444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Gulf Cooperation Council (GCC) frozen bakery products market refers to the industry that deals with the production and distribution of a wide range of frozen bakery products, including bread, cakes, pastries, and other baked goods. These products are manufactured, packaged, and stored under controlled temperatures to extend their shelf life and maintain their quality.

Meaning

Frozen bakery products are pre-baked goods that are frozen immediately after production, ensuring that they retain their freshness, taste, and texture when thawed and consumed. These products offer convenience to consumers as they can be stored for an extended period and quickly prepared whenever needed.

Executive Summary

The GCC frozen bakery products market has experienced significant growth in recent years due to changing consumer lifestyles, increasing urbanization, and a rising demand for convenience food products. The market has witnessed a shift in consumer preferences towards ready-to-eat and ready-to-bake products, driving the demand for frozen bakery items.

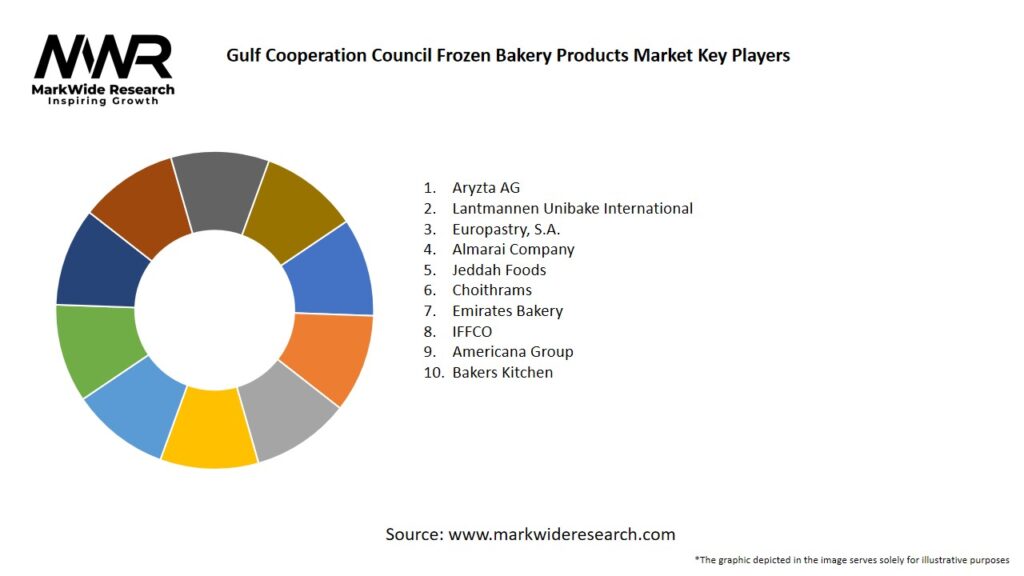

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC frozen bakery products market is characterized by intense competition among established players, who focus on product innovation, quality assurance, and marketing strategies to gain a competitive edge. Consumer preferences for premium and artisanal frozen bakery products are increasing, presenting opportunities for market players to differentiate themselves.

Regional Analysis

The GCC frozen bakery products market comprises the member countries of the Gulf Cooperation Council, including Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman. Among these, Saudi Arabia and the UAE dominate the market due to their larger consumer base, higher per capita income, and greater urbanization.

Competitive Landscape

Leading Companies in the Gulf Cooperation Council Frozen Bakery Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

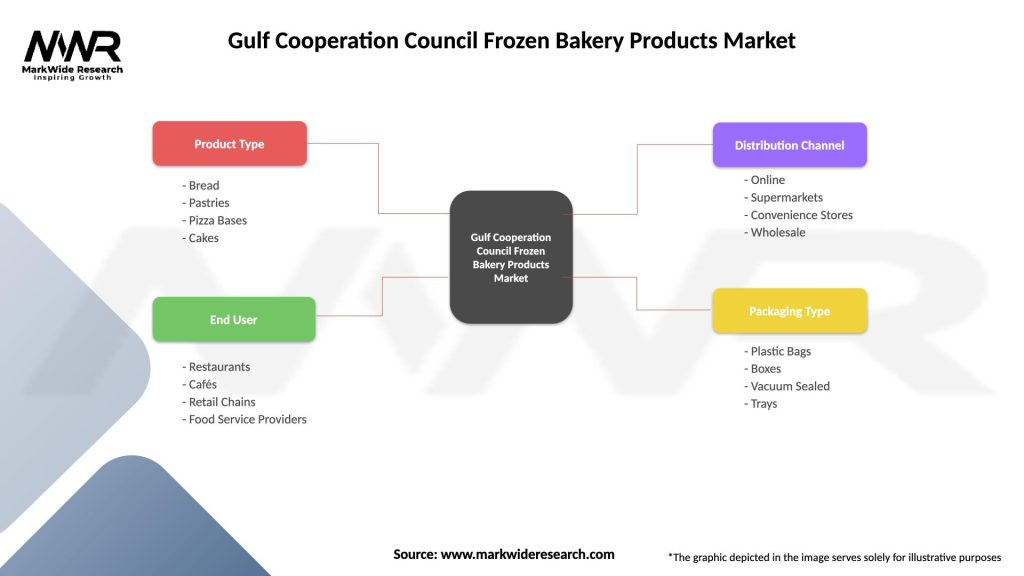

The GCC frozen bakery products market can be segmented based on product type, distribution channel, and end-use:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had both positive and negative effects on the GCC frozen bakery products market. On one hand, the market experienced increased demand as consumersturned to frozen bakery products for their longer shelf life and convenience during lockdowns and movement restrictions. On the other hand, disruptions in the supply chain and temporary closures of foodservice establishments impacted the market negatively.

Despite the challenges, the market showed resilience and adapted to the changing consumer behavior. Manufacturers implemented strict hygiene and safety measures to ensure the quality and safety of their products. Online retailing and home delivery services gained traction, allowing consumers to purchase frozen bakery products from the comfort of their homes.

Key Industry Developments

Analyst Suggestions

Future Outlook

The GCC frozen bakery products market is poised for steady growth in the coming years. The increasing urbanization, rising disposable incomes, and changing consumer preferences for convenience foods are expected to drive market expansion. Manufacturers will continue to focus on product innovation, quality assurance, and distribution channel optimization to stay competitive in the market.

Conclusion

The GCC frozen bakery products market is experiencing growth due to the rising demand for convenience foods and changing consumer lifestyles. With a wide range of product offerings, including bread, cakes, pastries, and pizza crusts, the market caters to diverse consumer preferences. Manufacturers, retailers, and consumers can benefit from the convenience and longer shelf life offered by frozen bakery products. Despite challenges posed by health concerns and fluctuating raw material prices, the market presents opportunities for innovation, expansion, and collaboration. With strategic initiatives and a focus on meeting consumer demands, the future outlook for the GCC frozen bakery products market remains positive.

What is Frozen Bakery Products?

Frozen Bakery Products refer to a variety of baked goods that are preserved through freezing, allowing for extended shelf life and convenience. These products include items such as bread, pastries, and cakes, which can be easily thawed and consumed by consumers and businesses alike.

What are the key players in the Gulf Cooperation Council Frozen Bakery Products Market?

Key players in the Gulf Cooperation Council Frozen Bakery Products Market include companies like Almarai, Bimbo Bakeries, and Aryzta, which are known for their extensive range of frozen baked goods. These companies compete on quality, variety, and distribution channels, among others.

What are the growth factors driving the Gulf Cooperation Council Frozen Bakery Products Market?

The growth of the Gulf Cooperation Council Frozen Bakery Products Market is driven by increasing consumer demand for convenience foods, the rise in the number of quick-service restaurants, and the growing trend of ready-to-eat meals. Additionally, the expansion of retail channels enhances product accessibility.

What challenges does the Gulf Cooperation Council Frozen Bakery Products Market face?

The Gulf Cooperation Council Frozen Bakery Products Market faces challenges such as fluctuating raw material prices, stringent food safety regulations, and competition from fresh bakery products. These factors can impact production costs and consumer preferences.

What opportunities exist in the Gulf Cooperation Council Frozen Bakery Products Market?

Opportunities in the Gulf Cooperation Council Frozen Bakery Products Market include the potential for product innovation, such as gluten-free and organic options, and the expansion into untapped markets. Additionally, increasing online sales channels present new avenues for growth.

What trends are shaping the Gulf Cooperation Council Frozen Bakery Products Market?

Trends shaping the Gulf Cooperation Council Frozen Bakery Products Market include a growing preference for healthier options, the incorporation of local flavors into frozen products, and advancements in freezing technology that enhance product quality and shelf life.

Gulf Cooperation Council Frozen Bakery Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bread, Pastries, Pizza Bases, Cakes |

| End User | Restaurants, Cafés, Retail Chains, Food Service Providers |

| Distribution Channel | Online, Supermarkets, Convenience Stores, Wholesale |

| Packaging Type | Plastic Bags, Boxes, Vacuum Sealed, Trays |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at