444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Guaranteed Auto Protection (GAP) insurance market is experiencing significant growth worldwide. With the rising number of vehicles on the road and the increasing demand for automobile insurance, GAP insurance has emerged as a crucial component of the automotive insurance landscape. This comprehensive article provides insights into the meaning, market drivers, restraints, opportunities, and dynamics of the GAP insurance market. Additionally, it explores regional analysis, competitive landscape, segmentation, key trends, the impact of COVID-19, industry developments, analyst suggestions, future outlook, and concludes with a summary of the market.

Meaning

GAP insurance, also known as Guaranteed Asset Protection insurance, is a type of insurance coverage that helps bridge the gap between the actual cash value (ACV) of a vehicle and the amount owed on an auto loan or lease. In the event of theft, accident, or total loss, when the ACV falls short of the outstanding loan or lease balance, GAP insurance covers the difference, ensuring that policyholders do not face financial burdens.

Executive Summary

The global GAP insurance market is witnessing robust growth, driven by factors such as the increasing number of financed vehicles, higher car ownership rates, and growing awareness about the importance of GAP insurance among consumers. The market is highly competitive, with key players focusing on expanding their product offerings and reaching out to a broader customer base. Regional markets, such as North America and Europe, are currently leading the market, while emerging economies in Asia Pacific show immense growth potential.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GAP insurance market operates in a dynamic environment influenced by various factors. Consumer preferences, regulatory frameworks, technological advancements, and market competition shape the industry landscape. Additionally, economic conditions, such as interest rates, unemployment rates, and GDP growth, impact the market’s growth trajectory. Monitoring these dynamics is essential for stakeholders to make informed decisions and capitalize on emerging opportunities.

Regional Analysis

Competitive Landscape

Leading Companies in the Guaranteed Auto Protection (GAP) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

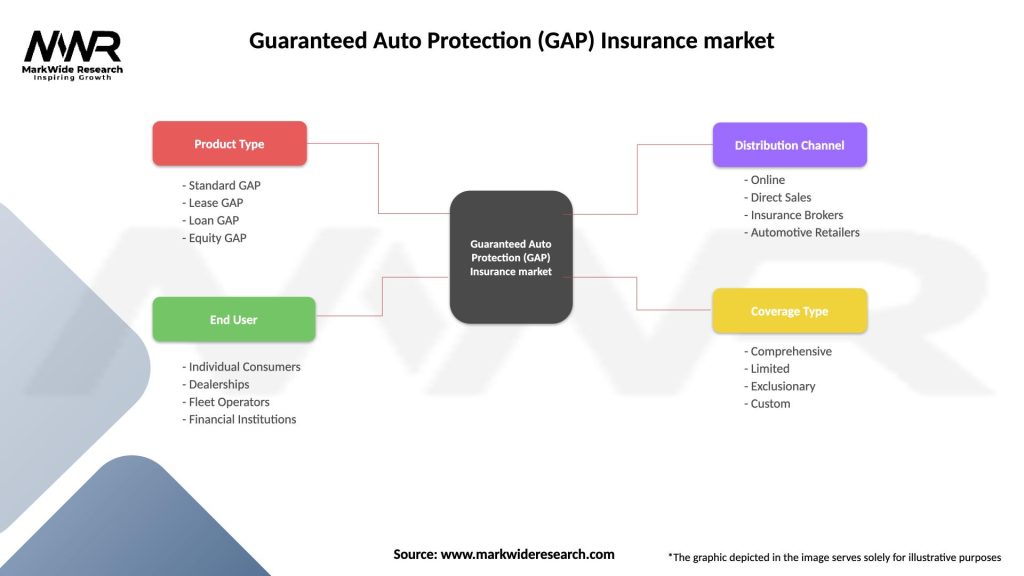

The GAP insurance market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the GAP insurance market. The economic downturn, job losses, and financial uncertainties have influenced consumer behavior and purchasing decisions. While there may have been a temporary decline in vehicle sales and financing during the pandemic, the need for financial protection and insurance coverage has become more prominent. As the economy recovers and vehicle sales rebound, the demand for GAP insurance is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The GAP insurance market is expected to witness steady growth in the coming years. Factors such as increasing vehicle ownership, growing awareness about financial risks, and the need for comprehensive insurance coverage will drive market expansion. Additionally, the emergence of digital platforms, personalized policies, and strategic collaborations will shape the market’s future landscape.

The Guaranteed Auto Protection (GAP) insurance market presents lucrative opportunities for industry participants and stakeholders. With the increasing number of financed vehicles and rising awareness about the importance of GAP insurance, the market is poised for steady growth. It is crucial for insurance companies, auto dealerships, and independent agents to educate consumers about the benefits of GAP insurance and leverage technological advancements to streamline the purchasing process.

Conclusion

In conclusion, the GAP insurance market is poised for expansion, driven by increasing vehicle ownership, growing consumer awareness, and evolving market dynamics. Industry participants need to stay abreast of market trends, embrace digitalization, foster collaborations, and prioritize customer education to capitalize on the opportunities presented by the GAP insurance market.

As the GAP insurance market continues to evolve, industry participants should focus on staying ahead of the competition by providing value-added services and enhancing customer satisfaction. Customized policies, usage-based pricing, and additional coverage options can cater to the unique needs of individual customers, providing them with tailored solutions.

What is Guaranteed Auto Protection (GAP) Insurance?

Guaranteed Auto Protection (GAP) Insurance is a type of coverage that helps pay the difference between what a car is worth and what the owner owes on their auto loan in the event of a total loss. This insurance is particularly beneficial for those who have financed or leased their vehicles.

What are the key players in the Guaranteed Auto Protection (GAP) Insurance market?

Key players in the Guaranteed Auto Protection (GAP) Insurance market include companies like Allstate, Progressive, and Geico, which offer various GAP insurance products to consumers. These companies compete on coverage options, pricing, and customer service, among others.

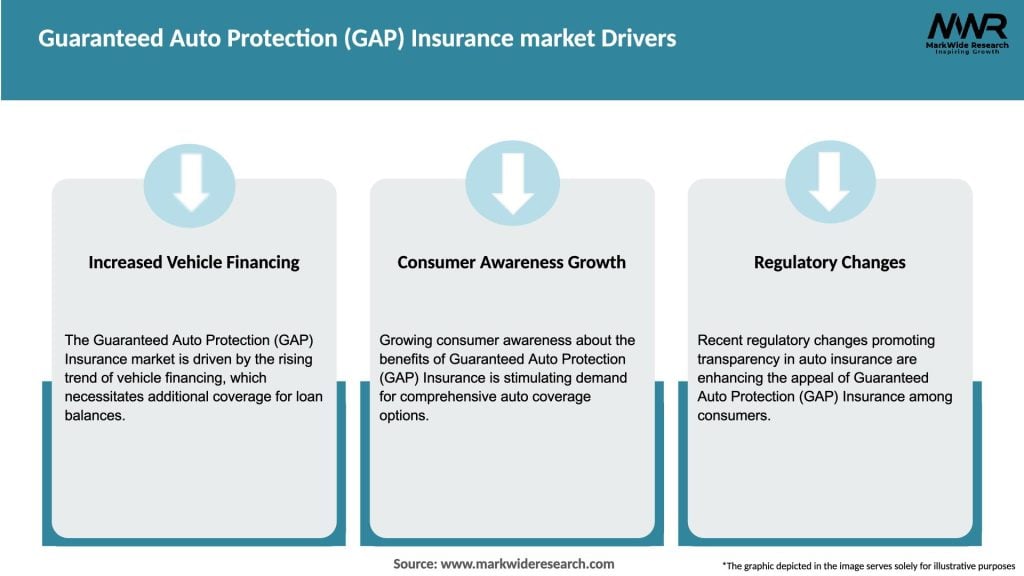

What are the growth factors driving the Guaranteed Auto Protection (GAP) Insurance market?

The growth of the Guaranteed Auto Protection (GAP) Insurance market is driven by increasing vehicle financing, rising awareness of financial protection among consumers, and the growing number of leased vehicles. Additionally, the expansion of online insurance platforms has made it easier for consumers to access GAP insurance.

What challenges does the Guaranteed Auto Protection (GAP) Insurance market face?

The Guaranteed Auto Protection (GAP) Insurance market faces challenges such as regulatory scrutiny, consumer misconceptions about the necessity of GAP insurance, and competition from alternative insurance products. These factors can impact market growth and consumer adoption.

What opportunities exist in the Guaranteed Auto Protection (GAP) Insurance market?

Opportunities in the Guaranteed Auto Protection (GAP) Insurance market include the potential for product innovation, such as bundling GAP insurance with other auto insurance products, and targeting new demographics like younger drivers. Additionally, partnerships with auto dealerships can enhance distribution channels.

What trends are shaping the Guaranteed Auto Protection (GAP) Insurance market?

Trends in the Guaranteed Auto Protection (GAP) Insurance market include the increasing use of technology for claims processing and customer service, as well as a shift towards more personalized insurance products. There is also a growing emphasis on educating consumers about the benefits of GAP insurance.

Guaranteed Auto Protection (GAP) Insurance market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard GAP, Lease GAP, Loan GAP, Equity GAP |

| End User | Individual Consumers, Dealerships, Fleet Operators, Financial Institutions |

| Distribution Channel | Online, Direct Sales, Insurance Brokers, Automotive Retailers |

| Coverage Type | Comprehensive, Limited, Exclusionary, Custom |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Guaranteed Auto Protection (GAP) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at