444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The helicopter simulator market has been experiencing significant growth in recent years. A helicopter simulator is a virtual training device that replicates the experience of flying a helicopter in a simulated environment. It provides a safe and cost-effective way for pilots to acquire and enhance their skills without the risks associated with real flight. The global helicopter simulator market is driven by the increasing demand for trained pilots, the need for cost-effective training solutions, and the rising emphasis on safety in the aviation industry.

A helicopter simulator is a sophisticated training tool that recreates the flight experience of a helicopter in a controlled environment. It replicates various flight conditions, scenarios, and emergency situations to train pilots and improve their flying skills. Helicopter simulators utilize advanced technologies, including high-fidelity visual systems, realistic motion platforms, and accurate flight controls, to create a realistic training environment. These simulators offer a safe and efficient way to train pilots, enabling them to practice maneuvers, emergency procedures, and navigation techniques.

Executive Summary:

The helicopter simulator market is witnessing robust growth due to the increasing demand for trained helicopter pilots worldwide. The rising emphasis on safety and the need to reduce training costs are driving the adoption of helicopter simulators in aviation training centers. The market is characterized by the presence of key players offering a wide range of simulator solutions to meet the specific requirements of helicopter operators. With advancements in technology, helicopter simulators are becoming more realistic and effective in providing immersive training experiences.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regulatory Mandates: ICAO’s requirement for reduced in-aircraft hours is driving 20% annual growth in simulator utilization for initial and recurrent training.

Fleet Expansion: Over 5,000 new civilian rotorcraft deliveries are projected from 2025–2030, necessitating proportional simulator procurement.

Cost Savings: Operators can reduce training costs by up to 70% per hour compared to in-flight training, accounting for fuel, maintenance, and insurance savings.

Technology Integration: AI-driven adaptive training allows real-time assessment of pilot performance, tailoring scenario complexity to individual skill levels.

Geographic Uptake: Asia Pacific and Middle East markets are emerging rapidly due to new offshore exploration projects and growing EMS services.

Market Drivers

Safety and Compliance: Regulators require scenario-based training for emergency procedures—only achievable in simulators—boosting demand for Level C/D devices.

Cost Efficiency: Helicopter operations carry high direct operating costs; simulators offer a cost-effective alternative for proficiency and type ratings.

Pilot Shortages: Airlines and charter services face pilot recruitment challenges; simulator-based training accelerates qualification pipelines.

Fleet Modernization: Introduction of advanced rotorcraft platforms (e.g., tiltrotors, heavy-lift helicopters) necessitates model-specific simulator programs.

Technological Advances: Improvements in motion-cueing algorithms, networked multi-crew training, and VR/AR integration enhance realism and training outcomes.

Market Restraints

High Capital Expenditure: Full-flight Level D simulators can cost upwards of $10 million, limiting uptake among smaller operators.

Infrastructure Requirements: Simulators demand dedicated facilities with reinforced flooring, power management, and climate control, adding to setup costs.

Certification Complexity: Achieving regulatory certification (FAA, EASA, military authorities) for new simulator models can take 12–18 months.

Technology Obsolescence: Rapid avionics and software updates in rotorcraft platforms may render simulators outdated without costly retrofits.

Limited Visibility: Fragmented market information on emerging operators and training centers can slow entry into underserved regions.

Market Opportunities

Fixed-Base Trainer Growth: FTDs (Levels 1–3) offer lower-cost entry points, attracting flight schools and regional operators seeking basic instrument and procedures training.

Mobile and Containerized Solutions: Portable simulators allow remote deployment to offshore rigs or military forward operating bases, expanding geographic reach.

Subscription-Based Models: Training-as-a-Service offerings—bundling simulator access, scenario libraries, and support—can reduce capital barriers.

VR/AR Adjuncts: Immersive head-mounted displays for procedural and cockpit familiarization are emerging as cost-effective supplemental trainers.

Multi-Crew Coordination: Networked simulators enable multi-crew training for search & rescue and marine rescue operations, improving mission readiness.

Market Dynamics

Civil vs. Military Split: Civil operators emphasize cost and regulatory compliance, while military customers prioritize mission-specific threat environments and classified scenario modules.

Vendor Partnerships: Collaboration between OEMs (e.g., Airbus, Bell, Leonardo) and simulator manufacturers ensures timely platform updates and data-link integration.

Aftermarket Services: Maintenance, software updates, and instructor training services create recurring revenue streams beyond initial sales.

Consolidation Trends: Acquisitions among specialized simulation providers are creating end-to-end training solution portfolios.

Digital Content Libraries: Cloud-hosted scenario repositories allow rapid deployment of new environmental and mission profiles across global simulator networks.

Regional Analysis

North America: Largest market share, driven by extensive EMS networks, offshore operations in the Gulf of Mexico, and U.S. military training pipelines.

Europe: Strong demand from oil & gas sectors in the North Sea, combined with rigorous EASA training mandates, sustains robust simulator growth.

Asia Pacific: Rapid expansion led by new helicopter orders in China, India, and Australia for tourism, EMS, and offshore exploration.

Middle East & Africa: Investments in search & rescue, VIP transport, and military modernization are driving simulator procurement in GCC and South Africa.

Latin America: Emerging demand fueled by mining support operations and expanding regional EMS services in Brazil and Chile.

Competitive Landscape:

Leading Companies in the Helicopter Simulator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

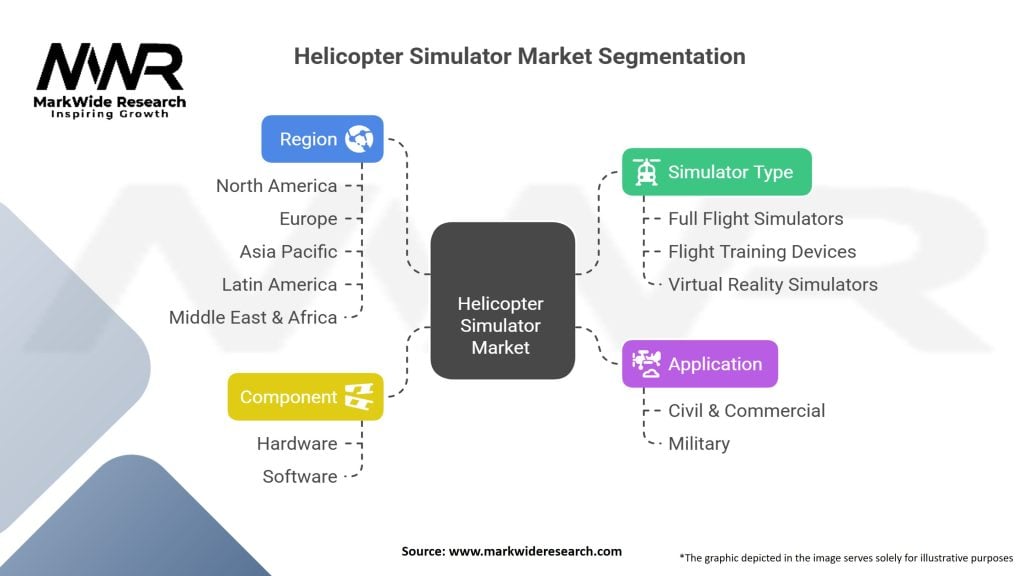

Segmentation:

The helicopter simulator market can be segmented based on simulator type, helicopter type, and end-user. By simulator type, the market can be divided into full flight simulators, flight training devices, and virtual reality simulators. Based on helicopter type, the market can be categorized into civil helicopters and military helicopters. The end-users of helicopter simulators include training centers, aviation academies, and military organizations.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has had a significant impact on the helicopter simulator market. The restrictions on travel and training activities resulted in a temporary slowdown in simulator installations and pilot training programs. However, the pandemic also highlighted the importance of simulation-based training, as it offered a safe and effective alternative to traditional training methods. As the aviation industry recovers from the pandemic, the demand for helicopter simulators is expected to rebound, driven by the need to address the growing pilot shortage and ensure safe and efficient training practices.

Key Industry Developments:

CAE and Airbus Collaboration: Launched a Type-Rated Airbus H145 simulator network in 2023, featuring VR adjuncts for mission-specific scenarios.

FlightSafety’s Tiltrotor Simulator: Debuted a Bell-Boeing V-22 Osprey full-flight simulator for U.S. Marine Corps recurrent training.

L3Harris’s Mobile FTD: Delivered portable AW139 procedural trainers to offshore operators in the North Sea, reducing crew travel.

TRU’s Subscription Platform: Rolled out “SimCloud”—an online repository of updated scenarios and maintenance procedures accessible via monthly subscription.

Analyst Suggestions:

Future Outlook:

The helicopter simulator market is expected to witness steady growth in the coming years. The demand for trained helicopter pilots, coupled with the need for cost-effective and safe training solutions, will continue to drive market expansion. Technological advancements, such as VR and AR integration, will further enhance the realism and effectiveness of helicopter simulators. The market is also likely to witness increased adoption of mission-specific simulators and collaborations between simulator manufacturers and helicopter operators. As the aviation industry continues to evolve, the helicopter simulator market will play a crucial role in ensuring the safety and proficiency of helicopter pilots.

Conclusion:

The helicopter simulator market is experiencing substantial growth, driven by the increasing demand for trained pilots, the need for cost-effective training solutions, and the focus on safety in the aviation industry. Helicopter simulators offer a realistic and immersive training experience, enabling pilots to practice maneuvers, emergency procedures, and navigation techniques in a controlled environment.

With advancements in technology and the integration of VR and AR, helicopter simulators are becoming more effective and tailored to specific training requirements. As the market continues to evolve, collaboration between simulator manufacturers and helicopter operators, along with a focus on innovation and market awareness, will be key to driving further growth in the helicopter simulator industry.

Helicopter Simulator Market:

| Segmentation Details | Description |

|---|---|

| Simulator Type | Full Flight Simulators, Flight Training Devices, Virtual Reality Simulators |

| Application | Civil & Commercial, Military |

| Component | Hardware, Software |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Helicopter Simulator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at