444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global xylenols market is experiencing significant growth and is expected to expand at a steady pace in the coming years. Xylenols are chemical compounds derived from xylene, which is a petroleum-based product. They find wide-ranging applications in various industries, including chemicals, pharmaceuticals, agriculture, and personal care. This comprehensive report provides key insights into the market, its drivers, restraints, opportunities, and regional analysis. It also covers the competitive landscape, segmentation, industry trends, and future outlook of the global xylenols market.

Meaning

Xylenols refer to a group of chemical compounds that are produced from xylene through various processes. They are commonly used as intermediates or raw materials in the production of other chemicals. Xylenols are known for their versatility and are widely utilized in different applications due to their beneficial properties such as antimicrobial, antioxidant, and solvent capabilities.

Executive Summary

The executive summary of the global xylenols market provides a concise overview of the key findings and insights covered in the report. It highlights the market’s growth potential, major trends, and key players operating in the industry. The executive summary serves as a quick reference guide for industry professionals and stakeholders seeking a comprehensive understanding of the market.

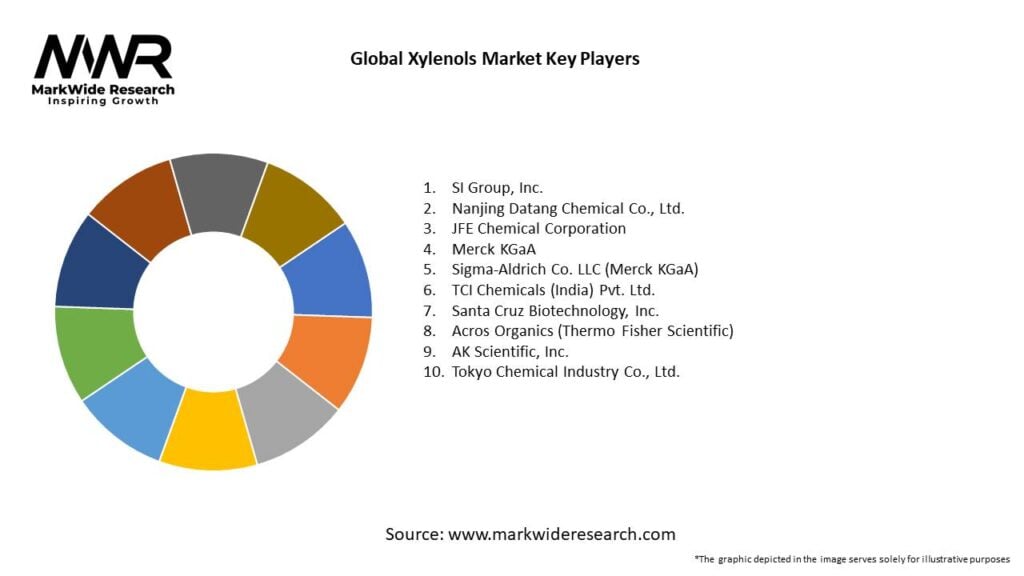

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Feedstock Dynamics: The primary feedstocks for xylenol production are coal tar creosote and petroleum-derived phenol streams. Shifts in crude oil and coal tar availability—due to energy market trends—directly impact cost structures and margin profiles.

Isomer Distribution: Ortho-xylenol commands a premium due to its superior antioxidant properties, whereas meta- and para-xylenols find greater use in resin production. Balancing isomer separation efficiency is a critical operational challenge.

Regulatory Landscape: Regulatory scrutiny around phenolic compounds—driven by environmental and health concerns—has intensified, leading to tighter emission controls on manufacturing facilities and strict permissible limits in consumer products.

Sustainability Trends: Innovation in lignin valorization and microbial fermentation routes for xylenol synthesis aligns with corporate ESG goals, reducing reliance on fossil feedstocks. Early-stage commercial projects are underway in Europe and North America.

Regional Production Hubs: Asia-Pacific, led by China and India, dominates xylenol production due to robust petrochemical infrastructure and lower-cost feedstocks. North America and Europe focus more on high-value applications and specialty derivatives.

Market Drivers

Automotive Lightweighting: Phenolic resins derived from xylenols are vital in composites used for lightweight automotive components, improving fuel efficiency and reducing emissions.

Infrastructure Development: Rapid urbanization and construction of bridges, highways, and public buildings spur demand for durable adhesives and coatings, many of which rely on xylenol-based chemistries.

Circular Economy Initiatives: Policies promoting recycled plastics and extended product lifecycles increase reliance on robust antioxidants, driving demand for xylenol-derived stabilizers.

Healthcare and Personal Care Growth: Rising healthcare expenditure and stringent sanitation protocols boost use of xylenol-based antiseptics and disinfectants in hospitals, food service, and household products.

Technological Breakthroughs: Advances in catalytic oxidation and high-throughput distillation improve isomer yields and reduce energy consumption, enhancing production economics.

Market Restraints

Feedstock Price Volatility: Fluctuations in crude oil and coal tar chemical feedstock prices can erode margins and disrupt supply chains.

Stringent Environmental Regulations: Phenolic emissions and wastewater byproducts require costly treatment systems, increasing capital and operating expenses for producers.

Competition from Alternative Chemistries: Emerging antioxidant and resin technologies—such as hindered amines and bio-based monomers—pose competitive threats to xylenol derivatives.

Complex Isomer Separation: Achieving high-purity isomer streams demands energy-intensive distillation or extraction processes, impacting operational efficiency.

Market Opportunities

Bio-Based Xylenols: Commercialization of lignin-to-xylenol processes could capture a sizable niche in green chemistry, appealing to brand-conscious end-users and aligning with sustainability regulations.

Smart Antioxidant Formulations: Integration of nano-encapsulation and controlled-release technologies for antioxidants can open premium markets in high-performance plastics and lubricants.

Specialized Phenolic Resins: Development of ultra-high-temperature phenolic resins for aerospace and electronics offers high-margin opportunities.

Regional Capacity Expansions: Greenfield and brownfield expansions in Southeast Asia and the Middle East to serve rapidly growing domestic manufacturing sectors.

Collaborative R&D: Partnerships between chemical producers and academic institutions to explore novel xylenol chemistries—such as fluorinated and alkylated derivatives—can create differentiated product lines.

Market Dynamics

Supply-Side Dynamics: Leading producers focus on continuous process improvements—advanced distillation, extractive crystallization, and catalytic oxidation—to boost yields and reduce waste. Investment in digital twins and process automation enhances plant reliability.

Demand-Side Dynamics: Key end-users (automotive, construction, rubber, plastics) increasingly specify performance criteria—UV stability, high-temperature resistance, color retention—driving tailored xylenol derivative solutions.

Pricing Dynamics: Market prices track feedstock costs with typical industry margins of 8–12%. Specialty derivatives command 20–30% premiums over commodity-grade xylenols.

Innovation and Collaboration: Cross-industry consortiums, such as those focused on lignin valorization, are pooling resources to overcome technical barriers and accelerate market entry for bio-based xylenols.

Regional Analysis

Asia-Pacific: Dominates production capacity (~65%) and consumption, powered by China’s vast petrochemical complexes and India’s growing polymers market. Rapid industrialization and infrastructure projects underpin robust demand.

North America: Focuses on high-value specialty applications. Invests heavily in process intensification and sustainability, with emerging bio-xylenol ventures in the U.S. Midwest.

Europe: Regulations driving circular economy initiatives and green chemistry adoption. Producers in Germany and Belgium specialize in precision isomer separations and high-performance resin intermediates.

Middle East & Africa: Leveraging abundant hydrocarbon feedstocks to expand xylenol production capacity, with new plants announced in the UAE and Saudi Arabia to serve domestic petrochemical growth.

Latin America: Growing consumption in Brazil and Mexico linked to automotive and construction sectors, but limited production capacity maintains heavy reliance on imports.

Competitive Landscape

Leading Companies in the Global Xylenols Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

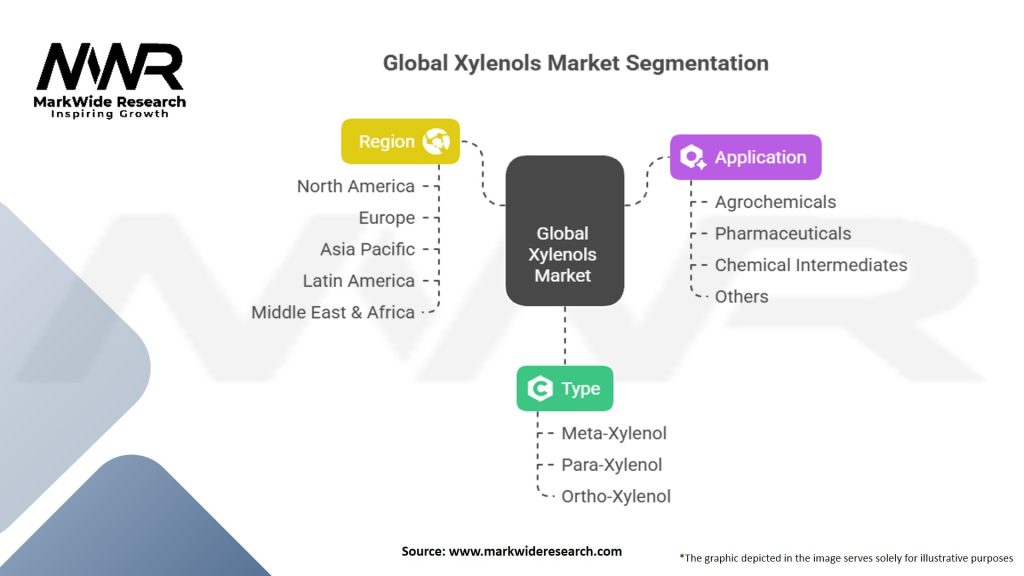

Segmentation

By Isomer Type: Ortho-xylenol (2,6), Meta-xylenol (3,5), Para-xylenol (2,4).

By Grade: Industrial-grade (commodity), Technical-grade (≥95% purity), Specialty-grade (≥99% purity).

By Application:

Antioxidants & Stabilizers (rubber, plastics, lubricants)

Phenolic Resins (adhesives, coatings, composites)

Disinfectants & Antiseptics (healthcare, hygiene)

Pharmaceutical Intermediates

Others (dyes, agrochemicals)

By End-Use Industry: Automotive, Construction, Electronics, Personal Care, Healthcare, Others.

By Region: Asia-Pacific, North America, Europe, Middle East & Africa, Latin America.

Category-wise Insights

Antioxidant & Stabilizer Segment: Largest end-use segment, driven by the demand for long-life plastics and heat-resistant rubber. Ortho-xylenol derivatives lead this segment.

Phenolic Resin Segment: High growth (~6% CAGR) due to rising use in aerospace-grade composites and fire-retardant panels. Specialty-grade para-xylenol is preferred for resin synthesis.

Disinfectant Segment: Valued for hospital-grade antiseptics and household cleaners; growth accelerated by heightened hygiene awareness post-pandemic.

Pharmaceutical Segment: Niche but high-value, as xylenols serve as building blocks for antiseptic drugs and other APIs.

Key Benefits for Industry Participants and Stakeholders

Enhanced Product Performance: Xylenol derivatives improve thermal stability, UV resistance, and oxidative longevity in end products.

Diversified Revenue Streams: Producing multiple isomer grades and downstream formulations can capture varied market segments.

Vertical Integration Advantage: Controlling feedstock sourcing, isomer separation, and derivative manufacturing enhances margin control and supply security.

Sustainability Credentials: Investing in bio-xylenols and greener processes strengthens ESG profiles and opens new customer segments.

Global Market Access: Expanding production footprints in key regions reduces logistical costs and improves responsiveness to local demand.

SWOT Analysis

Strengths:

Versatile applications across high-growth industries

Established production processes and supply chains

Ability to deliver high-purity specialty grades

Weaknesses:

Feedstock price volatility

Energy-intensive isomer separation steps

Regulatory compliance costs for phenolic emissions

Opportunities:

Commercialization of bio-based xylenols

Development of smart antioxidant delivery systems

Expansion into emerging regional markets

Threats:

Competition from alternative antioxidant chemistries (e.g., hindered amines)

Tightening environmental regulations

Economic downturns affecting end-use industries

Market Key Trends

Bio-Based Feedstocks: Partnerships to develop lignin-to-xylenol routes and scale microbial fermentation processes.

Digital Manufacturing: Adoption of Industry 4.0 technologies—advanced process control, predictive maintenance—to enhance plant efficiency and yield.

High-Performance Formulations: R&D into novel xylenol co-monomers for next-gen phenolic resins and thermosets.

Green Chemistry Certification: Proliferation of eco-labels and sustainability metrics for chemical intermediates, influencing procurement decisions.

Downstream Integration: Mergers between upstream xylenol producers and resin/antioxidant formulators to capture greater value.

Covid-19 Impact

Short-Term Disruptions: Temporary plant shutdowns, logistics bottlenecks, and workforce constraints impacted supply in early 2020.

Shift in Product Mix: Surge in demand for disinfectant-grade xylenols for hygiene and antiviral products.

Acceleration of Automation: Companies accelerated investments in remote operations, digital monitoring, and autonomous process control to mitigate future disruptions.

Supply Chain Resilience: Heightened focus on geographic diversification of feedstock and finished-goods supply to reduce single-source dependencies.

Key Industry Developments

Major Capacity Expansions: Leading petrochemical players in China and the Gulf investing in multi-hundred-thousand-ton xylenol facilities to meet rising demand.

Bio-XYLENOL Pilot Plants: European consortiums and U.S. startups moving pilot-scale bio-xylenol projects to demonstration scale.

Advanced Separation Technologies: Commercial adoption of membrane-based isomer separations and extractive crystallization to lower energy use.

Strategic Acquisitions: Specialty chemical companies acquiring bio-based technology firms to bolster sustainability credentials and add novel products.

Analyst Suggestions

Invest in Feedstock Flexibility: Secure access to both petrochemical and bio-based raw materials to hedge against price volatility and regulatory shifts.

Optimize Energy Efficiency: Target process intensification—heat integration, advanced separations—to reduce operating costs and carbon footprint.

Expand Downstream Footprint: Pursue vertical integration or partnerships with resin and antioxidant formulators to capture higher-value margins.

Accelerate Bio-Based Transition: Allocate R&D resources to scale sustainable production routes and secure early-mover advantage in green xylenol supply.

Strengthen Regulatory Engagement: Proactively collaborate with environmental agencies to shape phenolic emission standards and secure operating permits.

Enhance Digital Capabilities: Deploy advanced analytics, digital twins, and IoT sensors for process monitoring, predictive maintenance, and rapid troubleshooting.

Target High-Growth Regions: Focus sales and distribution efforts on emerging markets in Southeast Asia, the Middle East, and Latin America, where infrastructure investment is strong.

Future Outlook

The global xylenols market is set to maintain healthy growth through 2030, underpinned by rising demand in high-performance and sustainable applications. Key trends to monitor include:

Commercial Breakthroughs in Bio-XYLENOLS: Proof-of-concept to large-scale bio-xylenol production could reshape feedstock economics and sustainability narratives.

Advanced Formulations for Electric Vehicles and Electronics: Next-gen phenolic composites for electric vehicle battery housings and high-reliability electronics will drive premium xylenol demand.

Regulatory Evolution: Stricter global regulations on phenolic emissions and chemical safety will favor producers with best-in-class environmental performance.

Digital & Circular Economy Integration: Full lifecycle traceability—enabled by digital platforms—will differentiate suppliers that can credibly demonstrate circularity in xylenol production and use.

Stakeholders who invest in feedstock diversification, process innovation, and downstream integration, while aligning with sustainability imperatives, will be best positioned to capture the growth opportunities in this evolving market.

Conclusion

The Global Xylenols Market is at an inflection point, balancing established petrochemical production routes with emerging bio-based technologies. Xylenols’ core value as versatile intermediates in antioxidants, phenolic resins, disinfectants, and specialty chemicals creates a resilient demand base across multiple end-use segments. While feedstock volatility, environmental regulations, and process complexities pose challenges, strategic investments in process efficiency, digital transformation, and sustainable production routes promise to unlock new growth avenues.

In conclusion, the global xylenols market is poised for steady growth driven by the increasing demand for chemicals and chemical intermediates. The market offers lucrative opportunities in various industries, including pharmaceuticals, agrochemicals, and personal care. However, market players need to navigate challenges such as volatile raw material prices and stringent regulations. By leveraging key market insights, understanding regional dynamics, and focusing on product innovation, companies can position themselves for success in the competitive xylenols market.

What is Xylenols?

Xylenols are a group of chemical compounds derived from xylene, primarily used as solvents and in the production of various chemicals, including resins and plastics. They are important in the manufacturing of pharmaceuticals, agrochemicals, and other industrial applications.

What are the key players in the Global Xylenols Market?

Key players in the Global Xylenols Market include companies such as BASF, Eastman Chemical Company, and Mitsubishi Gas Chemical Company, which are known for their production and supply of xylenols for various applications, among others.

What are the growth factors driving the Global Xylenols Market?

The growth of the Global Xylenols Market is driven by increasing demand from the pharmaceutical and agrochemical industries, as well as the rising use of xylenols in the production of coatings and adhesives. Additionally, the expansion of industrial applications is contributing to market growth.

What challenges does the Global Xylenols Market face?

The Global Xylenols Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and limit the availability of xylenols in certain regions.

What opportunities exist in the Global Xylenols Market?

Opportunities in the Global Xylenols Market include the development of bio-based xylenols and innovations in production technologies. Additionally, the growing demand for sustainable and eco-friendly products presents new avenues for market expansion.

What trends are shaping the Global Xylenols Market?

Trends shaping the Global Xylenols Market include the increasing focus on sustainability and the adoption of green chemistry practices. Furthermore, advancements in chemical processing technologies are enhancing the efficiency of xylenol production.

Global Xylenols Market

| Segmentation Details | Details |

|---|---|

| Type | Meta-Xylenol, Para-Xylenol, Ortho-Xylenol |

| Application | Agrochemicals, Pharmaceuticals, Chemical Intermediates, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Xylenols Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at