444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The heavy-duty construction equipment market encompasses a wide array of machinery utilized in construction projects, infrastructure development, and mining activities. These equipment, including excavators, bulldozers, cranes, and loaders, play a pivotal role in enhancing efficiency and productivity across various construction sectors. As indispensable assets for construction endeavors, heavy-duty equipment continues to witness substantial demand globally.

Meaning

Heavy-duty construction equipment refers to machinery designed and engineered to perform strenuous tasks in construction, mining, and other industrial applications. These robust machines are characterized by their ability to withstand heavy loads, harsh environments, and prolonged usage. From earthmoving and material handling to excavation and demolition, heavy-duty construction equipment serves as the backbone of modern construction projects.

Executive Summary

The heavy-duty construction equipment market has experienced steady growth fueled by urbanization, infrastructural development, and increasing investments in construction activities worldwide. This market offers lucrative opportunities for manufacturers, suppliers, and service providers, albeit accompanied by competitive pressures and regulatory challenges. Understanding the key market dynamics, trends, and customer requirements is essential for stakeholders to capitalize on emerging opportunities and sustain growth.

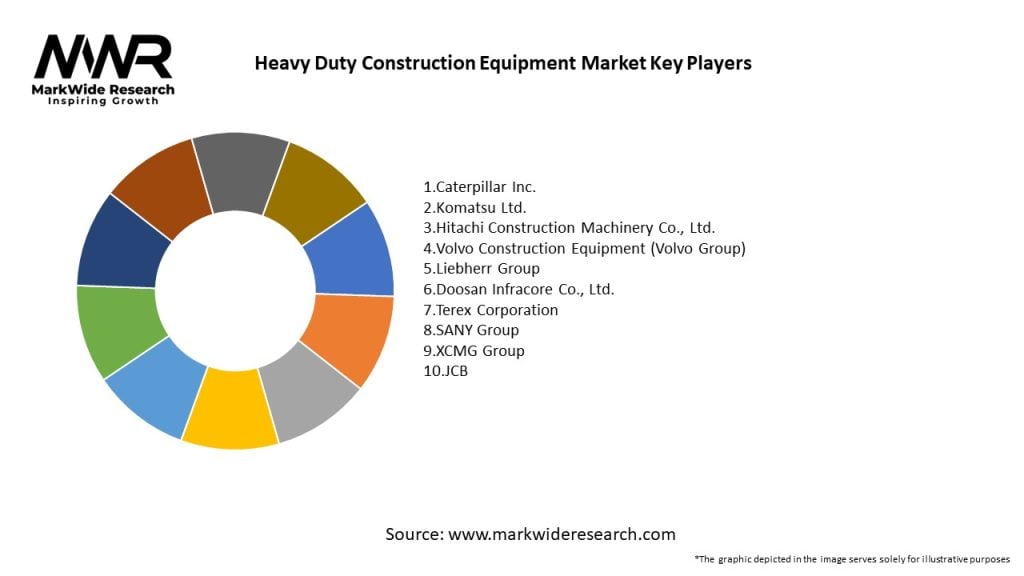

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The heavy-duty construction equipment market operates in a dynamic environment characterized by evolving customer preferences, technological innovations, regulatory changes, and competitive pressures. Market participants must adapt to changing market dynamics, anticipate customer needs, and differentiate their offerings to maintain relevance and competitiveness.

Regional Analysis

Regional variations in the heavy-duty construction equipment market stem from differences in economic conditions, infrastructure development, regulatory environments, and customer preferences. Notable regions include:

Competitive Landscape

Leading Companies in the Heavy Duty Construction Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

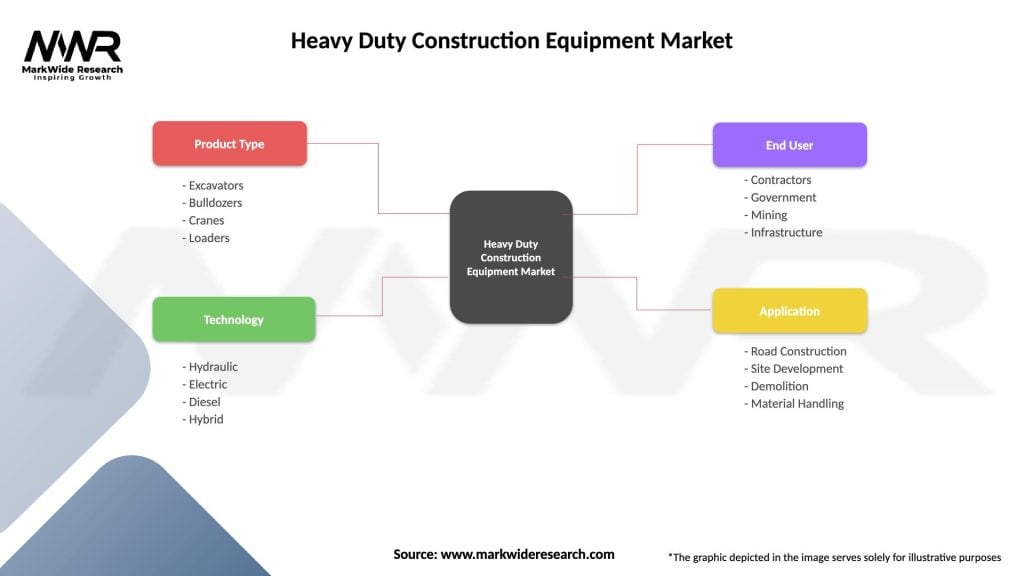

Segmentation

The heavy-duty construction equipment market can be segmented based on equipment type, application, end-user industry, and geography, allowing for targeted marketing strategies and product offerings tailored to specific customer segments and market preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis offers insights into the strengths, weaknesses, opportunities, and threats facing the heavy-duty construction equipment market:

Understanding these factors enables businesses to capitalize on strengths, address weaknesses, leverage opportunities, and mitigate threats, fostering sustainable growth within the heavy-duty construction equipment market.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had profound effects on the heavy-duty construction equipment market, disrupting supply chains, delaying projects, and impacting equipment sales and rentals:

Key Industry Developments

Analyst Suggestions

Future Outlook

The heavy-duty construction equipment market is poised for resilient growth in the post-pandemic era, driven by infrastructure investments, urbanization trends, and technological advancements. However, challenges such as regulatory compliance, economic uncertainties, and disruptive technologies require strategic adaptation and proactive measures to ensure sustained competitiveness and market leadership.

Conclusion

The heavy-duty construction equipment market remains a cornerstone of global infrastructure development and economic growth, providing essential machinery and solutions for construction, mining, and industrial applications. Despite challenges posed by the COVID-19 pandemic and evolving market dynamics, the industry is poised for growth fueled by technological innovations, sustainability initiatives, and infrastructure investments. By embracing digitalization, sustainability, and strategic partnerships, industry participants can navigate uncertainties and capitalize on emerging opportunities, driving long-term success and value creation within the heavy-duty construction equipment market.

What is Heavy Duty Construction Equipment?

Heavy Duty Construction Equipment refers to robust machinery designed for construction tasks such as excavation, lifting, and material handling. This category includes bulldozers, excavators, cranes, and loaders, which are essential for large-scale construction projects.

What are the key players in the Heavy Duty Construction Equipment Market?

Key players in the Heavy Duty Construction Equipment Market include Caterpillar, Komatsu, and Volvo Construction Equipment, among others. These companies are known for their innovative machinery and extensive product lines catering to various construction needs.

What are the main drivers of the Heavy Duty Construction Equipment Market?

The Heavy Duty Construction Equipment Market is driven by factors such as increasing urbanization, infrastructure development, and the growing demand for efficient construction processes. Additionally, advancements in technology are enhancing equipment capabilities and performance.

What challenges does the Heavy Duty Construction Equipment Market face?

Challenges in the Heavy Duty Construction Equipment Market include high operational costs, fluctuating raw material prices, and stringent regulations regarding emissions and safety. These factors can impact profitability and market growth.

What opportunities exist in the Heavy Duty Construction Equipment Market?

Opportunities in the Heavy Duty Construction Equipment Market include the adoption of electric and hybrid machinery, which aligns with sustainability goals. Furthermore, the expansion of smart construction technologies presents avenues for innovation and efficiency.

What trends are shaping the Heavy Duty Construction Equipment Market?

Trends in the Heavy Duty Construction Equipment Market include the integration of automation and telematics in machinery, enhancing operational efficiency and safety. Additionally, there is a growing focus on sustainability and eco-friendly equipment solutions.

Heavy Duty Construction Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Loaders |

| Technology | Hydraulic, Electric, Diesel, Hybrid |

| End User | Contractors, Government, Mining, Infrastructure |

| Application | Road Construction, Site Development, Demolition, Material Handling |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Heavy Duty Construction Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at