits from concentrated economic activity and serves as headquarters for major construction companies and international firms operating in Honduras.

San Pedro Sula region functions as the industrial and commercial hub, generating substantial construction demand for manufacturing facilities, logistics centers, and commercial developments. This northern region accounts for roughly 28% of construction market activity and benefits from proximity to Caribbean ports and transportation networks. Industrial construction projects dominate this region’s construction landscape.

Coastal regions experience tourism-driven construction growth, with hotel developments, resort facilities, and supporting infrastructure projects. The Caribbean and Pacific coastal areas attract international investment in hospitality construction, contributing approximately 18% of market activity. These regions also benefit from port infrastructure development and related commercial construction.

Rural and interior regions participate in infrastructure development projects, including road construction, rural electrification, and telecommunications infrastructure. While representing smaller individual markets, these regions collectively account for significant construction activity focused on connectivity and basic infrastructure development. Government infrastructure programs particularly target these underserved areas.

Border regions benefit from trade-related infrastructure development and commercial construction projects. Cross-border commerce drives demand for logistics facilities, customs infrastructure, and commercial developments. These regions experience growth tied to regional trade patterns and border infrastructure modernization initiatives.

Market leadership in the Honduras construction sector involves both established local companies and international firms with regional presence. The competitive landscape reflects diverse company capabilities and market focus areas:

Competitive strategies include specialization in specific construction segments, strategic partnerships with international firms, and investment in modern construction equipment and technologies. Companies differentiate through project quality, delivery timelines, and ability to handle complex construction challenges.

By Construction Type:

By Project Size:

By Funding Source:

Infrastructure Construction dominates the market with the highest growth potential and project values. This category includes transportation infrastructure, energy facilities, and telecommunications networks that form the foundation for economic development. MWR analysis indicates infrastructure projects typically have longer duration and higher complexity requirements, creating opportunities for specialized construction companies.

Residential Construction addresses growing housing demand driven by urbanization and population growth. This segment includes both affordable housing initiatives and higher-end residential developments. Market dynamics reflect income distribution patterns and government housing policies that influence demand characteristics and project feasibility.

Commercial Construction responds to business expansion and tourism sector growth, creating demand for office buildings, retail facilities, and hospitality infrastructure. This category often involves international design standards and modern construction technologies, providing opportunities for companies with advanced capabilities.

Industrial Construction supports manufacturing sector development and export-oriented industries. Projects in this category require specialized knowledge of industrial processes and safety requirements. The segment benefits from foreign investment in manufacturing and processing facilities.

Renovation and Modernization represents an emerging category as existing structures require updates and improvements. This segment includes seismic retrofitting, energy efficiency improvements, and facility modernization projects that extend building lifecycles and improve performance standards.

Construction Companies benefit from diverse project opportunities across multiple sectors and regions. The market offers potential for business growth, capability development, and strategic partnerships with both local and international entities. Companies can leverage government infrastructure spending and private sector investment to build sustainable business models.

Government Entities achieve infrastructure development objectives while supporting economic growth and job creation. Construction projects contribute to improved public services, enhanced connectivity, and modernized facilities that serve citizen needs. Strategic construction investments support long-term economic competitiveness and development goals.

International Investors access emerging market opportunities with growth potential and strategic importance in Central America. The construction sector provides entry points for various types of investment, from direct project participation to equipment and material supply. Market participation supports portfolio diversification and regional expansion strategies.

Local Communities benefit from improved infrastructure, housing availability, and employment opportunities created by construction activities. Projects enhance quality of life through better transportation, utilities, and public facilities. Construction activities support local economic development and skills development initiatives.

Material and Equipment Suppliers access growing demand for construction inputs and specialized equipment. Market expansion creates opportunities for both local suppliers and international companies seeking to establish regional presence. Supply chain development supports overall market growth and efficiency improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable construction practices are gaining prominence as environmental awareness increases and international standards influence project requirements. Green building technologies, energy-efficient designs, and sustainable material usage become increasingly important for project approval and financing. This trend creates opportunities for companies investing in sustainable construction capabilities.

Technology integration transforms construction processes through building information modeling, project management software, and advanced construction equipment. Companies adopting these technologies report improved efficiency and quality while reducing project timelines. Digital transformation affects all aspects of construction from design to project completion.

Modular and prefabricated construction methods gain acceptance for their efficiency and quality advantages. These approaches reduce on-site construction time and improve quality control while potentially lowering overall project costs. Prefabrication particularly benefits residential and commercial construction segments.

Public-private partnerships become increasingly common for large infrastructure projects, combining government objectives with private sector efficiency and expertise. PPP models enable complex project financing and risk sharing while accelerating infrastructure development. This trend particularly affects transportation and utility infrastructure projects.

Regional construction standards harmonization supports Central American integration and facilitates cross-border construction company operations. Standardized building codes and safety requirements reduce barriers to regional expansion and improve overall construction quality standards across the region.

Infrastructure investment programs launched by the government focus on transportation networks, energy systems, and telecommunications infrastructure. These programs represent multi-year commitments that provide construction companies with project pipeline visibility and planning certainty. Major highway and port development projects anchor these investment initiatives.

International development partnerships bring technical expertise and funding to large-scale construction projects. Partnerships with development banks and international organizations support infrastructure development while introducing advanced construction standards and practices. These collaborations often include technology transfer and skills development components.

Construction industry modernization initiatives promote adoption of modern construction methods, safety standards, and quality management systems. Government and industry association programs support workforce development and technology adoption. These initiatives aim to improve overall construction sector competitiveness and capabilities.

Foreign investment attraction efforts target construction sector participation through investment promotion and regulatory improvements. Government initiatives to streamline permitting processes and improve business climate support increased foreign participation in construction projects. These efforts particularly focus on infrastructure and commercial construction segments.

Regional trade integration facilitates construction material trade and cross-border construction company operations. Trade agreements and regional integration initiatives reduce barriers to construction industry participation across Central America. This development supports market expansion opportunities for established construction companies.

Strategic positioning recommendations for construction companies include specialization in high-growth segments such as infrastructure and sustainable construction. Companies should develop capabilities in modern construction methods and technologies to remain competitive in evolving market conditions. Strategic partnerships with international firms can provide access to advanced techniques and larger project opportunities.

Investment priorities should focus on workforce development, technology adoption, and equipment modernization to improve competitive positioning. Construction companies benefit from investing in project management capabilities and quality management systems that support larger and more complex projects. Financial management improvements help companies navigate material cost volatility and project financing challenges.

Market entry strategies for international companies should emphasize partnerships with established local firms that provide market knowledge and government relationships. Joint ventures and strategic alliances enable risk sharing while accessing local market expertise. Understanding regulatory requirements and building local relationships are critical success factors.

Risk management approaches should address natural disaster exposure, material cost volatility, and project financing risks. Construction companies benefit from diversified project portfolios and robust financial planning that accounts for market uncertainties. Insurance strategies and contingency planning help manage various construction project risks.

Growth strategies should leverage government infrastructure spending priorities and emerging market opportunities in sustainable construction and technology integration. Companies positioning themselves in high-growth segments can achieve above-average growth rates while building long-term competitive advantages.

Market growth prospects remain positive, with construction activity expected to maintain strong momentum driven by continued infrastructure investment and economic development initiatives. MarkWide Research projections indicate the construction sector will continue expanding at approximately 5.8% annually over the next five years, supported by government infrastructure programs and private sector investment.

Infrastructure development will continue dominating construction market growth, with transportation, energy, and telecommunications projects receiving priority attention. Government commitments to infrastructure modernization provide long-term growth foundation for construction companies capable of handling large-scale projects. International funding support enhances project feasibility and scope.

Technology adoption will accelerate across the construction sector, with companies increasingly implementing digital project management, building information modeling, and advanced construction equipment. This technological evolution will improve efficiency and quality while creating competitive advantages for early adopters. Construction companies investing in technology capabilities will be better positioned for future growth.

Sustainability requirements will become increasingly important for construction projects, driven by environmental regulations and international funding requirements. Green building practices and sustainable construction methods will transition from optional to essential capabilities for construction companies. This trend creates opportunities for companies developing sustainable construction expertise.

Regional integration will create additional opportunities for construction companies to expand beyond Honduras into neighboring Central American markets. Harmonized construction standards and reduced trade barriers will facilitate regional expansion strategies. Companies with strong Honduras market positions can leverage their expertise for regional growth.

The Honduras construction market presents substantial opportunities for growth and development, supported by strong government infrastructure investment, private sector expansion, and favorable economic conditions. Market dynamics indicate continued expansion across multiple construction segments, with infrastructure projects leading growth while residential and commercial construction provide additional opportunities.

Key success factors for market participants include capability development in modern construction methods, strategic partnerships for large projects, and adaptation to evolving sustainability requirements. Companies that invest in workforce development, technology adoption, and quality management systems will be best positioned to capitalize on market opportunities and achieve sustainable growth.

Future market evolution will be shaped by continued infrastructure investment, technology integration, and regional economic development initiatives. The construction sector’s role in economic development ensures continued government support and investment, while private sector growth creates additional demand across various construction segments. Strategic positioning and capability development will determine individual company success in this dynamic and growing market.

What is Honduras Construction?

Honduras Construction refers to the processes and activities involved in building infrastructure, residential, and commercial properties in Honduras. This includes various sectors such as residential construction, commercial development, and civil engineering projects.

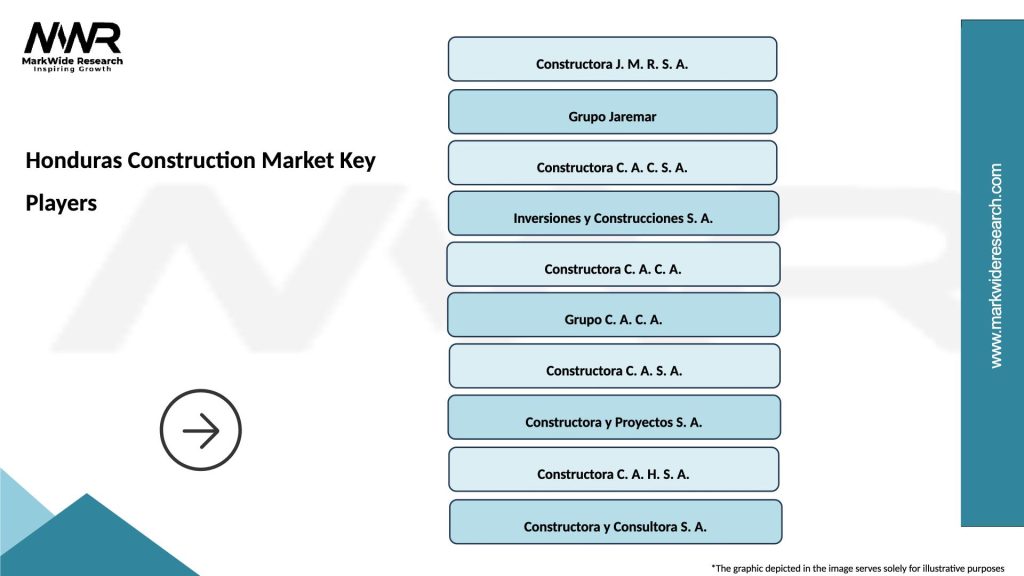

What are the key players in the Honduras Construction Market?

Key players in the Honduras Construction Market include companies like Constructora Jaremar, Grupo Jaremar, and Constructora Cáliz, which are involved in various construction projects ranging from residential buildings to large infrastructure developments, among others.

What are the growth factors driving the Honduras Construction Market?

The growth of the Honduras Construction Market is driven by factors such as urbanization, increased foreign investment, and government initiatives aimed at improving infrastructure. Additionally, the demand for housing and commercial spaces continues to rise.

What challenges does the Honduras Construction Market face?

The Honduras Construction Market faces challenges such as regulatory hurdles, limited access to financing, and issues related to labor shortages. These factors can hinder project timelines and increase costs.

What opportunities exist in the Honduras Construction Market?

Opportunities in the Honduras Construction Market include the potential for sustainable building practices, investment in renewable energy projects, and the development of smart city initiatives. These trends can lead to innovative construction solutions.

What trends are shaping the Honduras Construction Market?

Trends shaping the Honduras Construction Market include the adoption of green building materials, the use of technology in project management, and a focus on sustainable urban development. These trends are influencing how construction projects are planned and executed.

Honduras Construction Market

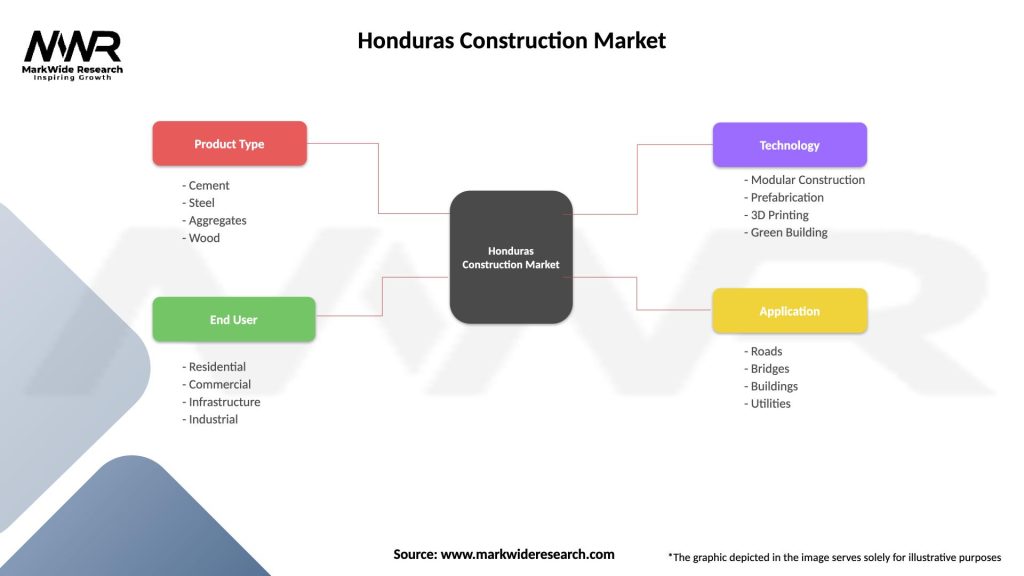

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Steel, Aggregates, Wood |

| End User | Residential, Commercial, Infrastructure, Industrial |

| Technology | Modular Construction, Prefabrication, 3D Printing, Green Building |

| Application | Roads, Bridges, Buildings, Utilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Honduras Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at