444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Global Revenue-Based Financing Market is experiencing significant growth and is expected to continue its upward trajectory in the coming years. Revenue-Based Financing (RBF), also known as royalty-based financing or revenue sharing, is an alternative funding model that has gained popularity among startups and small and medium-sized enterprises (SMEs) seeking capital without diluting ownership.

Revenue-Based Financing is a financing model where investors provide capital to businesses in exchange for a percentage of their future revenue. Unlike traditional debt financing, RBF does not require fixed repayments or equity ownership. Instead, the investors receive a portion of the company’s revenue until a predetermined cap or multiple of the investment is reached.

Executive Summary

The Global Revenue-Based Financing market is witnessing robust growth due to the increasing demand for alternative funding options, especially among early-stage startups and SMEs. The flexibility and non-dilutive nature of RBF make it an attractive choice for entrepreneurs looking to raise capital without sacrificing ownership control. The market is characterized by the presence of both established financial institutions and specialized RBF platforms catering specifically to startups and emerging businesses.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Revenue-Based Financing market is dynamic and influenced by various factors, including changes in the startup ecosystem, regulatory frameworks, and investor preferences. As the market evolves, it is essential to stay updated on emerging trends and adapt strategies accordingly to capitalize on opportunities and mitigate risks.

Regional Analysis

The Global Revenue-Based Financing market is geographically diverse, with significant activity observed in key regions such as North America, Europe, Asia Pacific, and Latin America. Each region has its unique characteristics, regulatory environments, and market players, shaping the dynamics of revenue-based financing in that particular area.

Competitive Landscape

Leading Companies in the Global Revenue-Based Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

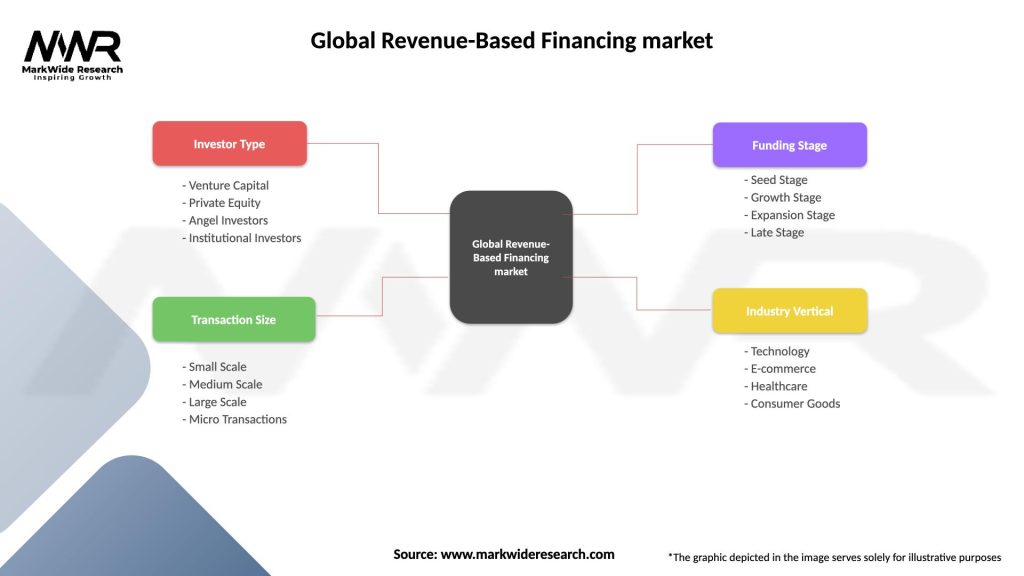

Segmentation

The Revenue-Based Financing market can be segmented based on various factors, including industry verticals, company size, and geographic regions. Segmentation allows businesses to tailor their offerings to specific customer segments and cater to their unique financing needs.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the Revenue-Based Financing market. Startups and SMEs faced challenges due to economic uncertainties, disrupted supply chains, and reduced consumer demand. However, the pandemic also highlighted the resilience and adaptability of businesses that had diversified revenue streams. Revenue-Based Financing played a crucial role in providing capital during this period, supporting companies in their recovery and growth efforts.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Global Revenue-Based Financing market looks promising, driven by the increasing demand for alternative funding options and the growing acceptance of RBF among startups and SMEs. As the market matures, it is expected to witness further consolidation and standardization, with established financial institutions entering the space and specialized platforms expanding their services.

Advancements in technology, such as artificial intelligence and data analytics, will continue to play a significant role in enhancing the efficiency and accuracy of underwriting and risk assessment processes. Integration with digital platforms and automation will streamline operations, making revenue-based financing more accessible to a wider range of businesses.

Furthermore, as regulatory frameworks evolve and become more defined, the market will gain stability and credibility, attracting more investors and businesses alike. Collaborations between RBF platforms and financial institutions will provide additional growth opportunities and increase the availability of RBF options in different geographic regions.

Conclusion

In conclusion, the Global Revenue-Based Financing market is poised for continued growth, driven by the need for flexible and non-dilutive funding options in the startup ecosystem. With the right strategies, awareness campaigns, and regulatory support, Revenue-Based Financing has the potential to reshape the landscape of business financing and support the growth of innovative and promising companies worldwide.

What is Revenue-Based Financing?

Revenue-Based Financing is a funding model where investors provide capital to businesses in exchange for a percentage of the company’s future revenue. This approach allows companies to access funds without giving up equity or taking on traditional debt.

What are the key players in the Global Revenue-Based Financing market?

Key players in the Global Revenue-Based Financing market include companies like Clearco, Pipe, and Uncapped, which specialize in providing revenue-based financing solutions to startups and growing businesses, among others.

What are the main drivers of growth in the Global Revenue-Based Financing market?

The main drivers of growth in the Global Revenue-Based Financing market include the increasing demand for flexible funding options, the rise of e-commerce businesses seeking alternative financing, and the growing trend of startups preferring non-dilutive capital.

What challenges does the Global Revenue-Based Financing market face?

Challenges in the Global Revenue-Based Financing market include the potential for high repayment costs, the risk of revenue fluctuations impacting repayment ability, and the need for businesses to maintain consistent revenue streams.

What opportunities exist in the Global Revenue-Based Financing market?

Opportunities in the Global Revenue-Based Financing market include expanding into emerging markets, developing tailored financing solutions for specific industries, and leveraging technology to streamline the funding process.

What trends are shaping the Global Revenue-Based Financing market?

Trends shaping the Global Revenue-Based Financing market include the increasing use of data analytics to assess borrower risk, the rise of automated funding platforms, and a growing focus on sustainability in financing practices.

Global Revenue-Based Financing market

| Segmentation Details | Description |

|---|---|

| Investor Type | Venture Capital, Private Equity, Angel Investors, Institutional Investors |

| Transaction Size | Small Scale, Medium Scale, Large Scale, Micro Transactions |

| Funding Stage | Seed Stage, Growth Stage, Expansion Stage, Late Stage |

| Industry Vertical | Technology, E-commerce, Healthcare, Consumer Goods |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Revenue-Based Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at