444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global shop floor solutions market, encompassing both software and hardware solutions, has witnessed significant growth in recent years. These solutions play a crucial role in optimizing manufacturing processes, improving operational efficiency, and enhancing productivity on the shop floor. This comprehensive analysis provides insights into the current market scenario, key trends, drivers, restraints, opportunities, and regional dynamics shaping the global shop floor solutions market. Shop floor solutions refer to a suite of software and hardware tools designed to streamline and automate manufacturing operations. These solutions offer real-time visibility, data analytics, and process optimization, enabling manufacturers to enhance their production capabilities and meet the ever-increasing demands of the market. With the integration of technologies like IoT, AI, and cloud computing, the shop floor solutions market is expected to witness robust growth in the coming years.

Shop floor solutions encompass a range of technologies, including manufacturing execution systems (MES), warehouse management systems (WMS), machine monitoring systems, industrial automation, and robotics. These solutions help manufacturers manage inventory, monitor equipment performance, track production data, ensure quality control, and streamline supply chain operations. By leveraging real-time data and analytics, businesses can make informed decisions, reduce downtime, minimize errors, and achieve cost savings.

Executive Summary:

The global shop floor solutions market has experienced substantial growth, driven by the need for improved operational efficiency, increased automation, and enhanced quality control in manufacturing processes. The market is witnessing a rapid adoption of advanced technologies, such as IoT-enabled devices, machine learning algorithms, and cloud-based platforms. These developments have revolutionized shop floor operations, empowering manufacturers to optimize their production lines and meet customer demands effectively.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Integration Imperative: 78% of manufacturers cite lack of real-time production visibility as their top pain point, fueling MES/SCADA adoption.

Edge Computing Rise: Over 40% of new shop floor projects include edge analytics gateways to reduce latency and enable on-site AI inference.

SaaS Momentum: Cloud-based MES solutions are growing at 18% CAGR as companies seek rapid deployment without heavy CAPEX.

Standardization Trends: OPC UA has become the de facto connectivity standard, adopted by 65% of automation hardware vendors.

Service-Led Growth: Managed services and systems integration account for nearly 30% of market revenue, underscoring the complexity of digital rollout.

Market Drivers

Labor Cost Pressure: Rising wages and skills shortages drive automation to maintain output and quality.

Customization Demand: Mass customization and shorter product lifecycles require flexible, digitally controlled shop floors.

Regulatory Compliance: Food, pharma, and automotive sectors demand electronic batch records, traceability, and audit trails.

Quality Imperatives: Zero-defect manufacturing goals necessitate real-time defect detection and corrective action workflows.

Sustainability Goals: Energy monitoring and waste reduction are implemented via integrated shop floor dashboards.

Market Restraints

Legacy Equipment: High retrofit costs and proprietary protocols hinder seamless integration into modern solutions.

Cybersecurity Risks: Connectivity increases attack surface; many facilities lack mature OT security measures.

Skill Gaps: Complex software/hardware solutions require specialized IT/OT convergence expertise.

High Initial Investment: Comprehensive shop floor overhauls involve significant CAPEX that can deter smaller operations.

Data Silos: Disparate systems and poor data governance impede single-source-of-truth implementations.

Market Opportunities

AI & Machine Learning: Embedding ML at the edge to predict equipment failures and optimize throughput in real time.

Digital Twins: Virtual replicas of production lines enable “what-if” simulations, speeding up changeover and capacity planning.

5G Adoption: Ultra-low-latency wireless networks will enable mobile robotics, AGV fleets, and remote-monitoring use cases.

SME Outreach: Tailored, modular shop floor solutions and pay-as-you-go pricing models can penetrate mid-market manufacturers.

Green Manufacturing: Carbon tracking and energy-optimization modules help companies meet sustainability targets.

Market Dynamics

Ecosystem Partnerships: Alliances between MES vendors, OT hardware suppliers, and cloud providers deliver integrated offerings.

Platform Consolidation: Converged MES-SCADA-HMI platforms reduce complexity versus best-of-breed approaches.

Vendor M&A: Acquisitions of niche analytics and IIoT startups by major automation players accelerate roadmaps.

Open-Source Software: Emerging community-driven MES frameworks lower barriers for custom deployments.

Shift to Outcome-Based Models: Vendors increasingly offer outcome guarantees—e.g., uptime or throughput improvements—tying fees to KPIs.

Regional Analysis

North America: Leading adopters of smart manufacturing; heavy investment in edge computing and cybersecurity.

Europe: Strong regulatory push (Industry 4.0, Made in China 2025) and established automation infrastructure drive MES/SCADA integration.

Asia-Pacific: Fastest growth, led by automotive and electronics hubs in China, Japan, and South Korea ramping up digital factories.

Latin America: Emerging interest; automotive and food & beverage sectors pilot turnkey solutions with government incentives.

Middle East & Africa: Low penetration but rising oil-&-gas spin-offs and defense manufacturing are driving initial shop floor digitization.

Competitive Landscape:

Leading Companies in the Global Shop Floor Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

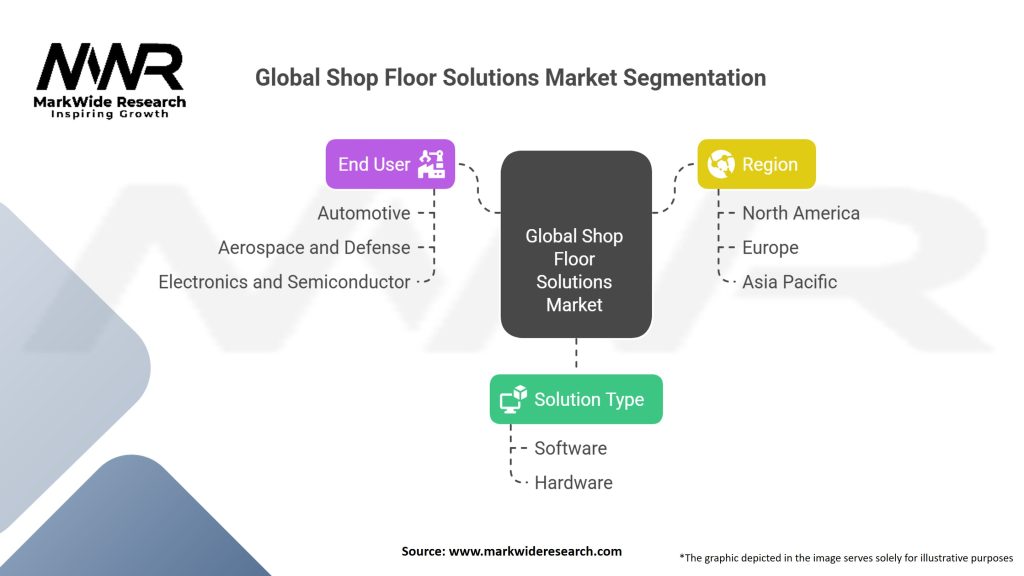

Segmentation:

The shop floor solutions market can be segmented based on solution type, deployment model, industry vertical, and geography. The software segment includes MES, WMS, quality management systems, and others, while the hardware segment comprises industrial automation systems, robotics, and machine monitoring devices. Deployment models can be on-premises, cloud-based, or hybrid. The market caters to various industry verticals such as automotive, aerospace, electronics, pharmaceuticals, and consumer goods.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has significantly impacted the global manufacturing sector. Supply chain disruptions, workforce shortages, and reduced demand have forced manufacturers to reassess their operations. Shop floor solutions have played a crucial role in mitigating the impact of the pandemic by enabling remote monitoring, predictive maintenance, and optimizing resource allocation. As the industry recovers, the adoption of shop floor solutions is expected to accelerate further, driving growth in the market.

Key Industry Developments:

Siemens Xcelerator Launch (2022): Unified platform integrating MES, SCADA, and edge analytics under a cloud-native architecture.

AVEVA & Microsoft Azure Partnership (2023): Pre-configured industrial analytics packages for rapid shop floor deployment on Azure.

Rockwell Automation Acquisition of PTC’s ThingWorx (2021): Combined MES with AR-enabled work instructions and IIoT device management.

Dassault Systèmes DELMIA Apriso Update (2024): Introduced predictive quality module powered by 3DEXPERIENCE Marketplace for spare-part sourcing.

Honeywell Forge Integration (2023): Integrated with Experion SCADA to deliver KPI dashboards and anomaly detection across multiple sites.

Analyst Suggestions:

Future Outlook:

The global shop floor solutions market is poised for significant growth in the coming years. The increasing adoption of advanced technologies, the need for operational efficiency, and the focus on quality control will continue to drive the market. Integration with emerging technologies like blockchain, augmented reality, and edge computing will unlock new opportunities. As manufacturers strive to optimize their operations and gain a competitive edge, shop floor solutions will play a crucial role in shaping the future of the manufacturing industry.

Conclusion:

The global shop floor solutions market offers a wide range of software and hardware solutions that enable manufacturers to optimize their operations, improve productivity, and meet customer demands effectively. With the integration of advanced technologies and the increasing emphasis on data-driven decision-making, the market is witnessing rapid growth and innovation. As manufacturers embrace digital transformation and invest in shop floor solutions, they can enhance their competitiveness, achieve cost savings, and ensure sustainable growth in the evolving manufacturing landscape.

What are Global Shop Floor Solutions (Software and Hardware)?

Global Shop Floor Solutions encompass a range of software and hardware tools designed to optimize manufacturing processes on the shop floor. These solutions facilitate real-time monitoring, data collection, and process automation to enhance efficiency and productivity in manufacturing environments.

Who are the key players in the Global Shop Floor Solutions (Software and Hardware) Market?

Key players in the Global Shop Floor Solutions market include Siemens, Rockwell Automation, and Honeywell, among others. These companies provide innovative solutions that cater to various manufacturing needs, enhancing operational efficiency and productivity.

What are the main drivers of growth in the Global Shop Floor Solutions (Software and Hardware) Market?

The growth of the Global Shop Floor Solutions market is driven by the increasing demand for automation in manufacturing, the need for real-time data analytics, and the push for operational efficiency. Additionally, the rise of Industry Four Point Zero technologies is significantly influencing market expansion.

What challenges does the Global Shop Floor Solutions (Software and Hardware) Market face?

Challenges in the Global Shop Floor Solutions market include the high initial investment costs and the complexity of integrating new technologies with existing systems. Additionally, there is a skills gap in the workforce that can hinder the effective implementation of these solutions.

What opportunities exist in the Global Shop Floor Solutions (Software and Hardware) Market?

Opportunities in the Global Shop Floor Solutions market include the growing adoption of IoT and AI technologies, which can enhance predictive maintenance and operational efficiency. Furthermore, the increasing focus on sustainability in manufacturing presents avenues for innovative solutions that reduce waste and energy consumption.

What trends are shaping the Global Shop Floor Solutions (Software and Hardware) Market?

Current trends in the Global Shop Floor Solutions market include the integration of advanced analytics and machine learning for improved decision-making, as well as the rise of cloud-based solutions that offer flexibility and scalability. Additionally, there is a notable shift towards mobile solutions that enable remote monitoring and management.

Global Shop Floor Solutions (Software and Hardware) Market:

| Segmentation | Details |

|---|---|

| Solution Type | Software, Hardware |

| Software Type | Manufacturing Execution Systems (MES), Enterprise Resource Planning (ERP), Product Lifecycle Management (PLM), Others |

| Hardware Type | Industrial Computers, Human Machine Interface (HMI) Devices, Sensors and Actuators, Industrial Robots, Others |

| End User | Automotive, Aerospace and Defense, Electronics and Semiconductor, Food and Beverage, Pharmaceuticals, Chemicals, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Shop Floor Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at