Key Market Insights

-

Packaging Dominance: Silica gel accounts for over 45% of total desiccant usage, primarily in packaging moisture-sensitive goods (electronics, food, pharma) .

-

Asia-Pacific Leadership: The region contributed nearly 35% of global consumption in 2023, fueled by China’s electronics assembly and India’s pharmaceutical growth .

-

Technological Innovations: Development of coated and color-changing silica gels enhances application-specific performance (e.g., indicating saturation) .

-

Environmental Regulations: Stricter mandates on shelf‑life and product safety in North America and Europe bolster demand for high-quality desiccants .

-

Competitive Landscape: Market consolidation through acquisitions and strategic partnerships is rising, enabling scale economies and expanded distribution.

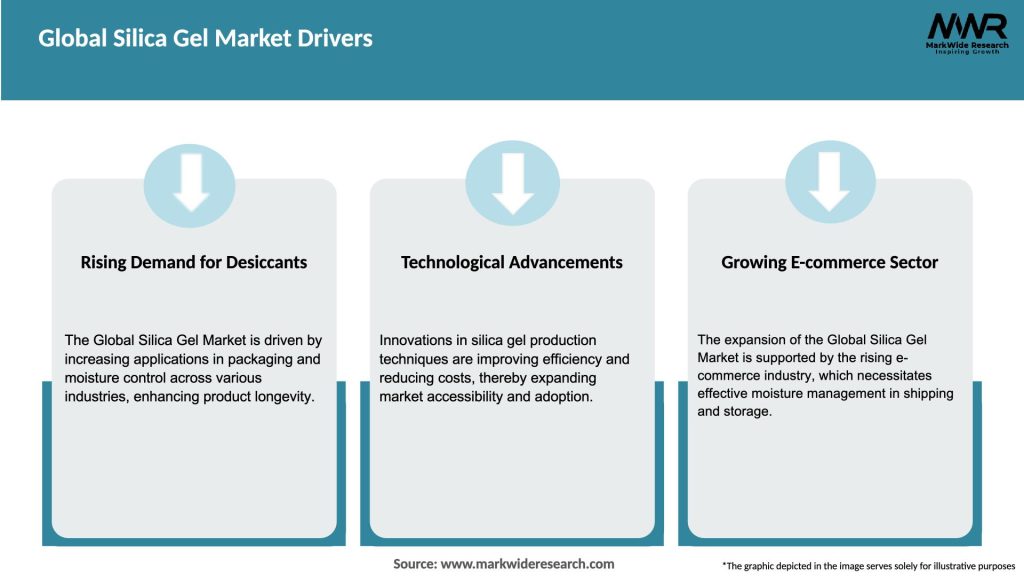

Market Drivers

-

Surge in Electronics Manufacturing: Moisture-sensitive semiconductors and lithium-ion batteries require stringent humidity control, driving silica gel demand in Asia-Pacific and North America .

-

Pharmaceutical Packaging Standards: WHO’s sterilization and packaging guidelines mandate robust desiccants to maintain drug potency, boosting pharmaceutical-grade silica gel consumption .

-

Food & Beverage Shelf‑Life Extension: Growing packaged food markets in Latin America and Middle East rely on silica gel packets to prevent spoilage, extending product shelf‑life and reducing waste .

-

Industrial Catalysis Applications: Silica gel’s role as a catalyst support in petrochemical and fine chemical production underpins steady industrial demand .

-

Green Packaging Trends: Biodegradable packaging solutions incorporating silica gel attract eco-conscious brands, opening new eco‑friendly product lines.

Market Restraints

-

Raw Material Price Volatility: Fluctuations in sodium silicate and sulfuric acid prices—key feedstocks—can squeeze manufacturer margins and destabilize pricing .

-

Alternative Desiccants: Competition from molecular sieves and clay-based desiccants, which offer higher adsorption at extreme conditions, poses substitution risks .

-

Regulatory Compliance Costs: Adhering to food and pharma packaging regulations (e.g., FDA, EU directives) increases production and certification expenses.

-

Environmental Disposal Concerns: Non‑biodegradable nature of traditional silica gel packets drives push for eco‑friendly alternatives, requiring R&D investments.

-

Logistics and Handling: Packaging, labeling, and safe handling protocols (e.g., preventing dust inhalation) add complexity and costs.

Market Opportunities

-

Biodegradable & Eco‑friendly Gels: R&D into silica gel alternatives synthesized from renewable sources or packaged in compostable materials addresses environmental concerns.

-

Value‑added Products: Color‑changing indicator gels and encapsulated forms for controlled release expand market reach in high‑value segments.

-

Emerging Market Penetration: Africa and Latin America’s nascent packaging and pharmaceuticals sectors offer untapped demand.

-

Customization & Private Labeling: Tailored desiccant pouches and bulk solutions for specific industries enhance supplier differentiation.

-

Digital Monitoring Integration: Smart packaging incorporating humidity sensors and silica gel indicators for real‑time monitoring in cold chains.

Market Dynamics

-

Supply Dynamics: Major producers in China control 50% of global capacity; capacity expansions in India and Southeast Asia are underway to meet rising demand.

-

Demand Dynamics: Electronics (35%), packaging (45%), pharmaceuticals (12%), food & beverage (5%), others (3%). Demand grows fastest in India (+8.2% CAGR) and China (+7.5% CAGR).

-

Economic Factors: Global GDP growth and trade volumes directly correlate with packaging and industrial usage, making silica gel demand cyclical.

-

Technological Disruption: Continuous crystallization and microencapsulation methods improve product purity and adsorption kinetics.

-

Regulatory Environment: Compliance with ISO 22000, GMP, and RoHS directives influences product specifications and traceability.

Regional Analysis

-

North America: Mature market; high per‑capita consumption in food, pharma, and electronics. Growth driven by e-commerce packaging and stringent FDA standards .

-

Europe: Strong demand in automotive and aerospace for corrosion prevention gels; eco‑friendly packaging initiatives drive biodegradable desiccant uptake .

-

Asia‑Pacific: Fastest‑growing region; China and India lead in electronics manufacturing and pharmaceutical production. Infrastructure investments and rising disposable incomes spur consumption .

-

Latin America: Emerging packaging sector; Brazil’s food exports utilize silica gel; growth hampered by economic volatility but long‑term potential robust .

-

Middle East & Africa: Nascent but growing demand in oil & gas pipeline desiccation and food packaging; infrastructure modernization fuels future growth.

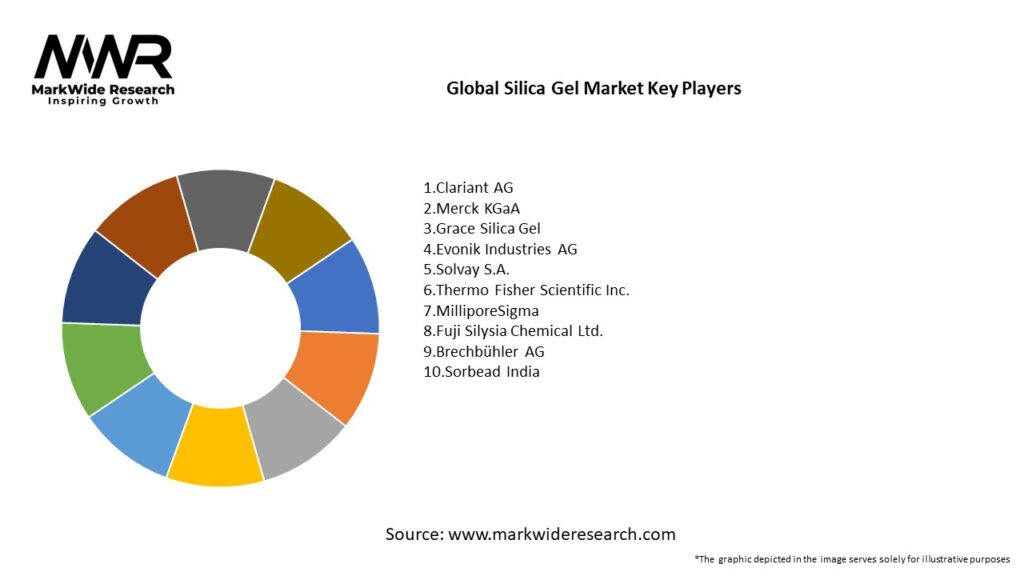

Competitive Landscape

Leading companies in the Global Silica Gel Market:

- Clariant AG

- Merck KGaA

- Grace Silica Gel

- Evonik Industries AG

- Solvay S.A.

- Thermo Fisher Scientific Inc.

- MilliporeSigma

- Fuji Silysia Chemical Ltd.

- Brechbühler AG

- Sorbead India

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

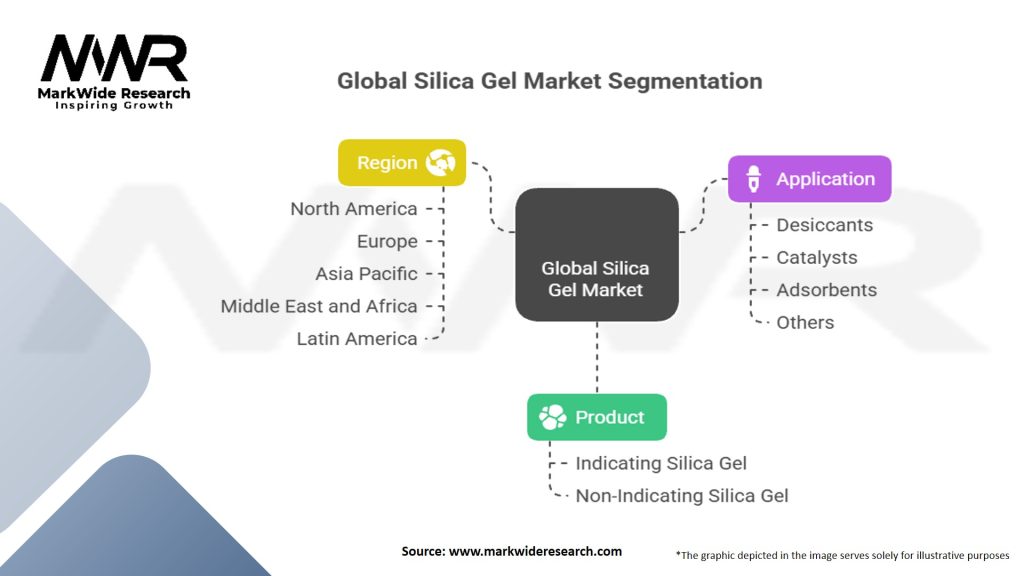

Segmentation

-

By Type:

-

Neutral Silica Gel (uncoated) – >60% share

-

Indicating Silica Gel (coated with moisture indicators) – ~25%

-

Activated Clay & Others – ~15%

-

-

By Application:

-

Packaging Desiccants – 45%

-

Pharmaceuticals – 12%

-

Electronics & Semiconductors – 20%

-

Food & Beverages – 5%

-

Industrial Catalysts & Adsorbents – 18%

-

-

By Form:

-

Beads – 70%

-

Powder – 20%

-

Granules – 10%

-

-

By End‑User:

-

Packaging & Logistics

-

Medical & Pharma

-

Automotive & Aerospace

-

Agriculture

-

Oil & Gas

-

-

By Region: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa.

Category-wise Insights

-

Neutral Beads: Workhorse for general packaging; cost‑effective with large pore volumes.

-

Indicating Gels: Optimal for pharmaceutical and high‑value electronics to visually signal saturation.

-

Microbeads & Powders: Used in chromatography and catalysis, with high surface areas for separation processes.

-

Coated & Encapsulated Forms: Provide controlled release in specialized applications (e.g., corrosion prevention).

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Shelf‑Life: Improves product stability and reduces spoilage in packaged goods.

-

Cost Savings: Lower product rejection and reduced warranty claims in electronics and pharma.

-

Regulatory Compliance: Meets stringent moisture‑control standards in pharmaceuticals and food.

-

Operational Efficiency: Regenerable gels cut lifecycle desiccant costs by up to 30%.

-

Competitive Differentiation: Private‑label and customized solutions foster stronger supplier‑customer partnerships.

SWOT Analysis

Strengths:

-

Versatility & Performance: High adsorption capacity and thermal stability.

-

Established Applications: Widely accepted across critical industries.

Weaknesses:

-

Non‑Biodegradability: Environmental disposal concerns.

-

Raw Material Dependency: Vulnerable to sodium silicate price swings.

Opportunities:

-

Green Silica Alternatives: Bio‑based desiccants and compostable packaging.

-

Smart Indicators: IOT‑enabled moisture sensors integrated with silica packets.

Threats:

-

Substitutes: Molecular sieves offer superior performance in extreme conditions.

-

Regulatory Shifts: Future bans on non‑recyclable packaging could restrict use.

Market Key Trends

-

Biodegradable & Compostable Desiccants: Aligning with global sustainability goals.

-

Smart Packaging Integration: Embedding moisture sensors with silica gel for real‑time monitoring.

-

Enhanced Purity Grades: Ultra‑pure silica gels for semiconductor and pharmaceutical applications.

-

Custom Formulations: Industry‑specific blends (e.g., oil‑resistant gels for petrochemicals).

-

Circular Economy Models: Regeneration and recycling programs to minimize waste.

Covid-19 Impact

-

Supply Chain Disruptions: Initial shortages of raw materials led to temporary price hikes.

-

E‑Commerce Boom: Surge in online shopping increased demand for protective desiccant packaging.

-

Pharmaceutical Spike: Vaccine distribution needs drove unprecedented growth in pharma‑grade gels.

-

Health & Safety Focus: Heightened hygiene standards boosted desiccant use in medical supplies.

-

Digital Transformation: Accelerated adoption of smart packaging and remote monitoring solutions.

Key Industry Developments

-

Capacity Expansions: Major producers adding new plants in India and Southeast Asia to meet demand.

-

Mergers & Acquisitions: Mid‑size players acquired by multinationals to consolidate market positions.

-

R&D Collaborations: Joint ventures between academia and industry for next‑gen bio‑derived desiccants.

-

Product Launches: Introduction of moisture‑indicating silica gels with digital readouts.

-

Sustainability Initiatives: Investment in closed‑loop regeneration facilities at large packaging centers.

Analyst Suggestions

-

Invest in Sustainable R&D: Prioritize development of biodegradable and low‑carbon silica gel alternatives.

-

Expand Regeneration Services: Offer on‑site desiccant regeneration to cut customer lifecycle costs.

-

Leverage Smart Packaging: Integrate IoT moisture sensors with silica packets for high‑value goods.

-

Penetrate Emerging Markets: Build localized production and distribution networks in Africa and Latin America.

-

Forge Strategic Alliances: Partner with packaging OEMs and e‑commerce platforms to embed desiccant solutions.

Future Outlook

The Global Silica Gel Market is set to maintain healthy growth through 2030, supported by:

-

Sustainability Imperatives: Eco‑friendly gel technologies and circular economy practices.

-

Technological Convergence: Smart packaging, IoT integration, and advanced analytics reshaping moisture control.

-

Emerging Sector Expansion: Electric vehicle batteries and green hydrogen require ultra‑dry conditions, creating new niches.

-

Pharma & Biomedical Growth: Continued biopharma and vaccine development driving high‑grade gel demand.

-

Global Trade Recovery: Post‑pandemic rebound in manufacturing and trade bolstering packaging desiccant needs.

Conclusion

The Global Silica Gel Market stands at the intersection of traditional desiccant uses and cutting‑edge smart packaging innovations. With resilient demand in packaging, pharmaceuticals, and electronics—coupled with emerging applications in energy storage and biotechnology—silica gel remains indispensable. Stakeholders who invest in sustainable production, smart integration, and regional expansion will capture significant opportunities. As the world pivots toward greener, more connected supply chains, silica gel producers and consumers alike must embrace innovation and collaboration to ensure dry, safe, and cost‑effective operations across industries.