444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Hard Empty Non-gelatin Capsule market is experiencing significant growth globally, driven by the increasing demand for vegetarian and vegan-friendly capsule alternatives, growing concerns about animal-derived products, and the expanding pharmaceutical and nutraceutical industries. Hard empty non-gelatin capsules, also known as plant-based or vegetarian capsules, are made from cellulose or other plant-derived materials, offering a viable alternative to traditional gelatin capsules. These capsules are widely used for encapsulating powders, granules, and semi-solids in pharmaceutical, nutraceutical, and dietary supplement formulations, catering to the diverse needs and preferences of consumers.

Meaning

Hard empty non-gelatin capsules are pharmaceutical-grade capsules made from plant-based materials such as cellulose, starch, or pullulan. Unlike traditional gelatin capsules, which are derived from animal collagen, non-gelatin capsules are suitable for vegetarian, vegan, and halal consumers, as well as individuals with religious or cultural dietary restrictions. These capsules are biodegradable, hypoallergenic, and free from additives and preservatives, making them a preferred choice for encapsulating sensitive ingredients and active compounds in pharmaceutical and nutraceutical formulations.

Executive Summary

The global hard empty non-gelatin capsule market is witnessing robust growth, driven by factors such as increasing consumer awareness about plant-based alternatives, rising demand for clean label products, and growing adoption of vegetarian and vegan lifestyles. Pharmaceutical companies, contract manufacturers, and dietary supplement manufacturers are increasingly transitioning from gelatin capsules to non-gelatin alternatives to meet the evolving needs and preferences of consumers. However, challenges such as higher production costs, limited availability of raw materials, and regulatory complexities pose barriers to market expansion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global hard empty non-gelatin capsule market is characterized by intense competition, rapid innovation, and evolving consumer preferences. Key market players are investing in research and development activities to enhance product performance, quality, and sustainability. Additionally, strategic partnerships, mergers, and acquisitions are common strategies employed by companies to expand their market presence and gain a competitive edge. Regulatory compliance, quality assurance, and supply chain management are critical factors influencing market dynamics and shaping industry trends.

Regional Analysis

North America leads the global hard empty non-gelatin capsule market, driven by factors such as increasing consumer demand for plant-based and clean label products, favorable regulatory environment, and strong presence of pharmaceutical and dietary supplement industries. The United States accounts for the largest share of revenue in the region, followed by Canada. Europe is the second-largest market for non-gelatin capsules, with countries such as Germany, the United Kingdom, and France leading the adoption curve. The Asia Pacific region is expected to witness significant growth during the forecast period, fueled by rising disposable incomes, changing dietary preferences, and expanding healthcare infrastructure in countries such as China, India, and Japan.

Competitive Landscape

Leading Companies in the Hard Empty Non-gelatin Capsule Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

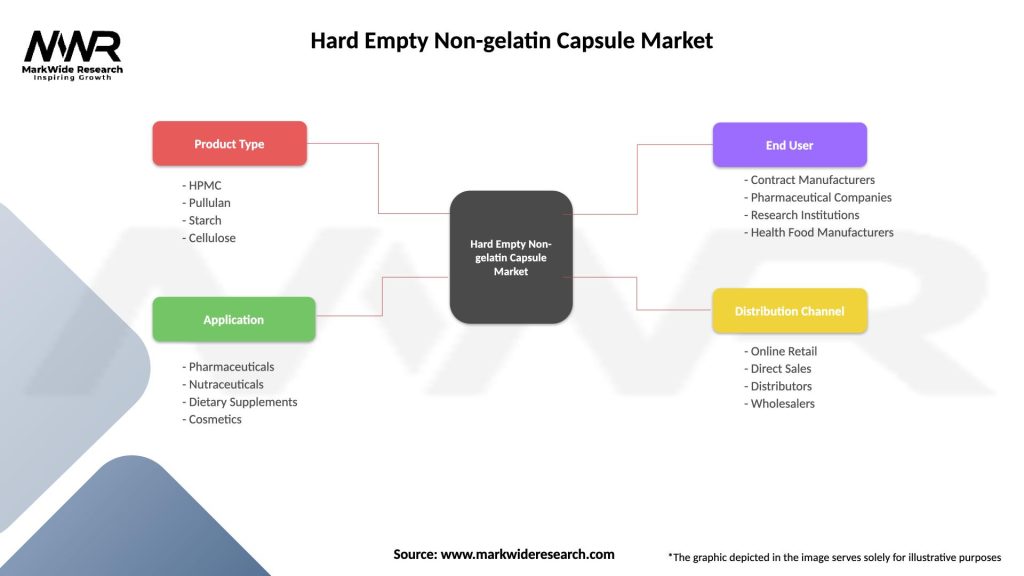

Segmentation

The global hard empty non-gelatin capsule market can be segmented based on material type, end-use industry, and region. By material type, the market is categorized into cellulose-based capsules, starch-based capsules, pullulan-based capsules, and others. By end-use industry, the market is segmented into pharmaceuticals, nutraceuticals, dietary supplements, and others. Geographically, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has underscored the importance of plant-based and clean label products, including hard empty non-gelatin capsules, in pharmaceutical and nutraceutical industries. As consumers become more health-conscious and prioritize immunity-boosting supplements and natural remedies, the demand for vegetarian and vegan-friendly capsules is expected to rise. Additionally, disruptions in global supply chains and manufacturing operations have highlighted the need for resilient and sustainable packaging solutions. While the pandemic has posed challenges such as supply chain disruptions and market uncertainties, it has also presented opportunities for innovation and collaboration in the hard empty non-gelatin capsule market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global hard empty non-gelatin capsule market is poised for significant growth in the coming years, driven by factors such as increasing consumer demand for plant-based and clean label products, technological advancements in capsule manufacturing processes, and expanding pharmaceutical and nutraceutical industries. Key trends such as sustainability, innovation, and collaboration are expected to shape the future of the market. However, challenges such as higher production costs, regulatory complexities, and competition from alternative encapsulation technologies may impact market dynamics. Nonetheless, the benefits of hard empty non-gelatin capsules in meeting consumer preferences for vegetarian, vegan, and halal-friendly products are expected to drive continued investment and innovation in the market.

Conclusion

In conclusion, the hard empty non-gelatin capsule market presents lucrative opportunities for pharmaceutical companies, contract manufacturers, and dietary supplement manufacturers seeking to meet the growing demand for plant-based and clean label products. With increasing consumer awareness, technological advancements, and evolving regulatory landscape, the market is poised for steady growth globally. By investing in research and development, expanding market reach, and enhancing regulatory compliance, stakeholders can capitalize on emerging trends and drive innovation in the dynamic landscape of hard empty non-gelatin capsules. As the market continues to evolve, collaboration, innovation, and a customer-centric approach will be key to success in meeting the diverse needs and preferences of consumers in the pharmaceutical and nutraceutical industries.

What is Hard Empty Non-gelatin Capsule?

Hard Empty Non-gelatin Capsules are solid dosage forms made from plant-based materials, designed to encapsulate powders, granules, or pellets. They are commonly used in the pharmaceutical and dietary supplement industries as a vegetarian alternative to traditional gelatin capsules.

What are the key players in the Hard Empty Non-gelatin Capsule Market?

Key players in the Hard Empty Non-gelatin Capsule Market include Capsugel, Qualicaps, and Suheung Co., Ltd., among others. These companies are known for their innovative capsule technologies and extensive product offerings.

What are the growth factors driving the Hard Empty Non-gelatin Capsule Market?

The growth of the Hard Empty Non-gelatin Capsule Market is driven by the increasing demand for vegetarian and vegan products, rising health consciousness among consumers, and the expansion of the dietary supplements sector. Additionally, advancements in capsule manufacturing technology are contributing to market growth.

What challenges does the Hard Empty Non-gelatin Capsule Market face?

The Hard Empty Non-gelatin Capsule Market faces challenges such as the higher production costs compared to gelatin capsules and potential limitations in the range of formulations that can be effectively encapsulated. Additionally, consumer awareness and acceptance of non-gelatin options can vary.

What opportunities exist in the Hard Empty Non-gelatin Capsule Market?

Opportunities in the Hard Empty Non-gelatin Capsule Market include the growing trend towards clean label products and the increasing popularity of personalized nutrition. Furthermore, expanding applications in the pharmaceutical sector for innovative drug delivery systems present significant growth potential.

What trends are shaping the Hard Empty Non-gelatin Capsule Market?

Trends shaping the Hard Empty Non-gelatin Capsule Market include the rise of plant-based and sustainable packaging solutions, as well as the development of capsules with enhanced bioavailability. Additionally, there is a growing focus on transparency in ingredient sourcing and manufacturing processes.

Hard Empty Non-gelatin Capsule Market

| Segmentation Details | Description |

|---|---|

| Product Type | HPMC, Pullulan, Starch, Cellulose |

| Application | Pharmaceuticals, Nutraceuticals, Dietary Supplements, Cosmetics |

| End User | Contract Manufacturers, Pharmaceutical Companies, Research Institutions, Health Food Manufacturers |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Hard Empty Non-gelatin Capsule Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at