444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global transmission and distribution equipment market represents a critical component of the worldwide electrical infrastructure ecosystem, encompassing essential technologies that facilitate the efficient transfer of electrical power from generation sources to end consumers. This comprehensive market includes transformers, switchgear, transmission lines, distribution panels, protective relays, and various monitoring systems that ensure reliable electricity delivery across vast networks.

Market dynamics indicate robust growth driven by increasing electricity demand, infrastructure modernization initiatives, and the integration of renewable energy sources. The sector is experiencing significant transformation as utilities worldwide upgrade aging grid infrastructure while simultaneously accommodating distributed energy resources and smart grid technologies. Growth projections suggest the market will expand at a 6.2% CAGR through the forecast period, reflecting strong demand across both developed and emerging economies.

Regional variations in market development reflect different stages of infrastructure maturity, with Asia-Pacific markets leading expansion efforts due to rapid industrialization and urbanization. Meanwhile, North American and European markets focus primarily on grid modernization and replacement of legacy equipment. The market’s evolution is increasingly influenced by digitalization trends, environmental regulations, and the growing emphasis on grid resilience and reliability.

The transmission and distribution equipment market refers to the comprehensive ecosystem of electrical infrastructure components, systems, and technologies designed to transport electrical power from generation facilities to end-use consumers through high-voltage transmission networks and medium-to-low voltage distribution systems.

Transmission equipment operates at high voltage levels, typically above 69 kV, and includes substations, transmission lines, transformers, and protective systems that carry electricity over long distances with minimal losses. Distribution equipment functions at lower voltage levels, generally below 69 kV, encompassing local distribution networks, residential transformers, switchgear, and metering systems that deliver power directly to consumers.

Modern equipment categories increasingly incorporate digital technologies, automation capabilities, and smart grid functionalities that enhance operational efficiency, enable real-time monitoring, and support advanced grid management strategies. This evolution reflects the industry’s transition toward more intelligent, responsive, and sustainable electrical infrastructure systems.

Market fundamentals demonstrate strong growth momentum driven by global electrification trends, infrastructure modernization requirements, and renewable energy integration initiatives. The transmission and distribution equipment sector serves as the backbone of electrical power systems, facilitating reliable energy delivery while adapting to evolving technological and regulatory landscapes.

Key growth drivers include increasing electricity consumption, aging infrastructure replacement needs, smart grid deployment initiatives, and regulatory mandates for grid modernization. Renewable energy integration represents a particularly significant driver, with 42% of new capacity additions requiring specialized transmission and distribution solutions to accommodate variable generation sources and bidirectional power flows.

Technology advancement continues reshaping market dynamics, with digitalization, automation, and IoT integration becoming standard features in modern equipment designs. Market participants are investing heavily in research and development to deliver solutions that meet evolving grid requirements while addressing sustainability, efficiency, and reliability objectives.

Competitive landscape features established global manufacturers alongside emerging technology providers, creating a dynamic environment characterized by innovation, strategic partnerships, and market consolidation activities. Regional market variations reflect different infrastructure development stages, regulatory frameworks, and investment priorities across major geographical markets.

Strategic market insights reveal several critical trends shaping the transmission and distribution equipment landscape:

Market maturity levels vary significantly across regions, with developed markets emphasizing replacement and upgrade activities while emerging economies focus on new infrastructure development and capacity expansion initiatives.

Primary market drivers encompass multiple interconnected factors that collectively fuel demand for transmission and distribution equipment across global markets. Electricity demand growth remains the fundamental driver, with global consumption increasing steadily due to population growth, urbanization, industrialization, and electrification of transportation and heating systems.

Infrastructure aging presents significant replacement opportunities, particularly in developed markets where substantial portions of transmission and distribution networks were installed decades ago and now require modernization or complete replacement. Grid reliability requirements are becoming increasingly stringent as societies become more dependent on continuous electricity supply for critical services and economic activities.

Renewable energy integration creates substantial demand for specialized equipment capable of handling variable generation sources, bidirectional power flows, and grid stability challenges. Smart grid initiatives drive adoption of advanced equipment featuring digital capabilities, automation, and communication functionalities that enable more efficient grid operations and enhanced customer services.

Regulatory mandates across various jurisdictions require utilities to upgrade infrastructure, improve reliability metrics, and reduce environmental impacts. Economic development in emerging markets necessitates substantial investments in new transmission and distribution infrastructure to support industrial growth and improve access to electricity services.

Market constraints present significant challenges that may limit growth potential and create barriers to market expansion. High capital requirements for transmission and distribution projects often strain utility budgets and require complex financing arrangements, potentially delaying or scaling back infrastructure investments.

Regulatory complexity and lengthy approval processes can significantly extend project timelines and increase development costs. Environmental concerns and permitting challenges, particularly for transmission line projects, create additional hurdles that may impact project feasibility and implementation schedules.

Technical challenges associated with integrating new equipment into existing infrastructure systems can create compatibility issues and require substantial engineering expertise. Supply chain disruptions and material availability constraints may impact equipment delivery schedules and project completion timelines.

Skilled workforce shortages in many regions limit the industry’s ability to execute large-scale infrastructure projects efficiently. Cybersecurity concerns require substantial investments in protective measures and may slow adoption of digital technologies. Economic uncertainties and fluctuating commodity prices can impact project economics and investment decisions.

Emerging opportunities within the transmission and distribution equipment market reflect evolving energy landscapes and technological advancement. Digital transformation initiatives create substantial opportunities for equipment manufacturers to develop innovative solutions incorporating IoT, artificial intelligence, and advanced analytics capabilities.

Grid modernization programs worldwide represent significant market opportunities, with utilities investing heavily in infrastructure upgrades to improve reliability, efficiency, and resilience. Renewable energy expansion continues creating demand for specialized equipment supporting wind, solar, and other renewable generation technologies.

Energy storage integration presents growing opportunities as utilities deploy battery systems and other storage technologies to enhance grid flexibility and reliability. Electric vehicle infrastructure development requires substantial distribution system upgrades and creates new market segments for specialized equipment.

Emerging market electrification offers substantial growth potential as developing countries expand electricity access and upgrade existing infrastructure. Microgrids and distributed energy resources create opportunities for innovative equipment solutions supporting localized energy systems and enhanced grid resilience.

Market dynamics reflect the complex interplay of technological, regulatory, economic, and social factors shaping the transmission and distribution equipment landscape. Technology evolution continues driving market transformation, with digitalization enabling new capabilities and business models while creating competitive advantages for innovative manufacturers.

Competitive intensity varies across different equipment categories and geographical markets, with established players leveraging scale advantages while emerging companies focus on specialized technologies and niche applications. Market consolidation activities continue as companies seek to expand capabilities, access new markets, and achieve operational efficiencies.

Customer requirements are evolving rapidly, with utilities demanding more sophisticated solutions that deliver enhanced performance, reliability, and operational flexibility. Sustainability considerations increasingly influence purchasing decisions, with 73% of utilities prioritizing environmental performance in equipment selection processes.

Supply chain dynamics play crucial roles in market development, with manufacturers working to optimize global sourcing strategies while managing risks associated with material availability and geopolitical uncertainties. Innovation cycles are accelerating as companies invest in research and development to maintain competitive positions and address emerging market requirements.

Comprehensive research methodology employed in analyzing the transmission and distribution equipment market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, utility managers, equipment manufacturers, and technology providers to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, trade publications, and technical literature to develop comprehensive understanding of market dynamics and competitive landscapes. Quantitative analysis utilizes statistical modeling techniques to project market trends, growth rates, and segment performance across different geographical regions and time periods.

Market validation processes include cross-referencing multiple data sources, conducting expert reviews, and performing sensitivity analyses to ensure research findings accurately reflect market realities. Data collection methodologies adhere to rigorous standards for accuracy, completeness, and objectivity while maintaining confidentiality of proprietary information.

Analytical frameworks incorporate industry best practices, established forecasting models, and proprietary methodologies developed through extensive market research experience. Quality assurance procedures ensure all research outputs meet high standards for accuracy, reliability, and professional presentation.

Regional market analysis reveals significant variations in transmission and distribution equipment demand patterns, growth drivers, and competitive dynamics across major geographical markets. Asia-Pacific markets demonstrate the strongest growth momentum, accounting for approximately 45% of global demand, driven by rapid industrialization, urbanization, and infrastructure development initiatives in countries like China, India, and Southeast Asian nations.

North American markets focus primarily on grid modernization and infrastructure replacement, with utilities investing heavily in smart grid technologies and aging equipment upgrades. Market share distribution shows North America representing approximately 28% of global demand, with strong emphasis on advanced technologies and regulatory compliance requirements.

European markets emphasize sustainability, renewable energy integration, and grid digitalization initiatives. Regional characteristics include stringent environmental regulations, advanced technology adoption, and substantial investments in offshore wind integration infrastructure. European market share accounts for approximately 22% of global demand.

Latin American markets present growing opportunities driven by economic development, electrification programs, and infrastructure modernization needs. Middle East and African markets show increasing activity related to economic diversification efforts, population growth, and industrial development initiatives. MarkWide Research analysis indicates these emerging regions collectively represent significant growth potential for equipment manufacturers.

Competitive landscape features a diverse mix of established global manufacturers, regional specialists, and emerging technology providers competing across various equipment categories and geographical markets. Market leadership positions vary by product segment, with different companies maintaining advantages in specific technologies or regional markets.

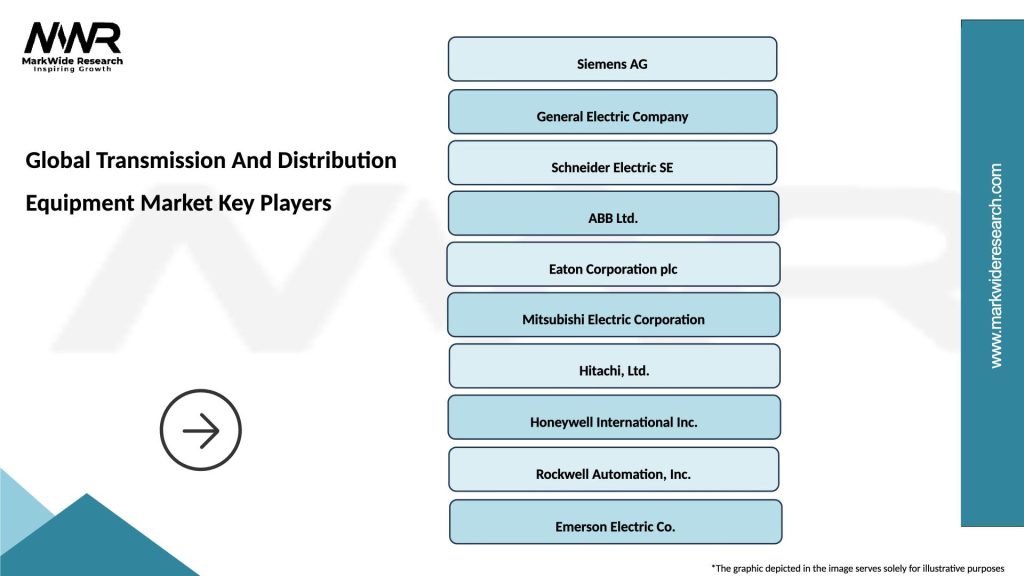

Major market participants include:

Competitive strategies focus on technology innovation, geographical expansion, strategic partnerships, and market consolidation activities. Research and development investments remain critical for maintaining competitive advantages and addressing evolving customer requirements.

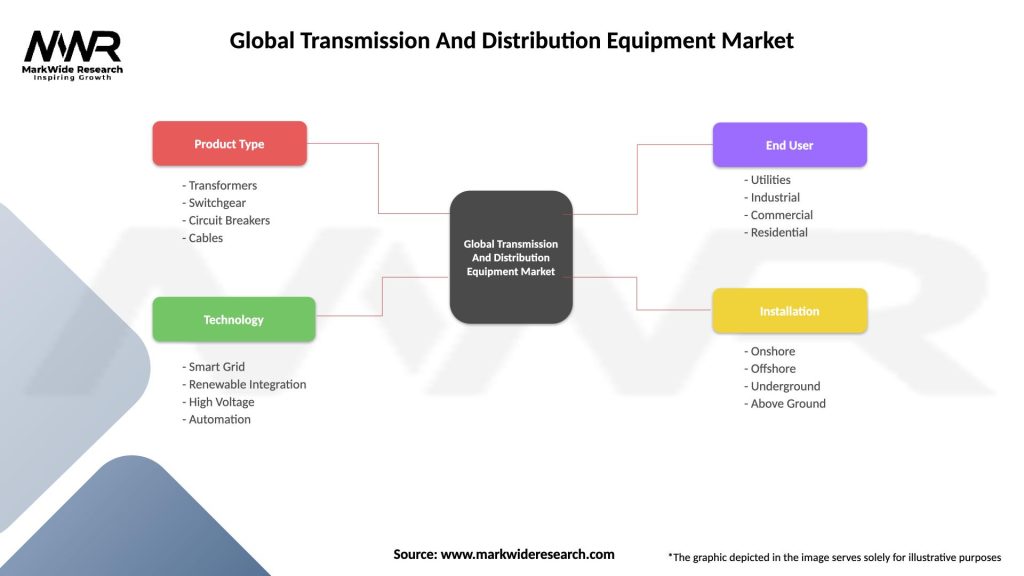

Market segmentation analysis reveals diverse categories and applications within the transmission and distribution equipment market, each characterized by distinct growth patterns, technology requirements, and competitive dynamics.

By Equipment Type:

By Voltage Level:

By Application:

Transformer segment represents the largest equipment category, driven by continuous demand for power transformers in transmission applications and distribution transformers for local networks. Technology advancement focuses on improved efficiency, reduced losses, and enhanced monitoring capabilities. Smart transformers incorporating digital technologies show particularly strong growth potential.

Switchgear category demonstrates robust growth driven by grid modernization initiatives and safety requirements. Gas-insulated switchgear gains market share due to space constraints and environmental considerations, while digital switchgear solutions offer enhanced operational capabilities and maintenance optimization.

Transmission line segment experiences steady demand driven by grid expansion and interconnection projects. Underground cable systems show increasing adoption in urban areas and environmentally sensitive locations, despite higher installation costs compared to overhead alternatives.

Distribution equipment category benefits from smart grid deployments and advanced metering infrastructure initiatives. Smart meters and distribution automation systems represent high-growth segments within this category, enabling improved grid management and customer services.

Monitoring systems segment experiences rapid growth as utilities invest in digital technologies for enhanced grid visibility and control. Advanced analytics and predictive maintenance capabilities drive adoption of sophisticated monitoring solutions.

Equipment manufacturers benefit from sustained demand growth driven by global electrification trends and infrastructure modernization requirements. Technology innovation opportunities enable companies to develop differentiated solutions and capture premium market positions while expanding into emerging application areas.

Utility companies gain access to advanced equipment solutions that improve operational efficiency, enhance reliability, and reduce maintenance costs. Smart grid technologies enable utilities to optimize asset utilization, improve customer services, and integrate renewable energy sources more effectively.

End consumers benefit from improved electricity reliability, enhanced service quality, and access to advanced energy management capabilities. Smart grid deployments enable consumers to better understand and control their energy consumption while participating in demand response programs.

Government agencies achieve policy objectives related to energy security, environmental protection, and economic development through strategic investments in transmission and distribution infrastructure. Grid modernization supports renewable energy integration and climate change mitigation goals.

Financial institutions find attractive investment opportunities in infrastructure projects that offer stable, long-term returns while supporting essential services and economic development. Green financing initiatives increasingly support sustainable infrastructure investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trend continues transforming the transmission and distribution equipment landscape, with manufacturers integrating IoT sensors, advanced analytics, and artificial intelligence capabilities into traditional equipment designs. Smart grid evolution drives demand for equipment featuring communication capabilities, remote monitoring, and automated control functions.

Sustainability focus influences product development priorities, with manufacturers developing eco-friendly materials, improving energy efficiency, and implementing circular economy principles. Environmental regulations increasingly impact equipment specifications and design requirements across global markets.

Modular design approaches gain popularity as utilities seek flexible solutions that can adapt to changing requirements and support future expansion needs. Standardization efforts aim to reduce costs and improve interoperability while maintaining performance and reliability standards.

Predictive maintenance technologies enable utilities to optimize equipment performance and reduce maintenance costs through condition-based monitoring and advanced analytics. Asset management systems integrate equipment data with operational requirements to optimize lifecycle performance and investment decisions.

Cybersecurity integration becomes standard practice as equipment manufacturers incorporate security features to protect against evolving cyber threats. MWR analysis indicates that 68% of new equipment deployments now include enhanced cybersecurity capabilities as standard features.

Recent industry developments reflect accelerating pace of innovation and market evolution within the transmission and distribution equipment sector. Strategic partnerships between equipment manufacturers and technology companies enable development of advanced digital solutions and integrated system offerings.

Merger and acquisition activities continue reshaping competitive landscapes as companies seek to expand capabilities, access new markets, and achieve operational synergies. Technology acquisitions focus particularly on digital technologies, software capabilities, and specialized engineering expertise.

Product launches emphasize digital integration, improved efficiency, and enhanced functionality across various equipment categories. Smart transformer introductions feature advanced monitoring capabilities, predictive maintenance functions, and grid optimization features.

Regulatory developments across major markets influence equipment specifications, safety requirements, and environmental performance standards. Grid code updates require equipment manufacturers to adapt products to new technical requirements and operational standards.

Investment announcements in manufacturing capacity expansion and research facilities demonstrate industry confidence in long-term growth prospects. Sustainability initiatives include commitments to carbon neutrality, circular economy practices, and environmental stewardship across equipment lifecycles.

Strategic recommendations for market participants emphasize the importance of embracing digital transformation while maintaining focus on core equipment reliability and performance characteristics. Technology integration should prioritize customer value creation and operational efficiency improvements rather than pursuing digitalization for its own sake.

Market expansion strategies should consider regional variations in infrastructure development stages, regulatory requirements, and customer preferences. Emerging market opportunities require careful assessment of local capabilities, partnership requirements, and long-term market potential.

Innovation investments should balance breakthrough technology development with incremental improvements to existing product lines. Customer collaboration becomes increasingly important for understanding evolving requirements and developing solutions that address real operational challenges.

Supply chain optimization requires proactive risk management, supplier diversification, and strategic inventory management to ensure reliable product delivery and cost competitiveness. Sustainability integration should encompass entire product lifecycles from design through end-of-life management.

Talent development initiatives must address skills gaps in digital technologies, cybersecurity, and advanced engineering disciplines. Partnership strategies can provide access to specialized capabilities and accelerate market entry in new geographical regions or application areas.

Future market prospects remain highly positive, driven by fundamental trends including global electrification, renewable energy integration, and digital transformation initiatives. Long-term growth projections indicate sustained demand expansion across all major equipment categories and geographical markets.

Technology evolution will continue accelerating, with artificial intelligence, machine learning, and advanced materials science creating new possibilities for equipment performance and functionality. Grid flexibility requirements will drive development of more adaptive and responsive equipment solutions capable of supporting diverse operational scenarios.

Market consolidation is expected to continue as companies seek scale advantages and comprehensive solution capabilities. Regional market development will reflect different infrastructure priorities, with emerging markets focusing on capacity expansion while developed markets emphasize modernization and replacement activities.

Regulatory evolution will increasingly emphasize sustainability, cybersecurity, and grid resilience requirements. Environmental considerations will become more prominent in equipment selection criteria, with 85% of utilities expected to prioritize sustainability metrics in procurement decisions by the end of the forecast period.

MarkWide Research projects that digital integration will become ubiquitous across all equipment categories, with traditional mechanical systems increasingly incorporating smart capabilities and connectivity features. Investment patterns will continue favoring solutions that deliver measurable operational improvements and support long-term strategic objectives.

The global transmission and distribution equipment market represents a dynamic and essential sector characterized by sustained growth prospects, technological innovation, and evolving customer requirements. Market fundamentals remain strong, supported by global electrification trends, infrastructure modernization needs, and renewable energy integration initiatives that create continuous demand for advanced equipment solutions.

Technology transformation continues reshaping market dynamics, with digitalization, automation, and smart grid capabilities becoming standard features rather than optional enhancements. Competitive success increasingly depends on companies’ ability to integrate traditional engineering excellence with advanced digital technologies while maintaining focus on reliability, efficiency, and customer value creation.

Regional market variations offer diverse opportunities for growth and expansion, with emerging markets providing substantial potential for infrastructure development while developed markets focus on modernization and replacement activities. Strategic positioning requires careful consideration of local requirements, regulatory frameworks, and competitive landscapes across different geographical markets.

Future success in the transmission and distribution equipment market will depend on companies’ ability to anticipate and respond to evolving customer needs while maintaining operational excellence and financial performance. Innovation investments, strategic partnerships, and sustainable business practices will play crucial roles in determining long-term competitive advantages and market leadership positions in this essential infrastructure sector.

What is Transmission And Distribution Equipment?

Transmission and distribution equipment refers to the infrastructure used to transport electricity from power plants to consumers. This includes transformers, circuit breakers, and substations, which are essential for maintaining the reliability and efficiency of electrical systems.

What are the key players in the Global Transmission And Distribution Equipment Market?

Key players in the Global Transmission And Distribution Equipment Market include Siemens AG, General Electric, Schneider Electric, and ABB Ltd. These companies are known for their innovative solutions and extensive product offerings in the transmission and distribution sector, among others.

What are the main drivers of the Global Transmission And Distribution Equipment Market?

The main drivers of the Global Transmission And Distribution Equipment Market include the increasing demand for electricity, the need for modernization of aging infrastructure, and the growing focus on renewable energy integration. These factors are pushing utilities to invest in advanced transmission and distribution technologies.

What challenges does the Global Transmission And Distribution Equipment Market face?

The Global Transmission And Distribution Equipment Market faces challenges such as high installation costs, regulatory hurdles, and the complexity of integrating new technologies with existing systems. Additionally, the risk of cyber threats to grid infrastructure poses significant concerns.

What opportunities exist in the Global Transmission And Distribution Equipment Market?

Opportunities in the Global Transmission And Distribution Equipment Market include the expansion of smart grid technologies, the rise of energy storage solutions, and the increasing investment in renewable energy projects. These trends are expected to drive innovation and growth in the sector.

What trends are shaping the Global Transmission And Distribution Equipment Market?

Trends shaping the Global Transmission And Distribution Equipment Market include the adoption of digital technologies, the shift towards decentralized energy systems, and the emphasis on sustainability and energy efficiency. These trends are influencing how companies design and implement their transmission and distribution solutions.

Global Transmission And Distribution Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Transformers, Switchgear, Circuit Breakers, Cables |

| Technology | Smart Grid, Renewable Integration, High Voltage, Automation |

| End User | Utilities, Industrial, Commercial, Residential |

| Installation | Onshore, Offshore, Underground, Above Ground |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Transmission And Distribution Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at