444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

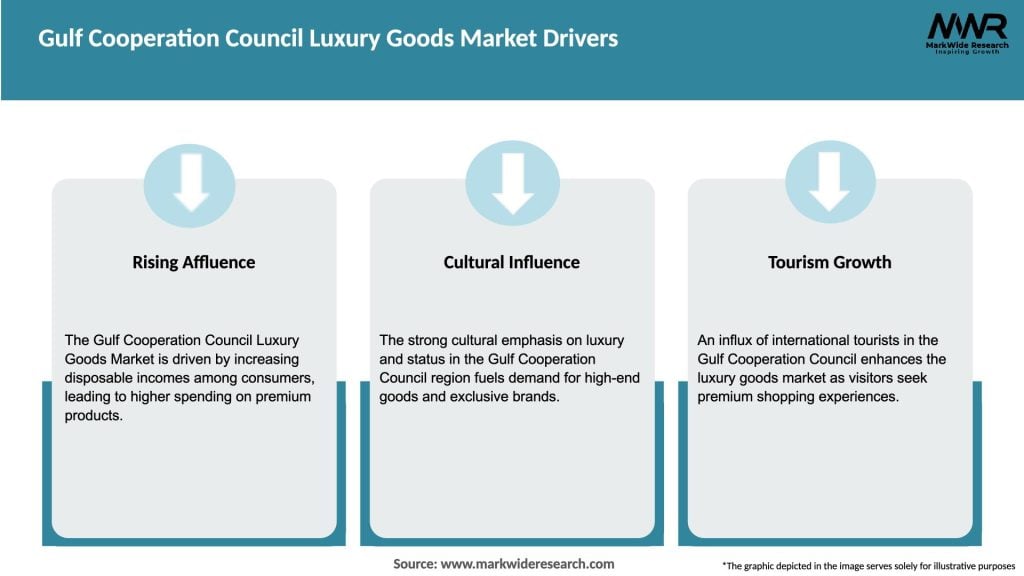

The Gulf Cooperation Council (GCC) luxury goods market has experienced significant growth in recent years. The GCC, consisting of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, has emerged as a prominent market for luxury goods, driven by rising disposable incomes, a growing middle class, and a penchant for luxury lifestyles. This article provides an in-depth analysis of the GCC luxury goods market, highlighting key insights, market drivers, restraints, opportunities, and trends.

Meaning

The term “luxury goods” refers to high-end products and services that are associated with premium quality, exclusivity, and craftsmanship. These goods are often characterized by their superior materials, exquisite designs, and prestigious brand names. Luxury goods encompass a wide range of categories, including fashion, accessories, jewelry, watches, cosmetics, fragrances, automobiles, hospitality, and more. The GCC luxury goods market caters to affluent consumers who seek luxurious and aspirational products to enhance their status and lifestyle.

Executive Summary

The GCC luxury goods market has witnessed robust growth in recent years, driven by a combination of factors such as economic prosperity, urbanization, increasing tourism, and changing consumer preferences. The region’s strategic location as a global business hub and its strong retail infrastructure have further fueled the demand for luxury goods. Key market players are expanding their presence in the GCC, capitalizing on the region’s favorable business environment and affluent consumer base.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC luxury goods market is driven by a dynamic interplay of various factors, including consumer behavior, economic conditions, technological advancements, and industry trends. Understanding these dynamics is crucial for market players to adapt their strategies and capitalize on emerging opportunities. Factors such as changing consumer preferences, the rise of digital channels, evolving retail formats, and the influence of social media play a significant role in shaping the market landscape.

Regional Analysis

The GCC luxury goods market exhibits variations across different countries within the region. Saudi Arabia and the United Arab Emirates are the leading markets, driven by their large population, strong economies, and favorable business environments. Qatar and Bahrain also contribute to the market’s growth, with their affluent consumer base and increasing tourism. Oman and Kuwait, although comparatively smaller markets, offer potential growth opportunities due to their growing middle class and expanding retail sectors.

Competitive Landscape

Leading Companies in the Gulf Cooperation Council Luxury Goods Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

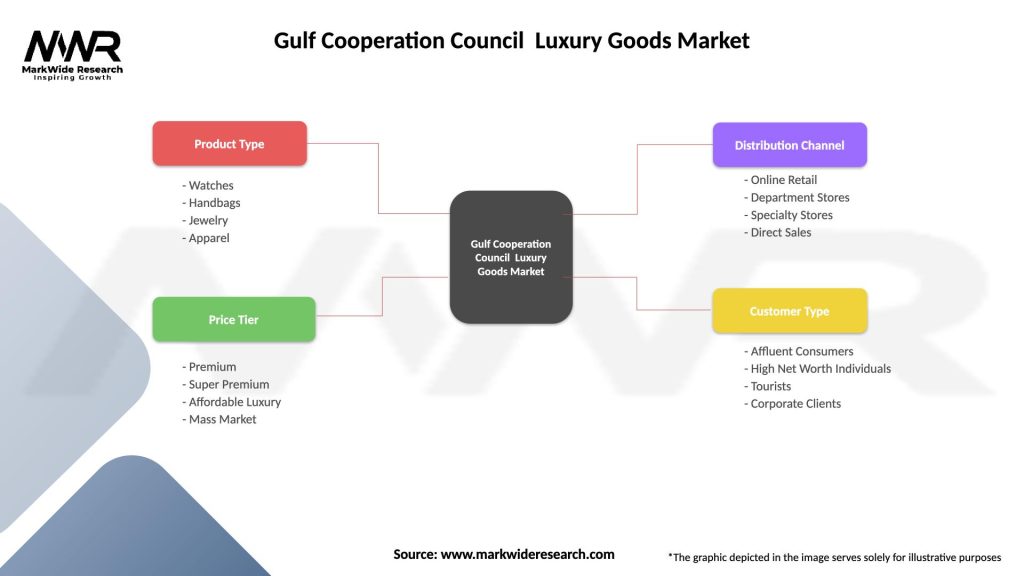

Segmentation

The GCC luxury goods market can be segmented based on product categories, including fashion and accessories, jewelry and watches, cosmetics and fragrances, automobiles, and hospitality. Each category exhibits unique characteristics and consumer preferences, necessitating tailored marketing and distribution strategies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the GCC luxury goods market. The closure of retail stores, travel restrictions, and economic uncertainties have led to a decline in consumer spending on luxury goods. However, the market has shown resilience, with the rise of e-commerce and digital platforms enabling consumers to continue their luxury shopping experiences online. Brands that have adapted their strategies to the changing market dynamics have been able to mitigate the impact and even find new opportunities during the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the GCC luxury goods market appears promising, with steady growth anticipated in the coming years. As the region continues to witness economic diversification efforts and investments in infrastructure, the demand for luxury goods is expected to increase. Brands that adapt to evolving consumer preferences, embrace digital transformation, and prioritize sustainability are likely to thrive in the competitive landscape.

Conclusion

The GCC luxury goods market presents significant opportunities for both international and regional luxury brands. With a growing affluent consumer base, rising disposable incomes, and a preference for luxurious lifestyles, the demand for high-end products and services is on the rise. By understanding market dynamics, embracing digital technologies, and catering to localized preferences, luxury brands can successfully navigate the GCC market and capitalize on its potential for growth.

What is Gulf Cooperation Council Luxury Goods?

Gulf Cooperation Council Luxury Goods refers to high-end products and services that cater to affluent consumers in the Gulf Cooperation Council region, including luxury fashion, jewelry, watches, and premium automobiles.

What are the key players in the Gulf Cooperation Council Luxury Goods Market?

Key players in the Gulf Cooperation Council Luxury Goods Market include luxury brands such as Louis Vuitton, Gucci, and Chanel, as well as regional retailers like Al Haramain and Al Tayer Group, among others.

What are the growth factors driving the Gulf Cooperation Council Luxury Goods Market?

The Gulf Cooperation Council Luxury Goods Market is driven by factors such as increasing disposable income, a growing population of affluent consumers, and a rising interest in luxury experiences and products.

What challenges does the Gulf Cooperation Council Luxury Goods Market face?

Challenges in the Gulf Cooperation Council Luxury Goods Market include economic fluctuations, changing consumer preferences, and the impact of global events on luxury spending.

What opportunities exist in the Gulf Cooperation Council Luxury Goods Market?

Opportunities in the Gulf Cooperation Council Luxury Goods Market include the expansion of e-commerce platforms, the rise of personalized luxury experiences, and the increasing demand for sustainable luxury products.

What trends are shaping the Gulf Cooperation Council Luxury Goods Market?

Trends in the Gulf Cooperation Council Luxury Goods Market include a shift towards digital engagement, the popularity of experiential luxury, and a growing emphasis on sustainability and ethical sourcing.

Gulf Cooperation Council Luxury Goods Market

| Segmentation Details | Description |

|---|---|

| Product Type | Watches, Handbags, Jewelry, Apparel |

| Price Tier | Premium, Super Premium, Affordable Luxury, Mass Market |

| Distribution Channel | Online Retail, Department Stores, Specialty Stores, Direct Sales |

| Customer Type | Affluent Consumers, High Net Worth Individuals, Tourists, Corporate Clients |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at