444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The GCC bottled water market refers to the production, distribution, and consumption of packaged drinking water within the Gulf Cooperation Council region, comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE). This market has experienced substantial growth due to various factors, including changing consumer preferences, increasing health consciousness, and the region’s harsh climatic conditions.

Meaning:

Bottled water in the GCC region refers to water that is sourced from natural springs, purified, and packaged in various sizes of bottles for convenient consumption. It serves as an alternative to tap water and provides consumers with a safe and reliable source of hydration.

Executive Summary:

The GCC bottled water market has witnessed robust growth in recent years, driven by factors such as growing urbanization, rising disposable incomes, and changing lifestyles. This report offers valuable insights into the market’s key drivers, restraints, opportunities, and dynamics, enabling industry participants and stakeholders to make informed decisions.

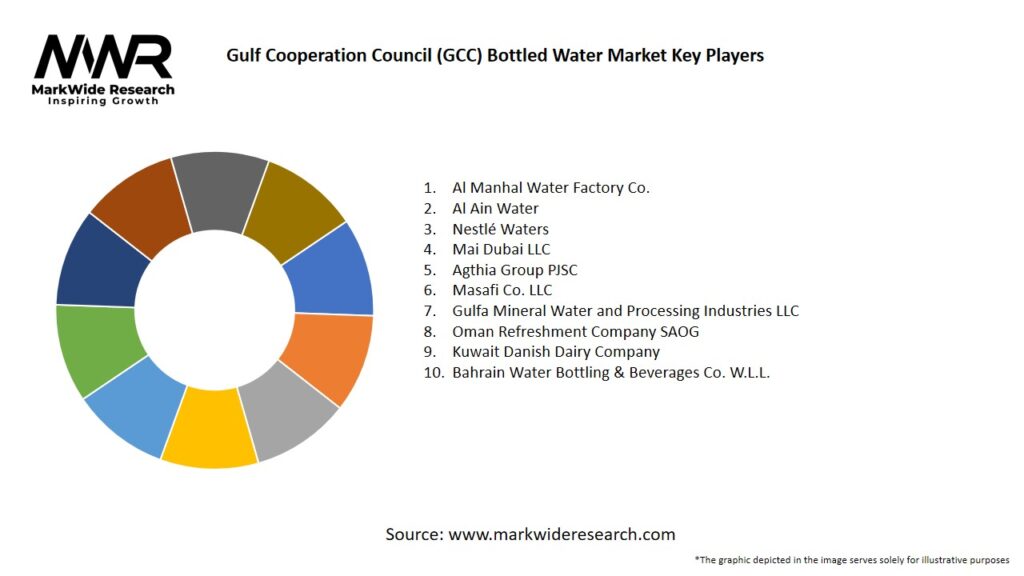

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Dynamics:

The GCC bottled water market is driven by a combination of demand and supply-side factors. Consumer preferences for safe and convenient hydration options, coupled with the region’s climatic conditions, act as key drivers. However, challenges related to plastic waste management and sustainability efforts pose significant restraints. The market dynamics are shaped by changing consumer behavior, evolving regulatory frameworks, and technological advancements in the bottling and packaging industry.

Regional Analysis:

Competitive Landscape:

Leading Companies in the Gulf Cooperation Council (GCC) Bottled Water Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The GCC bottled water market can be segmented based on packaging type, distribution channel, and product type. Packaging types include PET bottles, glass bottles, and others. Distribution channels comprise supermarkets/hypermarkets, convenience stores, online retail, and others. Product types include mineral water, purified water, flavored water, and functional water.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has had both positive and negative effects on the GCC bottled water market. Initially, there was a surge in demand for packaged water due to hygiene concerns. However, the closure of the HoReCa (Hotel/Restaurant/Café) sector and restrictions on outdoor activities impacted the market negatively. The market quickly adapted to the changing scenario by focusing on e-commerce channels and home delivery services.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The GCC bottled water market is expected to continue its growth trajectory in the coming years. Factors such as increasing population, urbanization, and tourism will drive market expansion. However, the industry will face challenges related to environmental sustainability and regulatory compliance. Market players that can effectively address these challenges while offering innovative products and sustainable packaging solutions are likely to gain a competitive advantage.

Conclusion:

The GCC bottled water market is witnessing significant growth due to changing consumer preferences, rising health consciousness, and favorable climatic conditions. While the market presents lucrative opportunities, it also poses challenges related to plastic waste and sustainability. By focusing on innovation, sustainability, and strategic collaborations, industry participants can capitalize on the growing demand for bottled water in the GCC region and ensure long-term success.

Gulf Cooperation Council (GCC) Bottled Water Market

| Segmentation Details | Description |

|---|---|

| Product Type | Spring Water, Mineral Water, Purified Water, Sparkling Water |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Vending Machines |

| Packaging Type | Plastic Bottles, Glass Bottles, Tetra Packs, Pouches |

| End User | Households, Offices, Restaurants, Events |

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at