444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Global Purified Terephthalic Acid (PTA) Market is a vital sector within the chemical and petrochemical industry, focusing on the production and distribution of PTA, a key raw material for the manufacturing of polyester fibers, films, and resins. PTA plays a pivotal role in various industries, including textiles, packaging, and automotive, where polyester products are widely used. In this comprehensive market overview, we will explore the significance of the Global PTA Market, provide an executive summary, key market insights, and delve into the market drivers, restraints, and opportunities. We will also analyze market dynamics, regional aspects, competitive landscape, segmentation, and category-wise insights. Additionally, we’ll discuss the key benefits for manufacturers, end-users, and sustainability efforts, perform a SWOT analysis, assess market key trends, and consider the impact of various factors, including environmental concerns and evolving polyester applications. We’ll conclude with analyst suggestions and a glimpse into the future outlook of the Global Purified Terephthalic Acid (PTA) Market.

Meaning

The Global Purified Terephthalic Acid (PTA) Market encompasses the production and distribution of PTA, a critical chemical compound used as a raw material in the production of polyester fibers, films, and resins. PTA is a fundamental building block in the textile, packaging, and automotive industries, where polyester-based products are in high demand.

Executive Summary

The Global Purified Terephthalic Acid (PTA) Market is a crucial segment within the chemical and petrochemical industry, providing the essential raw material for the production of polyester-based products. PTA is a foundational component in the manufacturing of polyester fibers, films, and resins, which are extensively used in a wide range of industries, including textiles, packaging, and automotive. This market primarily revolves around the production and distribution of PTA tailored to the specific needs of manufacturers and end-users. The growth of this market is driven by factors such as the increasing demand for polyester-based products, the growing textile and apparel industry, and the versatility of polyester in various applications. While challenges related to environmental concerns and sustainability persist, the Global PTA Market remains dynamic and adaptable, with continuous advancements in PTA production technology and expanding market opportunities.

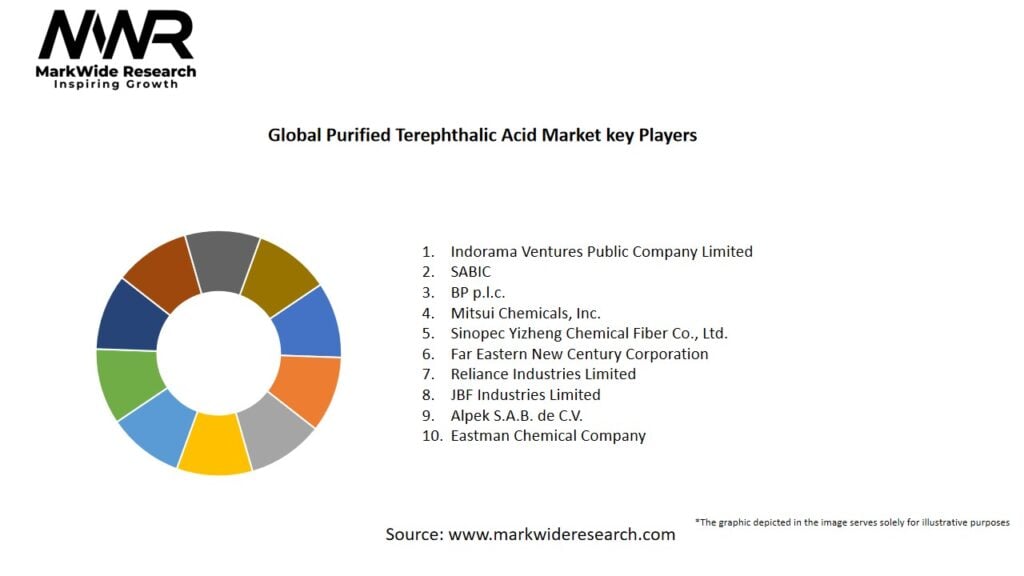

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

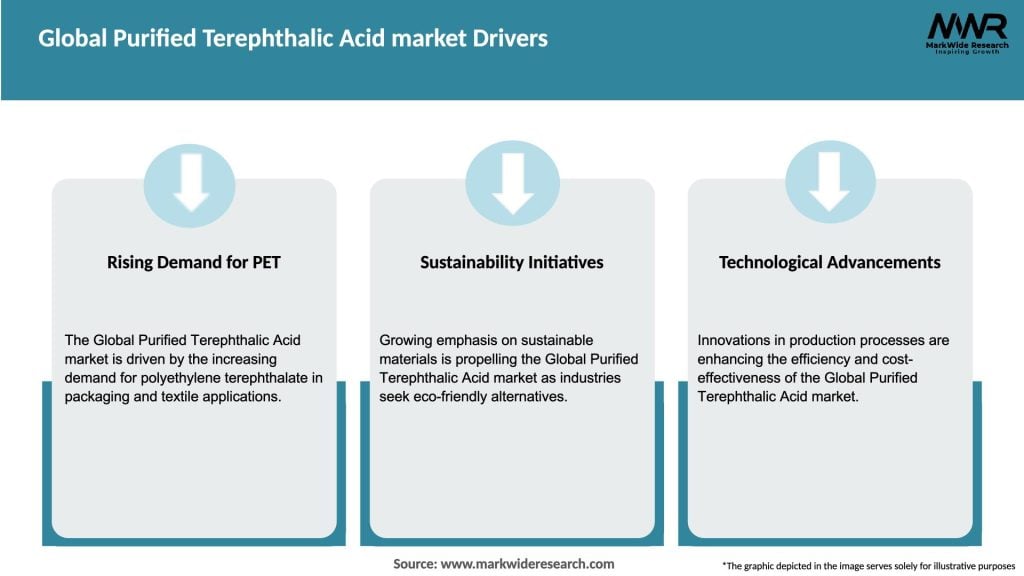

Market Drivers

Rising Demand for Polyester and PET:

The burgeoning demand for polyester-based products in the textile and packaging sectors is a key driver, as PTA is a critical input in their production.

Technological Improvements:

Advances in catalytic oxidation and purification processes have enhanced PTA yield and purity, making production more efficient and cost-effective.

Sustainability and Recycling Initiatives:

Growing emphasis on recyclable and sustainable packaging solutions drives demand for high-quality PTA, as it is essential for producing durable and recyclable PET.

Economic Growth in Emerging Markets:

Increased industrialization and urbanization in emerging economies boost the demand for consumer goods packaged in PET, indirectly driving the PTA market.

Strategic Capacity Expansion:

Investments by leading producers to expand production capacity and adopt modern, energy-efficient technologies support market growth and competitiveness.

Rising Global Packaging Needs:

The expansion of the food and beverage industry, coupled with growing environmental concerns over single-use plastics, has increased the need for high-performance PET packaging solutions.

Market Restraints

Volatility in Raw Material Prices:

Fluctuations in the cost of p-xylene and crude oil, which are essential inputs for PTA production, can impact profit margins and market pricing.

Environmental Regulations:

Stringent environmental standards and regulations governing emissions and waste disposal in petrochemical production can increase production costs and complicate market operations.

High Capital Investment:

Establishing or expanding PTA production facilities requires significant capital expenditure, which can be a barrier for new entrants and smaller players.

Competition from Alternative Materials:

The emergence of alternative packaging materials and bio-based plastics may reduce the demand for conventional PET packaging, affecting PTA consumption.

Supply Chain Disruptions:

Global supply chain challenges, including logistical issues and geopolitical tensions, can lead to disruptions in raw material supply and production continuity.

Market Opportunities

Expansion in Emerging Economies:

Rising industrialization and increased consumer demand in Asia-Pacific, Latin America, and Africa provide significant growth opportunities for PTA producers.

Green Technologies and Sustainable Production:

Investing in cleaner, energy-efficient production processes and reducing carbon footprints can open up new markets and enhance brand reputation among eco-conscious consumers.

Advanced Recycling Initiatives:

Collaboration with recycling firms to develop closed-loop systems for PET can boost demand for high-quality PTA used in recycled polyester production.

Diversification into Specialty PTA:

Developing specialty grades of PTA for specific applications, such as high-performance fibers or technical resins, can cater to niche markets and increase profitability.

Strategic Partnerships and Mergers:

Collaborations between global petrochemical companies and technology providers can drive innovation, streamline operations, and create synergies that enhance market competitiveness.

Digital Integration and Automation:

Adopting digital tools for process optimization, predictive maintenance, and supply chain management can reduce operational costs and improve production reliability.

Market Dynamics

The Global Purified Terephthalic Acid Market is influenced by several dynamics:

Supply Side Dynamics:

Technological innovations and strategic capacity expansions are critical factors. Leading producers are investing in advanced catalytic processes and automation to improve efficiency and reduce environmental impact.

Demand Side Dynamics:

The demand for polyester textiles and PET packaging drives PTA consumption. Shifts in consumer behavior, especially towards sustainable and recycled products, are shaping product requirements and market strategies.

Economic Influences:

Global economic trends, including industrial growth and consumer spending, impact demand for packaged goods and textiles, thereby affecting PTA market demand.

Regulatory Environment:

Compliance with environmental standards and safety regulations influences production methods and cost structures, prompting investments in cleaner technologies and waste reduction strategies.

Competitive Pressures:

The market is highly competitive, with major players leveraging scale, technology, and integrated supply chains to maintain market share. Price competition and innovation are key factors driving strategic decisions.

Regional Analysis

The Global Purified Terephthalic Acid Market shows regional variations based on industrial development, technological adoption, and economic factors:

Asia-Pacific:

The region is the largest consumer of PTA due to the booming polyester textile and PET packaging industries in countries like China, India, and Southeast Asian nations. Rapid industrialization, urbanization, and government support for petrochemical industries are major growth drivers.

North America:

Although the market in North America is more mature, steady demand from the packaging and textile sectors, along with investments in advanced manufacturing technologies, support ongoing growth. The region also emphasizes sustainability and recycling initiatives.

Europe:

Europe has a well-established PTA market driven by high-quality standards and stringent environmental regulations. The focus on sustainable production and the growing demand for eco-friendly packaging solutions are key market trends.

Latin America and Middle East & Africa:

These regions are emerging markets with significant potential due to increasing industrial activity and rising demand for consumer goods. However, infrastructural and economic challenges may affect growth rates.

Competitive Landscape

Leading Companies in Global Purified Terephthalic Acid Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

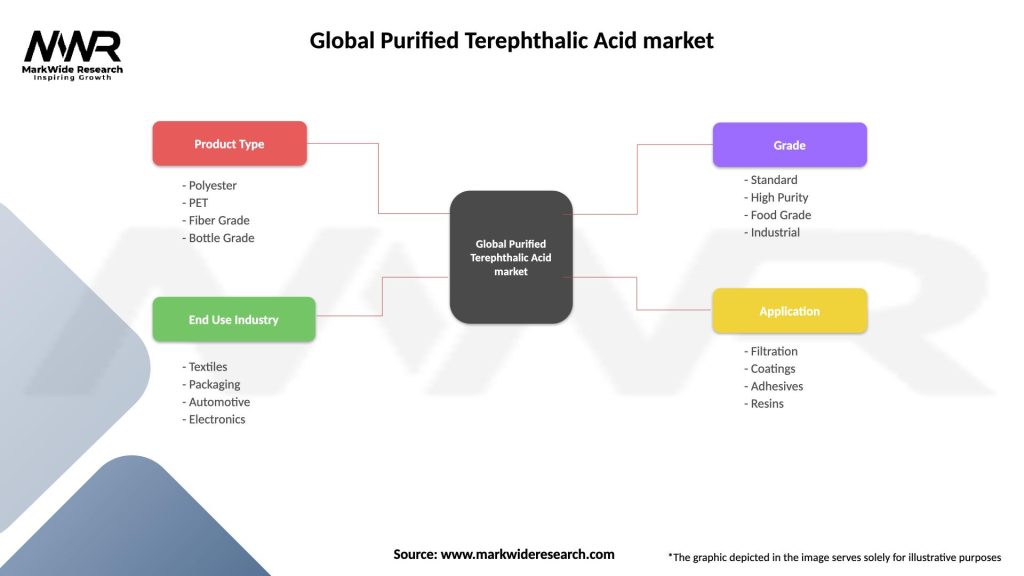

Segmentation

The Global Purified Terephthalic Acid Market can be segmented based on several criteria:

By Product Grade:

By End-Use Application:

By Region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has affected the Global Purified Terephthalic Acid Market in several ways:

Key Industry Developments

Recent developments in the Global PTA Market include:

Analyst Suggestions

Industry analysts recommend the following strategies for stakeholders in the Global Purified Terephthalic Acid Market:

Future Outlook

The future of the Global Purified Terephthalic Acid Market appears promising, with sustained growth anticipated due to continued demand for polyester and PET products. Key factors influencing future growth include:

While challenges such as raw material price volatility and regulatory pressures remain, companies that invest in innovation, sustainability, and strategic market expansion are well-positioned to capitalize on growth opportunities in the coming years.

Conclusion

The Global Purified Terephthalic Acid Market is a pivotal component of the petrochemical and textile industries, driven by the expanding demand for polyester and PET products worldwide. With continuous advancements in production technologies, a growing focus on sustainability, and expanding consumption in emerging economies, the market is poised for robust growth. Although challenges such as raw material volatility and high capital requirements persist, strategic investments in green technologies, supply chain resilience, and product diversification will drive long-term success.

What is Purified Terephthalic Acid?

Purified Terephthalic Acid (PTA) is a key raw material used in the production of polyester fibers and resins. It is primarily utilized in the textile and packaging industries, serving as a crucial component in the manufacturing of PET bottles and films.

What are the major companies in the Global Purified Terephthalic Acid market?

Major companies in the Global Purified Terephthalic Acid market include Indorama Ventures, Reliance Industries, and Eastman Chemical Company, among others. These companies play significant roles in the production and supply of PTA for various applications.

What are the drivers of growth in the Global Purified Terephthalic Acid market?

The growth of the Global Purified Terephthalic Acid market is driven by the increasing demand for polyester in the textile industry and the rising consumption of PET in packaging. Additionally, the shift towards sustainable materials is boosting PTA production.

What challenges does the Global Purified Terephthalic Acid market face?

The Global Purified Terephthalic Acid market faces challenges such as fluctuating raw material prices and environmental regulations. These factors can impact production costs and limit operational flexibility for manufacturers.

What opportunities exist in the Global Purified Terephthalic Acid market?

Opportunities in the Global Purified Terephthalic Acid market include the development of bio-based PTA and innovations in recycling technologies. These advancements can enhance sustainability and meet the growing consumer demand for eco-friendly products.

What trends are shaping the Global Purified Terephthalic Acid market?

Trends in the Global Purified Terephthalic Acid market include the increasing adoption of circular economy practices and advancements in production technologies. These trends are aimed at reducing environmental impact and improving efficiency in PTA manufacturing.

Global Purified Terephthalic Acid market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyester, PET, Fiber Grade, Bottle Grade |

| End Use Industry | Textiles, Packaging, Automotive, Electronics |

| Grade | Standard, High Purity, Food Grade, Industrial |

| Application | Filtration, Coatings, Adhesives, Resins |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Global Purified Terephthalic Acid Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at