Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

MIGS Dominance: Laparoscopic and hysteroscopic instruments account for approximately 45% of total market revenue, reflecting widespread adoption in procedures such as laparoscopic myomectomy and hysteroscopic polypectomy.

-

Robotics Upsurge: Robotic-assisted gynecologic surgery—led by platforms like the da Vinci® system—is growing at over 15% annually in high-income regions, driven by better visualization, ergonomics, and reduced conversion rates.

-

Energy Technologies: Radiofrequency and ultrasonic ablation devices represent the fastest-growing subsegment (~12% CAGR) for uterine fibroid and endometrial ablation therapies.

-

Single-Use Trend: Disposable trocars, sheaths, and electrosurgical accessories now comprise 30% of device volumes, driven by infection-control imperatives and OR efficiency goals.

-

Emerging Regions: Asia-Pacific and Latin America are forecast to register double-digit growth as government programs expand access to minimally invasive women’s health services.

Market Drivers

-

Rising Disease Burden: A growing global incidence of uterine fibroids (affecting up to 70% of women by age 50), endometriosis, and pelvic organ prolapse drives demand for surgical interventions.

-

Shift to Outpatient Settings: Advances in device miniaturization and enhanced recovery protocols are enabling more procedures to move from inpatient to ambulatory surgery centers.

-

Technological Innovation: Continuous R&D in digital imaging (HD and 3D endoscopy), smart energy delivery, and instrument articulation improves clinical precision and safety.

-

Patient Preference: Women increasingly seek minimally invasive options that minimize scarring, pain, and downtime, creating market pull for advanced devices.

-

Reimbursement Support: Favorable insurance coverage and procedure coding for MIGS and outpatient gynecologic surgeries encourage provider adoption.

Market Restraints

-

High Capital Expenditure: The cost of acquiring and maintaining advanced laparoscopy towers and robotic systems can exceed $2 million, limiting deployment in smaller hospitals.

-

Training Requirements: Mastery of laparoscopic and robotic techniques demands extensive surgeon training and proctoring, delaying widespread uptake.

-

Regulatory Hurdles: Stringent approvals for new energy-based devices and mesh implants—amid safety scrutiny—can extend time to market.

-

Reimbursement Variability: In some emerging markets and private-pay populations, inconsistent or limited reimbursement rates curtail device utilization.

-

Safety Concerns: Historical controversies over power morcellators and surgical mesh have led to stricter guidelines and slowed device innovation in certain subsegments.

Market Opportunities

-

Solid-State Energy Platforms: Next-generation bipolar and microwave devices promise more precise tissue ablation with reduced collateral damage.

-

Digital Integration: Connectivity between scopes, operating-room displays, and AI-driven tissue recognition tools offers potential for computer-assisted surgery.

-

Minimally Invasive Endometrial Diagnostics: Incorporating biopsy, imaging, and ablation into single hysteroscopic devices can streamline care pathways.

-

Mesh-Alternative Implants: Development of bioresorbable scaffolds and synthetic, lower-risk pelvic-support implants can rejuvenate the prolapse repair market.

-

Tele-Proctoring & VR Training: Remote surgical coaching and virtual-reality simulators can accelerate surgeon proficiency in resource-constrained regions.

Market Dynamics

-

OEM–Hospital Partnerships: Device makers increasingly offer managed-equipment-services models, bundling devices, maintenance, and training under subscription arrangements.

-

Consolidation Trends: Mergers and acquisitions among leading medical-device firms are consolidating portfolios of gynecologic technologies.

-

Evidence-Based Adoption: Publication of randomized trials and registries demonstrating improved outcomes with robotics and energy-based therapies drives clinical guidelines.

-

Value-Based Care Models: Bundled-payment initiatives align incentives toward single-visit, low-complication procedures, favoring integrated device solutions.

-

Decentralized Surgery: Growth of outpatient surgical centers and ambulatory hubs expands geographic access to specialized gynecologic care.

Regional Analysis

-

North America: Largest market share, driven by high robotic penetration, established outpatient surgical networks, and significant women’s health investment.

-

Europe: Strong minimally invasive tradition, with national initiatives (e.g., NHS GIRFT in the U.K.) promoting MIGS and outpatient hysteroscopy.

-

Asia-Pacific: Fastest growth trajectory, led by China, India, Japan, and South Korea as infrastructure and disposable usage rise.

-

Latin America: Emerging ambulatory surgery models and expanding private healthcare spending drive adoption in Brazil and Mexico.

-

Middle East & Africa: Growing medical tourism and government investment in specialty women’s hospitals create niche demand, though overall penetration remains low.

Competitive Landscape

Leading Companies in the Gynecological Surgical Devices Market:

- Johnson & Johnson

- Medtronic plc

- Stryker Corporation

- Hologic, Inc.

- Olympus Corporation

- Karl Storz SE & Co. KG

- Boston Scientific Corporation

- CooperSurgical, Inc. (The Cooper Companies, Inc.)

- Richard Wolf GmbH

- Ethicon US, LLC (A Subsidiary of Johnson & Johnson)

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

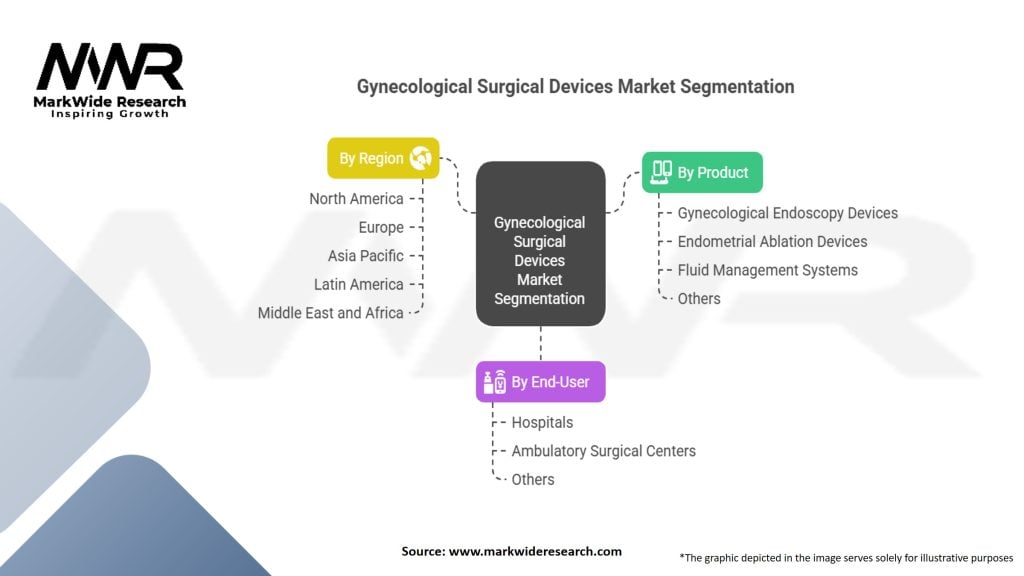

Segmentation

-

By Device Type: Laparoscopic Instruments, Robotic Systems, Hysteroscopes, Energy-Based Ablation Devices, Morcellators, Prolapse Repair Implants

-

By Procedure: Myomectomy, Endometrial Ablation, Hysterectomy, Polypectomy, Prolapse Repair, Endometriosis Resection

-

By End User: Hospitals, Ambulatory Surgery Centers, Specialty Women’s Clinics

-

By Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Category-wise Insights

-

Laparoscopic Instruments: Graspers, scissors, staplers, and advanced bipolar shears account for the largest instrument volume.

-

Robotic Systems: Premium segment with recurring revenue from instrument refreshes and software upgrades.

-

Hysteroscopic Devices: Myosure®-style tissue-morcellation systems and fluid-management consoles are rapidly displacing resectoscopes.

-

Energy Technologies: Transition from monopolar to bipolar and ultrasonic modalities reduces collateral thermal injury.

-

Prolapse Repair: Bio-absorbable scaffolds and native-tissue plication kits gain traction amidst mesh-safety concerns.

Key Benefits for Industry Participants and Stakeholders

-

Improved Clinical Outcomes: Enhanced visualization and instrument control translate to lower complication and conversion rates.

-

Operational Efficiency: Shorter OR times, reduced hospital stays, and lower readmission rates drive favorable cost-effectiveness profiles.

-

Patient Satisfaction: Minimally invasive approaches yield smaller scars, less pain, and faster return to daily activities.

-

Revenue Diversification: Hospitals and ASC operators capture higher-margin procedural revenue and device-service contracts.

-

Technology Leadership: OEMs and health systems demonstrating cutting-edge capabilities strengthen their competitive positioning.

SWOT Analysis

Strengths:

-

Proven safety and efficacy of minimally invasive gynecologic surgery.

-

Strong R&D pipelines delivering next-gen robotics and energy platforms.

-

High unmet need for women’s health interventions globally.

Weaknesses:

-

High cost and capital intensity of advanced systems limit access in resource-constrained settings.

-

Surgeon learning curves and workflow integration challenges.

-

Safety controversies (e.g., morcellator-related tissue dissemination) can affect adoption.

Opportunities:

-

Expansion of tele-mentoring and remote surgery to underserved regions.

-

Integration of AI for lesion detection and procedural guidance.

-

Growth of point-of-care women’s health clinics requiring compact device platforms.

Threats:

-

Reimbursement pressures and bundled payments potentially capping device pricing.

-

Emergence of non-surgical pharmacologic therapies for conditions like fibroids.

-

Regulatory scrutiny on novel implants and energy-based devices.

Market Key Trends

-

Ultrasonic & Bipolar Fusion: Combined ultrasonic and bipolar platforms streamline tissue cutting and sealing with less thermal spread.

-

Single-Site Surgery: Specialized port systems and articulating instruments enabling true laparoendoscopic single-site (LESS) gynecology.

-

Enhanced Visualization: 3D and fluorescence-guided imaging improve anatomical delineation and reduce complication rates.

-

Disposable Instrumentation: To minimize cross-contamination risk, single-use endoscopes and energy probes are gaining share.

-

Data-Driven Quality: Procedure-tracing software and OR analytics tools support continuous improvement in surgeon performance and patient outcomes.

Covid-19 Impact

The pandemic temporarily deferred elective gynecologic surgeries in 2020–2021, constraining device sales. However, the crisis accelerated adoption of outpatient and same-day MIS protocols to reduce hospital exposure. Virtual proctoring sustained surgeon training and device launches. As surgical backlogs cleared, pent-up demand bolstered market growth, particularly in minimally invasive and energy-based device adoption.

Key Industry Developments

-

Intuitive’s da Vinci® Xi System Upgrade (2023): Added integrated fluorescence imaging and slim port access for advanced gynecologic procedures.

-

Hologic’s NovaSure® Slim (2022): Launched a next-gen electrosurgical ablation device with shorter cycle times and reduced cramping.

-

Medtronic’s Aquamantys® 2.0 (2024): Enhanced radiofrequency ablation platform with improved hemostatic performance in myomectomy.

-

Olympus’ TruClear™ Elite (2021): Expanded with bipolar morcellation and continuous flow hysteroscopy for large-volume tissue removal.

Analyst Suggestions

-

Develop Tiered Offerings: Market entry versions of energy-based and endoscopic systems at lower price points for emerging markets.

-

Expand Digital Training: Scale virtual simulation and remote-proctor programs to accelerate surgeon uptake.

-

Pursue Evidence Generation: Invest in large multicenter trials comparing minimally invasive device outcomes to optimize reimbursement positioning.

-

Leverage AI Integration: Partner with AI vendors to add lesion-detection capabilities to endoscopic platforms.

-

Strengthen Aftermarket Support: Offer bundled service contracts and quick-swap disposable instrument kits to drive recurring revenue.

Future Outlook

The Gynecological Surgical Devices market is forecast to sustain high-single-digit growth through 2030, driven by expanding indications for MIS, enhanced device capabilities, and rising awareness of women’s health. Robotics and AI-augmented endoscopy will migrate beyond flagship centers into broader hospital networks, while compact, disposable-friendly platforms address ASC and emerging-market needs. The convergence of visualization, energy delivery, and data analytics will define the next wave of innovation—enabling safer, more efficient, and personalized gynecologic care worldwide.

Conclusion

Gynecologic surgical devices have transformed women’s healthcare by enabling precise, minimally invasive treatments that improve outcomes and patient experience. Continued advances in robotics, energy technologies, and digital integration promise to further elevate care standards. Manufacturers, providers, and payors who embrace comprehensive device portfolios, surgeon training, and evidence-based value propositions will lead in meeting the evolving demands of global gynecologic surgery—ensuring better health and quality of life for women everywhere.