444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Gulf Cooperation Council (GCC) textile market represents a dynamic and rapidly evolving sector within the Middle Eastern economy, encompassing the textile industries of Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman. This market has experienced substantial transformation over the past decade, driven by diversification initiatives, growing consumer demand, and strategic investments in manufacturing capabilities. The region’s textile industry spans multiple segments including apparel manufacturing, home textiles, technical textiles, and industrial fabrics, with each country contributing unique strengths to the overall market landscape.

Market dynamics in the GCC textile sector are characterized by increasing domestic production capabilities, rising consumer sophistication, and growing emphasis on sustainable textile solutions. The market is experiencing robust growth at a CAGR of 6.2%, supported by government initiatives promoting industrial diversification and reducing dependence on oil revenues. Key growth drivers include expanding retail infrastructure, increasing population, rising disposable incomes, and growing demand for high-quality textile products across both consumer and industrial applications.

Regional positioning within the global textile value chain has strengthened significantly, with GCC countries leveraging their strategic geographic location between Asia and Europe to establish themselves as important textile trading hubs. The market benefits from advanced logistics infrastructure, favorable business environments, and increasing integration with international textile supply chains. Growing emphasis on textile innovation and technology adoption has positioned the region as an emerging center for advanced textile manufacturing and sustainable production practices.

The GCC textile market refers to the comprehensive ecosystem of textile production, processing, distribution, and consumption activities across the six Gulf Cooperation Council member states, encompassing raw material processing, fabric manufacturing, garment production, and related textile services that serve both domestic and international markets.

Market scope includes various textile categories such as cotton textiles, synthetic fabrics, blended materials, technical textiles, and specialty fabrics used in diverse applications ranging from fashion apparel to industrial uses. The market encompasses the entire textile value chain, from fiber production and yarn manufacturing to fabric weaving, dyeing, finishing, and final product assembly. This comprehensive approach reflects the region’s growing capabilities in textile manufacturing and its increasing integration with global textile supply networks.

Strategic importance of the GCC textile market extends beyond traditional manufacturing, encompassing innovation in sustainable textiles, smart fabrics, and advanced material technologies. The market plays a crucial role in economic diversification strategies across GCC countries, contributing to job creation, export revenue generation, and industrial development. Growing focus on textile sustainability and circular economy principles has positioned the region as a potential leader in environmentally responsible textile production and consumption practices.

The GCC textile market demonstrates remarkable resilience and growth potential, driven by strategic government initiatives, increasing consumer demand, and expanding manufacturing capabilities across the region. Market expansion is supported by substantial investments in textile infrastructure, technology adoption, and human capital development. The sector benefits from favorable demographics, with a young and growing population driving demand for diverse textile products, while increasing urbanization and lifestyle changes create new market opportunities.

Key market trends include the rise of sustainable textile production, increasing adoption of digital technologies in manufacturing processes, and growing emphasis on local sourcing and production. The market is experiencing significant transformation through Industry 4.0 technologies, with automation adoption rates reaching approximately 35% across major textile facilities. This technological advancement is enhancing production efficiency, quality control, and competitiveness in global markets.

Competitive landscape features a mix of established international textile companies, regional manufacturers, and emerging local players focusing on niche markets and specialized applications. The market is characterized by increasing collaboration between government entities, private sector companies, and international partners to develop comprehensive textile ecosystems. Growing emphasis on export-oriented production has resulted in approximately 28% of regional textile output being directed toward international markets, reflecting the sector’s increasing global competitiveness.

Market segmentation reveals diverse opportunities across multiple textile categories, with apparel and fashion textiles representing the largest segment, followed by home textiles and technical textiles. The following key insights highlight critical market dynamics:

Economic diversification initiatives across GCC countries serve as primary drivers for textile market expansion, with governments implementing comprehensive strategies to reduce oil dependency and develop manufacturing sectors. These initiatives include substantial investments in industrial infrastructure, technology parks, and manufacturing zones specifically designed to support textile production. The emphasis on industrial development has created favorable conditions for textile companies to establish operations and expand their presence in the region.

Demographic advantages significantly contribute to market growth, with the GCC region experiencing steady population growth and increasing urbanization rates. The young demographic profile creates substantial demand for fashion and lifestyle textiles, while growing expatriate populations bring diverse consumer preferences and market opportunities. Rising disposable incomes and changing lifestyle patterns drive demand for premium textile products across multiple categories.

Strategic geographic positioning provides significant advantages for textile trade and distribution, with GCC countries serving as important gateways between Asian production centers and global markets. Advanced logistics infrastructure, including world-class ports and airports, facilitates efficient textile trade operations. The region’s free trade agreements and business-friendly policies attract international textile companies seeking to establish regional operations and access broader Middle Eastern and African markets.

Technology adoption and innovation drive market competitiveness, with increasing investments in advanced manufacturing technologies, automation systems, and digital solutions. The focus on Industry 4.0 implementation enhances production efficiency, quality control, and supply chain management capabilities. Growing emphasis on sustainable technologies and circular economy principles creates new opportunities for innovative textile solutions and environmentally responsible production practices.

Raw material dependency presents significant challenges for the GCC textile market, as the region relies heavily on imported fibers, yarns, and other essential textile inputs. This dependency creates vulnerability to global supply chain disruptions, price fluctuations, and availability constraints. Limited domestic production of natural fibers and synthetic materials increases production costs and affects overall market competitiveness compared to regions with established textile raw material bases.

Skilled labor shortages constrain market growth potential, particularly in specialized textile manufacturing processes and technical applications. The region faces challenges in developing sufficient local expertise in advanced textile technologies, quality control, and production management. Competition for skilled workers from other industrial sectors and higher labor costs compared to traditional textile manufacturing regions create additional workforce-related constraints.

Energy and utility costs impact production economics, despite the region’s energy resources. Textile manufacturing requires substantial energy inputs for various processes, and rising utility costs affect overall production competitiveness. Water scarcity issues in several GCC countries create additional challenges for textile processing operations that require significant water resources for dyeing, finishing, and other manufacturing processes.

Market competition from established textile manufacturing regions presents ongoing challenges, particularly from Asian countries with lower production costs and established supply chains. The need to compete with cost-effective imports requires continuous investment in efficiency improvements, technology upgrades, and value-added production capabilities. Regulatory compliance requirements and quality standards add complexity and costs to textile manufacturing operations.

Sustainable textile development presents substantial opportunities for market expansion, with growing global demand for environmentally responsible textile products creating new market segments. The region’s potential for renewable energy integration in textile manufacturing processes offers competitive advantages in sustainable production. Opportunities exist for developing circular economy approaches, recycling technologies, and eco-friendly textile materials that meet increasing consumer and regulatory demands for sustainability.

Technical textiles expansion offers significant growth potential, with increasing demand for specialized textile applications in construction, automotive, healthcare, and industrial sectors. The region’s growing infrastructure development projects create substantial demand for technical textiles, while expanding healthcare and automotive industries require specialized textile solutions. Investment in advanced material technologies and high-performance textiles can position GCC countries as regional leaders in technical textile applications.

Digital transformation opportunities enable textile companies to enhance operational efficiency, customer engagement, and market reach through e-commerce platforms, digital marketing, and smart manufacturing technologies. The region’s advanced digital infrastructure supports implementation of Industry 4.0 solutions, artificial intelligence applications, and data analytics for improved production planning and quality management.

Regional trade integration creates opportunities for expanded market access and supply chain optimization across GCC countries and broader Middle Eastern markets. Free trade agreements and economic partnerships facilitate textile trade expansion, while growing consumer markets in neighboring regions offer substantial growth potential. Development of textile clusters and industrial zones can enhance regional competitiveness and attract international investment.

Supply chain evolution significantly influences market dynamics, with increasing emphasis on regional supply chain development and integration. The shift toward supply chain resilience following global disruptions has created opportunities for regional textile suppliers and manufacturers to strengthen their market positions. Growing collaboration between GCC countries in textile supply chain development enhances overall regional competitiveness and reduces dependency on distant suppliers.

Consumer behavior changes drive market dynamics through increasing demand for premium, sustainable, and customized textile products. The rise of conscious consumerism creates opportunities for textile companies focusing on environmental responsibility and social impact. E-commerce growth and digital retail channels transform traditional textile distribution models, requiring companies to adapt their marketing and sales strategies to reach evolving consumer preferences.

Technology integration continues to reshape market dynamics through automation, digitalization, and advanced manufacturing processes. The adoption of smart manufacturing technologies enables textile companies to improve efficiency, reduce costs, and enhance product quality. Integration of artificial intelligence, machine learning, and data analytics provides competitive advantages in production planning, quality control, and market forecasting.

Regulatory environment influences market dynamics through quality standards, environmental regulations, and trade policies. Increasing emphasis on sustainability regulations and environmental compliance creates both challenges and opportunities for textile manufacturers. Government support programs, incentives, and industrial development policies significantly impact market growth trajectories and investment decisions across the textile sector.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the GCC textile market landscape. Primary research involves extensive interviews with industry executives, government officials, textile manufacturers, and market participants across all six GCC countries. This approach provides firsthand insights into market trends, challenges, opportunities, and strategic developments affecting the textile sector.

Secondary research methodology incorporates analysis of government publications, industry reports, trade statistics, and regulatory documents from relevant authorities across GCC countries. Data collection includes examination of textile production statistics, trade flows, investment patterns, and policy developments that influence market dynamics. Industry databases, company financial reports, and market intelligence sources provide additional quantitative and qualitative information.

Market validation processes ensure data accuracy through cross-referencing multiple sources, expert consultations, and statistical verification methods. MarkWide Research employs rigorous quality control measures to validate market insights and projections. The methodology includes trend analysis, comparative studies, and scenario modeling to provide comprehensive market understanding and future outlook assessments.

Analytical frameworks incorporate quantitative modeling, qualitative assessment, and strategic analysis techniques to evaluate market dynamics, competitive positioning, and growth potential. The research approach considers regional variations, country-specific factors, and cross-border market influences that affect textile market development across the GCC region.

Saudi Arabia represents the largest textile market within the GCC region, accounting for approximately 45% of regional textile consumption and production capacity. The kingdom’s textile sector benefits from substantial government support through Vision 2030 initiatives, industrial development programs, and infrastructure investments. Major textile manufacturing hubs in Riyadh, Jeddah, and Dammam contribute significantly to regional production capacity, while growing domestic demand drives market expansion across multiple textile segments.

United Arab Emirates serves as a critical textile trading and distribution hub, with Dubai and Abu Dhabi functioning as major centers for textile imports, exports, and re-export activities. The UAE’s textile market represents approximately 28% of regional market share, supported by advanced logistics infrastructure, free trade zones, and business-friendly policies. The country’s strategic position facilitates textile trade between Asian suppliers and Middle Eastern, African, and European markets.

Qatar, Kuwait, Bahrain, and Oman collectively contribute the remaining 27% of regional market share, with each country developing specialized textile capabilities and market niches. Qatar’s textile market focuses on luxury and premium segments, supported by high consumer purchasing power and growing retail infrastructure. Kuwait emphasizes textile imports and distribution, while Bahrain develops manufacturing capabilities in specialized textile applications. Oman’s textile sector benefits from government diversification initiatives and growing industrial development programs.

Cross-border collaboration enhances regional market integration through joint ventures, supply chain partnerships, and technology sharing initiatives. The GCC common market framework facilitates textile trade flows and investment coordination across member countries, creating synergies that strengthen overall regional competitiveness in global textile markets.

Market structure features a diverse mix of international textile companies, regional manufacturers, and local enterprises competing across various textile segments. The competitive landscape is characterized by increasing consolidation, strategic partnerships, and technology-driven differentiation strategies. Major players focus on capacity expansion, product innovation, and market penetration to strengthen their competitive positions.

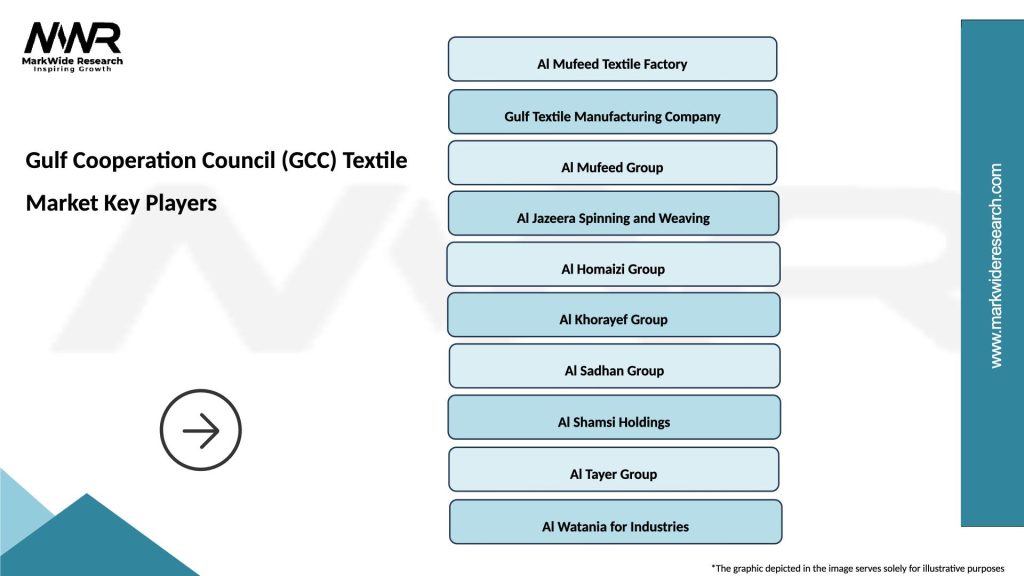

Leading textile companies operating in the GCC market include:

Competitive strategies focus on technology adoption, sustainability initiatives, product differentiation, and market expansion. Companies invest heavily in advanced manufacturing equipment, quality control systems, and research and development capabilities to maintain competitive advantages. Strategic partnerships with international textile companies provide access to advanced technologies, global markets, and specialized expertise.

By Product Type: The GCC textile market encompasses diverse product categories serving various applications and consumer needs. Apparel textiles represent the largest segment, including fashion fabrics, garment materials, and specialty clothing textiles. Home textiles constitute another significant segment, covering bedding, curtains, upholstery, and decorative fabrics. Technical textiles serve industrial applications, construction, automotive, and healthcare sectors with specialized performance characteristics.

By Application: Market segmentation by application reveals distinct usage patterns and growth opportunities across different sectors:

By Technology: Technological segmentation reflects manufacturing processes and innovation levels across the textile industry. Traditional weaving and knitting technologies remain important for basic textile production, while advanced technologies including digital printing, smart textiles, and sustainable production methods gain increasing market share.

By End-User: Market segmentation by end-user categories includes individual consumers, retail chains, industrial customers, and institutional buyers. Each segment has distinct requirements for product specifications, quality standards, pricing, and service levels, requiring tailored marketing and distribution approaches.

Apparel and Fashion Textiles: This category dominates the GCC textile market, driven by growing consumer sophistication, increasing fashion consciousness, and expanding retail infrastructure. The segment benefits from rising disposable incomes, changing lifestyle preferences, and growing expatriate populations with diverse fashion requirements. Premium and luxury textile segments show particularly strong growth, supported by high consumer purchasing power in the region.

Home Textiles: The home textiles category experiences robust growth driven by construction boom, interior design trends, and increasing consumer spending on home improvement. This segment includes bedding, curtains, carpets, upholstery fabrics, and decorative textiles. Growing hospitality sector and commercial construction projects create substantial demand for commercial-grade home textiles and interior fabrics.

Technical Textiles: This emerging category shows significant growth potential, driven by industrial development, infrastructure projects, and increasing adoption of advanced materials. Technical textiles serve specialized applications in construction, automotive, healthcare, agriculture, and industrial sectors. The segment benefits from growing emphasis on performance materials, sustainability, and innovative textile solutions.

Sustainable Textiles: Environmental consciousness drives growth in sustainable textile categories, including organic fabrics, recycled materials, and eco-friendly production processes. This category attracts increasing consumer and institutional interest, supported by government sustainability initiatives and corporate environmental responsibility programs. Innovation in sustainable textile technologies creates new market opportunities and competitive advantages.

Manufacturers benefit from expanding market opportunities, government support programs, and strategic geographic positioning within global textile supply chains. The region offers access to growing consumer markets, advanced infrastructure, and business-friendly environments that facilitate textile production and distribution operations. Investment incentives, industrial zones, and technology support programs enhance manufacturing competitiveness and profitability.

Investors gain exposure to a rapidly growing textile market supported by economic diversification initiatives, demographic advantages, and increasing consumer demand. The sector offers attractive investment returns through capacity expansion projects, technology upgrades, and market development opportunities. Government backing and strategic importance of textile sector development provide additional investment security and growth potential.

Suppliers and Service Providers benefit from expanding textile ecosystem requirements, including raw materials, machinery, technology services, and logistics support. Growing textile manufacturing capacity creates substantial demand for specialized suppliers, equipment providers, and technical service companies. The emphasis on technology adoption and sustainability creates opportunities for innovative suppliers and solution providers.

Consumers benefit from increasing product variety, quality improvements, and competitive pricing resulting from market expansion and competition. Growing local production capabilities reduce dependency on imports while providing faster delivery times and customization options. Emphasis on sustainable textiles and quality standards enhances consumer choice and product performance across multiple textile categories.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend across the GCC textile market, with companies increasingly adopting environmentally responsible production processes, sustainable raw materials, and circular economy principles. This trend is driven by consumer awareness, regulatory requirements, and corporate responsibility initiatives. Textile manufacturers invest in water recycling systems, renewable energy integration, and waste reduction technologies to minimize environmental impact.

Digital Transformation accelerates across textile manufacturing operations, with companies implementing Industry 4.0 technologies, automation systems, and data analytics solutions. Digital technologies enhance production efficiency, quality control, and supply chain management capabilities. E-commerce platforms and digital marketing strategies transform textile retail and customer engagement approaches, creating new market opportunities and business models.

Customization and Personalization trends drive demand for flexible manufacturing capabilities and made-to-order textile products. Advanced manufacturing technologies enable cost-effective small-batch production and customized textile solutions. This trend is particularly strong in fashion and home textiles segments, where consumers seek unique and personalized products.

Technical Textile Innovation expands rapidly, with increasing development of high-performance materials for specialized applications. Smart textiles incorporating electronic components, sensors, and connectivity features gain market traction. Innovation in medical textiles, protective fabrics, and industrial applications creates new market segments and growth opportunities.

Infrastructure Investments across GCC countries significantly enhance textile manufacturing capabilities and market competitiveness. Major textile industrial parks and manufacturing zones are developed in Saudi Arabia, UAE, and other regional countries. These investments include advanced production facilities, research and development centers, and integrated supply chain infrastructure that supports comprehensive textile ecosystem development.

Technology Partnerships between GCC textile companies and international technology providers accelerate innovation adoption and capability development. Strategic alliances focus on advanced manufacturing technologies, sustainable production processes, and digital transformation initiatives. These partnerships provide access to cutting-edge textile technologies and global best practices while building local expertise and capabilities.

Sustainability Initiatives gain momentum across the textile sector, with companies implementing comprehensive environmental management programs and sustainable production practices. MWR analysis indicates that sustainability investments have increased substantially, with companies focusing on water conservation, energy efficiency, and waste reduction. Green building certifications and environmental compliance programs become standard practice across major textile facilities.

Market Expansion Projects include capacity increases, new product line developments, and geographic expansion initiatives by major textile companies. Export-oriented production facilities are established to serve international markets, while domestic market expansion focuses on premium and specialized textile segments. Joint ventures and strategic partnerships facilitate market entry and expansion across different textile categories.

Strategic Focus Areas for textile companies operating in the GCC market should emphasize technology adoption, sustainability integration, and market differentiation strategies. Companies should invest in advanced manufacturing technologies that enhance productivity, quality, and cost competitiveness. Developing specialized capabilities in technical textiles, sustainable materials, and customized solutions can create competitive advantages and premium market positioning.

Supply Chain Development requires attention to raw material sourcing, supplier diversification, and regional supply chain integration. Companies should explore opportunities for backward integration, strategic supplier partnerships, and alternative sourcing strategies to reduce dependency and improve cost competitiveness. Regional supply chain collaboration can enhance resilience and efficiency across textile operations.

Market Positioning Strategies should focus on premium segments, specialized applications, and value-added products that leverage regional advantages and capabilities. Companies should develop strong brand positioning, quality differentiation, and customer service excellence to compete effectively with imports. Export market development requires investment in quality certifications, international marketing, and distribution partnerships.

Innovation Investment in research and development, technology adoption, and product development is essential for long-term competitiveness. Companies should collaborate with research institutions, technology providers, and international partners to access advanced textile technologies and innovation capabilities. Focus on sustainable technologies, smart textiles, and performance materials can create new market opportunities and competitive advantages.

Market growth prospects remain positive for the GCC textile sector, supported by continued economic diversification efforts, demographic advantages, and increasing consumer demand. The market is expected to maintain steady growth momentum, with particular strength in technical textiles, sustainable materials, and premium product segments. Government support programs and infrastructure investments will continue to enhance market competitiveness and growth potential.

Technology evolution will significantly impact market development, with increasing adoption of advanced manufacturing technologies, automation systems, and digital solutions. The integration of artificial intelligence, machine learning, and Internet of Things technologies will enhance production efficiency and quality control capabilities. Smart textiles and performance materials will create new market segments and application opportunities.

Sustainability transformation will accelerate across the textile sector, driven by regulatory requirements, consumer preferences, and corporate responsibility initiatives. Companies will increasingly adopt circular economy principles, sustainable production processes, and environmentally responsible materials. This transformation will create competitive advantages for early adopters and reshape market dynamics across textile segments.

Regional integration and international market expansion will enhance growth opportunities for GCC textile companies. Trade agreements, economic partnerships, and supply chain collaboration will facilitate market access and competitiveness. The region’s strategic position will continue to provide advantages for textile trade and distribution operations serving broader Middle Eastern, African, and Asian markets.

The GCC textile market represents a dynamic and rapidly evolving sector with substantial growth potential, driven by economic diversification initiatives, demographic advantages, and increasing consumer sophistication. The market benefits from strong government support, advanced infrastructure, and strategic geographic positioning that creates competitive advantages in global textile markets. While challenges exist in raw material dependency and skilled labor availability, the region’s focus on technology adoption, sustainability, and innovation positions it well for continued growth and development.

Future success in the GCC textile market will depend on companies’ ability to leverage regional advantages while addressing structural challenges through strategic investments, technology adoption, and market differentiation. The emphasis on sustainable textiles, technical applications, and premium products creates opportunities for value-added production and competitive positioning. As the market continues to mature and integrate with global textile supply chains, the GCC region is well-positioned to become an increasingly important player in the international textile industry, contributing to economic diversification goals while serving growing domestic and regional market demand.

What is Gulf Cooperation Council (GCC) Textile?

Gulf Cooperation Council (GCC) Textile refers to the textile products and materials produced and consumed within the GCC region, which includes countries like Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain. This sector encompasses various segments such as apparel, home textiles, and technical textiles.

What are the key players in the Gulf Cooperation Council (GCC) Textile Market?

Key players in the Gulf Cooperation Council (GCC) Textile Market include Al Hariri Group, Al Mufeed Group, and Gulf Textile Industries. These companies are involved in various aspects of textile production, from manufacturing to distribution, among others.

What are the growth factors driving the Gulf Cooperation Council (GCC) Textile Market?

The growth of the Gulf Cooperation Council (GCC) Textile Market is driven by increasing consumer demand for fashion and home textiles, the rise of e-commerce platforms, and government initiatives to promote local manufacturing. Additionally, the region’s growing population and tourism sector contribute to market expansion.

What challenges does the Gulf Cooperation Council (GCC) Textile Market face?

The Gulf Cooperation Council (GCC) Textile Market faces challenges such as competition from imported textiles, fluctuating raw material prices, and the need for sustainable practices. Additionally, the market must adapt to changing consumer preferences and economic fluctuations in the region.

What opportunities exist in the Gulf Cooperation Council (GCC) Textile Market?

Opportunities in the Gulf Cooperation Council (GCC) Textile Market include the potential for growth in sustainable textiles, the expansion of online retail channels, and increased investment in textile technology. The region’s focus on diversifying its economy also opens avenues for innovation in textile manufacturing.

What trends are shaping the Gulf Cooperation Council (GCC) Textile Market?

Trends shaping the Gulf Cooperation Council (GCC) Textile Market include a growing emphasis on eco-friendly materials, the integration of smart textiles, and the influence of global fashion trends. Additionally, customization and personalization in textile products are becoming increasingly popular among consumers.

Gulf Cooperation Council (GCC) Textile Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cotton, Polyester, Wool, Silk |

| Application | Apparel, Home Textiles, Industrial Fabrics, Technical Textiles |

| End User | Fashion Brands, Manufacturers, Retailers, Wholesalers |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Gulf Cooperation Council (GCC) Textile Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at