444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The hematocrit tests market refers to the global industry that focuses on the measurement of hematocrit levels in blood samples. Hematocrit tests are commonly used in clinical settings to assess red blood cell (RBC) levels and determine the overall health of an individual. This market analysis aims to provide insights into the current state and future prospects of the hematocrit tests market.

Hematocrit tests, also known as packed cell volume (PCV) tests, measure the percentage of RBCs in the total volume of blood. These tests are essential in diagnosing conditions such as anemia, polycythemia, and dehydration, as well as monitoring the effects of certain medications or treatments. Hematocrit levels are expressed as a percentage and are a crucial component of complete blood count (CBC) tests.

Executive Summary:

The hematocrit tests market has witnessed significant growth in recent years, driven by factors such as the increasing prevalence of blood-related disorders, the rising demand for point-of-care testing, and advancements in technology. This analysis aims to provide a comprehensive overview of the market, including key insights, market drivers, restraints, opportunities, and future outlook.

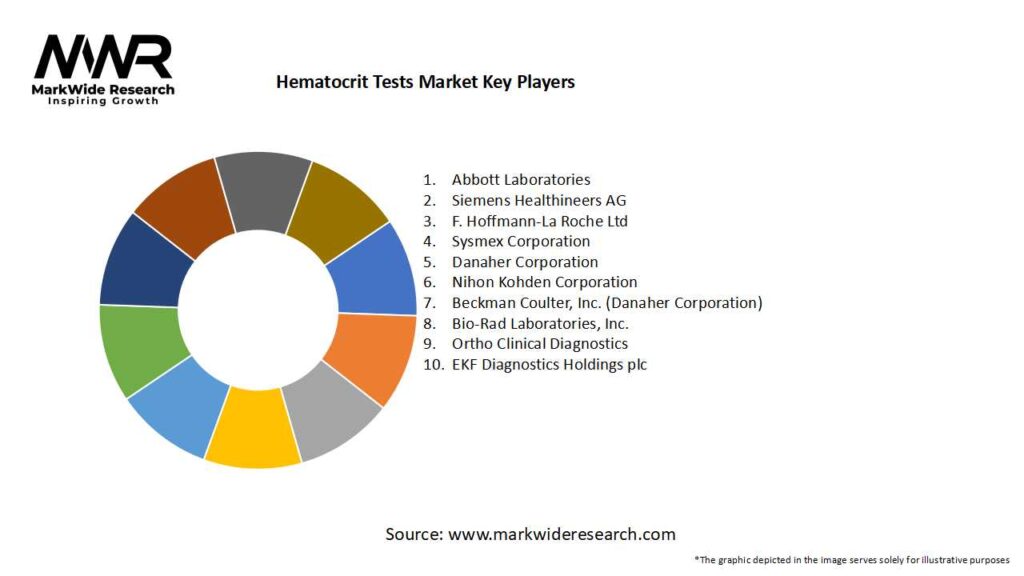

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Shift to POC Testing: Portable analyzers employing microfluidic cartridges enable hematocrit measurement in under five minutes, facilitating rapid clinical decisions in emergency and outpatient contexts.

Integrated Panels: Automated hematology analyzers now routinely report HCT alongside hemoglobin, RBC count, MCV, and other indices, increasing test volume and lab throughput.

Home Testing Kits: Capillary-based microcentrifuge devices and smartphone-linked readers are emerging for self-monitoring by patients with chronic kidney disease or chemotherapy-induced anemia.

Regulatory Momentum: FDA clearance and CE-marking of novel microfluidic hematocrit devices expand market access, while CLIA waiver designation in the U.S. enables broader POC use.

Emerging Economies: Government health screening programs in China, India, and parts of Africa are integrating HCT testing to combat malnutrition and infectious disease-related anemia.

Market Drivers

Rising Anemia Prevalence: WHO estimates over 1.6 billion people suffer from anemia globally, creating sustained demand for HCT testing in screening and disease management.

Chronic Disease Management: Hematocrit monitoring is essential in dialysis, chemotherapy, and critical care to guide transfusion and fluid therapy decisions.

POC Adoption: Clinicians increasingly rely on rapid POC hematology results to reduce hospital length of stay and improve workflow efficiency.

Home Healthcare Trends: Aging populations and telehealth initiatives drive remote monitoring solutions, including self-administered HCT tests.

Technological Innovation: Advances in lab-on-a-chip, optical sensors, and AI-driven analytics enhance accuracy, reduce sample volume, and lower per-test costs.

Market Restraints

Accuracy Concerns: POC and home-use devices can exhibit variability compared to laboratory standards, leading to clinician hesitancy without robust validation.

Reimbursement Challenges: Coverage limitations for decentralized and at-home HCT testing kits in some markets may slow adoption despite clinical need.

Supply Chain Disruptions: Dependence on specialized reagents and microfluidic consumables can expose providers to inventory shortages.

Regulatory Hurdles: Gaining CLIA waiver or equivalent certifications for new POC technologies requires extensive clinical data and can delay time to market.

Technical Training Needs: Ensuring correct sample collection and device operation in decentralized settings demands ongoing user training and support.

Market Opportunities

AI-Enhanced Analysis: Incorporating machine-learning algorithms to auto-flag abnormal HCT trends and integrate with electronic health records (EHRs) for proactive care.

Multi-Parameter Cartridges: Developing single-use cartridges that measure HCT, hemoglobin, WBC count, and other key indices to broaden POC value.

Emerging Market Expansion: Tailoring low-cost, ruggedized POC devices for deployment in rural clinics and mobile health units in developing countries.

Digital Health Integration: Linking at-home HCT readers to telemedicine platforms to support remote anemia management and therapy optimization.

Subscription Models: Offering reagent and cartridge subscriptions to ensure consistent supply and predictable revenue streams for device manufacturers.

Market Dynamics

Consolidation of IVD Vendors: Mergers and acquisitions are streamlining portfolios, combining hematology specialties with broader POC capabilities.

Collaborative Clinical Trials: Partnerships between device makers and academic centers to generate real-world evidence supporting POC HCT accuracy and outcomes impact.

Value-Based Care: Payers incentivizing early detection and management of anemia through bundled reimbursement models, driving POC testing uptake.

Open API Platforms: Adoption of interoperable software frameworks enables HCT devices to seamlessly share data with EHRs and laboratory information systems (LIS).

Sustainability Initiatives: Development of recyclable or biodegradable microfluidic cartridges addresses environmental concerns over single-use plastics.

Regional Analysis

North America: Largest market share, driven by comprehensive insurance coverage for both lab and POC HCT testing, strong home healthcare sector, and FDA-cleared devices.

Europe: High adoption of multi-parameter hematology panels in hospitals; growing CLIA-equivalent POC device approvals and telehealth integration.

Asia Pacific: Highest growth rate, propelled by government anemia eradication programs, expanding primary care infrastructure, and domestic device manufacturers.

Latin America: Moderate growth; increasing laboratory automation in private hospitals and pilot deployment of POC devices in public health clinics.

Middle East & Africa: Nascent POC adoption due to limited infrastructure; donor-funded programs introduce portable HCT devices for malaria and HIV-associated anemia screening.

Competitive Landscape:

Leading Companies in the Hematocrit Tests Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

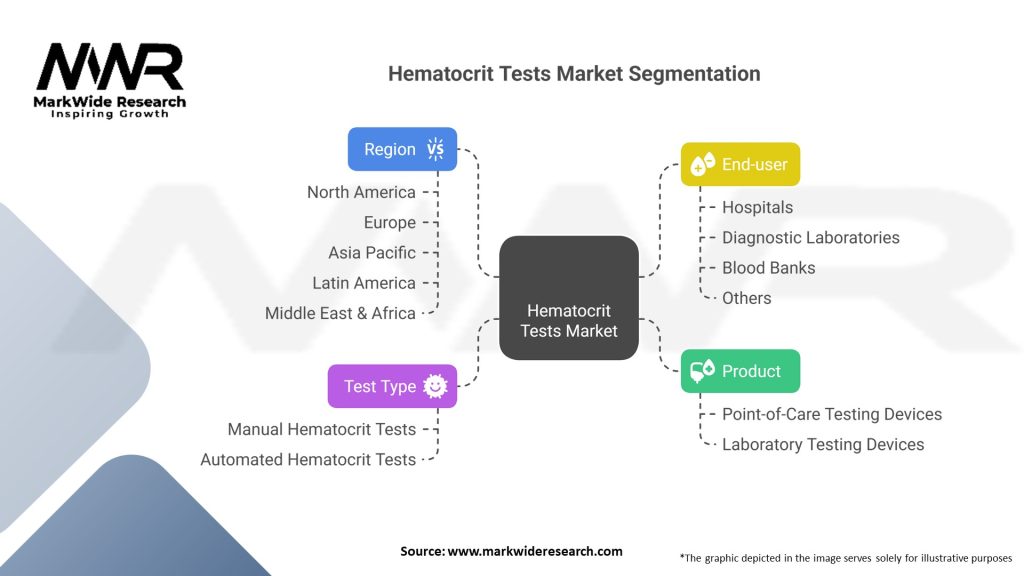

Segmentation:

By Product Type: Automated Laboratory Analyzers, Point-of-Care Devices, At-Home Test Kits, Consumables & Reagents

By Technology: Centrifugal Capillary, Electrical Impedance, Optical/Photometric Detection, Microfluidic Lab-on-Chip

By End User: Hospitals & Clinics, Diagnostic Laboratories, Home Healthcare, Blood Banks & Donor Centers, Research Institutions

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has had a mixed impact on the hematocrit tests market. On one hand, the demand for hematocrit testing increased during the pandemic due to the need for monitoring patients’ health status. On the other hand, disruptions in the healthcare system and supply chains posed challenges for market growth. However, as the situation stabilizes, the market is expected to recover and witness steady growth.

Key Industry Developments:

New Device Launches: Several IVD companies introduced ultra-compact hematocrit-only analyzers with smartphone interfaces and minimal maintenance requirements.

Regulatory Clearances: Expansion of CLIA waiver status for additional POC HCT devices in the U.S. and analogous approvals in Europe and Asia.

Strategic Collaborations: Partnerships between device makers and telehealth platforms to integrate HCT monitoring into chronic care management solutions.

Capacity Expansion: Additional manufacturing lines for microfluidic cartridges to meet surging demand for decentralized testing.

Analyst Suggestions:

Future Outlook:

The hematocrit tests market is expected to grow steadily in the coming years, driven by factors such as the increasing prevalence of blood-related disorders, technological advancements, and the rising demand for point-of-care testing. However, challenges such as high costs and regulatory requirements need to be addressed to ensure sustained market growth.

Conclusion:

The hematocrit tests market plays a crucial role in diagnosing and monitoring blood-related disorders. With advancements in technology and increasing adoption of point-of-care testing, the market is poised for growth. Stakeholders and industry participants can leverage opportunities in emerging markets and focus on innovation to drive market expansion. However, addressing challenges such as cost constraints and regulatory compliance will be essential for long-term success in the hematocrit tests market.

What are hematocrit tests?

Hematocrit tests measure the proportion of blood volume that is occupied by red blood cells. This test is crucial for diagnosing conditions such as anemia, dehydration, and polycythemia.

Who are the key players in the hematocrit tests market?

Key players in the hematocrit tests market include Abbott Laboratories, Siemens Healthineers, and Roche Diagnostics, among others.

What are the main drivers of growth in the hematocrit tests market?

The growth of the hematocrit tests market is driven by the increasing prevalence of blood disorders, advancements in diagnostic technologies, and the rising demand for routine health check-ups.

What challenges does the hematocrit tests market face?

Challenges in the hematocrit tests market include the high cost of advanced testing equipment and the need for skilled professionals to interpret results accurately.

What opportunities exist in the hematocrit tests market?

Opportunities in the hematocrit tests market include the development of point-of-care testing devices and the expansion of telemedicine services that facilitate remote patient monitoring.

What trends are shaping the hematocrit tests market?

Trends in the hematocrit tests market include the integration of artificial intelligence in diagnostic processes and the growing emphasis on personalized medicine to tailor treatments based on individual hematocrit levels.

Hematocrit Tests Market:

| Segmentation Details | Description |

|---|---|

| Product | Point-of-Care Testing (POCT) Devices, Laboratory Testing Devices |

| Test Type | Manual Hematocrit Tests, Automated Hematocrit Tests |

| End-user | Hospitals, Diagnostic Laboratories, Blood Banks, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Hematocrit Tests Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at