444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Gulf Cooperation Council (GCC) diesel generator market represents a critical infrastructure component across the six member nations, encompassing Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain. Market dynamics indicate substantial growth driven by rapid industrialization, expanding construction activities, and increasing demand for reliable backup power solutions. The region’s strategic focus on economic diversification and infrastructure development has positioned diesel generators as essential equipment for maintaining operational continuity across various sectors.

Regional characteristics of the GCC diesel generator market reflect unique environmental and economic factors that influence demand patterns. The harsh desert climate, frequent power outages in certain areas, and growing emphasis on industrial development create a robust market environment. Growth projections suggest the market will expand at a 6.2% CAGR through the forecast period, driven by increasing investments in healthcare facilities, data centers, and manufacturing operations.

Technology adoption trends show a shift toward more efficient and environmentally compliant diesel generator systems. The integration of advanced control systems, remote monitoring capabilities, and improved fuel efficiency features has enhanced the appeal of modern diesel generators. Market penetration varies across GCC countries, with the UAE and Saudi Arabia leading in terms of adoption rates, accounting for approximately 65% of regional demand.

The Gulf Cooperation Council (GCC) diesel generator market refers to the comprehensive ecosystem of diesel-powered electrical generation equipment, services, and related infrastructure across the six GCC member states. This market encompasses portable and stationary diesel generators ranging from small residential units to large industrial installations capable of providing primary or backup power solutions.

Market scope includes various generator configurations, power ratings, and application-specific solutions designed to meet the diverse energy requirements of the GCC region. The definition extends beyond equipment sales to include maintenance services, spare parts distribution, rental services, and comprehensive power management solutions. Technological integration aspects cover modern features such as automatic transfer switches, load management systems, and digital monitoring platforms.

Regional specificity of this market definition acknowledges the unique operating conditions, regulatory frameworks, and economic drivers present across GCC countries. The market encompasses both emergency backup applications and continuous power generation scenarios, reflecting the diverse energy needs of rapidly developing economies with significant industrial and commercial sectors.

Strategic analysis of the GCC diesel generator market reveals a dynamic landscape characterized by steady growth, technological advancement, and evolving customer requirements. The market demonstrates resilience despite global economic fluctuations, supported by ongoing infrastructure development projects and increasing industrial activities across the region. Key performance indicators suggest sustained demand growth with particular strength in the healthcare, telecommunications, and data center segments.

Market leadership patterns show established international manufacturers maintaining dominant positions while regional players gain market share through competitive pricing and localized service offerings. The competitive environment emphasizes reliability, fuel efficiency, and comprehensive after-sales support as primary differentiating factors. Customer preferences increasingly favor generators with advanced monitoring capabilities and reduced environmental impact.

Investment trends indicate significant capital allocation toward modernizing power infrastructure and implementing smart grid technologies. Government initiatives supporting economic diversification and industrial development create favorable conditions for market expansion. Future prospects remain positive, with anticipated growth in renewable energy integration driving demand for flexible backup power solutions.

Primary market drivers encompass several interconnected factors that sustain demand for diesel generators across the GCC region:

Market segmentation reveals distinct patterns across different power rating categories, with medium-capacity generators showing the strongest growth trajectory. Application analysis indicates commercial and industrial segments accounting for the largest market share, while residential applications show increasing adoption rates.

Economic transformation across GCC countries serves as a fundamental driver for diesel generator market growth. Vision 2030 initiatives in Saudi Arabia, UAE’s economic diversification strategy, and Qatar’s National Vision 2030 create substantial infrastructure development requirements. Industrial expansion in manufacturing, logistics, and technology sectors generates consistent demand for reliable power backup solutions.

Climate-related factors significantly influence market dynamics, with extreme temperatures and occasional sandstorms affecting grid stability. The region’s harsh environmental conditions necessitate robust backup power systems capable of operating reliably under challenging circumstances. Power grid reliability concerns, particularly in rapidly developing areas, drive investment in diesel generator systems as insurance against outages.

Regulatory frameworks increasingly mandate backup power systems for critical infrastructure, healthcare facilities, and high-rise buildings. Building codes and safety regulations across GCC countries specify minimum backup power requirements, creating a compliance-driven market segment. Healthcare sector growth represents a particularly strong driver, with hospital expansions and medical facility upgrades requiring sophisticated power backup solutions.

Digital infrastructure development creates new demand categories, with data centers, telecommunications facilities, and smart city projects requiring high-reliability power systems. The growing emphasis on business continuity planning across various industries further strengthens market demand for diesel generators.

Environmental concerns present significant challenges to diesel generator market growth, with increasing focus on carbon emissions and air quality across GCC countries. Stricter environmental regulations and sustainability commitments create pressure to adopt cleaner alternatives. Fuel cost volatility affects operational economics, particularly for continuous-use applications where fuel expenses represent a substantial portion of total operating costs.

Maintenance complexity and skilled technician shortages limit market expansion in certain segments. The requirement for regular maintenance, spare parts availability, and technical expertise creates barriers for smaller organizations considering diesel generator investments. Noise pollution regulations in urban areas restrict installation options and require additional soundproofing investments.

Alternative technology competition from natural gas generators, solar-plus-storage systems, and battery backup solutions challenges traditional diesel generator applications. Initial capital costs for high-quality diesel generators can be substantial, particularly for larger installations requiring comprehensive power management systems.

Grid infrastructure improvements in some areas reduce the perceived need for backup power systems, potentially limiting market growth in well-served regions. Import dependency for most diesel generator components creates supply chain vulnerabilities and currency exchange risks for market participants.

Renewable energy integration creates substantial opportunities for diesel generators as backup power sources for solar and wind installations. The intermittent nature of renewable energy sources necessitates reliable backup systems, positioning diesel generators as complementary technologies rather than competitors. Hybrid system development combining diesel generators with renewable energy and battery storage presents innovative market opportunities.

Smart city initiatives across GCC countries offer significant growth potential for advanced diesel generator systems with IoT connectivity and remote monitoring capabilities. Data center expansion driven by digital transformation and cloud computing adoption creates high-value market segments requiring sophisticated power backup solutions.

Healthcare infrastructure development presents substantial opportunities, particularly in specialized medical facilities requiring uninterrupted power for critical equipment. Industrial zone development and manufacturing sector growth create demand for large-scale power generation solutions. Tourism sector expansion in countries like Saudi Arabia and UAE generates requirements for hospitality infrastructure with reliable power systems.

Technology advancement opportunities include developing more fuel-efficient engines, advanced control systems, and environmentally compliant solutions. Service market expansion through comprehensive maintenance contracts, remote monitoring services, and performance optimization programs offers recurring revenue opportunities.

Supply chain dynamics in the GCC diesel generator market reflect a complex interplay of international manufacturers, regional distributors, and local service providers. Market structure shows concentration among major international brands while regional players compete primarily on price and service quality. The dynamics favor companies with strong local presence and comprehensive after-sales support capabilities.

Demand patterns exhibit seasonal variations, with peak demand during summer months when air conditioning loads stress electrical grids. Procurement cycles often align with government budget allocations and major project timelines, creating predictable demand patterns for larger installations. Technology adoption rates vary significantly across different customer segments, with industrial users typically adopting advanced features more rapidly than residential customers.

Competitive dynamics emphasize differentiation through reliability, fuel efficiency, and service quality rather than price competition alone. Market entry barriers include substantial service infrastructure requirements, technical expertise needs, and established customer relationships. Innovation cycles focus on improving fuel efficiency, reducing emissions, and enhancing remote monitoring capabilities.

Customer behavior patterns show increasing sophistication in power system requirements, with growing demand for integrated solutions rather than standalone generators. Market maturity levels vary across GCC countries, with UAE and Saudi Arabia showing more mature markets compared to other regional economies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the GCC diesel generator market. Primary research includes structured interviews with industry executives, distributors, end-users, and regulatory officials across all six GCC countries. Survey methodologies capture quantitative data on market size, growth rates, and customer preferences.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and company financial statements. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability. Market modeling techniques incorporate economic indicators, demographic trends, and infrastructure development plans to project future market scenarios.

Regional analysis methodology accounts for country-specific factors including regulatory environments, economic conditions, and infrastructure development patterns. Segmentation analysis employs both top-down and bottom-up approaches to accurately assess market size and growth potential across different application categories and power rating segments.

Expert validation processes involve industry specialists reviewing findings and providing insights on market trends and future developments. Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current and relevant market intelligence.

Saudi Arabia dominates the GCC diesel generator market, accounting for approximately 35% of regional demand. The kingdom’s massive infrastructure development projects, including NEOM, Red Sea Project, and various industrial cities, drive substantial generator requirements. Market characteristics include strong government spending on infrastructure, growing private sector investment, and increasing focus on economic diversification.

United Arab Emirates represents the second-largest market with approximately 28% market share, driven by Dubai’s tourism expansion and Abu Dhabi’s industrial development. The country’s advanced infrastructure and business-friendly environment attract significant commercial and industrial investments requiring reliable power backup systems. Technology adoption rates in the UAE lead the region, with customers preferring advanced generator systems with smart monitoring capabilities.

Qatar shows strong market growth supported by ongoing World Cup infrastructure legacy projects and industrial expansion. The country’s focus on becoming a regional hub for various industries creates consistent demand for power backup solutions. Market penetration in Qatar emphasizes high-quality, reliable systems suitable for critical applications.

Kuwait, Oman, and Bahrain collectively represent smaller but growing markets with distinct characteristics. Kuwait’s industrial sector development and infrastructure modernization drive generator demand. Oman’s economic diversification initiatives and tourism development create new market opportunities. Bahrain’s financial sector growth and manufacturing development support steady market demand.

Market leadership in the GCC diesel generator market is characterized by strong competition among established international manufacturers and emerging regional players. Competitive positioning emphasizes reliability, fuel efficiency, comprehensive service networks, and local market knowledge as key differentiating factors.

Competitive strategies include expanding service networks, developing region-specific products, and forming strategic partnerships with local distributors. Market consolidation trends show larger companies acquiring regional players to strengthen market position and service capabilities.

Power Rating Segmentation reveals distinct market patterns across different capacity categories:

Application-based Segmentation shows diverse market requirements:

Fuel Type Segmentation encompasses various diesel fuel specifications and alternative fuel options compatible with diesel engines. Technology Segmentation includes conventional generators, hybrid systems, and smart generators with advanced monitoring capabilities.

Commercial Segment Analysis reveals strong growth driven by retail expansion, hospitality development, and office construction across GCC countries. Market dynamics in this segment emphasize reliability, fuel efficiency, and low maintenance requirements. Commercial customers increasingly prefer generators with automatic start capabilities and remote monitoring features.

Industrial Segment Characteristics show demand for high-capacity, continuous-duty generators capable of supporting manufacturing operations and process industries. Customer requirements focus on durability, fuel efficiency, and integration with existing power management systems. The segment shows 15% annual growth driven by industrial diversification initiatives.

Healthcare Segment Dynamics emphasize critical power requirements with zero tolerance for power interruptions. Regulatory compliance requirements drive demand for sophisticated generator systems with automatic transfer capabilities and comprehensive monitoring. This segment shows premium pricing acceptance for high-reliability solutions.

Data Center Segment Growth reflects digital transformation trends and cloud computing adoption across the region. Technical requirements include high reliability, precise load management, and integration with uninterruptible power supply systems. Market trends show increasing demand for modular generator solutions and N+1 redundancy configurations.

Residential Segment Evolution shows growing adoption in high-end residential developments and villa communities. Customer preferences emphasize quiet operation, automatic operation, and aesthetic considerations. The segment benefits from increasing awareness of power quality issues and lifestyle expectations.

Manufacturers benefit from strong market demand driven by economic diversification and infrastructure development across GCC countries. Revenue opportunities include equipment sales, spare parts, maintenance services, and extended warranty programs. The market offers potential for premium pricing on advanced technology solutions and comprehensive service packages.

Distributors and Dealers gain from expanding customer base and increasing demand for local service capabilities. Business opportunities include rental services, maintenance contracts, and parts distribution. The market rewards companies with strong local presence and technical expertise.

End Users benefit from improved power reliability, business continuity, and operational efficiency. Economic advantages include reduced downtime costs, improved productivity, and compliance with regulatory requirements. Advanced generator systems offer operational cost savings through improved fuel efficiency and reduced maintenance requirements.

Service Providers find opportunities in the growing demand for maintenance services, remote monitoring, and performance optimization. Market expansion in service segments offers recurring revenue streams and long-term customer relationships.

Government Stakeholders benefit from improved infrastructure resilience, economic development support, and enhanced public services reliability. Strategic advantages include reduced grid stress during peak demand periods and improved emergency preparedness capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology Integration Trends show increasing adoption of smart generators with IoT connectivity, remote monitoring capabilities, and predictive maintenance features. Customer preferences shift toward generators offering real-time performance data, automated diagnostics, and smartphone-based control interfaces. Market evolution indicates 42% of new installations now include advanced monitoring systems.

Fuel Efficiency Improvements represent a major trend driven by operating cost concerns and environmental considerations. Engine technology advances focus on optimizing fuel consumption while maintaining power output and reliability. Market adoption of high-efficiency generators shows accelerating growth as customers recognize long-term cost benefits.

Hybrid System Development emerges as a significant trend combining diesel generators with renewable energy sources and battery storage. Integration approaches include solar-diesel hybrid systems for remote locations and battery-diesel combinations for urban applications. Market interest in hybrid solutions grows as customers seek to balance reliability with environmental considerations.

Service Model Evolution shows transition from traditional maintenance contracts to comprehensive power management services. Service offerings expand to include performance optimization, fuel management, and guaranteed uptime agreements. Customer adoption of service-based models increases as organizations focus on core business activities.

Modular Design Trends gain traction for applications requiring scalable power solutions. Market demand for modular generators increases in data centers, industrial facilities, and temporary installations where power requirements may change over time.

Recent technological advancements include development of Tier 4 compliant engines meeting stricter emission standards while maintaining performance and reliability. Manufacturing innovations focus on improving fuel efficiency, reducing noise levels, and enhancing control system capabilities. MarkWide Research analysis indicates significant investment in R&D activities across major manufacturers.

Strategic partnerships between international manufacturers and regional distributors strengthen market presence and service capabilities. Acquisition activities show consolidation trends as larger companies expand their regional footprint through strategic purchases of local service providers and distributors.

Infrastructure investments by major manufacturers include establishing regional manufacturing facilities, expanding service centers, and developing training programs for local technicians. Market expansion initiatives focus on strengthening presence in emerging segments such as data centers and healthcare facilities.

Regulatory developments include updated building codes requiring backup power systems for critical facilities and new environmental standards affecting generator specifications. Government initiatives supporting economic diversification create new market opportunities while environmental regulations drive technology advancement.

Digital transformation initiatives by manufacturers include developing mobile applications for generator monitoring, implementing predictive maintenance algorithms, and creating customer portals for service management. Technology adoption accelerates as customers recognize the value of digital tools for power system management.

Strategic recommendations for market participants emphasize the importance of developing comprehensive service capabilities and local market expertise. Investment priorities should focus on expanding service networks, training technical personnel, and developing region-specific product offerings. Market positioning strategies should emphasize reliability, fuel efficiency, and comprehensive support rather than competing solely on price.

Technology development recommendations include investing in smart generator technologies, improving fuel efficiency, and developing hybrid system capabilities. Customer engagement strategies should focus on understanding specific regional requirements and developing customized solutions for different market segments.

Partnership strategies should emphasize building strong relationships with local distributors, service providers, and key customers. Market expansion approaches should consider country-specific factors including regulatory requirements, customer preferences, and competitive dynamics.

Service excellence initiatives should focus on developing predictive maintenance capabilities, expanding parts availability, and improving response times. Digital transformation investments should include customer-facing applications, remote monitoring systems, and data analytics capabilities.

Sustainability initiatives should address environmental concerns through cleaner engine technologies, hybrid system development, and comprehensive recycling programs. Market differentiation opportunities exist for companies demonstrating environmental responsibility while maintaining performance standards.

Long-term market prospects remain positive despite challenges from alternative technologies and environmental concerns. Growth projections indicate sustained demand driven by continued infrastructure development, industrial expansion, and increasing focus on power reliability. Market evolution will likely favor companies adapting to changing customer requirements and technological advancement.

Technology trends suggest continued development of more efficient, cleaner, and smarter generator systems. Integration opportunities with renewable energy and storage systems will create new market segments and applications. MWR projections indicate that hybrid systems could represent 25% of new installations within the next five years.

Regional development patterns show Saudi Arabia and UAE maintaining market leadership while other GCC countries experience accelerating growth. Infrastructure investments across the region will continue supporting market expansion, particularly in healthcare, data centers, and industrial applications.

Competitive landscape evolution will likely see increased consolidation and strategic partnerships as companies seek to strengthen market position and service capabilities. Market maturation will emphasize service quality, technology innovation, and customer relationships over traditional price competition.

Regulatory environment changes will continue influencing market dynamics, with environmental standards driving technology development and building codes supporting demand growth. Economic diversification initiatives across GCC countries will create new market opportunities while reducing dependence on oil-related industries.

Market assessment of the GCC diesel generator market reveals a dynamic and resilient industry positioned for continued growth despite evolving challenges and opportunities. Fundamental drivers including infrastructure development, industrial expansion, and power reliability requirements provide strong support for sustained market demand across all six GCC countries.

Strategic positioning for success in this market requires comprehensive understanding of regional characteristics, customer requirements, and technological trends. Market leaders will be those companies investing in service excellence, technology innovation, and local market expertise while adapting to changing environmental and regulatory requirements.

Future success factors include developing smart generator technologies, expanding hybrid system capabilities, and building comprehensive service networks. Market opportunities in emerging segments such as data centers, healthcare facilities, and smart city projects offer significant growth potential for well-positioned companies.

Overall outlook remains optimistic with the GCC diesel generator market expected to maintain steady growth supported by economic diversification initiatives, infrastructure development, and increasing focus on power reliability across the region. Companies adapting to market evolution while maintaining focus on reliability and service excellence are best positioned for long-term success in this important regional market.

What is Diesel Generator?

A diesel generator is a combination of a diesel engine and an electric generator, used to provide electrical power. They are commonly utilized in various applications, including construction sites, remote locations, and as backup power sources for businesses and homes.

What are the key players in the Gulf Cooperation Council (GCC) Diesel Generator Market?

Key players in the Gulf Cooperation Council (GCC) Diesel Generator Market include companies like Caterpillar, Cummins, and Perkins, which are known for their reliable and efficient diesel generator solutions. These companies focus on innovation and customer service to maintain their competitive edge, among others.

What are the drivers of growth in the Gulf Cooperation Council (GCC) Diesel Generator Market?

The growth of the Gulf Cooperation Council (GCC) Diesel Generator Market is driven by increasing demand for reliable power supply in construction, oil and gas, and telecommunications sectors. Additionally, the rise in infrastructure development and urbanization in the region further fuels this demand.

What challenges does the Gulf Cooperation Council (GCC) Diesel Generator Market face?

The Gulf Cooperation Council (GCC) Diesel Generator Market faces challenges such as stringent environmental regulations and the high cost of diesel fuel. Additionally, the growing shift towards renewable energy sources poses a challenge to the traditional diesel generator market.

What opportunities exist in the Gulf Cooperation Council (GCC) Diesel Generator Market?

Opportunities in the Gulf Cooperation Council (GCC) Diesel Generator Market include the increasing adoption of hybrid power systems and advancements in generator technology. The demand for backup power solutions in critical sectors like healthcare and data centers also presents significant growth potential.

What trends are shaping the Gulf Cooperation Council (GCC) Diesel Generator Market?

Trends shaping the Gulf Cooperation Council (GCC) Diesel Generator Market include the integration of IoT technology for remote monitoring and management, as well as a focus on fuel efficiency and emissions reduction. Additionally, there is a growing interest in sustainable practices and alternative fuels.

Gulf Cooperation Council (GCC) Diesel Generator Market

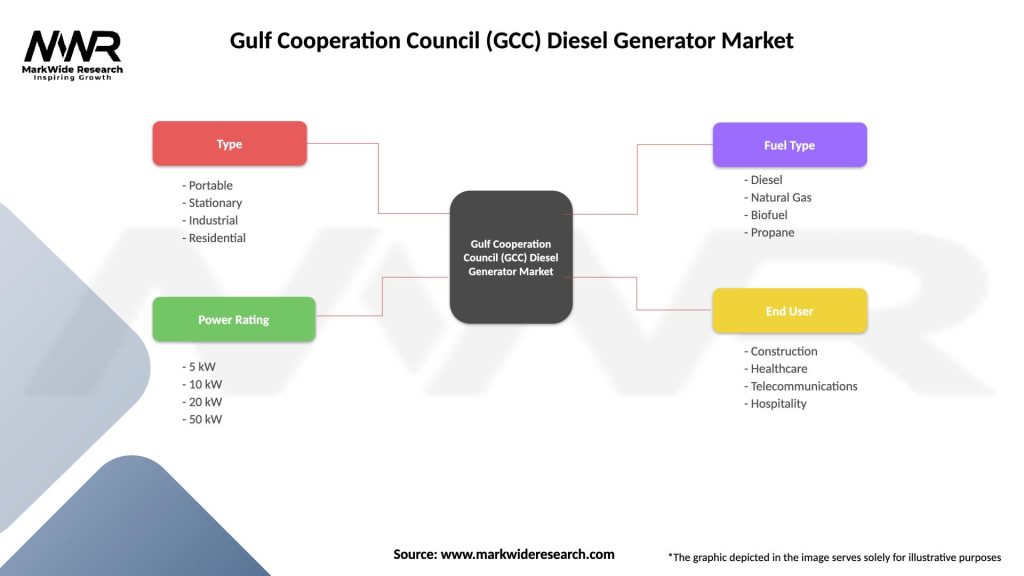

| Segmentation Details | Description |

|---|---|

| Type | Portable, Stationary, Industrial, Residential |

| Power Rating | 5 kW, 10 kW, 20 kW, 50 kW |

| Fuel Type | Diesel, Natural Gas, Biofuel, Propane |

| End User | Construction, Healthcare, Telecommunications, Hospitality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Gulf Cooperation Council (GCC) Diesel Generator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at