444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Guatemala construction market represents a dynamic and evolving sector that plays a crucial role in the country’s economic development. This Central American nation has experienced significant infrastructure development over the past decade, driven by urbanization trends, government investment initiatives, and growing private sector participation. Market dynamics indicate robust growth potential across residential, commercial, and infrastructure segments, with construction activities expanding at a steady pace of 6.2% annually.

Infrastructure development remains a primary catalyst for market expansion, with major projects spanning transportation networks, energy facilities, and urban development initiatives. The construction sector contributes substantially to Guatemala’s GDP, supporting employment generation and economic diversification efforts. Regional analysis reveals concentrated activity in Guatemala City and surrounding metropolitan areas, while rural infrastructure projects continue gaining momentum through government-backed programs.

Investment patterns show increasing foreign direct investment in construction projects, particularly in commercial real estate and industrial facilities. The market demonstrates resilience despite regional economic challenges, with construction companies adapting to evolving regulatory frameworks and sustainability requirements. Technology adoption in construction processes has accelerated, with approximately 35% of major contractors implementing digital project management systems and modern construction methodologies.

The Guatemala construction market refers to the comprehensive ecosystem of building and infrastructure development activities within Guatemala’s borders, encompassing residential housing, commercial buildings, industrial facilities, and public infrastructure projects. This market includes all stakeholders involved in planning, designing, constructing, and maintaining built environments across the country.

Market scope extends beyond traditional construction activities to include related services such as architectural design, engineering consulting, project management, and specialized trades. The sector encompasses both formal construction companies operating under established regulatory frameworks and informal construction activities that serve local communities. Economic significance of this market lies in its multiplier effect on related industries including cement, steel, construction materials, and professional services.

Regulatory environment shapes market operations through building codes, environmental regulations, and safety standards that govern construction practices. The market operates within Guatemala’s broader economic context, influenced by factors such as currency stability, interest rates, and government fiscal policies that affect construction financing and project viability.

Guatemala’s construction market demonstrates strong fundamentals supported by demographic trends, urbanization pressures, and infrastructure investment needs. The sector has maintained consistent growth momentum, with construction activities expanding across multiple segments including residential development, commercial projects, and public infrastructure initiatives. Market performance reflects the country’s economic stability and growing investor confidence in Guatemala’s long-term development prospects.

Key growth drivers include population growth, urban migration patterns, and government infrastructure spending programs that address critical development gaps. The residential segment shows particular strength, driven by housing demand from Guatemala’s growing middle class and urban population. Commercial construction benefits from retail expansion, office development, and industrial facility requirements supporting Guatemala’s manufacturing and export sectors.

Competitive landscape features a mix of established local construction companies and international firms participating in major infrastructure projects. Market consolidation trends indicate increasing professionalization of the construction industry, with larger firms gaining market share through superior project execution capabilities and financial resources. Future outlook remains positive, supported by continued economic growth and infrastructure development priorities.

Strategic analysis reveals several critical insights that define Guatemala’s construction market dynamics and future trajectory:

Population growth serves as a fundamental driver for Guatemala’s construction market, creating sustained demand for residential housing, educational facilities, healthcare infrastructure, and commercial services. The country’s demographic profile, with a significant portion of the population under 30 years old, generates long-term construction demand as this population enters prime home-buying and family-formation years.

Economic development initiatives drive infrastructure construction requirements, including transportation networks, energy generation facilities, and telecommunications infrastructure. Government investment in public works projects creates substantial construction opportunities while supporting broader economic development objectives. Private sector growth in manufacturing, agriculture processing, and services sectors generates demand for industrial and commercial construction projects.

Urbanization trends accelerate construction demand in Guatemala’s major cities, requiring residential developments, commercial centers, and supporting infrastructure. Rural-to-urban migration patterns create concentrated construction needs in metropolitan areas while generating opportunities for rural infrastructure development. Foreign investment in Guatemala’s economy brings international construction standards and financing for major development projects.

Regional integration through Central American trade agreements and infrastructure connectivity projects drives cross-border construction initiatives. Tourism sector development creates demand for hospitality construction, resort development, and supporting infrastructure that enhances Guatemala’s tourism competitiveness.

Financing constraints represent a significant challenge for Guatemala’s construction market, with limited access to long-term construction financing affecting project development timelines and scope. High interest rates and stringent lending requirements restrict construction project feasibility, particularly for smaller developers and residential projects targeting middle-income segments.

Regulatory complexity creates barriers to construction project implementation, with bureaucratic processes, permit delays, and compliance requirements increasing project costs and timelines. Inconsistent enforcement of building codes and safety standards creates market uncertainty while potentially compromising construction quality and safety outcomes.

Skills shortage in specialized construction trades limits market growth potential, with insufficient technical education programs and workforce development initiatives failing to meet industry demands. Limited availability of skilled construction workers affects project quality, safety standards, and completion timelines across all construction segments.

Material costs volatility impacts construction project economics, with imported construction materials subject to currency fluctuations and supply chain disruptions. Limited local manufacturing capacity for specialized construction materials creates dependency on imports and increases project cost uncertainty.

Infrastructure limitations in transportation and utilities constrain construction project development in certain regions, while inadequate access to reliable electricity and water services affects construction site operations and project feasibility.

Infrastructure modernization presents substantial opportunities for construction companies specializing in transportation, energy, and telecommunications projects. Guatemala’s infrastructure development needs create long-term construction demand supported by government investment programs and international development financing initiatives.

Affordable housing development represents a significant market opportunity, with substantial unmet demand for quality housing accessible to Guatemala’s growing middle class. Government housing programs and innovative financing mechanisms create opportunities for residential construction companies to serve underserved market segments.

Industrial construction opportunities emerge from Guatemala’s manufacturing sector growth, nearshoring trends, and export-oriented industrial development. Construction of manufacturing facilities, warehouses, and logistics infrastructure supports Guatemala’s position as a regional manufacturing and distribution hub.

Sustainable construction practices adoption creates opportunities for companies specializing in green building technologies, energy-efficient construction methods, and environmentally responsible development practices. Growing awareness of sustainability issues drives demand for construction solutions that minimize environmental impact.

Technology integration in construction processes offers opportunities for companies that embrace digital project management, building information modeling, and advanced construction methodologies. Smart building technologies and automated construction systems represent emerging opportunities for forward-thinking construction firms.

Supply and demand dynamics in Guatemala’s construction market reflect the interplay between economic growth, demographic trends, and infrastructure development needs. Construction demand consistently outpaces supply capacity in key segments, creating opportunities for market expansion while highlighting capacity constraints that limit growth potential.

Competitive dynamics show increasing market concentration among larger construction firms, while smaller companies focus on specialized niches and local market segments. International construction companies entering the Guatemalan market bring advanced technologies and project management capabilities, intensifying competition while raising industry standards.

Pricing dynamics reflect material cost fluctuations, labor availability, and project complexity factors that influence construction project economics. Market pricing shows regional variations based on local economic conditions, infrastructure availability, and competitive intensity in specific geographic markets.

Regulatory dynamics continue evolving as Guatemala modernizes its construction codes, safety standards, and environmental regulations. These changes create both challenges and opportunities for construction companies adapting to new requirements while potentially raising barriers for less sophisticated market participants.

Technology dynamics accelerate as construction companies recognize the competitive advantages of digital project management, advanced construction methods, and sustainable building practices. According to MarkWide Research analysis, technology adoption in construction processes shows measurable productivity improvements and project outcome enhancements.

Comprehensive analysis of Guatemala’s construction market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with construction industry executives, government officials, and key stakeholders across the construction value chain to gather firsthand perspectives on market conditions and trends.

Secondary research incorporates analysis of government construction statistics, industry reports, economic indicators, and regulatory documents that provide quantitative foundations for market assessment. Construction permit data, employment statistics, and economic indicators offer measurable insights into market performance and growth trajectories.

Field research involves site visits to major construction projects, interviews with construction workers and site managers, and direct observation of construction practices and technologies in use across different market segments. This approach provides practical insights into operational realities and implementation challenges.

Stakeholder analysis includes perspectives from construction companies, material suppliers, financial institutions, regulatory agencies, and end-users to develop comprehensive understanding of market dynamics and interdependencies. Expert interviews with industry professionals provide qualitative insights that complement quantitative data analysis.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical verification, and expert review of findings and conclusions. Ongoing market monitoring maintains current perspectives on rapidly evolving market conditions and emerging trends.

Guatemala City metropolitan area dominates the national construction market, accounting for approximately 45% of total construction activity across all segments. This concentration reflects the capital’s role as the economic and administrative center, driving demand for office buildings, residential developments, retail centers, and supporting infrastructure. Commercial construction shows particular strength in Guatemala City, with modern office complexes and shopping centers meeting growing business and consumer demands.

Quetzaltenango region represents the second-largest construction market, benefiting from its position as Guatemala’s commercial and industrial hub outside the capital. Manufacturing facility construction and residential development support the region’s economic growth, while infrastructure projects enhance connectivity to national and international markets.

Escuintla province shows significant construction activity driven by its strategic location along major transportation corridors and proximity to Pacific ports. Industrial construction dominates this region, with manufacturing facilities, logistics centers, and energy infrastructure projects supporting Guatemala’s export economy.

Northern regions including Petén show emerging construction opportunities related to tourism development, agricultural processing facilities, and infrastructure projects that improve regional connectivity. These areas represent growth frontiers for construction companies willing to operate in less developed markets.

Coastal regions along both Pacific and Caribbean coasts demonstrate construction potential in tourism infrastructure, port facilities, and residential developments that capitalize on Guatemala’s natural attractions and strategic location for regional trade.

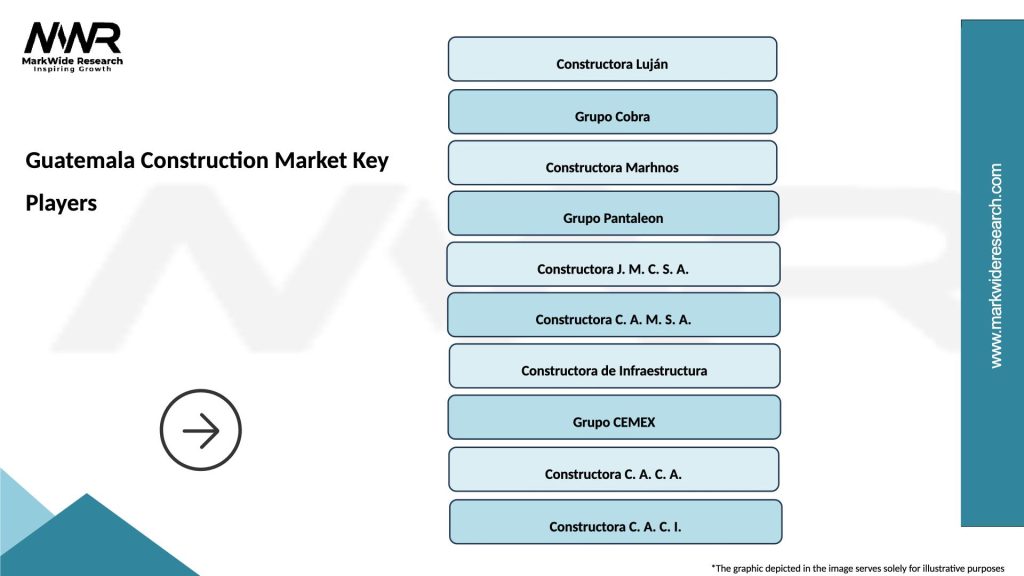

Market leadership in Guatemala’s construction sector includes both established local companies and international firms participating in major infrastructure and development projects:

Competitive strategies focus on project execution capabilities, financial strength, and technological advancement that enable companies to secure major contracts and deliver complex projects successfully. Market differentiation occurs through specialized expertise, safety records, and ability to manage large-scale construction projects.

Market consolidation trends show larger construction companies gaining market share through acquisitions, strategic partnerships, and superior project management capabilities. International firms bring advanced construction technologies and project financing capabilities that enhance competitive positioning.

By Construction Type:

By End-User:

By Project Size:

Residential Construction represents the largest segment of Guatemala’s construction market, driven by population growth, urbanization, and housing demand from the expanding middle class. This category shows consistent growth with approximately 40% of total construction activity, encompassing everything from luxury developments to affordable housing projects. Housing finance improvements and government programs support market expansion while addressing Guatemala’s substantial housing deficit.

Infrastructure Construction demonstrates significant growth potential, supported by government investment priorities and international development financing. Transportation infrastructure, including roads, bridges, and airports, receives substantial investment attention. Energy infrastructure projects, including renewable energy facilities and transmission networks, represent emerging opportunities within this category.

Commercial Construction benefits from Guatemala’s economic growth and business sector expansion, with office buildings, retail centers, and hospitality projects driving market activity. Modern retail formats and international business presence create demand for contemporary commercial construction that meets international standards.

Industrial Construction supports Guatemala’s manufacturing sector growth and export economy development. Manufacturing facilities, logistics centers, and processing plants represent key opportunities within this category. Nearshoring trends and regional manufacturing growth create additional demand for specialized industrial construction services.

Construction Companies benefit from diverse market opportunities across residential, commercial, and infrastructure segments that provide revenue diversification and growth potential. The market offers opportunities for both specialized niche players and diversified construction firms to establish sustainable competitive positions.

Material Suppliers gain from sustained construction demand that supports consistent sales volumes and market expansion opportunities. Local material suppliers benefit from import substitution trends, while international suppliers access growing market demand for specialized construction materials.

Financial Institutions find opportunities in construction project financing, equipment leasing, and real estate development lending that support portfolio diversification and revenue growth. Improved construction industry professionalization enhances credit quality and reduces lending risks.

Government Entities achieve development objectives through construction industry growth that supports employment generation, tax revenue, and infrastructure development. Construction sector expansion contributes to broader economic development goals and social progress indicators.

International Investors access Guatemala’s construction market through direct investment, joint ventures, and project financing that provide exposure to Central American economic growth. MWR analysis indicates growing international investor interest in Guatemala’s construction and real estate sectors.

End Users benefit from improved construction quality, expanded housing options, and enhanced infrastructure that supports quality of life improvements and economic opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Construction practices gain momentum as environmental awareness increases and green building standards become more prevalent. Construction companies increasingly adopt sustainable materials, energy-efficient designs, and environmentally responsible construction methods that reduce environmental impact while meeting growing demand for sustainable buildings.

Technology Integration accelerates across Guatemala’s construction industry, with digital project management systems, building information modeling, and advanced construction equipment improving project efficiency and quality. Smart building technologies and automated construction processes represent emerging trends that enhance construction capabilities.

Modular Construction methods gain acceptance as construction companies seek to improve project timelines, quality control, and cost efficiency. Prefabricated construction components and modular building systems offer advantages in both residential and commercial construction applications.

Public-Private Partnerships become increasingly important for major infrastructure projects, combining government development priorities with private sector efficiency and financing capabilities. These partnerships enable larger-scale infrastructure development while sharing risks and responsibilities between public and private stakeholders.

Regional Specialization emerges as construction companies focus on specific geographic markets or construction types where they can develop competitive advantages and specialized expertise. This trend supports market efficiency while enabling companies to build strong regional market positions.

Infrastructure Investment Programs launched by the Guatemalan government create substantial construction opportunities across transportation, energy, and social infrastructure sectors. These programs represent multi-year commitments that provide construction industry visibility and planning certainty for major projects.

Building Code Modernization initiatives update Guatemala’s construction standards to incorporate international best practices, safety requirements, and sustainability considerations. These regulatory improvements enhance construction quality while creating adaptation challenges for construction companies.

Construction Technology Centers established in major cities provide training and technology transfer services that support construction industry modernization and workforce development. These initiatives address skills gaps while promoting advanced construction methodologies.

International Construction Partnerships bring foreign expertise, financing, and technology to Guatemala’s construction market through joint ventures and strategic alliances. These partnerships enhance local construction capabilities while providing access to international markets and standards.

Sustainable Building Certification Programs introduced in Guatemala promote green construction practices and environmental responsibility. These programs create market differentiation opportunities for construction companies that embrace sustainable building practices.

Market Entry Strategies for new construction companies should focus on specialized niches or underserved geographic markets where competitive intensity remains manageable. Companies should develop strong local partnerships and understand regulatory requirements before committing significant resources to market entry.

Technology Investment represents a critical success factor for construction companies seeking competitive advantages in Guatemala’s evolving market. Companies should prioritize digital project management systems, advanced construction equipment, and workforce training that enhance productivity and project quality.

Financial Management requires careful attention to project financing, cash flow management, and risk mitigation strategies that address Guatemala’s construction market challenges. Companies should develop diverse financing sources and maintain strong balance sheets to navigate market volatility.

Workforce Development initiatives should receive priority attention from construction companies seeking to address skills shortages and improve project capabilities. Investment in training programs and employee development creates competitive advantages while supporting industry professionalization.

Sustainability Integration should become a strategic priority for construction companies positioning for long-term success in Guatemala’s market. Early adoption of sustainable construction practices creates competitive differentiation while meeting evolving market demands and regulatory requirements.

Long-term growth prospects for Guatemala’s construction market remain positive, supported by demographic trends, economic development priorities, and infrastructure investment needs that create sustained construction demand. The market is expected to maintain steady growth momentum with construction activity expanding at approximately 5.8% annually over the next five years.

Infrastructure development will continue driving market growth as Guatemala addresses critical infrastructure gaps in transportation, energy, and telecommunications. Government investment programs and international development financing support major infrastructure projects that provide substantial construction opportunities.

Residential construction demand remains robust, driven by population growth, urbanization trends, and housing needs of Guatemala’s expanding middle class. Affordable housing initiatives and improved financing mechanisms support market expansion while addressing social development objectives.

Technology transformation will accelerate across Guatemala’s construction industry, with digital construction technologies, sustainable building practices, and advanced project management systems becoming standard industry practices. Companies that embrace technological advancement will gain competitive advantages in market positioning.

Regional integration trends create opportunities for Guatemalan construction companies to expand into neighboring Central American markets while attracting international construction firms to Guatemala’s market. MarkWide Research projects continued market evolution toward greater professionalization and international standards adoption.

Guatemala’s construction market presents a compelling combination of growth opportunities, market challenges, and strategic potential that positions it as an attractive sector for investment and business development. The market demonstrates fundamental strength through demographic trends, economic development priorities, and infrastructure investment needs that create sustained construction demand across multiple segments.

Market dynamics reflect the interplay between economic growth, urbanization pressures, and development financing that supports construction industry expansion. While challenges exist in financing, regulatory complexity, and skills availability, these obstacles create opportunities for companies that develop appropriate strategies and capabilities to address market needs effectively.

Future success in Guatemala’s construction market will depend on companies’ ability to embrace technological advancement, sustainable construction practices, and professional project management capabilities that meet evolving market demands. The construction industry’s continued evolution toward international standards and best practices creates opportunities for forward-thinking companies while raising competitive requirements for market participation.

Strategic positioning for long-term success requires understanding of local market conditions, regulatory requirements, and stakeholder relationships that enable effective project execution and business development. Guatemala’s construction market offers substantial opportunities for companies prepared to invest in capabilities, partnerships, and market development strategies that align with the country’s economic development trajectory and infrastructure modernization priorities.

What is Guatemala Construction?

Guatemala Construction refers to the processes and activities involved in building infrastructure, residential, and commercial properties in Guatemala. This sector encompasses various segments such as residential construction, commercial projects, and civil engineering works.

What are the key players in the Guatemala Construction Market?

Key players in the Guatemala Construction Market include Cementos Progreso, Constructora Lala, and Grupo Cobra, among others. These companies are involved in various construction projects ranging from residential buildings to large-scale infrastructure developments.

What are the main drivers of growth in the Guatemala Construction Market?

The main drivers of growth in the Guatemala Construction Market include urbanization, increased government investment in infrastructure, and a growing demand for housing. Additionally, foreign investment in construction projects is also contributing to market expansion.

What challenges does the Guatemala Construction Market face?

The Guatemala Construction Market faces challenges such as regulatory hurdles, limited access to financing, and issues related to labor shortages. These factors can hinder project timelines and increase costs for construction companies.

What opportunities exist in the Guatemala Construction Market?

Opportunities in the Guatemala Construction Market include the potential for sustainable building practices, the development of smart cities, and the expansion of renewable energy projects. These areas present avenues for innovation and investment.

What trends are shaping the Guatemala Construction Market?

Trends shaping the Guatemala Construction Market include the adoption of green building materials, the integration of technology in construction processes, and a focus on infrastructure resilience. These trends are influencing how projects are designed and executed.

Guatemala Construction Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Steel, Aggregates, Wood |

| End User | Residential, Commercial, Infrastructure, Industrial |

| Technology | Modular Construction, Prefabrication, Green Building, Smart Materials |

| Application | Roads, Bridges, Buildings, Utilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Guatemala Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at