444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Greece POS terminal market represents a dynamic and rapidly evolving segment within the country’s financial technology landscape. As digital payment adoption accelerates across Greek businesses, the demand for advanced point-of-sale solutions continues to expand significantly. The market encompasses traditional card readers, mobile payment terminals, and sophisticated integrated systems that support multiple payment methods including contactless cards, mobile wallets, and QR code payments.

Market growth in Greece has been particularly robust, driven by regulatory changes, consumer preference shifts toward cashless transactions, and the ongoing digital transformation of retail and hospitality sectors. The implementation of mandatory electronic payment acceptance for businesses above certain transaction thresholds has created substantial opportunities for POS terminal providers. Current market expansion shows a compound annual growth rate of 8.2%, reflecting strong adoption across various business segments.

Technology integration has become increasingly sophisticated, with modern POS terminals offering cloud connectivity, real-time analytics, inventory management capabilities, and seamless integration with enterprise resource planning systems. The Greek market demonstrates particular strength in hospitality and retail applications, where businesses require flexible, reliable payment processing solutions that can handle high transaction volumes during peak tourism seasons.

The Greece POS terminal market refers to the comprehensive ecosystem of point-of-sale payment processing devices, software solutions, and related services operating within the Greek commercial landscape. This market encompasses hardware terminals, payment processing software, merchant services, and supporting infrastructure that enables businesses to accept electronic payments from customers.

POS terminals in the Greek context include traditional countertop card readers, portable wireless devices, mobile payment solutions, and integrated systems that combine payment processing with inventory management, customer relationship management, and business analytics. These systems facilitate secure transaction processing while providing merchants with valuable business insights and operational efficiency improvements.

Market participants include terminal manufacturers, payment processors, acquiring banks, software developers, and service providers who collectively deliver comprehensive payment solutions to Greek businesses. The market serves diverse sectors including retail, hospitality, healthcare, transportation, and professional services, each with specific requirements for payment processing capabilities and integration needs.

Greece’s POS terminal market demonstrates remarkable resilience and growth potential, supported by favorable regulatory frameworks and increasing consumer adoption of digital payment methods. The market benefits from strong government initiatives promoting cashless transactions and the modernization of payment infrastructure across the country. Digital payment adoption has reached 73% penetration among Greek consumers, creating substantial demand for advanced POS solutions.

Key market drivers include mandatory electronic payment acceptance regulations, tourism industry recovery, and small business digitization initiatives. The hospitality sector, representing a significant portion of Greece’s economy, has emerged as a primary growth driver for POS terminal adoption. Mobile POS solutions have gained particular traction, accounting for 34% of new terminal deployments as businesses seek flexible payment acceptance capabilities.

Competitive dynamics feature both international technology providers and local payment service companies, creating a diverse ecosystem that serves various market segments. The market shows strong potential for continued expansion, supported by ongoing infrastructure investments and increasing integration of advanced technologies such as artificial intelligence and machine learning in payment processing systems.

Strategic market insights reveal several critical trends shaping the Greece POS terminal landscape. The following key observations provide comprehensive understanding of market dynamics:

Primary market drivers propelling Greece’s POS terminal market growth stem from multiple interconnected factors that create sustained demand for advanced payment processing solutions. Regulatory mandates represent the most significant driver, with government requirements for electronic payment acceptance creating immediate market opportunities across various business sectors.

Digital transformation initiatives across Greek businesses have accelerated POS terminal adoption as companies seek to modernize their payment acceptance capabilities. The integration of advanced analytics and reporting features within modern terminals provides merchants with valuable business insights, driving demand for sophisticated solutions beyond basic payment processing. Consumer preference shifts toward contactless and mobile payments have created urgency for terminal upgrades and new deployments.

Tourism industry recovery following recent global challenges has generated substantial demand for flexible, multilingual POS solutions capable of handling diverse payment methods from international visitors. The seasonal nature of Greek tourism creates specific requirements for portable terminals and temporary deployment solutions. Small business digitization programs supported by government and European Union initiatives provide financial incentives for POS terminal adoption, particularly among traditionally cash-based businesses.

Technological advancement in payment processing, including enhanced security features, faster transaction processing, and improved user interfaces, continues to drive market growth as businesses seek competitive advantages through superior customer payment experiences.

Market restraints affecting Greece’s POS terminal market growth include several challenges that impact adoption rates and market expansion. Implementation costs remain a significant barrier for smaller businesses, particularly those operating with limited capital resources. Despite competitive pricing models, the total cost of ownership including terminal hardware, software licensing, transaction processing fees, and ongoing maintenance can strain small business budgets.

Technical complexity associated with modern POS systems creates adoption challenges for businesses lacking technical expertise or dedicated IT support. Integration requirements with existing business systems, staff training needs, and ongoing technical maintenance can overwhelm smaller merchants. Connectivity infrastructure limitations in rural or remote areas of Greece can restrict the deployment of cloud-based POS solutions that require reliable internet connectivity.

Regulatory compliance requirements, while driving market growth, also create complexity and costs for businesses navigating data protection regulations, payment card industry standards, and financial reporting requirements. Market fragmentation with multiple payment processors, terminal providers, and service models can create confusion for merchants selecting appropriate solutions.

Economic uncertainty and seasonal business fluctuations, particularly in tourism-dependent regions, can impact merchant willingness to invest in new payment technology. Traditional payment preferences among certain consumer segments and business types continue to limit the urgency for POS terminal adoption in specific market niches.

Significant market opportunities exist within Greece’s POS terminal landscape, driven by evolving payment technologies and changing business requirements. Mobile POS solutions present substantial growth potential as businesses seek flexible payment acceptance capabilities for outdoor events, delivery services, and temporary retail locations. The integration of advanced features such as inventory management, customer loyalty programs, and business analytics creates opportunities for comprehensive business management platforms.

Emerging payment technologies including cryptocurrency acceptance, buy-now-pay-later integration, and digital wallet expansion offer opportunities for terminal providers to differentiate their offerings. Vertical market specialization presents opportunities for customized solutions serving specific industries such as healthcare, professional services, and specialized retail segments with unique payment processing requirements.

Tourism sector expansion creates opportunities for multilingual, multi-currency POS solutions that can serve international visitors effectively. Government digitization initiatives and European Union funding programs provide opportunities for terminal providers to participate in large-scale deployment projects across public and private sectors.

Partnership opportunities with local banks, payment processors, and business service providers can create comprehensive solution offerings that address merchant needs beyond basic payment processing. Subscription-based service models and software-as-a-service offerings present opportunities for recurring revenue streams while making advanced POS technology more accessible to smaller businesses.

Market dynamics within Greece’s POS terminal sector reflect complex interactions between technological advancement, regulatory requirements, and evolving business needs. Competitive pressures drive continuous innovation in terminal capabilities, pricing models, and service offerings as providers seek to capture market share in a growing but increasingly crowded marketplace.

Technology convergence has created dynamic shifts in market positioning as traditional terminal manufacturers compete with software companies, payment processors, and mobile technology providers offering integrated solutions. MarkWide Research analysis indicates that integrated solution providers have captured 42% market share by offering comprehensive business management platforms rather than standalone payment terminals.

Customer expectations continue to evolve, demanding faster transaction processing, enhanced security features, and seamless integration with existing business operations. Seasonal demand fluctuations create unique market dynamics as tourism-dependent businesses require scalable solutions that can handle peak season transaction volumes while remaining cost-effective during slower periods.

Partnership ecosystems have become increasingly important as terminal providers collaborate with banks, software developers, and service providers to deliver comprehensive merchant solutions. Pricing competition has intensified as market maturity increases, driving innovation in service models and value-added features to maintain profitability while meeting merchant cost expectations.

Comprehensive research methodology employed for analyzing Greece’s POS terminal market incorporates multiple data collection and analysis techniques to ensure accurate market assessment. Primary research includes extensive interviews with terminal manufacturers, payment processors, acquiring banks, merchant service providers, and end-user businesses across various sectors to gather firsthand market insights and trend identification.

Secondary research encompasses analysis of industry reports, regulatory documentation, financial statements, and market studies from relevant organizations and government agencies. Quantitative analysis utilizes statistical modeling techniques to project market trends, growth rates, and segment performance based on historical data and current market indicators.

Market segmentation analysis examines various dimensions including terminal type, deployment model, business size, industry vertical, and geographic distribution to provide comprehensive market understanding. Competitive landscape assessment evaluates market participants through analysis of product offerings, market positioning, pricing strategies, and customer feedback.

Validation processes include cross-referencing data sources, expert review panels, and market participant feedback to ensure research accuracy and reliability. Trend analysis incorporates both quantitative metrics and qualitative insights to identify emerging market opportunities and potential challenges affecting future market development.

Regional market distribution across Greece reveals distinct patterns influenced by economic activity, population density, and business concentration. Athens metropolitan area represents the largest market segment, accounting for 38% of total POS terminal deployments, driven by high business density, corporate headquarters, and diverse commercial activities ranging from retail to professional services.

Thessaloniki region emerges as the second-largest market, capturing 16% market share with strong industrial and commercial activity supporting consistent demand for payment processing solutions. Island regions demonstrate unique seasonal patterns with significant terminal deployment increases during tourism seasons, particularly in Crete, Rhodes, and the Cyclades where hospitality businesses require scalable payment solutions.

Coastal tourism areas including the Peloponnese, Halkidiki, and Ionian Islands show strong market potential driven by seasonal business requirements and increasing international visitor payment preferences. Northern Greece regions demonstrate steady growth in POS adoption as agricultural and manufacturing businesses modernize their payment acceptance capabilities.

Rural market penetration remains limited but shows growth potential as connectivity infrastructure improves and government digitization initiatives reach smaller communities. Border regions present unique opportunities for terminals supporting multiple currencies and cross-border payment processing capabilities, particularly in areas with significant trade activity.

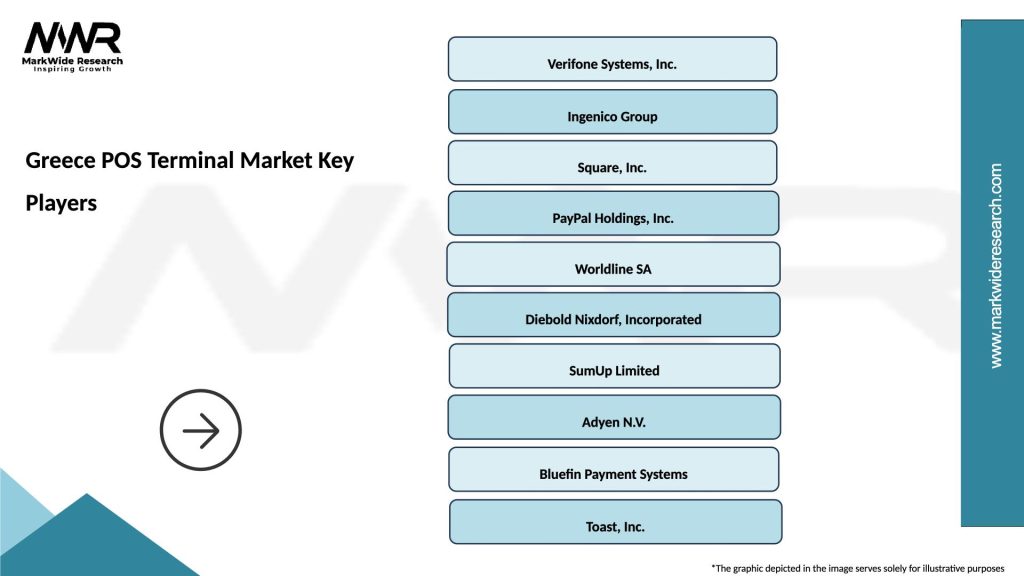

Competitive landscape within Greece’s POS terminal market features diverse participants ranging from global technology providers to specialized local service companies. Market leadership is distributed among several key players, each focusing on specific market segments and value propositions.

Competitive strategies focus on technology innovation, pricing optimization, customer service excellence, and strategic partnerships to capture market share in this growing sector.

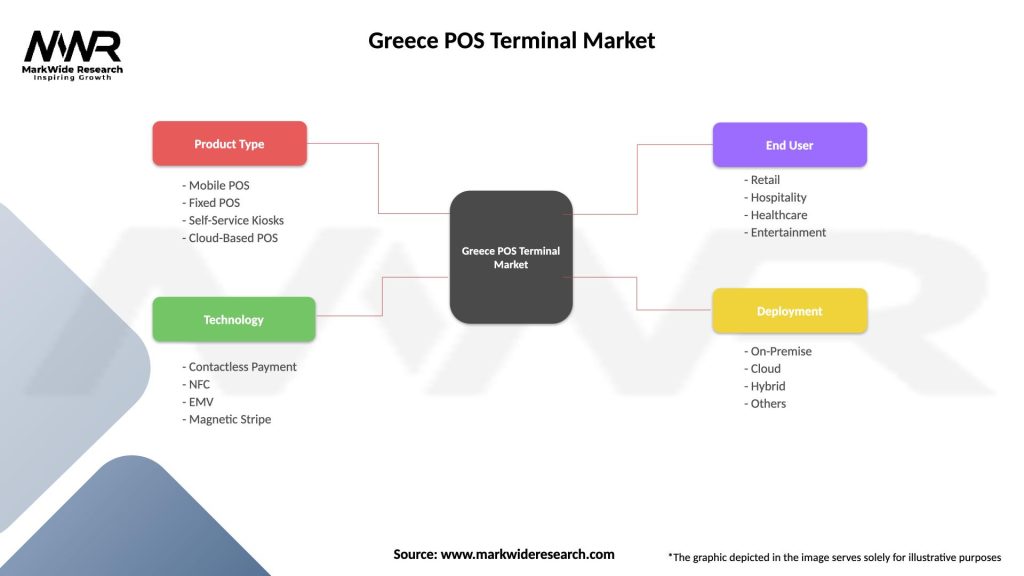

Market segmentation within Greece’s POS terminal market reveals distinct categories based on technology, deployment model, business size, and industry application. By terminal type, the market divides into traditional countertop terminals, mobile wireless devices, integrated POS systems, and software-based solutions running on tablets or smartphones.

By deployment model:

By business size:

By industry vertical:

Category analysis reveals distinct performance patterns and growth opportunities across different POS terminal segments. Mobile POS solutions demonstrate the strongest growth trajectory, with adoption rates increasing 28% annually as businesses seek flexible payment acceptance capabilities for various operational scenarios including outdoor events, home delivery services, and temporary retail locations.

Integrated POS systems combining payment processing with inventory management, customer relationship management, and business analytics show substantial market traction among medium and large businesses. These comprehensive solutions provide operational efficiency improvements of up to 35% by consolidating multiple business functions into unified platforms.

Contactless payment terminals have experienced accelerated adoption, particularly following increased consumer preference for touch-free transactions. Contactless transaction volume has grown to represent 67% of total card payments in Greece, driving demand for NFC-enabled terminals across all business categories.

Industry-specific solutions demonstrate strong performance in specialized markets such as hospitality, healthcare, and professional services where customized features address unique operational requirements. Hospitality-focused terminals with multilingual interfaces and tourism-specific features show particularly strong seasonal demand patterns aligned with Greece’s tourism industry cycles.

Cloud-connected terminals offering real-time analytics and remote management capabilities represent the fastest-growing category as businesses seek data-driven insights to optimize operations and customer experiences.

Industry participants and stakeholders in Greece’s POS terminal market realize substantial benefits through participation in this growing sector. Terminal manufacturers benefit from expanding market demand driven by regulatory requirements and digital transformation initiatives, creating opportunities for sustained revenue growth and market share expansion.

Payment processors gain access to growing transaction volumes as electronic payment adoption increases across Greek businesses. Transaction processing volumes have increased 22% year-over-year, providing substantial revenue opportunities for processing service providers. Financial institutions benefit through merchant acquiring services, equipment financing, and integrated banking product cross-selling opportunities.

Merchants and businesses realize operational benefits including improved transaction efficiency, enhanced security, better cash flow management, and valuable business analytics. Customer satisfaction improvements result from faster checkout processes and expanded payment method acceptance. Compliance benefits help businesses meet regulatory requirements while avoiding potential penalties.

Technology providers benefit from opportunities to integrate advanced features such as artificial intelligence, machine learning, and predictive analytics into POS solutions. Service providers gain recurring revenue opportunities through ongoing support, maintenance, and value-added services.

Economic stakeholders including government agencies benefit from increased tax compliance, reduced cash economy participation, and enhanced economic transparency through electronic payment adoption facilitated by widespread POS terminal deployment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Greece’s POS terminal landscape reflect broader technological advancement and changing business requirements. Contactless payment dominance has emerged as the primary trend, with businesses prioritizing terminals supporting NFC technology, mobile wallets, and tap-to-pay functionality to meet consumer preferences for touch-free transactions.

Cloud-based solutions represent another significant trend as businesses seek real-time data access, remote management capabilities, and automatic software updates. MWR research indicates that cloud-connected terminals now account for 56% of new deployments, reflecting strong demand for connected payment solutions.

Artificial intelligence integration is gaining traction as POS systems incorporate predictive analytics, fraud detection, and personalized customer experience features. Omnichannel payment processing has become essential as businesses require unified payment acceptance across physical locations, online platforms, and mobile applications.

Sustainability focus drives demand for energy-efficient terminals and environmentally responsible manufacturing practices. Subscription-based service models continue expanding as businesses prefer predictable monthly costs over large capital investments. Biometric authentication and advanced security features are increasingly important as payment fraud concerns grow.

Integration with business management systems has become standard expectation rather than premium feature, with merchants requiring seamless connectivity between payment processing and inventory management, accounting, and customer relationship management systems.

Recent industry developments demonstrate significant progress in Greece’s POS terminal market evolution. Regulatory implementation of mandatory electronic payment acceptance for businesses exceeding specific transaction thresholds has accelerated terminal adoption across previously cash-dependent sectors. Banking sector consolidation has created opportunities for streamlined merchant services and integrated payment solutions.

Technology partnerships between international POS providers and local banks have expanded solution availability and improved customer support capabilities. Mobile payment platform launches by major Greek banks have increased demand for compatible terminal solutions supporting various digital wallet applications.

Government digitization initiatives including tax system modernization and electronic invoicing requirements have created additional demand for integrated POS solutions capable of automated compliance reporting. Tourism industry recovery programs have included provisions for payment technology upgrades, supporting terminal deployment in hospitality businesses.

Cybersecurity enhancement initiatives have driven adoption of advanced encryption and tokenization technologies in POS systems. Small business support programs funded by European Union recovery funds have provided financial assistance for payment technology adoption among micro and small enterprises.

Fintech company expansion into the Greek market has introduced innovative payment solutions and competitive pricing models, stimulating overall market growth and technology advancement.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing current market challenges. Terminal providers should prioritize development of integrated business management platforms that combine payment processing with inventory management, customer relationship management, and analytics capabilities to differentiate from basic payment solutions.

Pricing strategy optimization through flexible service models including subscription-based offerings, pay-per-transaction options, and graduated pricing tiers can expand market accessibility across different business sizes. Partnership development with local banks, software providers, and business service companies can create comprehensive solution offerings that address merchant needs beyond payment processing.

Vertical market specialization presents opportunities for customized solutions serving specific industries such as healthcare, hospitality, and professional services with unique operational requirements. Mobile solution enhancement should focus on developing robust, user-friendly applications that can operate effectively in various business environments including outdoor events and delivery services.

Customer education programs can accelerate adoption by helping merchants understand the full value proposition of modern POS systems beyond basic payment acceptance. Security investment in advanced fraud prevention and data protection capabilities will become increasingly important as cyber threats evolve.

Geographic expansion strategies should consider the unique requirements of island and rural markets where connectivity and seasonal demand patterns create specific challenges and opportunities.

Future market outlook for Greece’s POS terminal sector indicates sustained growth driven by continued digital transformation and evolving payment preferences. Market expansion is projected to maintain strong momentum with growth rates exceeding 9% annually over the next five years, supported by ongoing regulatory requirements and business modernization initiatives.

Technology evolution will continue driving market development as artificial intelligence, machine learning, and advanced analytics become standard features in POS systems. Integration capabilities will expand beyond current offerings to include comprehensive business management platforms serving multiple operational functions.

Mobile payment adoption is expected to reach 85% penetration among Greek consumers within three years, creating sustained demand for compatible terminal solutions. Contactless payment processing will likely represent the majority of card transactions as consumer preferences solidify around touch-free payment methods.

Market consolidation may occur as smaller providers struggle to compete with comprehensive solution offerings from larger technology companies and integrated service providers. Subscription-based models are projected to become the dominant pricing approach as businesses prefer predictable operational expenses over capital investments.

MarkWide Research projections indicate that cloud-connected terminals will represent 78% of total deployments by 2028, reflecting strong demand for data-driven business insights and remote management capabilities. Emerging payment technologies including cryptocurrency acceptance and buy-now-pay-later integration will create new market opportunities for innovative terminal providers.

Greece’s POS terminal market represents a dynamic and rapidly expanding sector with substantial growth potential driven by regulatory support, digital transformation initiatives, and evolving consumer payment preferences. The market demonstrates strong fundamentals including government backing through mandatory electronic payment requirements, robust tourism industry demand, and increasing business adoption of advanced payment technologies.

Market opportunities remain significant across multiple dimensions including mobile payment solutions, integrated business management platforms, vertical market specialization, and emerging payment technologies. The competitive landscape features diverse participants offering various solutions from basic payment processing to comprehensive business management systems, creating options for businesses of all sizes and industries.

Future growth prospects appear favorable with continued regulatory support, ongoing digital transformation across Greek businesses, and increasing consumer preference for electronic payments. Technology advancement in areas such as artificial intelligence, cloud connectivity, and advanced analytics will continue driving market evolution and creating new value propositions for merchants.

Success factors for market participants include developing comprehensive solution offerings, implementing flexible pricing models, establishing strategic partnerships, and maintaining focus on customer education and support. The Greece POS terminal market is positioned for sustained expansion as businesses recognize the operational benefits and competitive advantages provided by modern payment processing solutions in an increasingly digital economy.

What is POS Terminal?

A POS terminal is a device used to process card payments at retail locations, enabling transactions between customers and merchants. These terminals can handle various payment methods, including credit cards, debit cards, and mobile payments.

What are the key players in the Greece POS Terminal Market?

Key players in the Greece POS Terminal Market include companies like Verifone, Ingenico, and PAX Technology, which provide a range of payment solutions and terminals for businesses. These companies are known for their innovative technologies and customer service, among others.

What are the growth factors driving the Greece POS Terminal Market?

The Greece POS Terminal Market is driven by the increasing adoption of cashless payments, the growth of e-commerce, and the demand for enhanced customer experiences. Additionally, advancements in technology, such as contactless payments, are contributing to market growth.

What challenges does the Greece POS Terminal Market face?

Challenges in the Greece POS Terminal Market include the high costs associated with terminal deployment and maintenance, as well as security concerns related to data breaches and fraud. Additionally, the need for continuous software updates can pose operational challenges for businesses.

What opportunities exist in the Greece POS Terminal Market?

Opportunities in the Greece POS Terminal Market include the expansion of mobile payment solutions and the integration of advanced technologies like AI and machine learning for better transaction processing. The growing trend of omnichannel retailing also presents new avenues for POS terminal adoption.

What trends are shaping the Greece POS Terminal Market?

Trends in the Greece POS Terminal Market include the rise of contactless payment options, the integration of POS systems with inventory management, and the increasing use of cloud-based solutions. These trends are enhancing the efficiency and functionality of payment processing systems.

Greece POS Terminal Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile POS, Fixed POS, Self-Service Kiosks, Cloud-Based POS |

| Technology | Contactless Payment, NFC, EMV, Magnetic Stripe |

| End User | Retail, Hospitality, Healthcare, Entertainment |

| Deployment | On-Premise, Cloud, Hybrid, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Greece POS Terminal Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at