444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The High-Yield Bonds market, also known as junk bonds, is a segment of the bond market that offers higher yields but carries higher credit risk compared to investment-grade bonds. These bonds are issued by companies with lower credit ratings or non-investment-grade status. The High-Yield Bonds market provides an avenue for companies to raise capital, offering investors the potential for higher returns. This comprehensive analysis provides insights into the market trends, key drivers, restraints, opportunities, and future outlook of the High-Yield Bonds market.

Meaning

High-Yield Bonds, or junk bonds, are fixed-income securities issued by companies with lower credit ratings. These bonds offer higher interest rates to compensate investors for the increased credit risk associated with the issuer. Companies that issue High-Yield Bonds typically have below-investment-grade ratings due to factors such as financial instability, high leverage, or limited operating history. Investors are attracted to High-Yield Bonds for their potential for higher returns compared to investment-grade bonds, but they also face a higher risk of default.

Executive Summary

The High-Yield Bonds market is a dynamic segment of the bond market that offers opportunities for both companies and investors. Companies with lower credit ratings can raise capital through High-Yield Bonds, while investors seeking higher yields can diversify their portfolios. The market provides a balance between risk and reward, with higher yields reflecting the increased credit risk associated with the bonds. However, investing in High-Yield Bonds requires thorough research and analysis to assess the creditworthiness of the issuers. This analysis explores the key aspects of the High-Yield Bonds market, including market drivers, restraints, opportunities, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

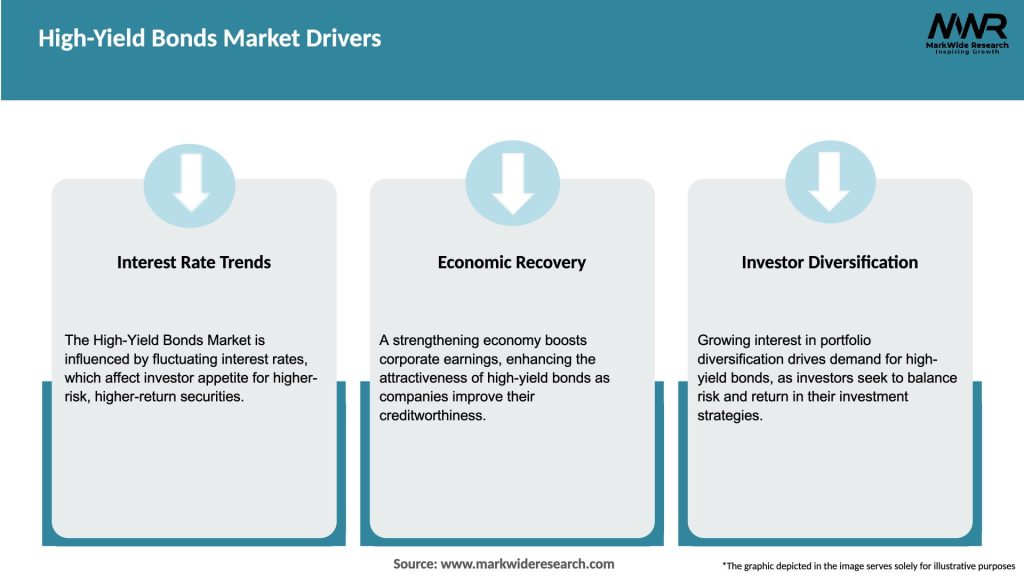

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The High-Yield Bonds market operates in a dynamic environment influenced by macroeconomic factors, credit market conditions, and investor sentiment. The market is driven by the demand for higher yields, access to capital for lower-rated companies, and favorable economic conditions. It faces challenges such as credit risk, interest rate sensitivity, liquidity constraints, and economic uncertainties. However, the market also presents opportunities for companies to raise capital and investors to diversify their portfolios. Successful investing in High-Yield Bonds requires in-depth credit analysis, risk management strategies, and active portfolio monitoring.

Regional Analysis

The High-Yield Bonds market is global in nature, with issuers and investors spanning various regions. However, the United States has traditionally been the largest market for High-Yield Bonds, driven by its well-developed corporate bond market and investor base. Europe has also experienced significant growth in High-Yield Bonds, with increasing issuance from companies in emerging markets and diverse sectors. Asia Pacific is witnessing a growing market for High-Yield Bonds, driven by the expansion of capital markets and increasing investor appetite for higher-yielding investments.

Competitive Landscape

Leading Companies in the High-Yield Bonds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

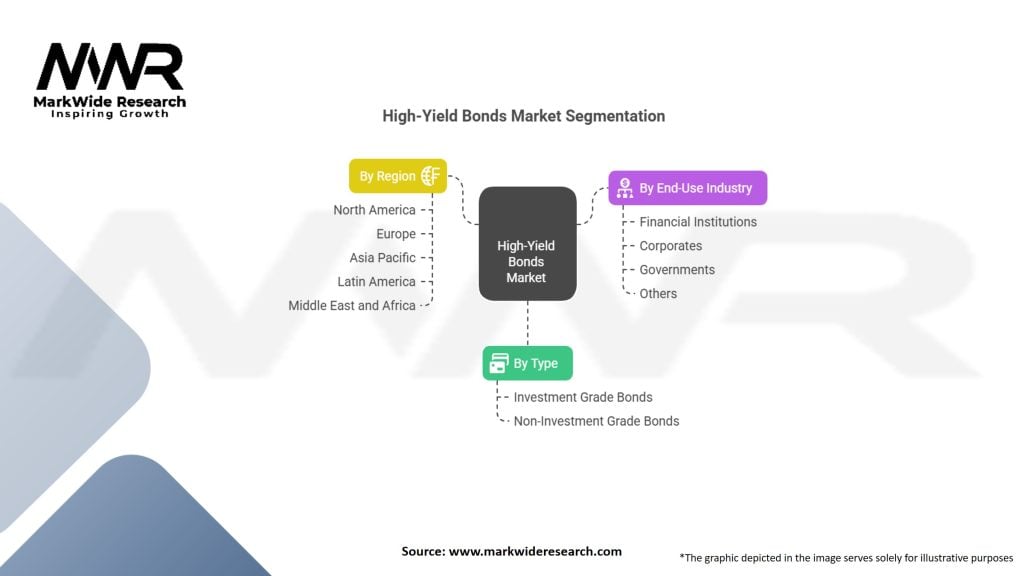

Segmentation

The High-Yield Bonds market can be segmented based on issuer type, industry sector, credit rating, and maturity.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the High-Yield Bonds market. The economic slowdown and increased credit risk led to higher default rates and volatility in bond prices. However, central bank interventions, fiscal stimulus measures, and accommodative monetary policies provided support to the market. The pandemic also highlighted the importance of credit analysis, risk management, and diversification in High-Yield Bond investing. As the global economy recovers from the pandemic, the High-Yield Bonds market is expected to regain momentum, driven by improving credit conditions and investor appetite for higher yields.

Key Industry Developments

Analyst Suggestions

Future Outlook

The High-Yield Bonds market is expected to witness continued growth in the coming years. The demand for higher-yielding fixed-income investments, favorable economic conditions, and access to capital for lower-rated companies will drive the market expansion. Investors will continue to seek opportunities for portfolio diversification and income generation. However, credit risk, interest rate sensitivity, and market volatility will remain challenges in the High-Yield Bonds market. Thorough credit analysis, risk management strategies, and active portfolio monitoring will be critical for successful investing in High-Yield Bonds.

Conclusion

The High-Yield Bonds market offers a balance between risk and reward for both companies and investors. It provides opportunities for companies with lower credit ratings to raise capital and investors seeking higher yields to diversify their portfolios. While High-Yield Bonds carry higher credit risk, they also offer the potential for attractive returns.

However, investing in High-Yield Bonds requires thorough research, credit analysis, and risk management strategies. The market is influenced by various factors, including economic conditions, investor sentiment, and regulatory changes. Despite the challenges, the High-Yield Bonds market presents opportunities for companies and investors to achieve their financial goals with careful evaluation and active portfolio management.

What is High-Yield Bonds?

High-yield bonds, often referred to as junk bonds, are fixed-income securities that offer higher interest rates due to a higher risk of default compared to investment-grade bonds. They are typically issued by companies with lower credit ratings and are used to raise capital for various business needs.

What are the key players in the High-Yield Bonds Market?

Key players in the High-Yield Bonds Market include investment firms such as BlackRock, PIMCO, and Franklin Templeton. These companies actively manage high-yield bond funds and provide investment strategies to capitalize on the potential returns of these securities, among others.

What are the growth factors driving the High-Yield Bonds Market?

The High-Yield Bonds Market is driven by factors such as low interest rates, increased corporate borrowing, and a search for yield among investors. Additionally, economic recovery phases often lead to higher demand for these bonds as companies seek to finance expansion.

What challenges does the High-Yield Bonds Market face?

The High-Yield Bonds Market faces challenges such as economic downturns that can increase default rates and volatility in interest rates. Additionally, regulatory changes and market sentiment can significantly impact investor confidence in high-yield securities.

What opportunities exist in the High-Yield Bonds Market?

Opportunities in the High-Yield Bonds Market include the potential for high returns in a low-yield environment and the ability to diversify investment portfolios. Investors may also find opportunities in distressed debt situations where companies are restructuring.

What trends are shaping the High-Yield Bonds Market?

Trends shaping the High-Yield Bonds Market include the increasing popularity of ESG-focused investments and the rise of technology-driven trading platforms. Additionally, there is a growing interest in analyzing credit risk through advanced data analytics and machine learning.

High-Yield Bonds Market

| Segmentation | Details |

|---|---|

| By Type | Investment Grade Bonds, Non-Investment Grade Bonds |

| By End-Use Industry | Financial Institutions, Corporates, Governments, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the High-Yield Bonds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at