444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The head-up display (HUD) system market is witnessing significant growth driven by increasing demand for advanced driver assistance systems (ADAS), rising adoption of connected vehicles, and growing emphasis on road safety. HUD systems project vital information onto the windshield, enabling drivers to access critical data without diverting their attention from the road. This market segment encompasses a range of HUD technologies catering to automotive, aviation, and military applications.

Meaning

Head-up display (HUD) systems refer to transparent displays that project essential information onto the windshield or a separate screen within the driver’s line of sight. These systems provide drivers with real-time data such as speed, navigation instructions, and vehicle diagnostics, enhancing situational awareness and reducing driver distraction. HUD technology finds applications in automotive, aviation, and military sectors, revolutionizing the way users interact with vehicle interfaces.

Executive Summary

The head-up display system market is experiencing rapid expansion fueled by technological advancements, increasing vehicle connectivity, and regulatory mandates promoting road safety. Industry players are focusing on developing innovative HUD solutions featuring augmented reality (AR) capabilities, advanced graphics, and seamless integration with vehicle infotainment systems. Despite challenges such as high manufacturing costs and consumer adoption barriers, the market presents lucrative opportunities for manufacturers and suppliers.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The head-up display system market operates within a dynamic landscape shaped by factors such as technological advancements, regulatory mandates, consumer preferences, and competitive pressures. These dynamics necessitate agility, innovation, and strategic partnerships from industry participants to capitalize on emerging opportunities, mitigate market risks, and maintain competitive advantage in a rapidly evolving automotive ecosystem.

Regional Analysis

Competitive Landscape

Leading Companies in the Head-Up Display System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

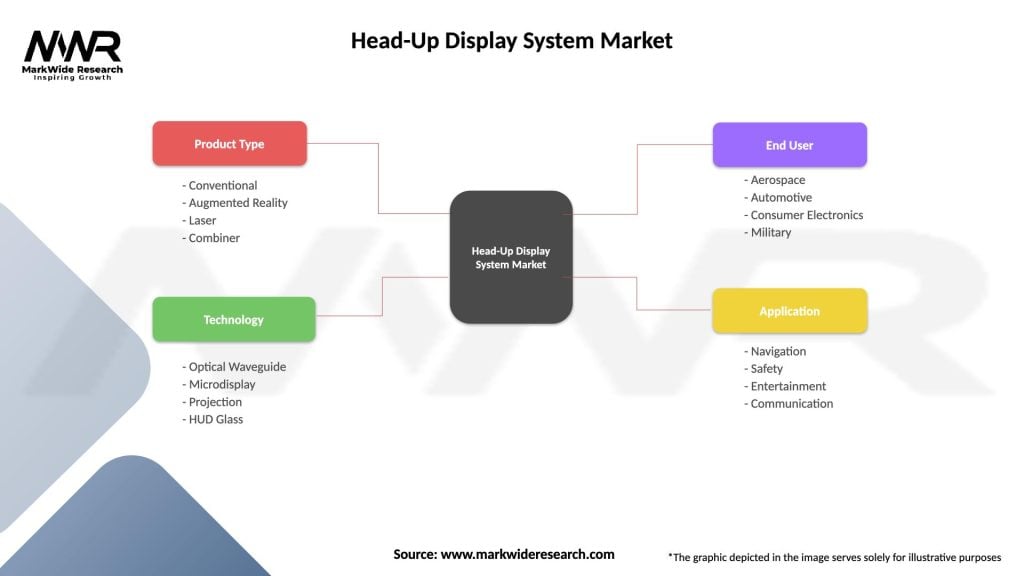

Segmentation

The head-up display system market can be segmented based on factors such as display technology, vehicle type, application, and end-user industry. This segmentation enables HUD manufacturers to tailor product offerings to specific market segments, customer preferences, and application requirements, fostering market differentiation and customer satisfaction.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the head-up display system market, with disruptions in supply chains and manufacturing operations offset by increased demand for connected vehicle features and augmented reality solutions. The pandemic underscored the importance of vehicle connectivity, driver safety, and remote access capabilities, driving market demand for HUD systems offering enhanced connectivity, navigation, and entertainment features.

Key Industry Developments

Analyst Suggestions

Future Outlook

The head-up display system market is poised for significant growth driven by increasing demand for connected vehicle features, rising emphasis on road safety, and technological advancements in display technology and augmented reality. Despite challenges such as high manufacturing costs and consumer adoption barriers, the market presents abundant opportunities for manufacturers and suppliers to capitalize on emerging trends, expand market reach, and drive industry innovation. By focusing on user-centric design, technological innovation, and strategic partnerships, industry participants can navigate market complexities and position themselves for sustained growth and success in a dynamic and rapidly evolving automotive ecosystem.

Conclusion

In conclusion, the head-up display system market represents a pivotal component of the modern automotive ecosystem, offering drivers enhanced safety, connectivity, and convenience. Despite challenges posed by high manufacturing costs, regulatory compliance, and consumer adoption barriers, the market presents abundant opportunities for manufacturers and suppliers to drive technological innovation, expand market reach, and capitalize on emerging trends. By focusing on user-centric design, strategic partnerships, and technological advancements, industry participants can navigate market complexities and position themselves for sustained growth and success in a rapidly evolving automotive landscape. Through innovation, collaboration, and customer-centric solutions, the head-up display system market will continue to thrive and redefine the future of connected vehicle experiences.

What is Head-Up Display System?

A Head-Up Display System is a technology that projects important information onto a transparent display in the driver’s line of sight, allowing them to access data such as speed, navigation, and alerts without taking their eyes off the road.

What are the key players in the Head-Up Display System Market?

Key players in the Head-Up Display System Market include companies like Continental AG, Denso Corporation, and Visteon Corporation, which are known for their innovative display technologies and automotive solutions, among others.

What are the growth factors driving the Head-Up Display System Market?

The growth of the Head-Up Display System Market is driven by increasing demand for advanced driver assistance systems, rising consumer preference for enhanced safety features, and the growing trend of vehicle automation.

What challenges does the Head-Up Display System Market face?

Challenges in the Head-Up Display System Market include high development costs, the complexity of integrating these systems into existing vehicle designs, and potential issues with user distraction.

What opportunities exist in the Head-Up Display System Market?

Opportunities in the Head-Up Display System Market include advancements in augmented reality technology, increasing adoption in electric and autonomous vehicles, and the potential for applications in aviation and other industries.

What trends are shaping the Head-Up Display System Market?

Trends in the Head-Up Display System Market include the integration of augmented reality features, the development of larger and more customizable displays, and the focus on improving user interface design for better driver engagement.

Head-Up Display System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Conventional, Augmented Reality, Laser, Combiner |

| Technology | Optical Waveguide, Microdisplay, Projection, HUD Glass |

| End User | Aerospace, Automotive, Consumer Electronics, Military |

| Application | Navigation, Safety, Entertainment, Communication |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Head-Up Display System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at