444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Greece property and casualty insurance market represents a dynamic and evolving sector within the broader European insurance landscape. This market encompasses comprehensive coverage for property damage, liability protection, and casualty insurance products tailored to meet the diverse needs of Greek consumers and businesses. Market dynamics indicate sustained growth driven by regulatory modernization, increased awareness of risk management, and expanding economic activities across various sectors.

Insurance penetration in Greece has shown remarkable improvement, with property and casualty segments experiencing 6.2% annual growth over recent years. The market demonstrates resilience despite economic challenges, supported by mandatory insurance requirements, growing middle-class prosperity, and enhanced digital distribution channels. Regulatory frameworks established by the Hellenic Republic’s insurance authorities have created a more stable and competitive environment for both domestic and international insurers.

Digital transformation initiatives have revolutionized service delivery, with 78% of insurers implementing advanced technology platforms to streamline claims processing and customer engagement. The integration of artificial intelligence, data analytics, and mobile applications has significantly improved operational efficiency and customer satisfaction levels across the Greek insurance sector.

The Greece property and casualty insurance market refers to the comprehensive ecosystem of insurance products and services designed to protect individuals, businesses, and organizations against financial losses arising from property damage, liability claims, and various casualty risks within the Greek territory. This market encompasses diverse insurance categories including motor vehicle coverage, homeowners insurance, commercial property protection, general liability, and specialized casualty products.

Property insurance components provide financial protection against physical damage to buildings, contents, and other tangible assets caused by perils such as fire, theft, natural disasters, and vandalism. Casualty insurance elements focus on liability protection, covering legal obligations arising from bodily injury or property damage caused to third parties through negligent acts or omissions.

Market participants include domestic insurance companies, international insurers with Greek operations, insurance brokers, agents, and regulatory bodies that collectively facilitate risk transfer mechanisms and ensure consumer protection throughout the insurance value chain.

Strategic analysis reveals that the Greece property and casualty insurance market has demonstrated remarkable resilience and growth potential despite historical economic challenges. The sector benefits from strengthening regulatory frameworks, increasing consumer awareness, and technological advancement that collectively drive market expansion and operational efficiency improvements.

Key performance indicators show consistent premium growth across major product lines, with motor insurance maintaining the largest market share at 42% of total premiums, followed by property insurance and general liability coverage. Digital adoption has accelerated significantly, with online policy purchases increasing by 35% annually as consumers embrace convenient digital insurance solutions.

Competitive landscape features a mix of established domestic insurers and international companies leveraging local partnerships to expand market presence. Innovation in product development, customer service excellence, and risk assessment capabilities have become critical differentiators in this increasingly competitive environment.

Future prospects indicate continued market growth supported by economic recovery, infrastructure development, and evolving consumer preferences toward comprehensive risk protection. The integration of emerging technologies and sustainable insurance practices positions the market for long-term expansion and modernization.

Market intelligence reveals several critical insights that shape the Greece property and casualty insurance landscape:

Economic recovery serves as a fundamental driver propelling the Greece property and casualty insurance market forward. As the Greek economy stabilizes and grows, increased business activities, property investments, and consumer spending create greater demand for comprehensive insurance protection across various sectors.

Regulatory compliance requirements mandate specific insurance coverage for businesses and individuals, creating a stable foundation for market growth. Motor vehicle insurance, professional liability coverage, and property insurance requirements ensure consistent demand while protecting consumers and businesses from financial risks.

Infrastructure development projects throughout Greece generate substantial insurance needs for construction, property, and liability coverage. Government investments in transportation, energy, and telecommunications infrastructure create opportunities for specialized commercial insurance products and services.

Digital transformation initiatives have revolutionized insurance delivery, making products more accessible and affordable for consumers. Online platforms, mobile applications, and automated underwriting processes have reduced operational costs while improving customer experience and market penetration.

Climate change awareness drives increased demand for comprehensive property insurance coverage as extreme weather events become more frequent. Consumers and businesses recognize the importance of adequate protection against natural disasters, flooding, and other climate-related risks.

Economic uncertainty continues to impact consumer spending patterns and business investment decisions, potentially limiting premium growth in certain market segments. Economic volatility affects purchasing power and may lead to reduced insurance coverage or delayed policy renewals among price-sensitive customers.

Regulatory complexity creates compliance challenges for insurance companies, particularly smaller domestic insurers with limited resources. Evolving regulatory requirements demand significant investments in systems, processes, and personnel to ensure full compliance with national and European Union directives.

Intense competition among insurance providers has led to pricing pressures that may impact profitability margins. The presence of multiple domestic and international insurers creates a highly competitive environment where companies must balance competitive pricing with sustainable business models.

Claims inflation affects the cost of settling property and casualty claims, driven by increasing repair costs, medical expenses, and legal settlements. Rising inflation impacts the overall cost structure of insurance operations and may necessitate premium adjustments to maintain profitability.

Fraud concerns pose ongoing challenges for the insurance industry, requiring investments in fraud detection systems and investigation capabilities. Insurance fraud increases operational costs and may impact premium pricing for honest policyholders.

Digital innovation presents significant opportunities for insurers to develop new products, improve customer engagement, and streamline operations. The integration of artificial intelligence, machine learning, and blockchain technology can enhance underwriting accuracy, claims processing efficiency, and fraud detection capabilities.

Emerging risk categories create opportunities for specialized insurance products addressing cyber security, environmental liability, and technology-related risks. As businesses become increasingly digital and environmentally conscious, demand for innovative insurance solutions continues to grow.

Tourism sector recovery offers substantial opportunities for travel, hospitality, and event insurance products. Greece’s position as a major tourist destination creates demand for specialized coverage protecting tourism businesses and international visitors.

Small and medium enterprise growth represents an underserved market segment with significant potential for commercial insurance products. As SMEs expand and modernize their operations, they require comprehensive insurance protection tailored to their specific business needs.

Sustainable insurance practices align with growing environmental consciousness and regulatory requirements. Green insurance products, carbon offset programs, and sustainable business practices can differentiate insurers and attract environmentally aware customers.

Supply and demand dynamics in the Greece property and casualty insurance market reflect a complex interplay of economic factors, regulatory requirements, and consumer behavior patterns. Market equilibrium is influenced by the availability of insurance capacity, competitive pricing strategies, and evolving risk profiles across different customer segments.

Pricing mechanisms demonstrate increasing sophistication through the adoption of advanced analytics and risk modeling techniques. Insurers utilize telematics data, satellite imagery, and predictive algorithms to develop more accurate pricing models that reflect individual risk characteristics and market conditions.

Customer acquisition strategies have evolved to emphasize digital channels, personalized service offerings, and value-added benefits beyond traditional insurance coverage. Retention rates have improved through enhanced customer service, loyalty programs, and proactive risk management services.

Market concentration shows a balanced distribution among major players, with the top five insurers holding approximately 68% market share while maintaining healthy competition. This structure promotes innovation and competitive pricing while ensuring market stability and consumer choice.

Reinsurance relationships provide crucial capacity and risk-sharing mechanisms that enable Greek insurers to underwrite larger risks and maintain financial stability. International reinsurance partnerships facilitate knowledge transfer and best practice implementation across the local market.

Comprehensive research methodology employed in analyzing the Greece property and casualty insurance market combines quantitative and qualitative research techniques to provide accurate, reliable, and actionable market intelligence. Primary research involves direct engagement with industry stakeholders including insurance executives, regulatory officials, and market participants through structured interviews and surveys.

Secondary research encompasses extensive analysis of industry reports, regulatory filings, financial statements, and market publications from authoritative sources. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification of key findings and market insights.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project future market developments and identify emerging opportunities. Segmentation analysis provides detailed insights into specific market categories, customer demographics, and regional variations.

Industry expert consultations provide valuable perspectives on market trends, competitive dynamics, and regulatory developments. These insights enhance the depth and accuracy of market analysis while providing context for quantitative findings and statistical data.

Athens metropolitan area dominates the Greece property and casualty insurance market, accounting for approximately 45% of total premium volume due to high population density, concentrated business activities, and elevated property values. The capital region demonstrates sophisticated insurance needs with demand for comprehensive commercial and personal lines coverage.

Thessaloniki region represents the second-largest market concentration, contributing 18% of national premiums through diverse industrial activities, port operations, and growing service sectors. The region benefits from strategic location advantages and increasing foreign investment that drives commercial insurance demand.

Island territories including Crete, Rhodes, and other tourist destinations show seasonal variations in insurance demand, with peak requirements during summer months. Tourism-related businesses require specialized coverage for hospitality, marine, and event-related risks that create unique market opportunities.

Rural and agricultural regions demonstrate growing insurance penetration as farming operations modernize and adopt comprehensive risk management practices. Agricultural insurance, property coverage, and liability protection for farming enterprises represent expanding market segments with significant growth potential.

Northern Greece regions benefit from cross-border trade activities and industrial development that generate demand for commercial insurance products. Manufacturing, logistics, and energy sector activities create opportunities for specialized commercial lines coverage.

Market leadership in the Greece property and casualty insurance sector is characterized by a diverse mix of domestic and international insurers competing across multiple product lines and distribution channels. Competitive positioning depends on factors including financial strength, product innovation, customer service quality, and distribution network effectiveness.

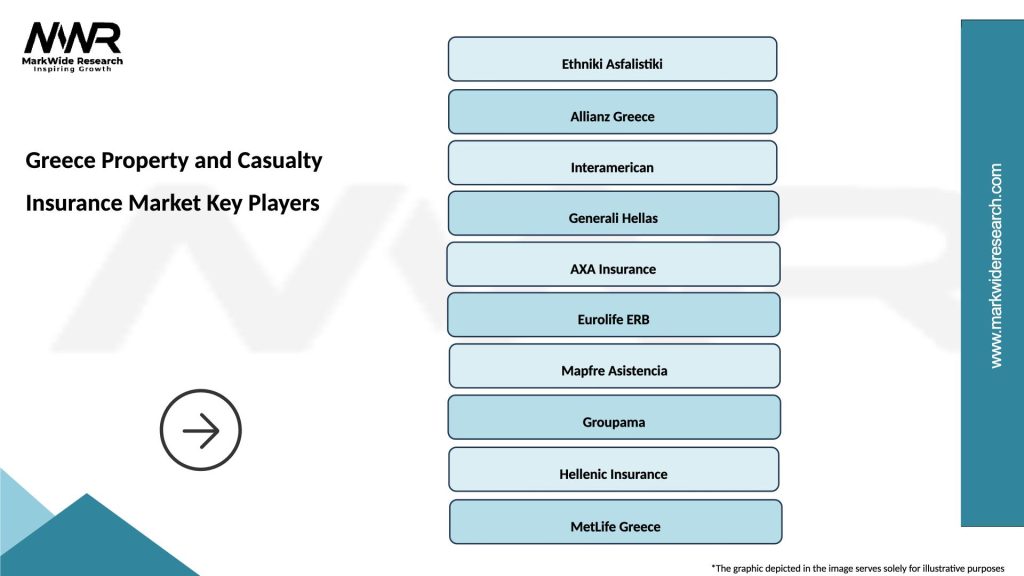

Major market participants include:

Competitive strategies emphasize digital transformation, customer experience enhancement, and product innovation to differentiate offerings and capture market share. Strategic partnerships with banks, automotive dealers, and real estate companies expand distribution reach and customer acquisition capabilities.

Market consolidation trends continue as smaller insurers seek strategic partnerships or merger opportunities to achieve scale advantages and regulatory compliance capabilities. This consolidation creates stronger, more competitive entities capable of serving diverse customer needs effectively.

Product segmentation of the Greece property and casualty insurance market reveals distinct categories with varying growth patterns and customer requirements:

By Product Type:

By Customer Type:

By Distribution Channel:

Motor insurance maintains its position as the dominant category within the Greece property and casualty insurance market, driven by mandatory coverage requirements and growing vehicle ownership. Telematics adoption has reached 23% penetration among motor insurers, enabling usage-based insurance products and improved risk assessment capabilities.

Property insurance demonstrates steady growth supported by increasing property values, mortgage requirements, and enhanced awareness of natural disaster risks. Climate-related claims have influenced product development, with insurers offering specialized coverage for flood, earthquake, and extreme weather events.

Commercial liability insurance shows robust demand as businesses recognize the importance of comprehensive risk protection. Professional liability, cyber liability, and directors and officers coverage represent high-growth segments within the commercial insurance category.

Marine insurance leverages Greece’s maritime heritage and strategic location, serving shipping companies, port operators, and marine-related businesses. This specialized segment requires expertise in international maritime law and complex risk assessment capabilities.

Specialty insurance lines including cyber security, environmental liability, and technology errors and omissions coverage represent emerging opportunities as businesses face evolving risk landscapes. These products require specialized underwriting expertise and innovative coverage solutions.

Insurance companies benefit from expanding market opportunities, improved operational efficiency through technology adoption, and enhanced risk management capabilities. Digital transformation enables cost reduction, better customer service, and more accurate underwriting that supports sustainable profitability and competitive positioning.

Consumers and businesses gain access to comprehensive risk protection, competitive pricing, and improved service quality through market competition and innovation. Digital platforms provide convenient policy management, claims reporting, and customer service that enhance the overall insurance experience.

Economic stakeholders including banks, real estate developers, and business communities benefit from stable insurance markets that facilitate economic growth, investment, and risk transfer mechanisms. Insurance availability supports lending activities, property development, and business expansion initiatives.

Regulatory authorities achieve improved market stability, consumer protection, and compliance with European Union directives through effective oversight and regulation. Market development contributes to financial sector strength and economic resilience.

Reinsurance partners access growing premium volumes, diversified risk portfolios, and opportunities for knowledge transfer and capacity deployment. Strategic partnerships enhance market development and risk management capabilities across the insurance value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Greece property and casualty insurance market. Artificial intelligence and machine learning applications enhance underwriting accuracy, claims processing efficiency, and fraud detection capabilities while reducing operational costs and improving customer experience.

Personalization trends drive demand for customized insurance products tailored to individual risk profiles and coverage preferences. Usage-based insurance models, particularly in motor insurance, provide personalized pricing based on actual driving behavior and risk exposure patterns.

Sustainability initiatives influence product development and business practices as insurers respond to environmental consciousness and regulatory requirements. Green insurance products and sustainable business practices become competitive differentiators and customer attraction factors.

Omnichannel distribution strategies integrate traditional and digital channels to provide seamless customer experiences across multiple touchpoints. Customer journey optimization focuses on convenience, accessibility, and service quality throughout the insurance lifecycle.

Data analytics advancement enables more sophisticated risk assessment, pricing accuracy, and predictive modeling capabilities. Big data utilization improves decision-making processes and supports evidence-based business strategies across all market segments.

Regulatory modernization initiatives have strengthened the Greece property and casualty insurance market through implementation of enhanced solvency requirements, consumer protection measures, and digital governance frameworks. Regulatory technology adoption facilitates compliance monitoring and reporting efficiency.

Strategic partnerships between insurers and technology companies have accelerated digital transformation and innovation capabilities. Insurtech collaborations introduce new products, distribution channels, and customer engagement platforms that enhance market competitiveness.

Market consolidation activities including mergers and acquisitions have created stronger, more competitive insurance entities with enhanced service capabilities and financial resources. Operational synergies from consolidation improve efficiency and market positioning.

Product innovation focuses on emerging risk categories including cyber security, climate change, and technology-related exposures. Specialized coverage development addresses evolving customer needs and market opportunities in niche segments.

International expansion strategies by Greek insurers and foreign market entry by international companies have increased competition and knowledge transfer. Cross-border activities enhance market sophistication and service quality standards.

MarkWide Research analysis suggests that insurers should prioritize digital transformation investments to enhance operational efficiency and customer experience. Technology adoption represents a critical success factor for maintaining competitive positioning and achieving sustainable growth in the evolving market landscape.

Product diversification strategies should focus on emerging risk categories and underserved market segments to capture new growth opportunities. Innovation capabilities in product development and service delivery will differentiate successful insurers from competitors in an increasingly crowded marketplace.

Customer-centric approaches emphasizing personalization, convenience, and value-added services will drive customer acquisition and retention success. Omnichannel strategies that integrate digital and traditional touchpoints provide competitive advantages in customer engagement and service delivery.

Risk management enhancement through advanced analytics, predictive modeling, and comprehensive data utilization will improve underwriting accuracy and profitability. Data-driven decision making supports evidence-based business strategies and operational optimization initiatives.

Strategic partnerships with technology providers, distribution partners, and international insurers can accelerate market development and capability enhancement. Collaborative approaches enable resource sharing, knowledge transfer, and market expansion opportunities.

Long-term prospects for the Greece property and casualty insurance market remain positive, supported by economic recovery, regulatory stability, and technological advancement. Market growth is projected to continue at a steady pace of 5.8% annually over the next five years, driven by increasing insurance penetration and product innovation.

Digital transformation will accelerate, with MWR projecting that 85% of insurers will implement comprehensive digital platforms by 2028. This technological evolution will enhance operational efficiency, customer experience, and competitive positioning across the market.

Emerging risk categories including cyber security, climate change, and technology-related exposures will drive product development and market expansion. Specialized insurance solutions addressing these evolving risks represent significant growth opportunities for innovative insurers.

Regulatory evolution will continue aligning Greek insurance markets with European Union standards while promoting innovation and competition. Regulatory technology adoption will streamline compliance processes and reduce administrative burdens for market participants.

Market consolidation trends will create stronger, more competitive insurance entities capable of serving diverse customer needs effectively. Strategic partnerships and international collaboration will enhance market sophistication and service quality standards throughout the sector.

The Greece property and casualty insurance market demonstrates remarkable resilience and growth potential despite historical economic challenges. Market fundamentals including regulatory modernization, technological advancement, and increasing risk awareness create a favorable environment for sustained expansion and development.

Digital transformation emerges as the primary catalyst driving market evolution, enabling operational efficiency improvements, enhanced customer experiences, and innovative product development. Technology adoption will continue reshaping competitive dynamics and customer expectations throughout the insurance value chain.

Strategic opportunities exist across multiple market segments, from traditional property and casualty coverage to emerging risk categories addressing cyber security, environmental liability, and technology-related exposures. Market participants that successfully navigate digital transformation, regulatory compliance, and customer-centric service delivery will achieve sustainable competitive advantages.

The future outlook remains optimistic, with projected growth rates and expanding market opportunities supporting long-term sector development. Continued innovation, strategic partnerships, and regulatory alignment with European standards position the Greece property and casualty insurance market for sustained success and modernization in the evolving global insurance landscape.

What is Property and Casualty Insurance?

Property and Casualty Insurance refers to a type of insurance that provides coverage for property loss and liability for damages to others. It encompasses various policies, including homeowners, auto, and commercial insurance, protecting individuals and businesses from financial losses due to unforeseen events.

What are the key players in the Greece Property and Casualty Insurance Market?

Key players in the Greece Property and Casualty Insurance Market include Ethniki Asfalistiki, Allianz Greece, and Interamerican. These companies offer a range of insurance products tailored to meet the needs of consumers and businesses, among others.

What are the growth factors driving the Greece Property and Casualty Insurance Market?

The growth of the Greece Property and Casualty Insurance Market is driven by increasing awareness of insurance products, rising property ownership, and the need for businesses to mitigate risks. Additionally, economic recovery and urbanization contribute to the demand for comprehensive insurance solutions.

What challenges does the Greece Property and Casualty Insurance Market face?

The Greece Property and Casualty Insurance Market faces challenges such as regulatory changes, economic fluctuations, and competition from alternative risk transfer solutions. These factors can impact profitability and market stability.

What opportunities exist in the Greece Property and Casualty Insurance Market?

Opportunities in the Greece Property and Casualty Insurance Market include the expansion of digital insurance platforms, the introduction of innovative products, and the growing demand for customized insurance solutions. These trends can enhance customer engagement and improve service delivery.

What trends are shaping the Greece Property and Casualty Insurance Market?

Trends shaping the Greece Property and Casualty Insurance Market include the adoption of technology for claims processing, the rise of telematics in auto insurance, and an increased focus on sustainability in insurance practices. These innovations are transforming how insurers operate and interact with customers.

Greece Property and Casualty Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Home Insurance, Auto Insurance, Liability Insurance, Travel Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Third-Party, Fire, Theft |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Greece Property and Casualty Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at