444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global public sector consulting and advisory services market represents a critical component of modern governance transformation, encompassing comprehensive solutions that help government entities optimize operations, enhance service delivery, and navigate complex regulatory landscapes. This dynamic sector has experienced substantial growth as public organizations worldwide seek specialized expertise to address evolving citizen expectations, technological disruptions, and fiscal constraints.

Government agencies across developed and emerging economies are increasingly partnering with consulting firms to implement digital transformation initiatives, streamline bureaucratic processes, and improve public service efficiency. The market encompasses diverse service categories including strategic planning, technology implementation, organizational restructuring, and policy development, each tailored to address specific public sector challenges.

Market dynamics indicate robust expansion driven by growing demand for specialized expertise in areas such as cybersecurity, data analytics, and citizen engagement platforms. Public sector entities are experiencing unprecedented pressure to modernize legacy systems while maintaining operational continuity and regulatory compliance. This transformation imperative has created significant opportunities for consulting firms specializing in government modernization and public service optimization.

Regional variations in market development reflect different stages of digital maturity and governance reform priorities. North American and European markets demonstrate advanced adoption of consulting services, with growth rates of 6.2% annually, while Asia-Pacific regions show accelerated expansion as governments invest heavily in infrastructure modernization and administrative efficiency improvements.

The public sector consulting and advisory services market refers to the comprehensive ecosystem of professional services designed to assist government agencies, public institutions, and quasi-governmental organizations in improving operational efficiency, implementing strategic initiatives, and enhancing citizen service delivery through specialized expertise and innovative solutions.

Core components of this market include strategic consulting for policy development, technology consulting for digital transformation, operational consulting for process optimization, and specialized advisory services for regulatory compliance and risk management. These services bridge the gap between public sector requirements and private sector innovation, enabling government entities to leverage best practices and cutting-edge technologies.

Service delivery models within this market range from traditional consulting engagements to long-term advisory partnerships, managed services arrangements, and hybrid public-private collaboration frameworks. Consulting firms provide expertise in areas where government agencies may lack internal capabilities or require external validation for critical decisions.

Value proposition centers on helping public sector organizations navigate complex challenges including budget constraints, regulatory requirements, stakeholder expectations, and technological evolution while maintaining accountability and transparency standards essential to public governance.

Market momentum in the global public sector consulting and advisory services sector reflects fundamental shifts in governance approaches, with governments worldwide recognizing the strategic value of external expertise in addressing complex operational and policy challenges. The sector demonstrates resilient growth patterns despite economic uncertainties, driven by mandatory compliance requirements and citizen service improvement initiatives.

Key growth drivers include accelerating digital transformation mandates, increasing cybersecurity threats requiring specialized expertise, and growing emphasis on data-driven decision making in public administration. Government agencies are allocating approximately 12-15% of their modernization budgets to external consulting services, indicating strong commitment to leveraging private sector expertise.

Competitive landscape features a diverse mix of global consulting giants, specialized government contractors, and boutique advisory firms, each offering distinct value propositions tailored to specific public sector needs. Market consolidation trends are creating opportunities for strategic partnerships and capability expansion across service categories.

Future trajectory points toward continued expansion as governments face mounting pressure to improve service delivery while managing fiscal constraints. Emerging technologies including artificial intelligence, blockchain, and cloud computing are creating new consulting opportunities while traditional areas like organizational change management remain fundamental to public sector transformation initiatives.

Strategic insights reveal several critical trends shaping the public sector consulting landscape:

Market maturity varies significantly across regions, with developed economies focusing on optimization and innovation while emerging markets emphasize foundational infrastructure and governance framework development.

Technological disruption serves as the primary catalyst for public sector consulting demand, as government agencies struggle to keep pace with rapid technological evolution while maintaining operational stability. Legacy system modernization initiatives require specialized expertise that most public sector organizations lack internally, creating sustained demand for technology consulting services.

Citizen expectations have evolved dramatically, with public service users demanding digital-first experiences comparable to private sector standards. This expectation gap drives government investment in user experience consulting and service design optimization, as agencies seek to improve satisfaction ratings and operational efficiency simultaneously.

Regulatory complexity continues expanding as governments implement new compliance requirements across areas including data privacy, environmental protection, and financial transparency. Organizations require specialized advisory services to navigate these complex regulatory landscapes while maintaining operational effectiveness.

Budget optimization pressure compels public sector entities to seek external expertise for identifying cost reduction opportunities and operational efficiency improvements. Consulting services provide objective analysis and proven methodologies for achieving fiscal sustainability without compromising service quality.

Cybersecurity threats against government infrastructure have intensified, creating urgent demand for specialized security consulting services. Public sector organizations recognize that cybersecurity expertise requires continuous investment and external validation to maintain effective defense capabilities.

Budget constraints represent the most significant challenge facing public sector consulting market expansion, as government agencies operate under strict fiscal limitations and lengthy procurement processes that can delay or prevent consulting engagements. Economic uncertainties and competing budget priorities often result in deferred consulting investments despite recognized needs.

Procurement complexity creates barriers to market entry and service delivery, with lengthy bidding processes, extensive documentation requirements, and risk-averse selection criteria that favor established providers over innovative solutions. These procedural constraints can limit market dynamism and slow adoption of emerging consulting approaches.

Internal resistance to external consulting services remains prevalent within some government organizations, where career civil servants may view consultants as threats to job security or indicators of internal capability gaps. This cultural resistance can limit engagement effectiveness and reduce demand for consulting services.

Political volatility affects long-term consulting relationships, as changing administrations may alter priorities, cancel existing projects, or implement new policies that disrupt ongoing consulting engagements. This uncertainty creates challenges for both consulting firms and government clients in planning strategic initiatives.

Security clearance requirements limit the pool of available consulting talent for sensitive government projects, creating capacity constraints and potentially higher costs for specialized security-cleared consultants. These requirements can extend project timelines and complicate resource allocation for consulting firms.

Digital transformation acceleration presents unprecedented opportunities for consulting firms specializing in government modernization, as public sector organizations recognize the imperative to digitize services and operations. Cloud migration, artificial intelligence implementation, and data analytics integration create substantial consulting demand across all government levels.

Smart city initiatives are expanding globally, creating opportunities for consulting firms with expertise in urban planning, IoT integration, and sustainable development. These comprehensive transformation projects require multidisciplinary consulting approaches combining technology, policy, and operational expertise.

Regulatory compliance evolution continues generating consulting opportunities as governments implement new requirements for data protection, environmental sustainability, and social responsibility. Specialized advisory services help organizations navigate these complex requirements while maintaining operational efficiency.

Emerging market expansion offers significant growth potential as developing economies invest in governance infrastructure and administrative capacity building. These markets present opportunities for foundational consulting services including institutional development and capacity building initiatives.

Public-private partnerships are creating new consulting models that combine government oversight with private sector efficiency, generating demand for specialized advisory services in partnership structuring and performance management. These hybrid arrangements require sophisticated consulting expertise to balance public interest with commercial viability.

Competitive intensity within the public sector consulting market continues escalating as traditional consulting firms compete with specialized government contractors, technology vendors, and boutique advisory practices. This competition drives innovation in service delivery models and pricing strategies while improving overall value proposition for government clients.

Technology integration is reshaping consulting methodologies, with firms increasingly leveraging automation, artificial intelligence, and data analytics to enhance service delivery efficiency and outcomes measurement. These technological capabilities enable consultants to provide more sophisticated analysis and recommendations while reducing engagement costs.

Client sophistication is increasing as government procurement professionals develop deeper understanding of consulting value propositions and performance metrics. This evolution drives demand for more specialized expertise and measurable outcomes, challenging consulting firms to demonstrate clear return on investment.

Regulatory evolution affects both consulting demand and delivery approaches, as new compliance requirements create opportunities while also constraining certain consulting activities. Firms must continuously adapt their service offerings to align with changing regulatory landscapes across different jurisdictions.

Talent mobility between public and private sectors creates opportunities for consulting firms to attract experienced government professionals while also providing career development pathways for consultants interested in public service. This talent flow enhances mutual understanding and collaboration effectiveness.

Comprehensive analysis of the global public sector consulting and advisory services market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with government procurement officials, consulting firm executives, and industry experts across major geographic markets.

Secondary research encompasses analysis of government budget documents, consulting firm financial reports, industry publications, and academic studies focusing on public sector transformation trends. This multi-source approach provides comprehensive market understanding and validates primary research findings.

Quantitative analysis utilizes statistical modeling to identify market trends, growth patterns, and correlation factors affecting consulting demand. Data collection includes government spending patterns, consulting contract values, and performance metrics across different service categories and geographic regions.

Qualitative assessment explores market dynamics through stakeholder interviews, case study analysis, and expert opinion synthesis. This approach provides insights into decision-making processes, success factors, and emerging trends that quantitative analysis alone cannot capture.

Market segmentation analysis examines consulting demand patterns across different government levels, service categories, and geographic regions to identify growth opportunities and competitive positioning strategies for market participants.

North America maintains market leadership in public sector consulting services, driven by substantial federal, state, and local government investment in modernization initiatives. The region demonstrates mature consulting relationships with established procurement processes and sophisticated service delivery models. Growth rates of 5.8% annually reflect continued investment in digital transformation and cybersecurity enhancement.

Europe exhibits strong demand for consulting services focused on regulatory compliance, sustainability initiatives, and cross-border collaboration projects. The European Union’s digital agenda and green transition policies create substantial consulting opportunities, with the region accounting for approximately 28% of global consulting engagements in public sector transformation.

Asia-Pacific represents the fastest-growing regional market, with emerging economies investing heavily in governance infrastructure and administrative capacity building. Countries including India, Indonesia, and Vietnam are experiencing rapid expansion in consulting demand, with growth rates exceeding 9.2% annually as governments prioritize modernization initiatives.

Middle East and Africa show increasing consulting adoption as governments implement economic diversification strategies and governance reform programs. Oil-rich nations are investing in administrative efficiency while African countries focus on institutional development and service delivery improvement.

Latin America demonstrates growing consulting demand driven by urbanization trends, infrastructure development needs, and governance transparency initiatives. Regional governments are increasingly recognizing the value of external expertise in addressing complex development challenges.

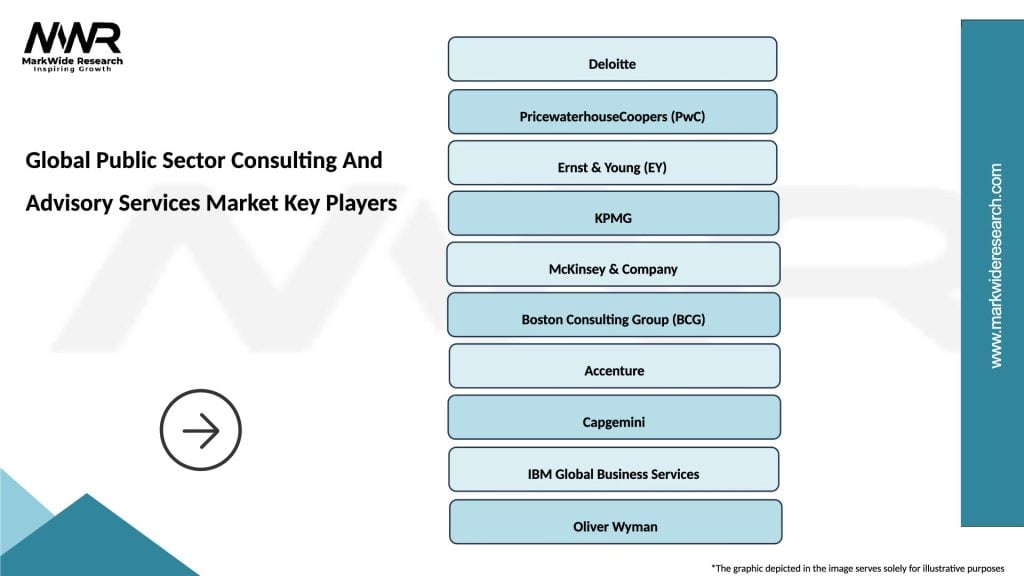

Market leaders in the global public sector consulting and advisory services sector include established firms with extensive government experience and specialized capabilities:

Competitive differentiation occurs through specialized expertise, security clearance capabilities, technology innovation, and proven track records in specific government domains. Firms compete on factors including past performance, technical approach, cost effectiveness, and ability to deliver measurable outcomes.

By Service Type:

By Government Level:

By Application Area:

Strategic Consulting represents the highest-value segment within public sector advisory services, focusing on long-term transformation initiatives and policy development. Government agencies increasingly seek external expertise for strategic planning processes, organizational restructuring, and change management initiatives. This category demonstrates steady growth as public sector leaders recognize the value of objective analysis and proven methodologies.

Technology Consulting exhibits the fastest growth rate within the market, driven by urgent digital transformation requirements and cybersecurity enhancement needs. Cloud migration projects, data analytics implementations, and citizen service digitization initiatives create substantial demand for specialized technology expertise. Consulting firms with strong technical capabilities and government experience command premium pricing in this segment.

Operational Consulting focuses on efficiency improvement and cost optimization, appealing to budget-conscious government agencies seeking to maximize resource utilization. Process reengineering, performance management, and service delivery optimization represent core service areas within this category. Growth rates of 4.3% annually reflect consistent demand for operational excellence initiatives.

Regulatory Advisory services address the growing complexity of compliance requirements across multiple domains including data privacy, environmental protection, and financial transparency. Specialized expertise in regulatory interpretation and compliance framework development creates opportunities for boutique consulting firms with deep domain knowledge.

Government Agencies benefit from access to specialized expertise that may not be available internally, enabling them to implement best practices and innovative solutions while maintaining focus on core governmental functions. External consulting provides objective analysis and validation for critical decisions while offering flexibility to scale resources based on project requirements.

Consulting Firms gain access to stable, long-term revenue streams through government contracts while building specialized expertise that differentiates them in competitive markets. Public sector experience enhances firm credibility and creates opportunities for expansion into related markets including healthcare, education, and infrastructure.

Citizens ultimately benefit from improved public services, enhanced digital experiences, and more efficient government operations resulting from successful consulting engagements. Better service delivery, reduced wait times, and improved accessibility represent tangible outcomes of effective consulting partnerships.

Technology Vendors leverage consulting partnerships to access government markets and demonstrate solution effectiveness through successful implementations. Consulting firms serve as trusted advisors who can validate technology solutions and facilitate adoption within risk-averse government environments.

Academic Institutions benefit from consulting firm partnerships that provide real-world case studies, internship opportunities, and career pathways for students interested in public service and consulting careers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Outcome-based Contracting is gaining traction as government agencies seek to align consulting fees with measurable results and performance improvements. This trend shifts risk to consulting firms while providing opportunities for premium pricing based on successful outcomes. Performance-based contracts now represent approximately 23% of government consulting engagements.

Agile Methodology Adoption is transforming government consulting approaches, with iterative development processes replacing traditional waterfall project management. This shift enables faster delivery, improved stakeholder engagement, and better adaptation to changing requirements throughout project lifecycles.

Data-Driven Decision Making is becoming standard practice in government consulting, with firms leveraging advanced analytics and artificial intelligence to provide deeper insights and more accurate recommendations. Consulting engagements increasingly include data strategy development and analytics capability building components.

Citizen Experience Focus is driving consulting demand for user-centered design and service delivery optimization. Government agencies are prioritizing citizen satisfaction metrics and seeking consulting expertise in experience design and digital service delivery.

Sustainability Integration is becoming a standard requirement in government consulting projects, with environmental and social impact considerations embedded in all transformation initiatives. Consulting firms are developing specialized capabilities in sustainable governance and green transformation.

Strategic partnerships between major consulting firms and technology vendors are reshaping service delivery capabilities, enabling comprehensive solutions that combine strategic advice with technical implementation. These alliances allow consulting firms to offer end-to-end transformation services while technology partners gain access to government markets.

Acquisition activity within the consulting sector continues as firms seek to expand capabilities and geographic reach. Recent acquisitions focus on specialized government expertise, cybersecurity capabilities, and emerging technology skills that complement existing service portfolios.

Innovation centers and government-focused research initiatives are being established by leading consulting firms to develop new methodologies and solutions specifically for public sector challenges. These investments demonstrate long-term commitment to government markets and drive competitive differentiation.

Talent development programs are expanding as consulting firms recognize the need for professionals with both consulting skills and government domain expertise. Partnerships with universities and government agencies create pipeline development opportunities for future consulting professionals.

Digital platform development is enabling consulting firms to deliver services more efficiently while providing government clients with self-service capabilities and ongoing support. These platforms combine consulting expertise with technology tools to create scalable service delivery models.

MarkWide Research analysis indicates that consulting firms should prioritize development of specialized capabilities in emerging areas including artificial intelligence, cybersecurity, and sustainability consulting to capture growing government demand. Investment in these capabilities will differentiate firms in increasingly competitive markets.

Government agencies should develop more sophisticated procurement approaches that balance cost considerations with value delivery, enabling them to access the best consulting expertise while maintaining fiscal responsibility. Outcome-based contracting models offer opportunities to align consultant incentives with government objectives.

Technology integration should be a priority for consulting firms seeking to improve service delivery efficiency and outcomes measurement. Firms that successfully combine human expertise with technological capabilities will achieve competitive advantages in government markets.

Partnership strategies between consulting firms and government agencies should focus on long-term relationship building rather than transactional engagements. Sustained partnerships enable deeper understanding of government needs and more effective solution development.

Talent development initiatives should emphasize cross-sector experience and specialized government expertise to address the growing demand for consultants who understand both private sector best practices and public sector constraints.

Market expansion is expected to continue as governments worldwide recognize the strategic value of external consulting expertise in addressing complex transformation challenges. MWR projections indicate sustained growth driven by digital transformation mandates, cybersecurity requirements, and citizen service improvement initiatives.

Technology evolution will create new consulting opportunities while potentially disrupting traditional service delivery models. Artificial intelligence, blockchain, and quantum computing represent emerging areas where government agencies will require specialized consulting expertise to navigate implementation challenges and realize benefits.

Regulatory complexity is expected to increase across multiple domains, creating sustained demand for specialized advisory services in compliance management and risk mitigation. Climate change regulations, data privacy requirements, and social responsibility mandates will drive consulting demand.

Emerging markets present significant growth opportunities as developing economies invest in governance infrastructure and administrative capacity building. These markets offer potential for foundational consulting services and long-term partnership development.

Service delivery innovation will continue evolving with hybrid models combining remote and on-site consulting, digital platforms for knowledge transfer, and outcome-based contracting becoming standard practice. These innovations will improve efficiency while maintaining service quality.

The global public sector consulting and advisory services market represents a dynamic and essential component of modern governance transformation, driven by accelerating digital transformation requirements, evolving citizen expectations, and increasing regulatory complexity. Market growth reflects the fundamental recognition that external expertise is crucial for successful public sector modernization initiatives.

Competitive dynamics continue evolving as traditional consulting firms compete with specialized government contractors and technology vendors, driving innovation in service delivery models and value propositions. Success factors include specialized expertise, proven track records, and ability to navigate complex government procurement processes while delivering measurable outcomes.

Future opportunities are substantial, particularly in emerging markets and specialized areas including cybersecurity, sustainability, and citizen experience optimization. Consulting firms that invest in these capabilities while building long-term government relationships will be well-positioned for sustained growth in this expanding market.

Strategic implications for market participants include the need for continuous capability development, technology integration, and outcome-focused service delivery models that align with government objectives and fiscal constraints. The public sector consulting market will continue serving as a critical bridge between government transformation needs and private sector innovation capabilities.

What is Public Sector Consulting And Advisory Services?

Public Sector Consulting And Advisory Services refer to professional services that assist government entities and public organizations in improving their operations, policy-making, and service delivery. These services often include strategic planning, performance management, and organizational development.

What are the key players in the Global Public Sector Consulting And Advisory Services Market?

Key players in the Global Public Sector Consulting And Advisory Services Market include Deloitte, Accenture, and McKinsey & Company, among others. These firms provide a range of services tailored to the needs of public sector clients, including digital transformation and operational efficiency.

What are the growth factors driving the Global Public Sector Consulting And Advisory Services Market?

The growth of the Global Public Sector Consulting And Advisory Services Market is driven by increasing demand for digital transformation, the need for improved public service delivery, and the rising complexity of government regulations. Additionally, the focus on data-driven decision-making is propelling the market forward.

What challenges does the Global Public Sector Consulting And Advisory Services Market face?

The Global Public Sector Consulting And Advisory Services Market faces challenges such as budget constraints within government agencies, resistance to change from public sector employees, and the need for specialized expertise. These factors can hinder the implementation of effective consulting solutions.

What opportunities exist in the Global Public Sector Consulting And Advisory Services Market?

Opportunities in the Global Public Sector Consulting And Advisory Services Market include the growing emphasis on sustainability initiatives, the integration of advanced technologies like AI and data analytics, and the potential for public-private partnerships to enhance service delivery.

What trends are shaping the Global Public Sector Consulting And Advisory Services Market?

Trends shaping the Global Public Sector Consulting And Advisory Services Market include the increasing adoption of cloud-based solutions, a focus on citizen engagement through digital platforms, and the rise of agile methodologies in project management. These trends are transforming how public sector organizations operate.

Global Public Sector Consulting And Advisory Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Strategy Consulting, Operations Consulting, IT Consulting, Financial Advisory |

| End User | Government Agencies, Non-Profit Organizations, Educational Institutions, Healthcare Providers |

| Industry Vertical | Public Safety, Transportation, Defense, Urban Development |

| Solution | Digital Transformation, Risk Management, Compliance Services, Performance Improvement |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Public Sector Consulting And Advisory Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at