444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The high pressure oil and gas separator market represents a critical segment within the upstream oil and gas industry, encompassing sophisticated equipment designed to separate oil, gas, and water under extreme pressure conditions. These separators operate at pressures exceeding 1,000 psi and are essential for maintaining operational efficiency in challenging extraction environments. The market has experienced substantial growth driven by increasing deepwater drilling activities, unconventional resource development, and the need for enhanced recovery techniques.

Market dynamics indicate robust expansion across key regions, with North America leading adoption rates at approximately 35% market share, followed by the Middle East and Asia-Pacific regions. The technology has evolved significantly to handle higher pressures and more complex fluid compositions, making it indispensable for modern oil and gas operations. Technological advancements in separator design, including improved internals and enhanced materials, have contributed to increased efficiency rates of up to 98% separation effectiveness.

Industry adoption continues to accelerate as operators seek to maximize production from existing wells while minimizing environmental impact. The integration of smart monitoring systems and automated controls has further enhanced the appeal of high pressure separators, enabling real-time optimization and predictive maintenance capabilities.

The high pressure oil and gas separator market refers to the global industry focused on manufacturing, distributing, and servicing specialized equipment designed to separate crude oil, natural gas, and produced water under high-pressure conditions typically exceeding 1,000 psi. These separators utilize advanced engineering principles including gravity separation, centrifugal force, and coalescence to achieve efficient phase separation in challenging operational environments.

High pressure separators are engineered to withstand extreme operating conditions while maintaining optimal separation efficiency. The equipment incorporates sophisticated internal components such as mist eliminators, coalescing plates, and distribution systems that work together to ensure clean separation of hydrocarbon phases. Modern separator designs feature enhanced materials like duplex stainless steel and specialized coatings to resist corrosion and extend operational life.

Applications span across various segments of the oil and gas industry, including offshore platforms, onshore production facilities, gas processing plants, and enhanced oil recovery operations. The technology plays a crucial role in upstream operations by enabling efficient processing of well fluids before transportation to downstream facilities.

The high pressure oil and gas separator market demonstrates strong growth momentum driven by increasing global energy demand and the expansion of unconventional resource development. Key market drivers include the growing complexity of hydrocarbon extraction, stricter environmental regulations, and the need for enhanced operational efficiency in challenging environments.

Regional analysis reveals significant opportunities across multiple geographic markets, with offshore drilling activities contributing approximately 42% of total demand for high pressure separation equipment. The market benefits from continuous technological innovation, including the development of compact separator designs and integration of digital monitoring systems.

Competitive dynamics feature established equipment manufacturers competing on the basis of technological superiority, reliability, and comprehensive service offerings. Market participants are investing heavily in research and development to create next-generation separators capable of handling increasingly complex fluid compositions and extreme operating conditions.

Future prospects remain positive, supported by ongoing investments in oil and gas infrastructure, the development of deepwater resources, and the growing adoption of enhanced oil recovery techniques. The market is expected to benefit from increasing focus on operational efficiency and environmental compliance across the global energy sector.

Strategic insights reveal several critical factors shaping the high pressure oil and gas separator market landscape:

Market intelligence indicates that operators increasingly prioritize total cost of ownership over initial capital expenditure, driving demand for high-quality, durable separator solutions. The trend toward integrated production systems creates opportunities for separator manufacturers to provide comprehensive solutions rather than standalone equipment.

Primary market drivers propelling growth in the high pressure oil and gas separator market include several interconnected factors that reflect broader industry trends and operational requirements.

Unconventional resource development represents a major growth driver, as shale oil and gas operations require sophisticated separation equipment to handle complex fluid compositions and varying pressure conditions. The expansion of hydraulic fracturing and horizontal drilling techniques has created substantial demand for high pressure separators capable of processing multiphase flows efficiently.

Deepwater exploration activities continue to drive market growth, with offshore operations requiring specialized separator equipment designed to withstand harsh marine environments and extreme pressure conditions. The development of deepwater fields in regions such as the Gulf of Mexico, North Sea, and offshore Brazil creates sustained demand for advanced separation technology.

Enhanced oil recovery (EOR) techniques increasingly rely on high pressure separation equipment to process fluids from secondary and tertiary recovery operations. These applications often involve complex fluid compositions requiring sophisticated separation capabilities to maintain production efficiency.

Environmental regulations drive demand for separators with improved environmental performance, including reduced emissions and enhanced water treatment capabilities. Operators seek equipment that helps achieve compliance with increasingly stringent environmental standards while maintaining operational efficiency.

Operational efficiency requirements push operators to invest in advanced separator technology that maximizes hydrocarbon recovery while minimizing operational costs and downtime. The focus on optimizing production from existing assets creates opportunities for high-performance separation equipment.

Market restraints affecting the high pressure oil and gas separator market include several challenges that may impact growth trajectories and adoption rates across different market segments.

High capital investment requirements represent a significant barrier for many operators, particularly smaller independent companies with limited financial resources. The substantial upfront costs associated with high pressure separator systems can delay project implementation and limit market penetration in certain segments.

Technical complexity of modern separator systems requires specialized expertise for operation and maintenance, creating challenges for operators in regions with limited technical infrastructure. The need for skilled personnel and comprehensive training programs can increase total ownership costs and complicate deployment decisions.

Volatile oil and gas prices create uncertainty in capital investment decisions, leading to project delays and reduced equipment procurement during market downturns. Price volatility affects operator willingness to invest in new separation equipment and can impact market growth during challenging economic periods.

Regulatory compliance costs associated with environmental and safety requirements add complexity and expense to separator system implementation. Evolving regulations may require equipment modifications or upgrades, increasing operational costs for existing installations.

Supply chain challenges including material availability, manufacturing capacity constraints, and logistics complexities can impact equipment delivery schedules and project timelines. Global supply chain disruptions may affect component availability and increase equipment costs.

Significant market opportunities exist across multiple dimensions of the high pressure oil and gas separator market, driven by technological advancement, geographic expansion, and evolving industry requirements.

Digital transformation initiatives present substantial opportunities for separator manufacturers to develop smart, connected equipment with advanced monitoring and optimization capabilities. The integration of artificial intelligence and machine learning technologies enables predictive maintenance and real-time performance optimization, creating value-added service opportunities.

Emerging market expansion offers considerable growth potential, particularly in regions with developing oil and gas industries such as Africa, Latin America, and parts of Asia. These markets present opportunities for both equipment sales and comprehensive service offerings as local industries mature and adopt advanced separation technologies.

Retrofit and upgrade markets provide ongoing opportunities as operators seek to enhance the performance of existing separator installations. Modernization projects involving control system upgrades, internal component improvements, and efficiency enhancements represent a substantial market segment.

Renewable energy integration creates new applications for separation technology in hybrid energy systems and carbon capture applications. The development of hydrogen production and carbon utilization projects may require specialized separation equipment, opening new market segments.

Modular and standardized solutions present opportunities to reduce costs and improve deployment speed through standardized designs and modular construction approaches. These solutions can make high pressure separation technology more accessible to smaller operators and emerging markets.

Market dynamics in the high pressure oil and gas separator sector reflect complex interactions between technological innovation, regulatory requirements, economic factors, and operational demands that shape industry evolution.

Technological convergence drives the integration of separation equipment with broader production systems, creating opportunities for comprehensive solutions that optimize entire production processes. This trend toward system integration requires separator manufacturers to develop broader capabilities and strategic partnerships.

Competitive intensity continues to increase as established manufacturers face competition from emerging technology providers and regional specialists. Market participants differentiate through technological innovation, service capabilities, and comprehensive solution offerings rather than competing solely on price.

Customer expectations evolve toward demanding higher performance, greater reliability, and enhanced environmental compliance from separator equipment. Operators increasingly seek partners capable of providing comprehensive support throughout the equipment lifecycle, from initial design through decommissioning.

Supply chain optimization becomes increasingly important as manufacturers seek to improve cost competitiveness while maintaining quality standards. Strategic sourcing, manufacturing efficiency improvements, and logistics optimization contribute to competitive advantage in the market.

Regulatory evolution continues to influence market dynamics as environmental and safety standards become more stringent. Manufacturers must anticipate regulatory changes and develop equipment capable of meeting future compliance requirements while maintaining operational efficiency.

Comprehensive research methodology employed in analyzing the high pressure oil and gas separator market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, technical specialists, and end-users across different market segments and geographic regions. These interviews provide valuable insights into market trends, technology developments, competitive dynamics, and future growth prospects from industry participants with direct market experience.

Secondary research encompasses analysis of industry publications, technical literature, regulatory documents, and company financial reports to gather comprehensive market intelligence. This research provides historical context, market sizing information, and competitive landscape analysis essential for understanding market evolution.

Technical analysis involves evaluation of separator technology developments, performance characteristics, and application requirements across different industry segments. This analysis helps identify technology trends and assess the impact of innovation on market growth and competitive positioning.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth trends and identify key growth drivers. These models incorporate multiple variables including economic indicators, industry activity levels, and technology adoption rates to generate reliable market projections.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review, and consistency checking. This rigorous approach helps maintain high standards of research quality and provides confidence in market analysis and recommendations.

Regional market analysis reveals distinct patterns of growth and opportunity across major geographic markets, with each region presenting unique characteristics, challenges, and growth drivers for high pressure oil and gas separator adoption.

North America maintains market leadership with approximately 38% of global demand, driven by extensive shale oil and gas development, offshore Gulf of Mexico operations, and ongoing infrastructure investments. The region benefits from advanced technology adoption, established supply chains, and comprehensive service networks that support high pressure separator deployment.

Middle East and Africa represent significant growth markets, accounting for roughly 28% of global separator demand, supported by large-scale oil and gas production operations and ongoing field development projects. The region’s focus on maximizing production from existing assets creates sustained demand for advanced separation technology.

Asia-Pacific markets demonstrate rapid growth potential with increasing energy demand and expanding oil and gas exploration activities. Countries such as China, India, and Australia present substantial opportunities for separator manufacturers, particularly in offshore development and unconventional resource projects.

Europe maintains steady demand driven by North Sea operations, though market maturity limits growth compared to emerging regions. The region’s focus on environmental compliance and operational efficiency creates opportunities for advanced separator technology and retrofit projects.

Latin America offers considerable growth potential, particularly in offshore Brazil and unconventional resource development across the region. Political and economic stability improvements in key countries support increased investment in oil and gas infrastructure and separation equipment.

The competitive landscape in the high pressure oil and gas separator market features established global manufacturers, specialized technology providers, and regional suppliers competing across multiple dimensions including technology, service capabilities, and market reach.

Competitive strategies focus on technological differentiation, comprehensive service offerings, and strategic partnerships to enhance market position. Leading companies invest heavily in research and development to maintain technology leadership and develop next-generation separator solutions.

Market consolidation trends continue as larger companies acquire specialized technology providers and regional manufacturers to expand capabilities and market reach. These acquisitions enable comprehensive solution offerings and enhanced global service capabilities.

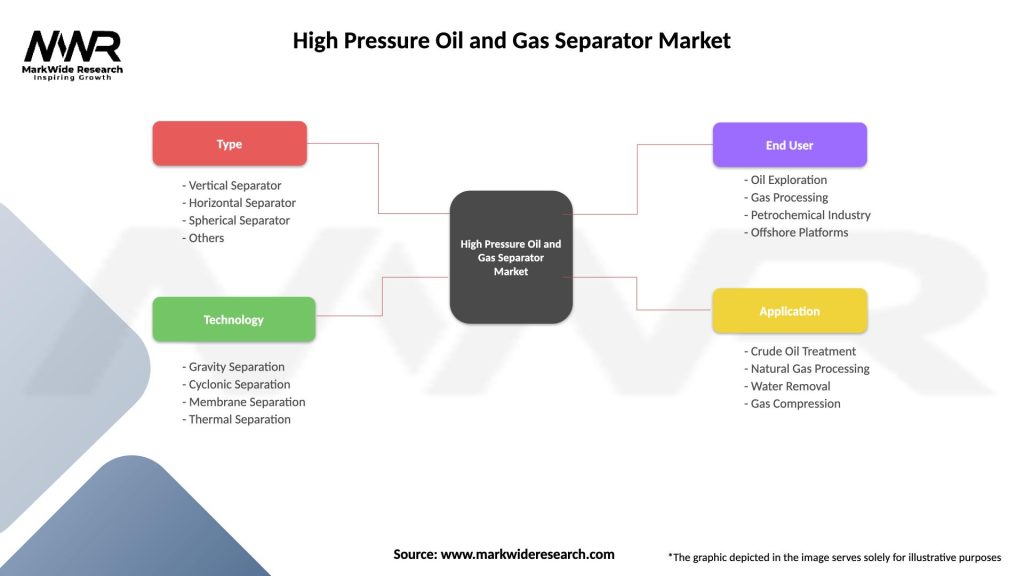

Market segmentation analysis reveals distinct categories within the high pressure oil and gas separator market, each characterized by specific requirements, applications, and growth dynamics that influence purchasing decisions and technology development.

By Pressure Rating:

By Configuration:

By Application:

By End-User:

Category-wise analysis provides detailed insights into specific market segments, revealing unique characteristics, growth patterns, and competitive dynamics that influence market development and strategic positioning.

Horizontal separator category dominates market share due to superior liquid handling capacity and established design preferences among operators. These separators excel in applications with high liquid flow rates and provide excellent separation efficiency for conventional oil and gas production operations.

Ultra-high pressure segment demonstrates the fastest growth rate, driven by increasing deepwater exploration and unconventional resource development requiring specialized equipment capable of handling extreme operating conditions. This segment commands premium pricing due to advanced engineering requirements and specialized materials.

Offshore applications represent the most demanding segment in terms of technical requirements, environmental resistance, and reliability standards. Equipment for offshore use requires specialized coatings, enhanced structural design, and comprehensive testing to ensure reliable operation in harsh marine environments.

Smart separator category emerges as a high-growth segment, incorporating advanced monitoring systems, automated controls, and predictive analytics capabilities. These systems enable real-time optimization and reduce operational costs through improved efficiency and predictive maintenance.

Retrofit and upgrade segment provides steady revenue streams for manufacturers through modernization of existing separator installations. This category focuses on performance enhancement, regulatory compliance improvements, and lifecycle extension of existing equipment.

Industry participants and stakeholders realize substantial benefits from high pressure oil and gas separator technology adoption, encompassing operational, economic, and strategic advantages that support business objectives and competitive positioning.

Operational Benefits:

Economic Benefits:

Strategic Benefits:

Comprehensive SWOT analysis reveals the strategic position of the high pressure oil and gas separator market, identifying internal strengths and weaknesses alongside external opportunities and threats that influence market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the high pressure oil and gas separator industry reflect broader technological, environmental, and economic forces that influence product development, market demand, and competitive dynamics.

Digitalization and Smart Technology Integration represents a transformative trend, with separator manufacturers incorporating IoT sensors, advanced analytics, and machine learning capabilities into their equipment. These smart separators enable real-time monitoring, predictive maintenance, and automated optimization, improving operational efficiency by up to 25% in many applications.

Modular and Standardized Designs gain popularity as operators seek to reduce costs and improve deployment speed. Modular separator systems enable faster installation, easier maintenance, and greater flexibility in system configuration, making advanced separation technology more accessible to smaller operators and emerging markets.

Environmental Performance Enhancement drives development of separators with improved environmental characteristics, including reduced emissions, enhanced water treatment capabilities, and materials designed for easier recycling and disposal. This trend reflects increasing regulatory requirements and corporate sustainability commitments.

Compact and Lightweight Designs address space and weight constraints in offshore and remote applications. Advanced engineering and materials enable separator designs that maintain performance while reducing footprint and weight requirements, particularly important for floating production systems and remote installations.

Service Integration and Lifecycle Support becomes increasingly important as operators seek comprehensive solutions rather than standalone equipment. Manufacturers expand service offerings to include installation, commissioning, maintenance, optimization, and eventual decommissioning services.

Recent industry developments demonstrate the dynamic nature of the high pressure oil and gas separator market, with significant technological advances, strategic partnerships, and market expansion initiatives shaping the competitive landscape.

Technology Innovation Initiatives focus on developing next-generation separator designs capable of handling increasingly complex fluid compositions and extreme operating conditions. Recent developments include advanced internal components, enhanced materials, and integrated monitoring systems that improve separation efficiency and reliability.

Strategic Acquisitions and Partnerships reshape the competitive landscape as major companies acquire specialized technology providers and form strategic alliances to enhance capabilities. These transactions enable comprehensive solution offerings and expanded geographic reach while accelerating technology development.

Digital Transformation Projects accelerate across the industry as companies invest in smart separator technology and digital service platforms. These initiatives enable remote monitoring, predictive analytics, and automated optimization capabilities that improve operational efficiency and reduce costs.

Sustainability Initiatives drive development of environmentally friendly separator designs and manufacturing processes. Companies invest in research and development focused on reducing environmental impact while maintaining operational performance and reliability.

Market Expansion Activities include establishment of manufacturing facilities, service centers, and distribution networks in emerging markets. These investments support growing demand in developing oil and gas regions while reducing logistics costs and improving customer service.

Strategic recommendations for market participants reflect comprehensive analysis of market dynamics, competitive positioning, and growth opportunities within the high pressure oil and gas separator market.

Technology Investment Priorities should focus on digital integration capabilities, advanced materials research, and modular design development. Companies investing in smart separator technology and predictive analytics capabilities position themselves advantageously for future market growth and customer demand evolution.

Geographic Expansion Strategies should prioritize emerging markets with growing oil and gas industries, particularly in Asia-Pacific, Latin America, and Africa. Establishing local presence through partnerships, service centers, or manufacturing facilities enables better customer service and competitive positioning in these high-growth regions.

Service Capability Development represents a critical success factor as customers increasingly seek comprehensive solutions rather than standalone equipment. Companies should invest in service capabilities including installation, commissioning, maintenance, optimization, and lifecycle support to differentiate their offerings and create recurring revenue streams.

Partnership and Acquisition Opportunities should focus on complementary technologies, specialized capabilities, and geographic expansion. Strategic alliances with technology providers, service companies, and regional specialists can accelerate market penetration and capability development.

Sustainability Integration becomes increasingly important as environmental regulations tighten and corporate sustainability commitments expand. Companies should incorporate environmental performance considerations into product development and manufacturing processes to meet evolving market requirements.

Future market prospects for the high pressure oil and gas separator industry remain positive, supported by fundamental growth drivers including increasing energy demand, technological advancement, and expanding unconventional resource development across global markets.

Technology evolution will continue driving market growth as separator manufacturers develop increasingly sophisticated equipment capable of handling complex operating conditions and providing enhanced performance. The integration of artificial intelligence, machine learning, and advanced materials will create new opportunities for performance improvement and cost reduction.

Market expansion into emerging regions presents significant growth opportunities as developing countries increase oil and gas production and infrastructure investment. MarkWide Research analysis indicates that emerging markets could account for up to 45% of incremental demand over the next decade, driven by resource development and infrastructure modernization.

Digital transformation will reshape the industry as smart separator technology becomes standard rather than premium offering. The adoption of IoT, predictive analytics, and automated optimization will improve operational efficiency and create new service opportunities for equipment manufacturers.

Environmental considerations will increasingly influence purchasing decisions as operators seek equipment that supports sustainability objectives and regulatory compliance. Separator manufacturers investing in environmental performance enhancement will gain competitive advantages in markets with stringent environmental requirements.

Industry consolidation may accelerate as companies seek to achieve scale advantages and comprehensive capability portfolios. Strategic acquisitions and partnerships will continue reshaping the competitive landscape while creating opportunities for specialized technology providers.

The high pressure oil and gas separator market demonstrates robust growth potential driven by fundamental industry trends including unconventional resource development, deepwater exploration, and increasing focus on operational efficiency. The market benefits from continuous technological innovation, expanding geographic opportunities, and evolving customer requirements that favor advanced separation solutions.

Key success factors for market participants include technology leadership, comprehensive service capabilities, and strategic positioning in high-growth geographic markets. Companies that invest in digital integration, environmental performance, and customer-centric solutions will be best positioned to capitalize on market opportunities and achieve sustainable competitive advantages.

Market dynamics indicate continued evolution toward smart, connected separator systems that provide enhanced performance, improved reliability, and comprehensive lifecycle support. The integration of advanced technologies with traditional separation equipment creates opportunities for differentiation and value creation across the industry value chain.

Future growth prospects remain positive despite cyclical industry challenges, supported by increasing global energy demand, technological advancement, and expanding applications in unconventional resource development. The high pressure oil and gas separator market represents a critical component of the global energy infrastructure, with sustained demand expected across multiple market segments and geographic regions.

What is High Pressure Oil and Gas Separator?

High Pressure Oil and Gas Separator is a device used in the oil and gas industry to separate oil, gas, and water from the production stream under high pressure conditions. This equipment is essential for ensuring the efficient processing and transportation of hydrocarbons.

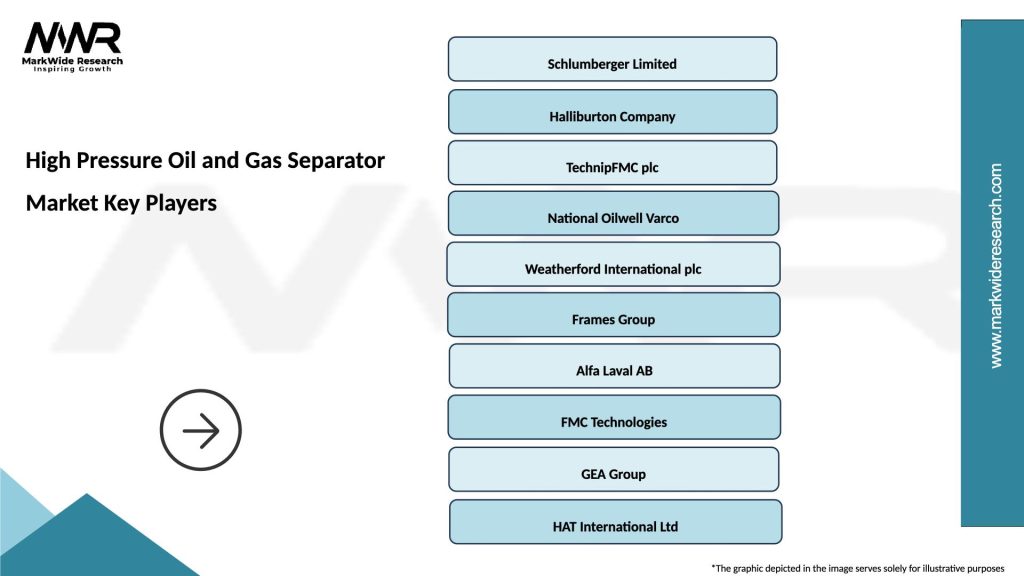

What are the key players in the High Pressure Oil and Gas Separator Market?

Key players in the High Pressure Oil and Gas Separator Market include Schlumberger, Halliburton, and Baker Hughes, among others. These companies are known for their innovative technologies and extensive product offerings in the separation equipment sector.

What are the growth factors driving the High Pressure Oil and Gas Separator Market?

The growth of the High Pressure Oil and Gas Separator Market is driven by increasing demand for efficient oil and gas extraction, advancements in separation technology, and the rising need for enhanced recovery techniques in mature fields.

What challenges does the High Pressure Oil and Gas Separator Market face?

The High Pressure Oil and Gas Separator Market faces challenges such as high operational costs, the complexity of equipment maintenance, and regulatory compliance issues that can hinder market growth.

What opportunities exist in the High Pressure Oil and Gas Separator Market?

Opportunities in the High Pressure Oil and Gas Separator Market include the development of more efficient and environmentally friendly separation technologies, as well as the expansion of oil and gas exploration activities in untapped regions.

What trends are shaping the High Pressure Oil and Gas Separator Market?

Trends shaping the High Pressure Oil and Gas Separator Market include the integration of automation and digital technologies, the focus on sustainability and reducing emissions, and the increasing adoption of modular separator systems for flexibility in operations.

High Pressure Oil and Gas Separator Market

| Segmentation Details | Description |

|---|---|

| Type | Vertical Separator, Horizontal Separator, Spherical Separator, Others |

| Technology | Gravity Separation, Cyclonic Separation, Membrane Separation, Thermal Separation |

| End User | Oil Exploration, Gas Processing, Petrochemical Industry, Offshore Platforms |

| Application | Crude Oil Treatment, Natural Gas Processing, Water Removal, Gas Compression |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the High Pressure Oil and Gas Separator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at