444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The Greece life and non-life insurance market has witnessed significant growth over the years. Insurance plays a crucial role in providing financial protection to individuals and businesses against various risks. This comprehensive analysis explores the key aspects of the Greece insurance market, including its meaning, executive summary, market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a concluding summary.

Meaning:

Insurance is a contract between an individual or an organization and an insurance company, wherein the insured party pays a premium to the insurer in exchange for financial protection against potential risks or losses. Life insurance provides coverage for the policyholder’s life, while non-life insurance, also known as general insurance, covers a wide range of risks, including property, health, motor, and liability insurance.

Executive Summary:

The executive summary provides a concise overview of the Greece life and non-life insurance market, summarizing its key aspects, including market size, growth rate, major players, and emerging trends. It serves as a snapshot of the comprehensive analysis and provides readers with a quick understanding of the market’s current state.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Greece Life and Non-Life Insurance Market is shaped by a variety of factors that influence both its growth trajectory and its competitive dynamics. Key insights include the growing importance of digital transformation, as insurers leverage online platforms and advanced analytics to improve customer service and operational efficiency. In addition, regulatory reforms aimed at strengthening consumer protection and market stability have fostered an environment of increased trust among policyholders. The aging population and rising health concerns are boosting demand for life and health insurance products, while non-life insurance continues to be a cornerstone for safeguarding property, vehicles, and businesses. These trends are creating a dynamic market where traditional practices are increasingly complemented by modern, technology-driven approaches.

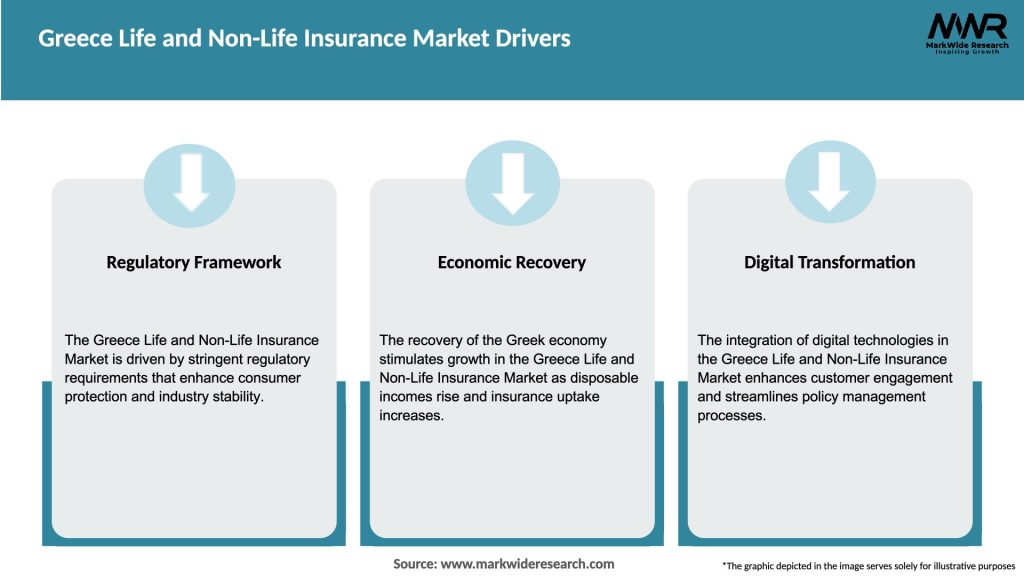

Market Drivers

Several key factors are driving the growth of the Greece Life and Non-Life Insurance Market:

These drivers are collectively contributing to a robust and evolving insurance market in Greece.

Market Restraints

Despite strong growth potential, the Greece Life and Non-Life Insurance Market faces several challenges that could impede expansion:

Addressing these restraints requires continued innovation, strategic investment, and regulatory support to foster sustainable market growth.

Market Opportunities

The Greece Life and Non-Life Insurance Market offers numerous opportunities for growth and innovation:

By capitalizing on these opportunities, insurers can enhance their product offerings, improve customer engagement, and drive sustainable growth.

Market Dynamics

The dynamics of the Greece Life and Non-Life Insurance Market are shaped by a combination of supply-side and demand-side factors, as well as broader economic and technological influences:

Supply Side Factors:

Demand Side Factors:

Economic and Regulatory Influences:

These dynamics illustrate a market that is continuously evolving to meet the challenges and opportunities presented by both internal and external factors.

Regional Analysis

Greece’s insurance market exhibits regional variations influenced by differences in economic development, urbanization, and consumer behavior:

Athens and Urban Centers:

Rural and Peripheral Regions:

Regional Economic Disparities:

Understanding these regional nuances is key to developing targeted strategies that address local market needs and foster overall growth.

Competitive Landscape

Leading Companies in the Greece Life and Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on various dimensions, providing a detailed view of its structure and dynamics:

By Insurance Type:

By Distribution Channel:

By Customer Segment:

This segmentation enables targeted marketing, product development, and distribution strategies to address the diverse needs of the Greek insurance market.

Category-wise Insights

Each category within the Greece Life and Non-Life Insurance Market offers distinct advantages and targets different risk management needs:

These insights highlight the importance of offering a diverse range of insurance products to meet the varied demands of consumers and enterprises in Greece.

Key Benefits for Industry Participants and Stakeholders

The Greece Life and Non-Life Insurance Market provides numerous benefits for insurers, intermediaries, policyholders, and the broader economy:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are currently influencing the evolution of the Greece Life and Non-Life Insurance Market:

These trends are driving market innovation and shaping a more responsive, customer-focused insurance landscape.

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the Greece Life and Non-Life Insurance Market in multiple ways:

Key Industry Developments

Recent developments in the Greece Life and Non-Life Insurance Market highlight a trend toward modernization and customer-centric innovation:

Analyst Suggestions

Industry experts recommend several strategic actions for stakeholders in the Greece Life and Non-Life Insurance Market:

Future Outlook

The future outlook for the Greece Life and Non-Life Insurance Market is positive, with expectations for steady growth driven by technological innovation, regulatory improvements, and evolving consumer behavior. As digital transformation continues to reshape the industry, insurers will be better positioned to offer personalized, efficient, and accessible products that meet the needs of a diverse customer base. The market is also expected to benefit from increased economic stability, rising consumer awareness, and greater integration of sustainability practices. With continuous investment in digital and operational improvements, the insurance sector in Greece is poised for robust long-term growth, ensuring enhanced financial protection and economic resilience for both individuals and businesses.

Conclusion

The Greece Life and Non-Life Insurance Market is a dynamic and evolving sector that plays a pivotal role in protecting against financial risks while fostering economic stability. With a diverse range of products designed to meet both individual and corporate needs, the market is transitioning from traditional practices to embrace digital innovation and customer-centric strategies. Despite challenges such as economic volatility and complex regulatory environments, continuous investments in technology, product diversification, and strategic partnerships are driving sustainable growth. As the market adapts to new consumer expectations and global trends, insurers in Greece are well-positioned to enhance financial security, drive economic resilience, and contribute to the overall stability of the nation’s financial landscape.

What is Greece Life and Non-Life Insurance?

Greece Life and Non-Life Insurance refers to the insurance services provided in Greece that cover life-related risks and non-life risks such as property, health, and liability. This sector plays a crucial role in financial security and risk management for individuals and businesses.

What are the key players in the Greece Life and Non-Life Insurance Market?

Key players in the Greece Life and Non-Life Insurance Market include Ethniki Insurance, Allianz Greece, and Interamerican. These companies offer a range of products from life insurance to property and casualty coverage, among others.

What are the growth factors driving the Greece Life and Non-Life Insurance Market?

The growth of the Greece Life and Non-Life Insurance Market is driven by increasing awareness of insurance products, a growing middle class, and the rising need for health and property coverage. Additionally, regulatory changes are encouraging more individuals to seek insurance.

What challenges does the Greece Life and Non-Life Insurance Market face?

The Greece Life and Non-Life Insurance Market faces challenges such as economic instability, low penetration rates, and competition from alternative financial products. These factors can hinder growth and consumer adoption of insurance services.

What opportunities exist in the Greece Life and Non-Life Insurance Market?

Opportunities in the Greece Life and Non-Life Insurance Market include the expansion of digital insurance solutions, increased demand for personalized insurance products, and the potential for growth in underserved segments. Insurers can leverage technology to enhance customer experience and streamline operations.

What trends are shaping the Greece Life and Non-Life Insurance Market?

Trends in the Greece Life and Non-Life Insurance Market include the rise of insurtech, a focus on sustainability in insurance practices, and the integration of artificial intelligence for risk assessment. These trends are transforming how insurance products are developed and delivered.

Greece Life and Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Casualty Insurance |

| Customer Type | Individuals, Families, Corporates, SMEs |

| Distribution Channel | Direct Sales, Brokers, Agents, Online Platforms |

| Service Type | Claims Processing, Underwriting, Risk Assessment, Policy Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at