444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The global travel credit card market has witnessed significant growth in recent years. Travel credit cards are specifically designed to cater to the needs of frequent travelers, offering various benefits and rewards. These cards provide convenient payment options, travel insurance coverage, and exclusive perks such as airport lounge access and discounts on hotels and airlines. This comprehensive analysis will delve into the key insights, market dynamics, regional analysis, competitive landscape, and future outlook of the global travel credit card market.

Meaning:

Travel credit cards are financial products that enable cardholders to earn rewards and enjoy travel-related benefits. These cards typically offer points or miles for every dollar spent, which can be redeemed for flights, hotel stays, car rentals, or other travel-related expenses. They also come with features like no foreign transaction fees, travel insurance, and concierge services, making them an ideal choice for individuals who frequently travel for business or leisure purposes.

Executive Summary:

The global travel credit card market has experienced robust growth in recent years, driven by the increasing popularity of travel and the growing consumer demand for convenient payment options and travel-related benefits. Key market players have been introducing innovative card offerings, enhancing rewards programs, and partnering with airlines and hotel chains to attract more customers. However, the market also faces challenges such as intense competition and changing consumer preferences. Despite these hurdles, the market presents numerous opportunities for growth, especially with the rising trend of international travel and the emergence of new technologies.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

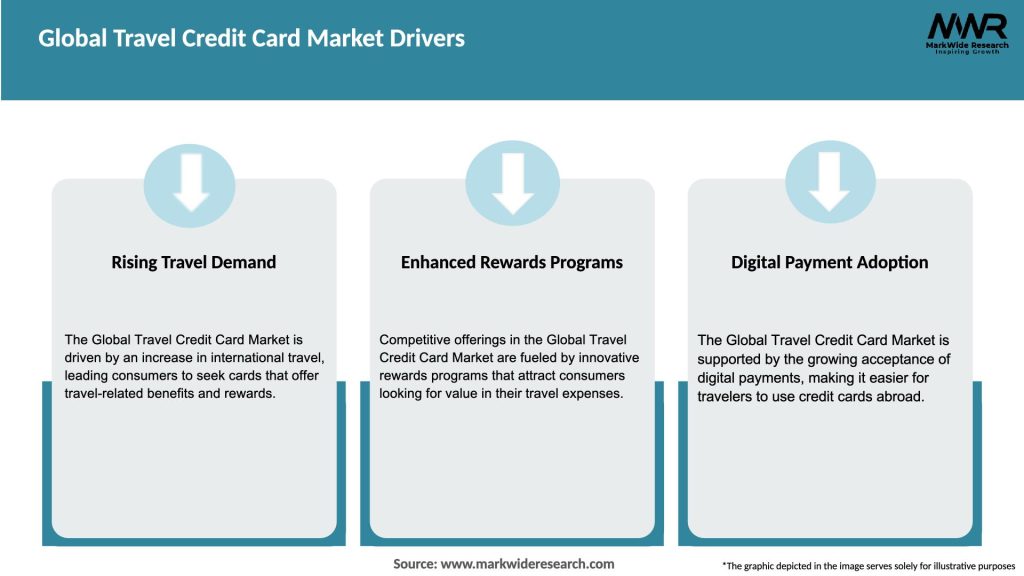

Market Drivers

Several factors are driving the growth of the Global Travel Credit Card Market:

Market Restraints

Despite the strong growth, the Global Travel Credit Card market faces several challenges:

Market Opportunities

The Global Travel Credit Card market offers significant opportunities for growth:

Market Dynamics

The Global Travel Credit Card market is shaped by several dynamic factors:

Regional Analysis

The Global Travel Credit Card market is seeing varied adoption across different regions:

Competitive Landscape

Leading Companies in the Global Travel Credit Card Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

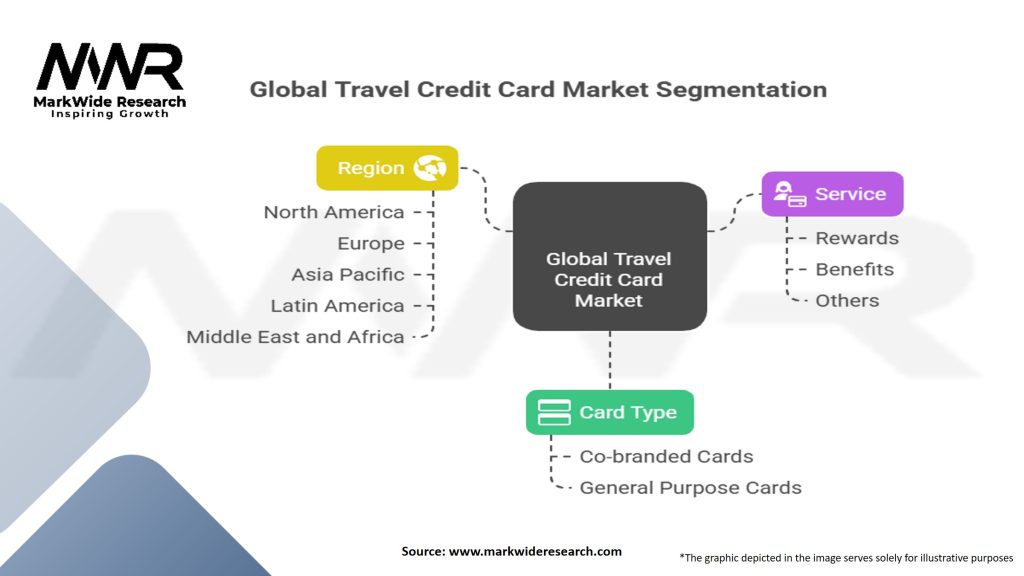

Segmentation

The Global Travel Credit Card Market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Global Travel Credit Card market offers several benefits:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends in the Global Travel Credit Card market include:

Covid-19 Impact:

The Covid-19 pandemic has significantly impacted the travel industry, including the travel credit card market. This analysis will evaluate the effects of the pandemic on consumer behavior, travel patterns, and the overall market. It will also discuss the measures taken by market players to mitigate the impact and adapt to the changing landscape.

Key Industry Developments:

This section will focus on recent developments and trends within the travel credit card market. It will cover product launches, strategic partnerships, technological advancements, and regulatory updates that have influenced the market dynamics. Recent industry developments include new premium travel cards, collaborations between financial institutions and travel companies, and an increase in mobile payment solutions.

Analyst Suggestions

Future Outlook:

The future of the Global Travel Credit Card market looks promising, with continued growth driven by rising travel activity and increasing consumer demand for premium, reward-based credit cards. The future outlook section will provide a forward-looking perspective on the global travel credit card market. It will analyze anticipated market trends, growth opportunities, challenges, and regulatory developments that are expected to shape the market in the coming years.

Conclusion:

In conclusion, the global travel credit card market presents lucrative opportunities for industry participants. The market is driven by factors such as increasing disposable income, rising international travel, and attractive rewards programs. However, market players need to navigate the challenges posed by intense competition and changing consumer preferences. By leveraging emerging technologies, targeting specific consumer segments, and forming strategic partnerships, industry participants can gain a competitive edge and thrive in the evolving travel credit card market landscape.

What is Travel Credit Card?

A Travel Credit Card is a financial product designed to offer benefits and rewards for travelers, such as points for travel-related purchases, no foreign transaction fees, and travel insurance. These cards cater to frequent travelers by providing perks that enhance their travel experience.

What are the key players in the Global Travel Credit Card Market?

Key players in the Global Travel Credit Card Market include American Express, Chase, Capital One, and Citibank, among others. These companies offer a variety of travel credit cards tailored to different consumer needs and preferences.

What are the growth factors driving the Global Travel Credit Card Market?

The Global Travel Credit Card Market is driven by increasing travel activities, a growing preference for cashless transactions, and the rising demand for rewards programs. Additionally, partnerships with airlines and hotels enhance the appeal of these cards.

What challenges does the Global Travel Credit Card Market face?

Challenges in the Global Travel Credit Card Market include intense competition among card issuers, regulatory changes affecting fees and rewards, and consumer concerns regarding data security. These factors can impact customer trust and card adoption.

What opportunities exist in the Global Travel Credit Card Market?

Opportunities in the Global Travel Credit Card Market include the expansion of digital payment solutions, the integration of advanced technology for personalized offers, and the growing trend of sustainable travel. These factors can attract new customers and enhance user engagement.

What trends are shaping the Global Travel Credit Card Market?

Trends in the Global Travel Credit Card Market include the rise of contactless payments, increased focus on travel-related benefits, and the incorporation of mobile apps for managing rewards. Additionally, there is a growing emphasis on customer experience and loyalty programs.

Global Travel Credit Card Market

| Segmentation | Details |

|---|---|

| By Card Type | Co-branded Cards, General Purpose Cards |

| By Service | Rewards, Benefits, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Travel Credit Card Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at