444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The heavy equipment monitoring devices market is an integral part of the construction, mining, and transportation industries, offering advanced technologies to track and manage heavy machinery’s performance, usage, and maintenance. These devices provide real-time data on equipment health, location, fuel consumption, and operator behavior, enabling fleet managers to optimize productivity, minimize downtime, and enhance operational efficiency.

Meaning

Heavy equipment monitoring devices encompass a range of sensors, telematics systems, and software solutions designed to monitor, track, and analyze the performance and usage of heavy machinery, including excavators, bulldozers, loaders, cranes, and dump trucks. These devices collect data on equipment operation, fuel consumption, engine health, and maintenance needs, facilitating proactive maintenance, asset management, and fleet optimization for construction, mining, and logistics companies.

Executive Summary

The heavy equipment monitoring devices market has witnessed significant growth driven by the increasing adoption of telematics, IoT, and AI technologies in the construction and mining industries. These devices offer comprehensive monitoring, diagnostics, and analytics capabilities, empowering fleet managers to improve equipment utilization, reduce operating costs, and maximize ROI. However, challenges such as data security, interoperability, and integration complexity require strategic partnerships and innovative solutions to address customer needs and market demands effectively.

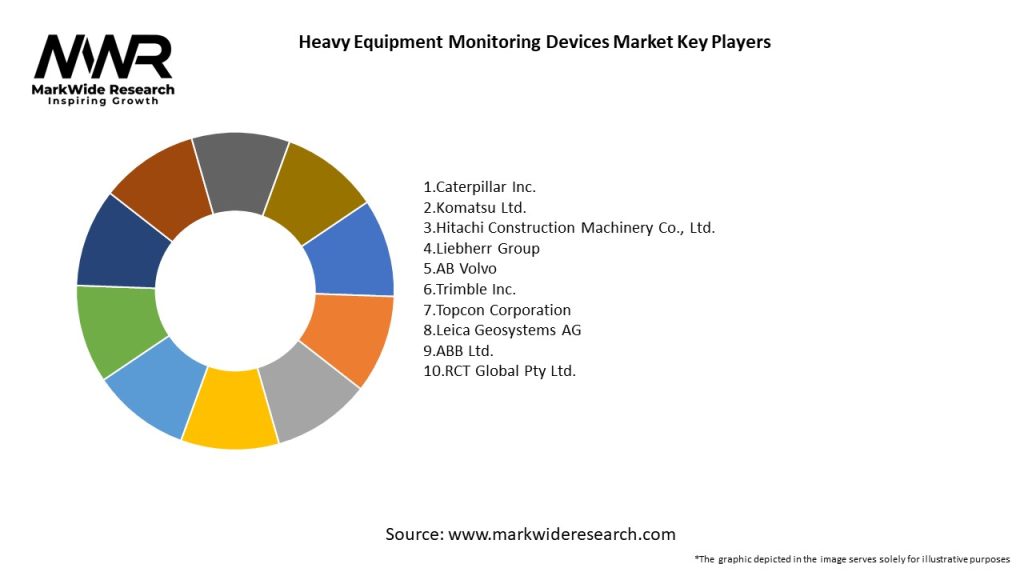

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The heavy equipment monitoring devices market operates within a dynamic landscape influenced by factors such as technological advancements, regulatory changes, industry trends, and economic conditions, shaping market dynamics and driving growth opportunities, challenges, and competitive pressures for industry participants and stakeholders.

Regional Analysis

The heavy equipment monitoring devices market exhibits regional variations in demand, adoption, and market dynamics influenced by factors such as construction and mining activity levels, infrastructure development projects, regulatory environments, and economic conditions. Key regional markets include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, each offering unique opportunities and challenges for market players.

Competitive Landscape

Leading Companies in the Heavy Equipment Monitoring Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The heavy equipment monitoring devices market can be segmented based on various factors such as:

Segmentation provides a more detailed understanding of market dynamics, customer needs, and competitive landscapes, enabling vendors to tailor their products, services, and marketing strategies to specific market segments and target audiences effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides insights into the heavy equipment monitoring devices market’s strengths, weaknesses, opportunities, and threats, guiding strategic planning, decision-making, and market positioning for industry participants and stakeholders.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the heavy equipment monitoring devices market, leading to disruptions in supply chains, changes in demand patterns, and shifts in industry dynamics. Key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the heavy equipment monitoring devices market is positive, driven by increasing construction, mining, and infrastructure development activities, coupled with advancements in sensor technology, telematics systems, and predictive analytics capabilities. However, challenges such as data security, interoperability, and integration complexity require strategic investments and collaborative efforts to overcome, ensuring sustainable growth and market leadership in a rapidly evolving landscape.

Conclusion

In conclusion, the heavy equipment monitoring devices market plays a critical role in optimizing equipment performance, reducing downtime, and enhancing operational efficiency for construction, mining, and transportation fleets. Despite challenges such as data security concerns, interoperability issues, and economic uncertainties, strategic investments in innovation, service excellence, and digital transformation will enable industry participants to capitalize on emerging opportunities, drive sustainable growth, and navigate uncertainties in the dynamic heavy equipment monitoring devices market landscape. By embracing innovation, collaboration, and customer-centricity, heavy equipment monitoring device manufacturers, suppliers, and service providers can position themselves for success and contribute to the advancement of key industries and global economic growth.

What is Heavy Equipment Monitoring Devices?

Heavy Equipment Monitoring Devices are tools and technologies used to track and manage the performance, location, and condition of heavy machinery. These devices help in optimizing operations, reducing downtime, and enhancing safety in industries such as construction, mining, and logistics.

What are the key players in the Heavy Equipment Monitoring Devices Market?

Key players in the Heavy Equipment Monitoring Devices Market include Caterpillar, John Deere, and Komatsu, which offer advanced monitoring solutions for heavy machinery. These companies focus on integrating IoT technology and data analytics to improve equipment efficiency and maintenance, among others.

What are the growth factors driving the Heavy Equipment Monitoring Devices Market?

The Heavy Equipment Monitoring Devices Market is driven by the increasing demand for operational efficiency and safety in construction and mining sectors. Additionally, the rise of IoT technology and the need for predictive maintenance are significant factors contributing to market growth.

What challenges does the Heavy Equipment Monitoring Devices Market face?

Challenges in the Heavy Equipment Monitoring Devices Market include high initial investment costs and the complexity of integrating new technologies with existing equipment. Additionally, data security concerns and the need for skilled personnel to manage these systems pose significant hurdles.

What opportunities exist in the Heavy Equipment Monitoring Devices Market?

The Heavy Equipment Monitoring Devices Market presents opportunities in the development of advanced analytics and AI-driven solutions. As industries increasingly adopt automation and smart technologies, there is potential for growth in sectors like construction, agriculture, and logistics.

What trends are shaping the Heavy Equipment Monitoring Devices Market?

Trends in the Heavy Equipment Monitoring Devices Market include the growing adoption of cloud-based monitoring solutions and the integration of machine learning for predictive maintenance. Additionally, there is an increasing focus on sustainability and reducing the environmental impact of heavy machinery operations.

Heavy Equipment Monitoring Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Telematics Systems, Condition Monitoring Sensors, Fleet Management Software, Asset Tracking Devices |

| Technology | GPS Tracking, IoT Connectivity, Data Analytics, Cloud Computing |

| End User | Construction Companies, Mining Operations, Agriculture Sector, Logistics Providers |

| Application | Equipment Maintenance, Performance Monitoring, Fuel Management, Safety Compliance |

Leading Companies in the Heavy Equipment Monitoring Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at