Key Market Insights

-

Product Mix: Surface cleaners (30%), laundry care (25%), dishwashing (20%), air care (15%), other (10%)

-

Growth Leaders: Green and natural formulations are expanding at 10–12% annually, outpacing conventional offerings.

-

Unit Concentration: Water-based concentrates—tablets, pouches, and high-strength liquids—comprise over 20% of new launches, reducing packaging weight and transport costs.

-

Channel Dynamics: Modern trade (supermarkets, hypermarkets) accounts for 60% of volume; e-commerce and convenience formats are fastest-growing.

-

Regional Drivers: Asia-Pacific leads volume growth, fueled by large populations, urbanization, and improving retail access; North America and Europe focus on premiumization and sustainability.

Market Drivers

-

Health & Hygiene Awareness: COVID-19 raised household disinfection practices, sustaining elevated usage of sanitizers and antibacterial cleaners.

-

Sustainability Trends: Consumers demand low-impact ingredients, recyclable packaging, and carbon-neutral production, pushing brands to reformulate.

-

Innovation in Formulations: Enzyme-powered detergents, cold-water performance, and multi-surface cleaners meet consumer convenience and energy-saving preferences.

-

Rising Dual-Income Households: Time-starved consumers value fast-acting, multi-purpose products and subscription services for home essentials.

-

Digital Adoption: Online platforms enable direct engagement, personalized recommendations, and auto-ship models, improving retention and ASPs.

Market Restraints

-

Regulatory Complexity: Differing global regulations on biocides, VOC limits, and “green” claims complicate product development and labeling.

-

Ingredient Costs: Fluctuations in raw-material prices (surfactants, essential oils) affect margins, especially for natural formulations.

-

Consumer Skepticism: Misinformation around chemical safety drives over-cautious avoidance of beneficial antimicrobial products.

-

Retail Shelf Space Competition: Large CPG players occupy prime in-store real estate, challenging smaller or niche brands.

-

Environmental Impact: Concerns over microplastics, wastewater toxicity, and packaging waste heighten scrutiny of certain product categories.

Market Opportunities

-

Natural & Plant-Based Lines: Expansion into bio-based surfactants, microbial cleaners, and essential-oil fragrances for green-certified segments.

-

Smart Dispensers: Sensor-driven dosing systems reduce overuse, minimize waste, and offer data insights on household usage patterns.

-

Functional Air Care: Incorporating VOC scavengers, allergen blockers, and essential-oil aromatherapeutic properties in air fresheners.

-

Emerging Markets: Penetration into rural and tier-2/3 cities in India, China, Latin America, and Africa through localized distribution and affordable pack sizes.

-

Subscription & Refill Models: Reusable packaging and concentrate refills sold online reduce plastic waste and build customer loyalty.

Market Dynamics

-

Consolidation & M&A: Global CPG giants acquire specialized or digital-native brands to capture growth in premium and eco segments.

-

Private-Label Growth: Retailers expand store-brand home care ranges—often at lower price points—to compete on value.

-

Cross-Industry Innovation: Ingredients developed for personal care (enzymes, probiotics) are adapted for household cleaning efficacy.

-

Digital Marketing: Social commerce, influencer partnerships, and hyper-targeted ads drive trial in younger demographics.

-

Sustainability Reporting: Brands publish ESG data (LCA results, plastic-reduction pledges) to meet investor and consumer expectations.

Regional Analysis

-

Asia-Pacific: Largest volume; growth driven by India, China, Southeast Asia. Premium and natural segments gain traction in urban centers.

-

North America: High per-capita spend; innovation hub for specialty products (ozone-safe disinfectants, non-chlorine bleach).

-

Europe: Stringent environmental regulations (REACH, VOC limits) accelerate shift to ultra-low-VOC and biodegradable formulas.

-

Latin America: Rising retail modernization supports value and mid-tier brands; growth in internet access spurs e-commerce sales.

-

Middle East & Africa: Premiumization in GCC; variable growth in sub-Saharan Africa, limited by distribution infrastructure.

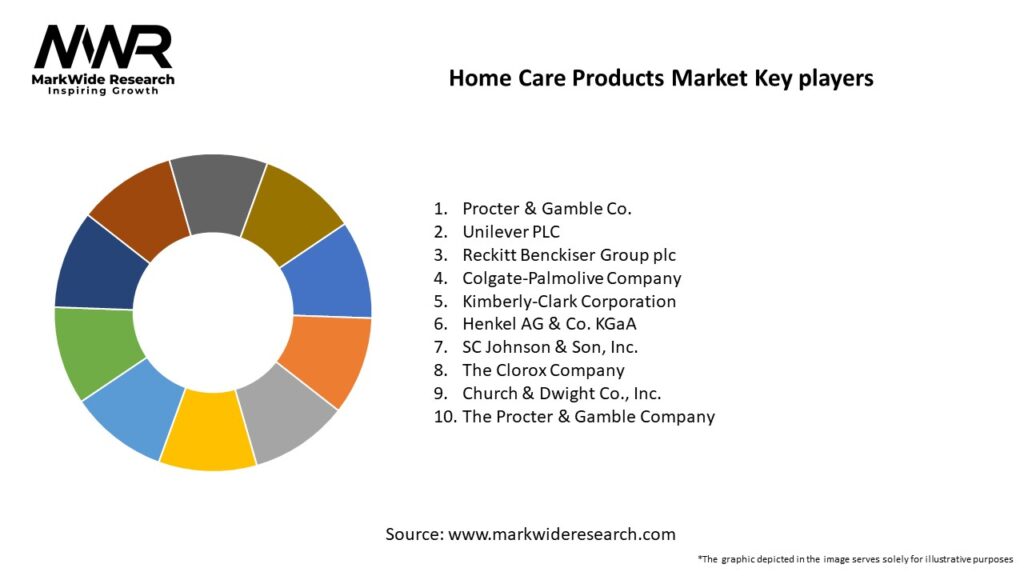

Competitive Landscape

Leading Companies in the Home Care Products Market:

- Procter & Gamble Co.

- Unilever PLC

- Reckitt Benckiser Group plc

- Colgate-Palmolive Company

- Kimberly-Clark Corporation

- Henkel AG & Co. KGaA

- SC Johnson & Son, Inc.

- The Clorox Company

- Church & Dwight Co., Inc.

- The Procter & Gamble Company

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

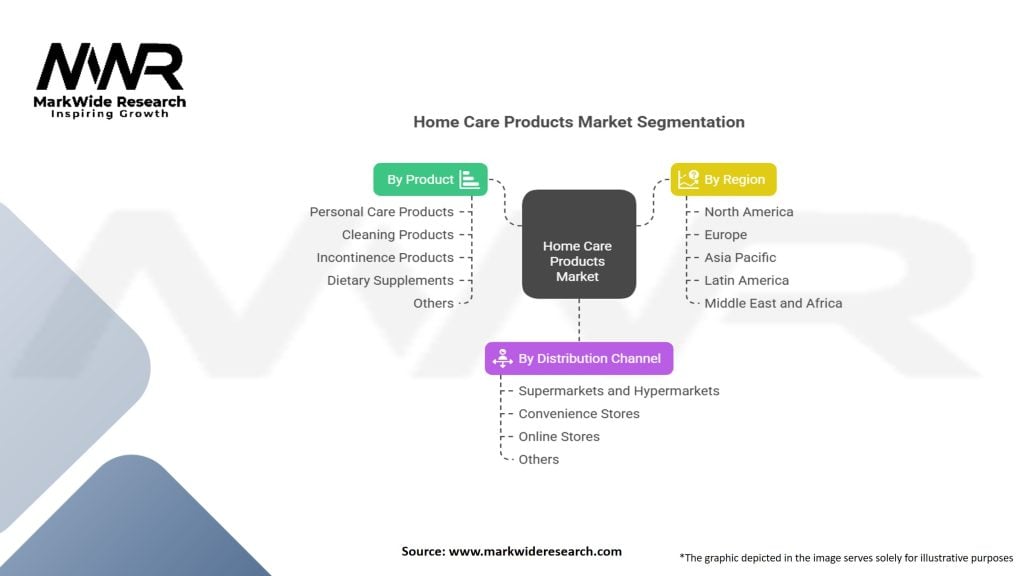

Segmentation

-

By Product Category: Surface Cleaners, Laundry Care, Dishwashing, Air Care, Specialty Disinfectants, Floor Care & Others

-

By Ingredient Type: Synthetic Surfactants, Enzyme-based, Plant-based/Bio-based, Antimicrobial Actives

-

By Packaging Format: Liquids, Tablets & Pods, Sprays, Concentrates, Wipes

-

By Distribution Channel: Supermarkets/Hypermarkets, Convenience/Drug Stores, E-commerce, Direct B2B & Institutional

-

By Region: Asia-Pacific, North America, Europe, Latin America, Middle East & Africa

Category-wise Insights

-

Surface Cleaners: Trend toward non-chlorine, all-purpose sprays with quick-dry, streak-free formulations.

-

Laundry Care: Shift from liquid to highly concentrated pods and tablets; enzyme blends for low-temperature washes.

-

Dishwashing: Rise of machine pods with rinse agents; eco pods with reduced phosphate and dye content.

-

Air Care: Transition from aerosol sprays to passive diffusers, smart plug-ins, and refrigerant-free ultrasonics.

-

Specialty Disinfectants: Growth in hospital-grade, EPA-verified products with broad-spectrum claims.

-

Wipes & Others: Biodegradable and flushable wipe formulations; antimicrobial wipes for high-touch surfaces.

Key Benefits for Industry Participants and Stakeholders

-

Consumer Loyalty: Innovative formats (pods, smart dispensers) lock in repeat purchases and higher margins.

-

Operational Efficiency: Concentrates and tablets reduce logistics costs, packaging waste, and shelf-space requirements.

-

Regulatory Compliance: Adherence to global and local safety standards mitigates legal and reputational risks.

-

Sustainability Leadership: Green formulations and refill models enhance brand equity and meet ESG targets.

-

Channel Diversification: Strong omnichannel presence spreads risk and captures digitally savvy consumers.

SWOT Analysis

Strengths:

-

Diverse product categories that insulate players from demand swings in any single segment.

-

High brand equity and extensive distribution networks.

-

Continuous R&D and marketing investments.

Weaknesses:

-

High competition leads to price pressure and margin erosion.

-

Regulatory complexity across regions slows new launches.

-

Environmental concerns over plastic packaging and chemical residues.

Opportunities:

-

Expansion of subscription-based and re-fill stream models.

-

Investment in biodegradable surfactants and post-consumer recycled packaging.

-

Customizable, on-demand formula kits via e-commerce channels.

Threats:

-

Emergence of private-label products with competitive quality at lower price points.

-

Volatility in raw-material costs (petrochemical derivatives, essential oils).

-

Consumer pushback on perceived “over-chemicalization” and need for cleaner labels.

Market Key Trends

-

Ultra-Concentrates & Tablets: Reducing water content, enabling lightweight, sustainable shipping.

-

Enzyme Innovation: Next-gen proteases and amylases effective at low temperature and pH, boosting energy savings.

-

Probiotic Cleaners: Live-culture formulations for odor control and protective biofilms.

-

Digital Engagement: QR-linked bottles offering usage tutorials, refill orders, and loyalty rewards.

-

Refill Stations: Retail and in-home refill dispensers for bulk liquid concentrates, minimizing single-use plastic.

Covid-19 Impact

The pandemic triggered unprecedented surges in disinfectant and multi-surface cleaner demand. Brands rapidly scaled production and expanded capacity, while supply-chain disruptions prompted reformulations using alternative actives. Heightened consumer hygiene routines—frequent sanitization of high-touch areas—persisted post-pandemic, sustaining elevated sales of disinfectant wipes and sprays. E-commerce ordering ramped up sharply, leading to permanent shifts in channel mix and the adoption of DTC models.

Key Industry Developments

-

P&G’s Dawn Powerwash™ Launch (2024): A pre-mixed spray formula eliminating need for pre-rinsing, driving growth in convenience segment.

-

Unilever’s Seventh Generation Acquisition (2023): Bolstered natural lineup in North America, leveraging plant-based surfactants and recycled PET.

-

RB’s Lysol® Touch Technology (2022): Introduced anti-microbial surface-sealant technology extending germ protection between cleanings.

-

Clorox’s Clorox Green Works™ Reformulation (2021): Transitioned to naturally derived surfactants and essential-oil fragrances while maintaining efficacy.

Analyst Suggestions

-

Scale Sustainable Formats: Invest in ultra-concentrate tablets and refill systems to meet environmental mandates and lower supply-chain costs.

-

Expand Premium Green Lines: Grow natural, fragrance-free, and hypoallergenic segments to capture health-conscious consumers.

-

Leverage Digital Direct: Build robust DTC platforms with subscription options and personalized housekeeping solutions.

-

Enhance Ingredient Traceability: Use blockchain or QR codes to provide transparency on sourcing and safety credentials.

-

Collaborate on Regulations: Engage proactively with regulators and NGOs to shape feasible, science-based standards on claims and ingredients.

Future Outlook

The Home Care Products market is set to continue expanding at 4–6% CAGR through 2030, supported by ongoing urbanization, increasing hygiene consciousness, and sustainability imperatives. Natural-derivative and multifunctional formulations will gain share, while digital engagement and smart dispensing accelerate household adoption. Regional growth will be led by Asia-Pacific and Latin America’s rising middle classes, with Western markets focusing on premiumization and circular packaging. Industry participants who balance innovation, environmental stewardship, and omnichannel strategies will secure leadership in a dynamic, consumer-centric marketplace.

Conclusion

In conclusion, the Global Home Care Products market presents significant opportunities for both established multinationals and nimble challengers. By advancing eco-friendly formulations, smart delivery systems, and engaging digital experiences, brands can meet evolving consumer demands for efficacy, convenience, and sustainability. Aligning product development with regulatory frameworks and leveraging data-driven insights will enable stakeholders to maintain growth, drive loyalty, and achieve competitive differentiation in this essential segment of consumer goods.