444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Greece telecom market represents a dynamic and evolving telecommunications landscape that has undergone significant transformation over the past decade. Digital infrastructure modernization has become a cornerstone of Greece’s economic recovery and technological advancement, with telecommunications serving as the backbone for digital transformation across various sectors. The market demonstrates robust growth potential, driven by increasing demand for high-speed internet connectivity, mobile services expansion, and the gradual rollout of 5G networks throughout the country.

Market dynamics in Greece’s telecommunications sector reflect broader European trends while maintaining unique characteristics shaped by the country’s geographic topology and economic conditions. The sector has experienced a 12.5% annual growth rate in broadband penetration, indicating strong consumer adoption of digital services. Mobile network operators continue to invest heavily in infrastructure upgrades, with particular emphasis on enhancing rural connectivity and supporting the government’s digital agenda.

Competitive landscape features both established international players and domestic operators, creating a diverse ecosystem that fosters innovation and service quality improvements. The market benefits from European Union regulatory frameworks while adapting to local market conditions and consumer preferences. Fiber optic deployment has accelerated significantly, with coverage expanding at an impressive rate across urban and suburban areas.

The Greece telecom market refers to the comprehensive telecommunications infrastructure and services ecosystem operating within Greek territory, encompassing mobile communications, fixed-line services, broadband internet, and emerging technologies. This market includes all commercial and residential telecommunications services provided by licensed operators, ranging from traditional voice communications to advanced data services and digital solutions.

Telecommunications infrastructure in Greece comprises extensive network assets including cellular towers, fiber optic cables, switching centers, and data transmission facilities that enable connectivity across the mainland and numerous islands. The market encompasses various service categories including mobile voice and data services, fixed broadband connections, enterprise telecommunications solutions, and value-added digital services that support both consumer and business communications needs.

Regulatory framework governing the Greece telecom market operates under European Union directives while incorporating national telecommunications policies designed to promote competition, consumer protection, and infrastructure development. The market structure includes multiple network operators, service providers, and technology vendors working collaboratively to deliver comprehensive telecommunications solutions to Greek consumers and businesses.

Strategic positioning of Greece’s telecommunications market reflects the country’s commitment to digital transformation and economic modernization through advanced connectivity solutions. The sector has demonstrated remarkable resilience and growth, particularly in areas of broadband expansion and mobile service enhancement, contributing significantly to the nation’s digital economy development.

Key performance indicators reveal substantial progress in network modernization, with fiber optic penetration reaching new milestones and mobile network coverage extending to previously underserved areas. The market benefits from substantial infrastructure investments, regulatory support, and increasing consumer demand for high-quality telecommunications services across both urban and rural regions.

Investment trends show continued commitment from major operators to expand network capabilities, with particular focus on 5G deployment and enhanced broadband services. The market demonstrates strong fundamentals supported by favorable demographic trends, increasing digitalization across industries, and government initiatives promoting digital inclusion and connectivity improvements throughout the Greek territory.

Market penetration analysis reveals several critical insights that define the current state and future trajectory of Greece’s telecommunications landscape:

Digital transformation initiatives across Greece’s public and private sectors serve as primary catalysts for telecommunications market expansion. Government digitalization programs, including e-governance platforms and digital public services, create substantial demand for reliable, high-capacity telecommunications infrastructure that supports nationwide connectivity requirements.

Economic recovery momentum following previous financial challenges has renewed focus on technology infrastructure as a foundation for sustainable growth. Businesses across various sectors increasingly recognize telecommunications services as essential utilities for operational efficiency, customer engagement, and competitive positioning in both domestic and international markets.

European Union funding and regulatory support provide significant impetus for telecommunications infrastructure development. EU digital agenda initiatives, combined with national recovery and resilience plans, allocate substantial resources toward broadband expansion, 5G deployment, and digital skills development programs that directly benefit the telecommunications sector.

Consumer lifestyle changes accelerated by remote work trends, online education adoption, and digital entertainment consumption create sustained demand for high-quality telecommunications services. The shift toward digital-first lifestyles requires robust network infrastructure capable of supporting multiple connected devices and bandwidth-intensive applications simultaneously.

Geographic challenges posed by Greece’s unique topology, including numerous islands and mountainous terrain, create significant infrastructure deployment complexities and increased operational costs for telecommunications providers. These geographic constraints require specialized solutions and higher investment levels to achieve comprehensive network coverage across all regions.

Economic sensitivity among certain consumer segments continues to influence telecommunications service adoption rates, particularly for premium services and advanced technology offerings. Price-conscious consumers may delay upgrades to higher-tier services, affecting revenue growth potential for operators seeking to monetize network investments.

Regulatory compliance requirements and evolving European Union telecommunications directives necessitate ongoing investments in systems, processes, and personnel training. Compliance costs can impact operational efficiency and require careful resource allocation to maintain competitive service delivery while meeting regulatory obligations.

Infrastructure maintenance demands for existing network assets require continuous investment alongside new technology deployment. Balancing legacy system support with modern infrastructure development creates resource allocation challenges that telecommunications operators must navigate carefully to maintain service quality and financial performance.

5G network deployment presents substantial opportunities for telecommunications operators to introduce innovative services, enhance network capabilities, and create new revenue streams through advanced connectivity solutions. Early 5G adoption positions operators advantageously for capturing enterprise customers requiring ultra-low latency and high-bandwidth applications.

Internet of Things expansion across various sectors including agriculture, tourism, shipping, and manufacturing creates demand for specialized telecommunications solutions. IoT applications require reliable, scalable connectivity infrastructure that telecommunications operators are uniquely positioned to provide through existing network assets and technical expertise.

Digital services integration offers opportunities for telecommunications companies to expand beyond traditional connectivity services into cloud computing, cybersecurity, digital payments, and managed IT services. This diversification strategy can improve customer retention, increase average revenue per user, and create competitive differentiation.

Smart city initiatives in major Greek urban centers require comprehensive telecommunications infrastructure supporting traffic management, environmental monitoring, public safety systems, and citizen services. These projects represent significant long-term revenue opportunities for operators capable of delivering integrated smart city solutions.

Competitive intensity within Greece’s telecommunications market drives continuous innovation and service improvement initiatives among major operators. Competition focuses on network quality, service reliability, pricing strategies, and value-added services that differentiate operators in an increasingly commoditized connectivity market.

Technology convergence trends blur traditional boundaries between telecommunications, media, and technology services, creating opportunities for integrated service offerings while intensifying competition from non-traditional market entrants. Operators must adapt business models to address evolving customer expectations for seamless, multi-service experiences.

Investment cycles in telecommunications infrastructure require careful timing and strategic planning to maximize return on investment while maintaining competitive positioning. According to MarkWide Research analysis, operators demonstrate 18% efficiency improvements through strategic infrastructure sharing and network optimization initiatives.

Customer expectations continue evolving toward higher service quality, faster response times, and more personalized service experiences. Meeting these expectations requires ongoing investment in customer service capabilities, network performance monitoring, and service delivery optimization across all customer touchpoints.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Greece’s telecommunications market dynamics. Primary research activities include structured interviews with industry executives, regulatory officials, and key stakeholders across the telecommunications value chain.

Secondary research incorporates analysis of regulatory filings, financial reports, industry publications, and government statistics to validate primary research findings and provide comprehensive market context. Data triangulation techniques ensure consistency and reliability across multiple information sources.

Quantitative analysis utilizes statistical modeling and trend analysis to identify market patterns, growth trajectories, and performance indicators that inform strategic recommendations. Market sizing methodologies incorporate multiple data points to ensure accuracy and reliability of market assessments.

Qualitative insights gathered through expert interviews and industry observation provide contextual understanding of market dynamics, competitive positioning, and strategic considerations that quantitative data alone cannot capture. This balanced approach ensures comprehensive market understanding and actionable insights for stakeholders.

Athens metropolitan area dominates Greece’s telecommunications market, accounting for approximately 40% of total market activity due to high population density, business concentration, and advanced infrastructure development. The capital region benefits from comprehensive fiber optic coverage, extensive 5G deployment, and competitive service offerings from all major operators.

Thessaloniki region represents the second-largest telecommunications market, with strong infrastructure development and growing demand for business services. The region demonstrates 25% market share in enterprise telecommunications services, driven by industrial activity, port operations, and educational institutions requiring advanced connectivity solutions.

Island territories present unique challenges and opportunities for telecommunications providers, requiring specialized infrastructure solutions including submarine cables, satellite connectivity, and resilient network designs. Tourism-dependent islands show seasonal demand variations that operators must accommodate through flexible capacity management.

Rural mainland areas benefit from targeted infrastructure investment programs supported by EU funding and national development initiatives. These regions show 15% annual growth in broadband adoption as connectivity improvements enable economic development and digital service access for previously underserved communities.

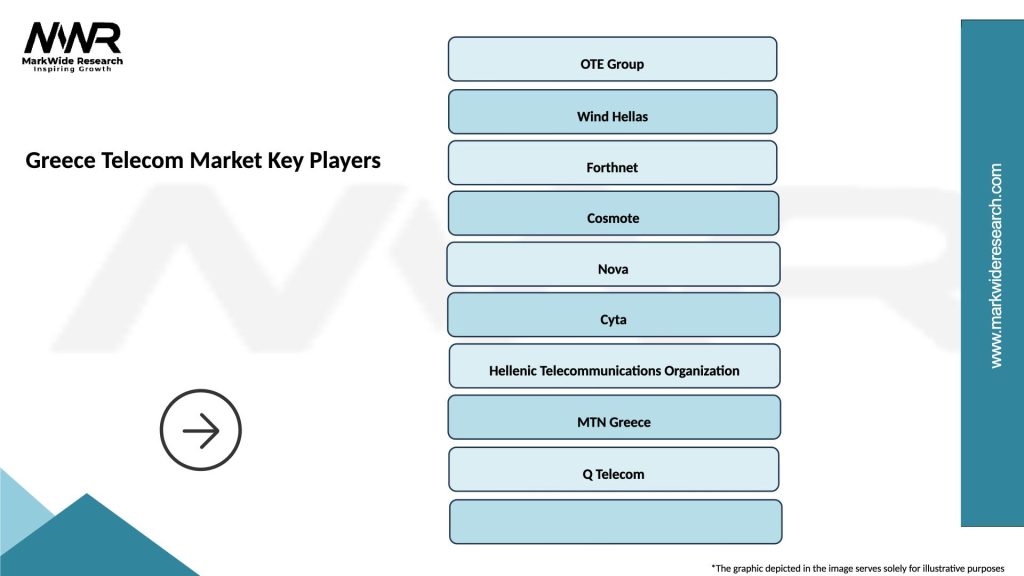

Market leadership in Greece’s telecommunications sector features several key players competing across mobile, fixed-line, and broadband service segments:

Strategic positioning among competitors emphasizes network quality, service innovation, and customer experience differentiation. Operators invest heavily in brand development, customer acquisition, and retention programs while maintaining focus on operational efficiency and profitability.

Partnership strategies include infrastructure sharing agreements, technology collaboration, and joint venture arrangements that enable operators to reduce costs while expanding service capabilities and market reach across Greece’s diverse geographic regions.

Service-based segmentation reveals distinct market categories with unique characteristics and growth patterns:

By Service Type:

By Customer Segment:

Mobile communications category demonstrates strongest growth momentum with continuous network upgrades, service enhancements, and increasing data consumption patterns. Smartphone penetration reaches 85% of the population, driving demand for high-speed mobile data services and advanced applications.

Broadband services show accelerating adoption rates as fiber optic infrastructure expands and service quality improves. Residential broadband penetration increases steadily, supported by competitive pricing, improved service reliability, and growing demand for bandwidth-intensive applications including streaming media and remote work solutions.

Enterprise telecommunications segment exhibits strong growth potential as businesses increasingly adopt digital technologies, cloud services, and remote work capabilities. Demand for managed network services, cybersecurity solutions, and integrated communications platforms creates opportunities for service providers to develop comprehensive business solutions.

Value-added services including cloud computing, digital payments, and IoT connectivity represent emerging growth categories that telecommunications operators leverage to diversify revenue streams and enhance customer relationships beyond traditional connectivity services.

Network operators benefit from expanding market opportunities, regulatory support for infrastructure development, and increasing demand for advanced telecommunications services. Operators can leverage existing network assets to introduce new services while optimizing operational efficiency through technology upgrades and process improvements.

Equipment vendors gain from substantial infrastructure investment requirements, technology upgrade cycles, and expanding network deployment projects across Greece’s diverse geographic regions. Vendor partnerships with operators create long-term revenue opportunities through equipment sales, maintenance contracts, and technology consulting services.

Enterprise customers benefit from improved connectivity options, competitive pricing, and enhanced service quality that enables digital transformation initiatives, operational efficiency improvements, and competitive advantage development. Advanced telecommunications services support business growth and market expansion opportunities.

Government entities realize significant benefits through improved digital infrastructure that supports e-governance initiatives, citizen services enhancement, and economic development programs. Telecommunications infrastructure investments contribute to national competitiveness and digital inclusion objectives.

Consumers enjoy expanding service options, improved network quality, competitive pricing, and access to innovative digital services that enhance communication capabilities, entertainment options, and access to information and services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Network virtualization emerges as a dominant trend enabling telecommunications operators to improve operational efficiency, reduce infrastructure costs, and accelerate service deployment through software-defined networking and network function virtualization technologies.

Edge computing integration with telecommunications infrastructure creates opportunities for ultra-low latency applications, improved service quality, and new revenue streams through distributed computing capabilities positioned closer to end users.

Sustainability initiatives drive telecommunications operators toward energy-efficient technologies, renewable energy adoption, and circular economy practices that reduce environmental impact while controlling operational costs. MWR data indicates 30% energy efficiency improvements through green technology adoption.

Artificial intelligence implementation across network operations, customer service, and business processes enables predictive maintenance, automated problem resolution, and personalized service delivery that improves customer satisfaction while reducing operational costs.

Convergence acceleration between telecommunications, media, and technology services creates integrated service offerings that address evolving customer expectations for seamless, multi-platform experiences across communication, entertainment, and productivity applications.

Infrastructure sharing agreements among major operators enable cost reduction, accelerated network deployment, and improved service coverage while maintaining competitive differentiation through service quality and customer experience initiatives.

5G spectrum allocation processes advance through regulatory frameworks, enabling operators to begin commercial 5G service deployment in major urban centers with planned expansion to secondary markets and rural areas over the coming years.

Fiber optic expansion projects receive substantial investment commitments from operators and government entities, targeting comprehensive coverage of urban areas and strategic rural locations that support economic development objectives.

Digital services integration initiatives by telecommunications operators expand service portfolios beyond traditional connectivity to include cloud computing, cybersecurity, digital payments, and managed IT services that address comprehensive customer needs.

Regulatory framework updates align with European Union directives while addressing national market conditions, promoting competition, consumer protection, and infrastructure development that supports Greece’s digital transformation goals.

Strategic focus on network quality and customer experience differentiation will become increasingly important as market competition intensifies and service commoditization pressures increase. Operators should prioritize investments in network reliability, customer service capabilities, and innovative service development.

Partnership development with technology companies, content providers, and enterprise customers can create new revenue opportunities while reducing operational risks through shared investment and expertise. Strategic alliances enable operators to expand service capabilities without substantial independent investment.

Rural market development presents significant growth opportunities for operators willing to invest in infrastructure and service solutions tailored to underserved communities. Government support programs and EU funding create favorable conditions for rural expansion initiatives.

Enterprise segment focus should emphasize comprehensive solutions that address business digital transformation requirements including cloud connectivity, cybersecurity, and managed services. This segment offers higher margins and stronger customer relationships than consumer markets.

Technology roadmap planning must balance current network optimization with future technology adoption including 5G, edge computing, and artificial intelligence integration. Careful timing of technology investments ensures competitive positioning while managing financial resources effectively.

Market evolution toward advanced telecommunications services will accelerate as 5G networks mature, IoT applications expand, and digital transformation initiatives gain momentum across public and private sectors. The telecommunications market will increasingly serve as the foundation for Greece’s digital economy development.

Investment trends indicate continued substantial commitments to infrastructure modernization, with particular emphasis on fiber optic expansion, 5G deployment, and network optimization technologies. MarkWide Research projects 22% growth in infrastructure investment over the next five years.

Service innovation will focus on integrated solutions combining connectivity with cloud services, cybersecurity, and digital platforms that address comprehensive customer needs. Operators will increasingly compete on solution capabilities rather than basic connectivity services.

Regulatory environment will continue evolving to support competition, consumer protection, and infrastructure development while addressing emerging challenges including cybersecurity, data privacy, and sustainable development objectives.

Market consolidation possibilities may emerge as operators seek scale advantages, operational efficiencies, and enhanced competitive positioning through strategic partnerships, acquisitions, or infrastructure sharing arrangements that optimize resource utilization while maintaining service quality.

Greece’s telecommunications market demonstrates strong fundamentals and promising growth prospects driven by digital transformation initiatives, infrastructure modernization, and increasing demand for advanced connectivity services. The market benefits from supportive regulatory frameworks, European Union funding programs, and growing recognition of telecommunications infrastructure as essential for economic competitiveness.

Strategic opportunities abound for telecommunications operators, equipment vendors, and service providers willing to invest in network modernization, service innovation, and customer experience enhancement. The transition toward 5G networks, fiber optic expansion, and integrated digital services creates multiple avenues for revenue growth and market differentiation.

Competitive dynamics will continue evolving as operators balance infrastructure investment requirements with profitability objectives while addressing changing customer expectations and regulatory requirements. Success will depend on strategic positioning, operational efficiency, and ability to deliver comprehensive solutions that address customer needs across residential, business, and government segments.

Long-term outlook remains positive for Greece’s telecommunications market, supported by favorable demographic trends, economic recovery momentum, and commitment to digital infrastructure development. The market will play an increasingly critical role in supporting Greece’s digital economy transformation and integration with broader European telecommunications networks and services.

What is Telecom?

Telecom refers to the transmission of information over significant distances by electronic means. It encompasses various services such as telephone, internet, and broadcasting, which are essential for communication in both personal and business contexts.

What are the key players in the Greece Telecom Market?

The Greece Telecom Market features several key players, including OTE Group, Vodafone Greece, and Wind Hellas. These companies provide a range of services, including mobile and fixed-line telecommunications, internet services, and digital solutions, among others.

What are the growth factors driving the Greece Telecom Market?

The Greece Telecom Market is driven by factors such as increasing smartphone penetration, the demand for high-speed internet, and the expansion of digital services. Additionally, the rise in remote working and online entertainment has further fueled the need for robust telecom infrastructure.

What challenges does the Greece Telecom Market face?

The Greece Telecom Market faces challenges such as regulatory hurdles, intense competition among service providers, and the need for continuous investment in infrastructure. Additionally, issues related to cybersecurity and data privacy are becoming increasingly significant.

What opportunities exist in the Greece Telecom Market?

Opportunities in the Greece Telecom Market include the expansion of 5G networks, the growth of IoT applications, and the increasing demand for cloud-based services. These trends present avenues for innovation and investment in new technologies.

What trends are shaping the Greece Telecom Market?

Trends shaping the Greece Telecom Market include the shift towards digital transformation, the rise of mobile payment solutions, and the increasing focus on sustainability in telecom operations. Additionally, the integration of AI and machine learning in service delivery is gaining traction.

Greece Telecom Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile, Fixed Line, Broadband, VoIP |

| Customer Type | Residential, Business, Government, Enterprise |

| Technology | 4G, 5G, Fiber Optic, DSL |

| Deployment | On-Premises, Cloud, Hybrid, Managed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Greece Telecom Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at