444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Guatemala container glass market represents a vital segment of the country’s manufacturing and packaging industry, serving diverse sectors including food and beverage, pharmaceuticals, cosmetics, and household products. Container glass manufacturing in Guatemala has experienced steady growth driven by increasing domestic consumption, export opportunities, and the rising demand for sustainable packaging solutions across Central America.

Market dynamics indicate robust expansion with the sector benefiting from Guatemala’s strategic geographic position, abundant raw materials, and growing industrial base. The market encompasses various glass container types including bottles, jars, vials, and specialty containers, with the food and beverage segment representing the largest application area. Growth projections suggest the market will expand at a 6.2% CAGR over the forecast period, supported by increasing urbanization and changing consumer preferences toward premium packaging.

Regional positioning plays a crucial role as Guatemala serves as a manufacturing hub for Central American markets, with local producers leveraging cost advantages and proximity to key export destinations. The market benefits from established supply chains, skilled workforce, and supportive government policies promoting industrial development and export growth.

The Guatemala container glass market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of glass containers within Guatemala’s borders, including both domestic manufacturing and import activities. This market involves the transformation of raw materials such as silica sand, soda ash, and limestone into various glass packaging solutions through advanced manufacturing processes.

Container glass specifically denotes hollow glass products designed for packaging applications, distinguished from flat glass or specialty glass products. The market includes primary packaging containers such as beverage bottles, food jars, pharmaceutical vials, cosmetic containers, and industrial glass packaging solutions. Manufacturing processes involve furnace operations, forming techniques, annealing procedures, and quality control measures ensuring product safety and performance standards.

Market scope extends beyond manufacturing to include supply chain management, distribution networks, recycling initiatives, and end-user applications across multiple industries. The ecosystem supports various stakeholders including raw material suppliers, equipment manufacturers, glass producers, packaging companies, and end-user industries requiring reliable container glass solutions.

Guatemala’s container glass market demonstrates strong fundamentals with consistent growth trajectory supported by diverse end-user applications and favorable market conditions. The sector benefits from established manufacturing capabilities, strategic location advantages, and increasing demand for sustainable packaging alternatives across regional markets.

Key market drivers include expanding food and beverage industry, growing pharmaceutical sector, rising consumer awareness regarding sustainable packaging, and increasing export opportunities to neighboring countries. The market shows particular strength in beer bottles, soft drink containers, and food preservation jars, with beverage applications accounting for approximately 68% market share of total container glass consumption.

Competitive landscape features both domestic manufacturers and international players, with local companies leveraging cost advantages and market knowledge while multinational corporations bring advanced technology and global best practices. Innovation trends focus on lightweight designs, improved barrier properties, enhanced recyclability, and customized solutions meeting specific customer requirements.

Future prospects remain positive with anticipated market expansion driven by infrastructure development, increasing industrial activity, and growing consumer preference for glass packaging over alternative materials. Sustainability initiatives and circular economy principles are expected to further boost market growth as environmental consciousness increases among consumers and businesses.

Strategic insights reveal several critical factors shaping Guatemala’s container glass market dynamics and future development trajectory:

Primary growth drivers propelling Guatemala’s container glass market expansion encompass multiple interconnected factors creating favorable conditions for sustained development:

Economic expansion serves as a fundamental driver with Guatemala’s growing GDP supporting increased consumer spending and industrial activity. Rising disposable incomes enable consumers to purchase premium products often packaged in glass containers, while expanding manufacturing sector creates demand for industrial packaging solutions.

Beverage industry growth represents the most significant market driver, with increasing consumption of beer, soft drinks, juices, and premium beverages requiring high-quality glass packaging. The sector benefits from both domestic consumption growth and export opportunities, with beverage packaging showing 8.5% annual growth in recent years.

Sustainability trends increasingly favor glass packaging as consumers and businesses prioritize environmentally responsible packaging choices. Glass containers offer superior recyclability, chemical inertness, and premium product positioning compared to alternative packaging materials, driving adoption across multiple sectors.

Food preservation requirements support demand for glass jars and containers, particularly in the growing processed food and specialty food segments. Glass packaging provides excellent barrier properties, extended shelf life, and maintains product quality, making it preferred choice for premium food products.

Pharmaceutical expansion creates specialized demand for pharmaceutical-grade glass containers, vials, and bottles meeting stringent quality and safety requirements. Guatemala’s growing pharmaceutical manufacturing sector requires reliable supply of high-quality glass packaging solutions.

Market challenges facing Guatemala’s container glass industry include several constraining factors that may impact growth trajectory and operational efficiency:

Energy costs represent a significant operational challenge as glass manufacturing requires substantial energy inputs for furnace operations and forming processes. Fluctuating energy prices and limited energy infrastructure can impact production costs and competitiveness, particularly affecting smaller manufacturers with less efficient equipment.

Transportation limitations pose logistical challenges due to the fragile nature of glass products requiring specialized handling and packaging. High transportation costs and infrastructure constraints can limit market reach and increase delivered product costs, particularly for export markets.

Competition from alternatives includes plastic containers, metal packaging, and flexible packaging solutions that may offer cost advantages or specific performance benefits for certain applications. Plastic packaging continues to capture 23% market share in segments where glass traditionally dominated, creating competitive pressure.

Raw material price volatility affects production costs and profitability, particularly for imported materials such as soda ash and specialized additives. Currency fluctuations and global supply chain disruptions can create cost uncertainties impacting business planning and pricing strategies.

Technical complexity of glass manufacturing requires specialized expertise, advanced equipment, and stringent quality control measures. High capital investment requirements and technical barriers may limit new market entrants and expansion opportunities for existing players.

Emerging opportunities within Guatemala’s container glass market present significant potential for growth and market expansion across multiple dimensions:

Export market expansion offers substantial growth potential as Guatemala’s strategic location and competitive manufacturing costs enable access to broader Central American, Caribbean, and North American markets. Regional trade agreements and improving logistics infrastructure support export-oriented growth strategies.

Premium packaging segments present opportunities for value-added products including specialty bottles, decorative containers, and custom-designed packaging solutions. Growing demand for premium beverages, artisanal foods, and luxury cosmetics creates market opportunities for differentiated glass packaging products.

Sustainable packaging initiatives align with global trends toward environmental responsibility, positioning glass containers as preferred choice for eco-conscious consumers and businesses. Circular economy principles and recycling programs create additional value streams and market positioning advantages.

Technology advancement opportunities include adoption of Industry 4.0 technologies, automated production systems, and advanced quality control measures. Digital transformation can enhance operational efficiency, product quality, and customer service capabilities, creating competitive advantages.

Pharmaceutical market growth presents specialized opportunities for high-value glass packaging solutions meeting stringent regulatory requirements. Guatemala’s expanding pharmaceutical manufacturing sector and potential for contract manufacturing services create demand for specialized glass containers.

Market dynamics in Guatemala’s container glass sector reflect complex interactions between supply-side capabilities, demand-side requirements, and external environmental factors shaping industry evolution:

Supply chain integration has become increasingly sophisticated with manufacturers developing closer relationships with raw material suppliers, equipment providers, and end-user customers. Vertical integration strategies enable better cost control, quality assurance, and supply chain reliability, with integrated operations showing 15% efficiency improvements compared to fragmented supply chains.

Demand patterns show increasing sophistication with customers requiring customized solutions, shorter lead times, and enhanced service levels. Just-in-time delivery requirements and inventory optimization strategies drive manufacturers to develop more flexible and responsive production capabilities.

Technology evolution continues transforming manufacturing processes with advanced furnace designs, automated handling systems, and real-time quality monitoring capabilities. Digital technologies enable predictive maintenance, process optimization, and enhanced customer communication, improving overall operational performance.

Regulatory environment influences market dynamics through food safety requirements, environmental regulations, and trade policies. Compliance requirements drive investment in quality systems and environmental management while creating barriers for non-compliant competitors.

Competitive intensity varies across market segments with commodity products facing price-based competition while specialty and premium segments offer opportunities for differentiation and value-based pricing strategies.

Comprehensive research approach employed for analyzing Guatemala’s container glass market incorporates multiple data sources, analytical techniques, and validation methods ensuring accuracy and reliability of market insights:

Primary research activities include structured interviews with industry executives, manufacturers, distributors, and end-user companies across Guatemala’s container glass value chain. Survey methodologies capture quantitative data on production volumes, market shares, pricing trends, and growth projections from key market participants.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements providing comprehensive market context and historical trend analysis. Database analysis includes examination of import/export statistics, production data, and consumption patterns across different market segments.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and growth projections. Econometric models incorporate macroeconomic indicators, industry-specific variables, and external factors influencing market development.

Validation processes include cross-referencing multiple data sources, expert consultations, and market participant feedback ensuring data accuracy and insight reliability. Quality assurance measures include peer review, data triangulation, and sensitivity analysis validating research conclusions and recommendations.

Geographic distribution of Guatemala’s container glass market reveals distinct regional patterns reflecting industrial concentration, infrastructure development, and market access considerations:

Guatemala City metropolitan area dominates market activity with the highest concentration of manufacturing facilities, distribution centers, and end-user industries. The region benefits from superior infrastructure, skilled workforce availability, and proximity to major consumption centers, accounting for approximately 45% of national production capacity.

Escuintla region serves as a secondary manufacturing hub with several major glass production facilities leveraging port access for raw material imports and finished product exports. The area’s industrial infrastructure and logistics advantages support both domestic and export-oriented operations.

Quetzaltenango province represents an emerging market area with growing industrial activity and increasing demand for container glass products. The region’s agricultural processing industries and beverage manufacturers create steady demand for glass packaging solutions.

Northern regions including Alta Verapaz and Petén show developing market potential with expanding agricultural and food processing activities requiring packaging solutions. Infrastructure development and industrial growth in these areas present future market expansion opportunities.

Border regions benefit from cross-border trade opportunities with Mexico, Belize, Honduras, and El Salvador. Export activities from these regions account for approximately 28% of total glass container shipments, highlighting the importance of regional trade relationships.

Competitive environment in Guatemala’s container glass market features diverse players ranging from large-scale manufacturers to specialized producers serving niche market segments:

Market positioning strategies vary significantly with larger players emphasizing scale advantages, product breadth, and service capabilities while smaller manufacturers focus on specialization, flexibility, and niche market expertise. Technology investments and operational efficiency improvements represent key competitive differentiators across all market segments.

Strategic partnerships and customer relationships play crucial roles in competitive success, with leading companies developing long-term supply agreements and collaborative product development programs with major customers. Innovation capabilities and technical expertise increasingly determine competitive positioning in premium market segments.

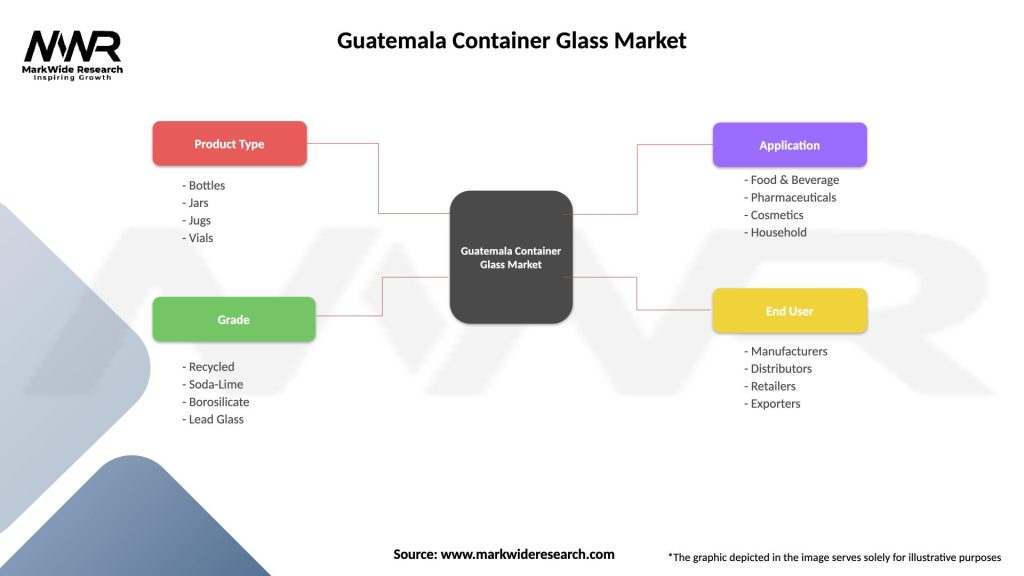

Market segmentation analysis reveals distinct categories within Guatemala’s container glass market based on product type, application, and end-user industry characteristics:

By Product Type:

By Application:

By Manufacturing Process:

Beverage containers dominate Guatemala’s container glass market with beer bottles representing the single largest product category. Local brewery demand drives consistent volume requirements while export opportunities to regional markets support growth expansion. The segment benefits from established customer relationships, standardized products, and economies of scale in production.

Food packaging applications show steady growth driven by expanding processed food industry and increasing consumer preference for glass containers in food preservation. Specialty food products including sauces, preserves, and gourmet items create demand for premium glass packaging solutions with custom designs and enhanced functionality.

Pharmaceutical glass containers represent a high-value market segment with stringent quality requirements and specialized manufacturing processes. Regulatory compliance and quality certifications create barriers to entry while ensuring stable margins for qualified suppliers. The segment shows 12% annual growth driven by expanding pharmaceutical manufacturing in Guatemala.

Cosmetic and personal care packaging emphasizes design innovation, premium aesthetics, and functional performance. This segment requires close collaboration with customers on product development and often involves smaller production runs with higher unit values. Brand differentiation through unique packaging designs drives demand for customized glass solutions.

Industrial applications include chemical containers, laboratory glassware, and specialty industrial packaging requiring specific performance characteristics such as chemical resistance, temperature tolerance, or specialized closure systems. This segment offers opportunities for technical innovation and value-added solutions.

Manufacturers in Guatemala’s container glass market benefit from several competitive advantages including access to abundant raw materials, strategic geographic location, and established industrial infrastructure. Cost advantages relative to developed markets enable competitive pricing while maintaining acceptable profit margins across diverse product categories.

End-user industries benefit from reliable local supply sources, reduced transportation costs, and responsive customer service from domestic manufacturers. Supply chain efficiency improvements and reduced inventory requirements enable better working capital management and operational flexibility for customer companies.

Export customers gain access to cost-effective glass packaging solutions with competitive pricing and reliable delivery performance. Quality standards meeting international requirements ensure product acceptability in export markets while competitive costs support market penetration strategies.

Local communities benefit from employment opportunities, skill development programs, and economic multiplier effects from glass manufacturing operations. Environmental benefits include recycling programs, waste reduction initiatives, and sustainable manufacturing practices supporting community environmental goals.

Government stakeholders benefit from industrial development, export earnings, tax revenues, and technology transfer associated with container glass manufacturing. Economic development initiatives supported by the industry contribute to broader industrialization and economic diversification objectives.

Supply chain partners including raw material suppliers, equipment manufacturers, and logistics providers benefit from stable demand, long-term relationships, and opportunities for business expansion within the growing container glass ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping Guatemala’s container glass market with manufacturers implementing comprehensive environmental management systems and circular economy principles. Recycling programs and closed-loop manufacturing processes are becoming standard practices, with recycled content in new glass products reaching 35% average levels across the industry.

Lightweight design innovation continues advancing with manufacturers developing thinner wall containers maintaining structural integrity while reducing material usage and transportation costs. Weight reduction initiatives have achieved 18% average weight savings in beverage bottles over the past five years without compromising performance or safety standards.

Customization and personalization trends drive demand for unique packaging solutions enabling brand differentiation and consumer engagement. Digital printing technologies and advanced decoration techniques enable cost-effective customization for smaller production runs and seasonal campaigns.

Smart packaging integration includes incorporation of digital technologies such as QR codes, NFC tags, and temperature indicators providing enhanced functionality and consumer interaction capabilities. Connected packaging solutions create new value propositions for premium product segments.

Automation advancement encompasses implementation of robotic systems, automated quality control, and predictive maintenance technologies improving operational efficiency and product consistency. Industry 4.0 adoption enables real-time monitoring, data analytics, and optimized production planning.

Premium positioning strategies focus on developing high-value products for luxury beverages, artisanal foods, and premium cosmetics requiring superior aesthetics, functionality, and performance characteristics.

Recent industry developments highlight significant progress in technology adoption, market expansion, and operational improvements across Guatemala’s container glass sector:

Manufacturing modernization initiatives include major capital investments in advanced furnace technology, automated production lines, and quality control systems. Several manufacturers have completed facility upgrades incorporating energy-efficient equipment and environmental management systems improving both operational performance and sustainability credentials.

Market expansion projects focus on developing new customer relationships in export markets and expanding product portfolios to serve emerging application areas. Strategic partnerships with regional distributors and end-user companies support market penetration and customer service enhancement initiatives.

Technology partnerships with international equipment suppliers and technology providers enable access to advanced manufacturing capabilities and technical expertise. Knowledge transfer programs and technical training initiatives enhance local capabilities and operational excellence.

Sustainability programs include implementation of comprehensive recycling systems, energy efficiency improvements, and waste reduction initiatives. Environmental certifications and compliance programs ensure adherence to international standards and customer requirements.

Product innovation activities focus on developing specialized containers for pharmaceutical applications, premium beverage packaging, and custom solutions for industrial customers. Research and development investments support continuous improvement and market differentiation strategies.

Strategic recommendations for Guatemala’s container glass market participants emphasize leveraging competitive advantages while addressing key challenges and market opportunities:

Technology investment priorities should focus on energy-efficient manufacturing equipment, automated quality control systems, and digital technologies enabling operational excellence and cost competitiveness. MarkWide Research analysis indicates that manufacturers implementing comprehensive technology upgrades achieve 22% productivity improvements and enhanced market positioning.

Market diversification strategies should emphasize developing capabilities in high-value segments such as pharmaceutical containers, premium beverage packaging, and specialty industrial applications. Value-added services including custom design, technical support, and supply chain integration create competitive differentiation and customer loyalty.

Export market development requires systematic approach including market research, customer relationship building, quality certifications, and logistics optimization. Regional trade opportunities within Central America and Caribbean markets offer accessible expansion targets with cultural and business familiarity advantages.

Sustainability leadership positions companies favorably for future market requirements and customer preferences. Environmental management systems, recycling programs, and energy efficiency initiatives create both cost savings and market positioning advantages.

Workforce development investments in technical training, safety programs, and skill enhancement ensure operational excellence and support business growth objectives. Human capital development creates sustainable competitive advantages and operational reliability.

Long-term prospects for Guatemala’s container glass market remain positive with multiple growth drivers supporting sustained expansion and market development over the forecast period:

Market expansion is expected to continue with projected growth rates of 6.8% annually driven by increasing domestic consumption, export opportunities, and industrial development. Economic growth and rising consumer spending support demand across all major application segments with particular strength in beverage and food packaging categories.

Technology evolution will continue transforming manufacturing processes with advanced automation, energy efficiency improvements, and quality enhancement systems becoming standard industry practices. Digital transformation initiatives will enable better customer service, supply chain optimization, and operational excellence.

Sustainability requirements will increasingly influence market dynamics with glass packaging benefiting from superior environmental profile compared to alternative materials. Circular economy principles and recycling programs will create additional value streams and competitive advantages for industry participants.

Regional integration opportunities through trade agreements and economic cooperation initiatives will expand market access and growth potential. MWR projections indicate that export markets could account for 42% of total production within the next decade, highlighting the importance of regional market development strategies.

Innovation opportunities in smart packaging, premium products, and specialized applications will create new market segments and value propositions. Customer collaboration and technical innovation will drive product development and market differentiation strategies.

Guatemala’s container glass market presents compelling opportunities for sustained growth and development supported by favorable market fundamentals, competitive advantages, and positive industry trends. The market benefits from abundant raw materials, strategic geographic location, established manufacturing capabilities, and growing demand across multiple end-user segments.

Key success factors include technology adoption, operational excellence, market diversification, and sustainability leadership enabling companies to capitalize on emerging opportunities while addressing competitive challenges. Export market development and premium segment positioning offer particular potential for value creation and business expansion.

Industry outlook remains positive with projected growth supported by economic development, increasing consumer spending, and favorable trends toward sustainable packaging solutions. Strategic investments in technology, workforce development, and market expansion will determine competitive success and long-term sustainability in this dynamic market environment.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

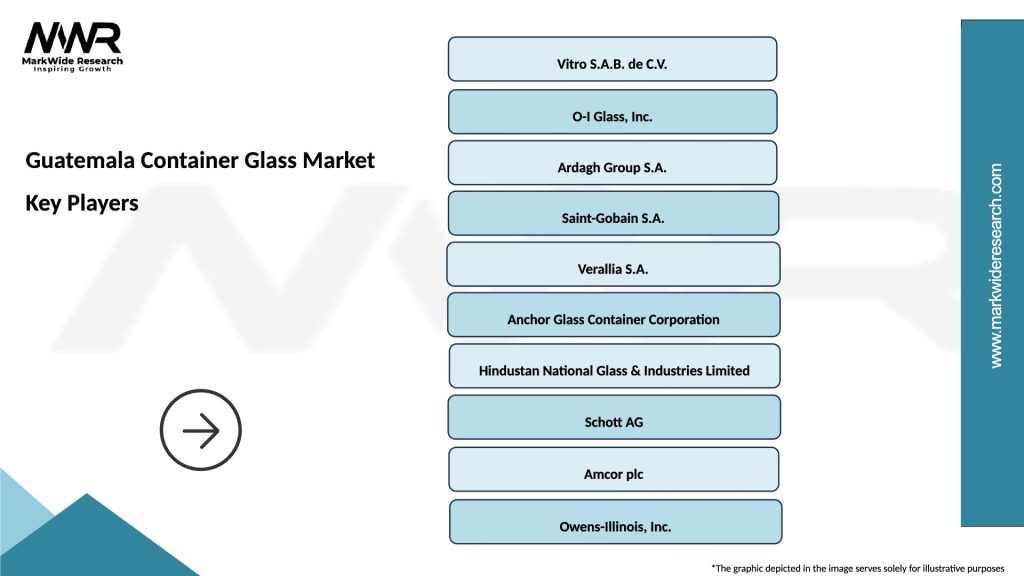

What are the key players in the Guatemala Container Glass Market?

Key players in the Guatemala Container Glass Market include Vitro, O-I Glass, and Grupo Modelo, which are involved in the production and distribution of container glass products for various industries, among others.

What are the growth factors driving the Guatemala Container Glass Market?

The Guatemala Container Glass Market is driven by increasing demand for sustainable packaging solutions, the growth of the beverage industry, and rising consumer preferences for glass over plastic due to health and environmental concerns.

What challenges does the Guatemala Container Glass Market face?

Challenges in the Guatemala Container Glass Market include high production costs, competition from alternative packaging materials, and the need for significant energy consumption during manufacturing processes.

What opportunities exist in the Guatemala Container Glass Market?

Opportunities in the Guatemala Container Glass Market include the expansion of the e-commerce sector, which increases demand for safe packaging, and innovations in glass recycling technologies that enhance sustainability.

What trends are shaping the Guatemala Container Glass Market?

Trends in the Guatemala Container Glass Market include a shift towards lightweight glass packaging, the introduction of decorative glass containers, and increased investment in eco-friendly production methods.

Guatemala Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| Grade | Recycled, Soda-Lime, Borosilicate, Lead Glass |

| Application | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| End User | Manufacturers, Distributors, Retailers, Exporters |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Guatemala Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at