444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The home equity loans market has witnessed significant growth in recent years, driven by the increasing demand for financial flexibility among homeowners. A home equity loan allows individuals to leverage the equity they have built in their homes as collateral for a loan. This type of loan is commonly used for purposes such as home improvements, debt consolidation, or funding major expenses. In this comprehensive analysis, we will delve into the various aspects of the home equity loans market, including its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding summary.

Meaning

Home equity loans, also known as second mortgages, are loans that allow homeowners to borrow money using their homes as collateral. These loans are typically based on the difference between the homeowner’s equity and the home’s current market value. Equity represents the portion of the property that the homeowner owns outright, excluding any outstanding mortgage balance. Home equity loans provide individuals with access to a lump sum of money that can be used for various purposes, providing them with financial flexibility.

Executive Summary

The home equity loans market has experienced substantial growth in recent years, driven by the increasing demand for funds for various purposes among homeowners. This report provides a comprehensive overview of the market, including its key drivers, restraints, opportunities, and future outlook. It also examines the impact of the Covid-19 pandemic on the market and provides valuable insights and suggestions for industry participants and stakeholders.

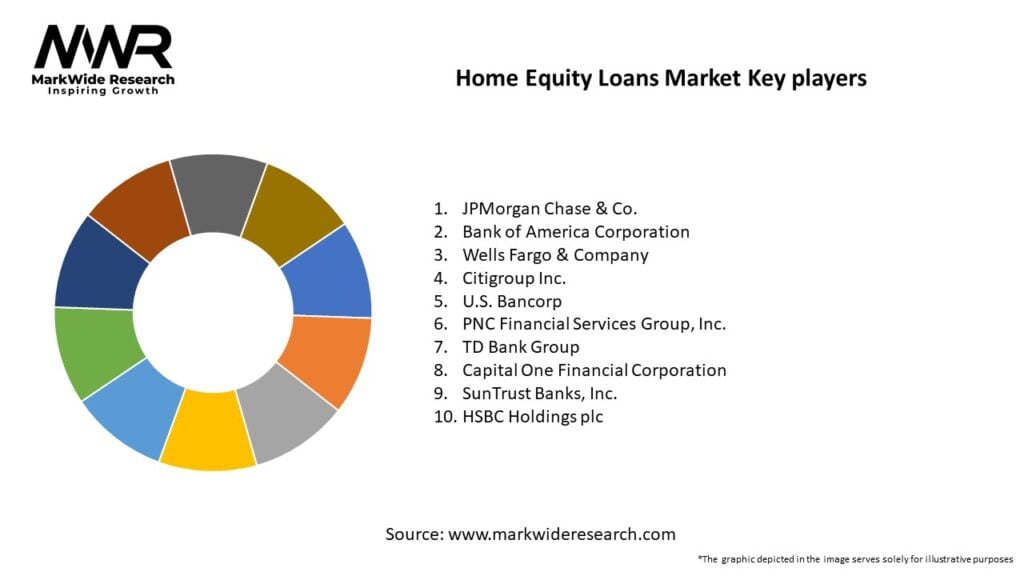

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The home equity loans market is driven by several factors that contribute to its growth and expansion. These drivers include:

Market Restraints

While the home equity loans market exhibits growth potential, there are also certain factors that pose challenges and act as restraints. These include:

Market Opportunities

The home equity loans market presents several opportunities for growth and development. These include:

Market Dynamics

The home equity loans market is characterized by dynamic factors that influence its growth and trajectory. These dynamics include market drivers, restraints, opportunities, and trends. Understanding and adapting to these dynamics is crucial for industry participants to maintain a competitive edge in the market.

Regional Analysis

The home equity loans market exhibits regional variations in terms of demand, market size, and key players. A comprehensive regional analysis provides insights into the market dynamics and trends specific to each geographical area, helping stakeholders identify opportunities and formulate effective strategies.

Competitive Landscape

Leading Companies in the Home Equity Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

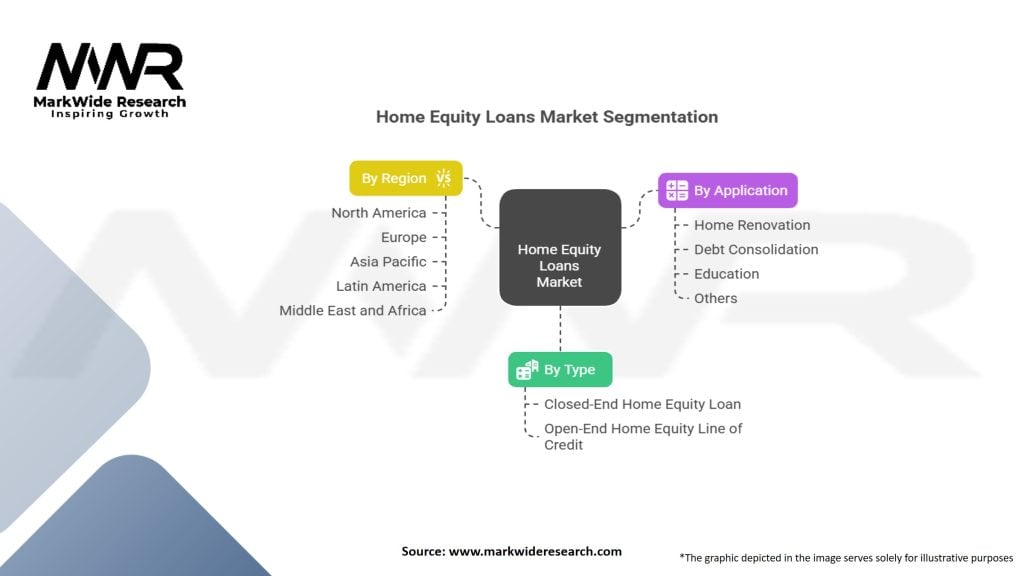

Segmentation

The home equity loans market can be segmented based on various factors, such as loan type, loan amount, interest rate, and borrower profile. Segmentation enables a deeper understanding of customer preferences and allows lenders to tailor their offerings to specific target segments effectively.

Category-wise Insights

Analyzing the home equity loans market based on different categories, such as loan purpose (home improvement, debt consolidation, etc.) or borrower profile (first-time homebuyers, existing homeowners, etc.), provides valuable insights into consumer behavior and market trends for each category.

Key Benefits for Industry Participants and Stakeholders

The home equity loans market offers several benefits for industry participants and stakeholders. These include:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Identifying key trends in the home equity loans market helps industry participants stay ahead of the curve and adapt their strategies accordingly. Key trends may include technological advancements, changing customer preferences, regulatory shifts, or emerging market dynamics.

Covid-19 Impact

The Covid-19 pandemic has had a profound impact on the global economy, including the home equity loans market. This section examines the effects of the pandemic on the market, including shifts in borrower behavior, regulatory changes, and industry responses. Understanding the Covid-19 impact is crucial for market participants to navigate the evolving landscape successfully.

Key Industry Developments

Tracking key industry developments, such as mergers and acquisitions, product launches, partnerships, or regulatory changes, provides valuable insights into the market’s direction and potential future developments. This section highlights recent noteworthy events in the home equity loans market.

Analyst Suggestions

Based on the market analysis, industry experts and analysts provide valuable suggestions and recommendations for industry participants to capitalize on market opportunities, overcome challenges, and enhance their competitive position.

Future Outlook

The future outlook section presents a forward-looking perspective on the home equity loans market, considering factors such as market trends, technological advancements, regulatory landscape, and customer preferences. This analysis helps stakeholders understand the potential growth prospects and make informed decisions for their businesses.

Conclusion

In conclusion, the home equity loans market is witnessing robust growth driven by the increasing demand for financial flexibility among homeowners. This comprehensive analysis has explored various aspects of the market, including its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and summarized the key findings. With a deep understanding of these factors, industry participants can position themselves strategically and tap into the immense potential offered by the home equity loans market.

What is Home Equity Loans?

Home equity loans are financial products that allow homeowners to borrow against the equity they have built in their property. This type of loan is typically used for major expenses such as home renovations, debt consolidation, or education costs.

What are the key players in the Home Equity Loans Market?

Key players in the Home Equity Loans Market include Wells Fargo, Bank of America, and Quicken Loans, among others. These companies offer various home equity loan products tailored to different consumer needs and financial situations.

What are the main drivers of growth in the Home Equity Loans Market?

The main drivers of growth in the Home Equity Loans Market include rising home values, increased consumer confidence, and a growing demand for home improvement financing. Additionally, low-interest rates have made borrowing more attractive for homeowners.

What challenges does the Home Equity Loans Market face?

The Home Equity Loans Market faces challenges such as fluctuating interest rates, regulatory changes, and potential economic downturns that can affect homeowners’ ability to repay loans. These factors can lead to increased risk for lenders and borrowers alike.

What opportunities exist in the Home Equity Loans Market?

Opportunities in the Home Equity Loans Market include the development of innovative loan products and digital platforms that enhance customer experience. Additionally, as more homeowners seek to leverage their equity for various financial needs, lenders can expand their offerings to meet this demand.

What trends are shaping the Home Equity Loans Market?

Trends shaping the Home Equity Loans Market include the rise of online lending platforms, increased focus on customer service, and the integration of technology in the loan application process. These trends are making home equity loans more accessible and user-friendly for consumers.

Home Equity Loans Market

| Segmentation | Details |

|---|---|

| By Type | Closed-End Home Equity Loan, Open-End Home Equity Line of Credit |

| By Application | Home Renovation, Debt Consolidation, Education, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Home Equity Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at