444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global property and casualty reinsurance market plays a pivotal role in the insurance industry by providing risk management solutions to insurance companies. Reinsurance serves as a protection mechanism for insurers against large and catastrophic losses. It allows insurance companies to transfer a portion of their risk to reinsurance companies in exchange for a premium. The property and casualty reinsurance market specifically focuses on covering losses related to property damage and liability claims.

Property and casualty reinsurance refers to the process of reinsuring property and liability risks faced by insurance companies. This type of reinsurance helps insurance companies mitigate potential losses resulting from natural disasters, accidents, and other unforeseen events. By transferring a portion of their risks to reinsurers, insurers can safeguard their financial stability and maintain adequate reserves to pay claims.

Executive Summary

The global property and casualty reinsurance market has witnessed significant growth in recent years, driven by various factors such as the increasing frequency and severity of natural disasters, rising awareness of risk management among insurers, and evolving regulations in the insurance industry. Reinsurers play a critical role in enabling insurance companies to underwrite policies with larger coverage limits and expand their market presence.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The property and casualty reinsurance market operates in a dynamic environment influenced by various factors, including economic conditions, regulatory changes, natural disasters, and evolving customer preferences. Reinsurers must adapt to these dynamics by offering innovative solutions, building strong relationships with insurers, and leveraging technology to gain a competitive edge.

Regional Analysis

The property and casualty reinsurance market exhibit regional variations influenced by factors such as economic development, regulatory frameworks, natural disaster risks, and insurance market maturity. North America and Europe are key regions in terms of market size and technological advancements, while Asia-Pacific and Latin America offer immense growth potential due to expanding insurance markets and rising awareness of risk management.

Competitive Landscape

Leading Companies in the Global Property And Casualty Reinsurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

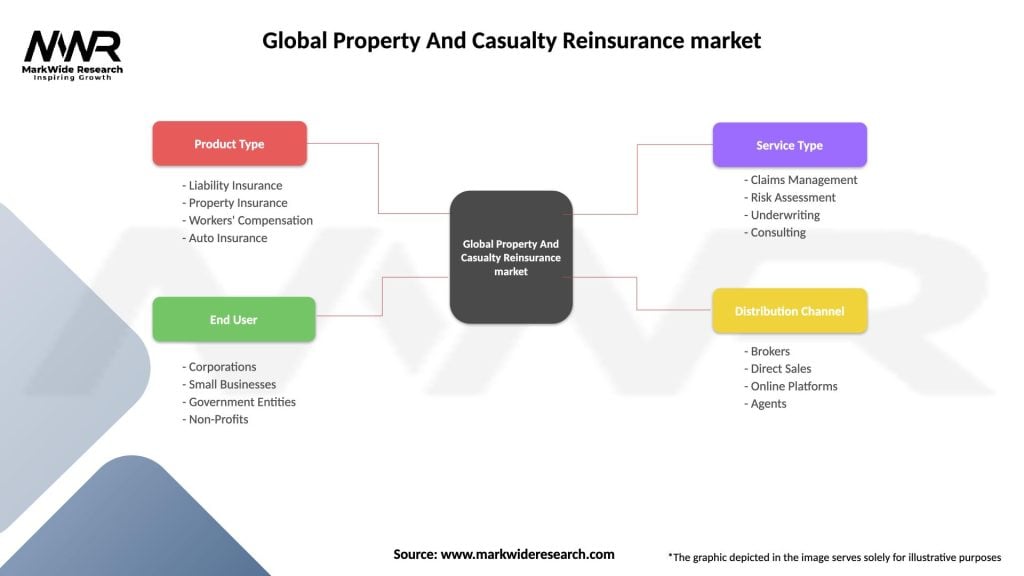

Segmentation

The property and casualty reinsurance market can be segmented based on various factors such as type of coverage (property, liability, and others), distribution channel (direct and indirect), and region. Each segment presents unique opportunities and challenges for reinsurers, requiring tailored strategies and product offerings.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The global property and casualty reinsurance market, like other sectors, has been impacted by the Covid-19 pandemic. The pandemic has resulted in increased uncertainties and risks, particularly in the liability segment. Reinsurers have faced challenges in assessing pandemic-related losses, adjusting premiums, and managing their investment portfolios. However, the pandemic has also highlighted the importance of risk management and resilience, emphasizing the need for robust reinsurance solutions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global property and casualty reinsurance market is poised for steady growth in the coming years. Factors such as increasing risk awareness, evolving regulations, technological advancements, and emerging markets will drive the market’s expansion. Reinsurers that adapt to changing market dynamics, invest in innovation, and provide comprehensive risk management solutions will thrive in this evolving landscape.

Conclusion

The global property and casualty reinsurance market plays a critical role in enabling insurers to manage risks effectively and maintain financial stability. The market offers numerous opportunities driven by emerging markets, technological advancements, and evolving risk landscapes. Reinsurers must navigate pricing pressures, uncertainties in loss estimation, and regulatory changes to succeed in this competitive landscape. By embracing innovation, building strong relationships, and tailoring solutions to meet insurers’ needs, reinsurers can thrive and contribute to a resilient and sustainable insurance industry.

What is Property And Casualty Reinsurance?

Property and casualty reinsurance refers to the practice where insurance companies transfer portions of their risk portfolios to other insurers to reduce the likelihood of paying a large obligation resulting from an insurance claim. This type of reinsurance is crucial for managing risk in sectors such as auto, home, and commercial insurance.

What are the key players in the Global Property And Casualty Reinsurance market?

Key players in the Global Property And Casualty Reinsurance market include Munich Re, Swiss Re, and Berkshire Hathaway, among others. These companies provide various reinsurance solutions to help primary insurers manage their risk exposure effectively.

What are the main drivers of growth in the Global Property And Casualty Reinsurance market?

The main drivers of growth in the Global Property And Casualty Reinsurance market include increasing natural disasters leading to higher claims, the need for insurers to maintain solvency, and the growing complexity of risks in various sectors. Additionally, advancements in data analytics are enhancing risk assessment capabilities.

What challenges does the Global Property And Casualty Reinsurance market face?

The Global Property And Casualty Reinsurance market faces challenges such as regulatory changes, increasing competition, and the impact of climate change on risk assessment. These factors can complicate pricing models and affect the availability of coverage.

What opportunities exist in the Global Property And Casualty Reinsurance market?

Opportunities in the Global Property And Casualty Reinsurance market include the expansion into emerging markets, the development of innovative reinsurance products, and the integration of technology for better risk management. These trends can lead to enhanced service offerings and improved operational efficiencies.

What trends are shaping the Global Property And Casualty Reinsurance market?

Trends shaping the Global Property And Casualty Reinsurance market include the increasing use of artificial intelligence for underwriting, the rise of parametric insurance solutions, and a focus on sustainability in risk management practices. These trends are influencing how reinsurance is structured and delivered.

Global Property And Casualty Reinsurance market

| Segmentation Details | Description |

|---|---|

| Product Type | Liability Insurance, Property Insurance, Workers’ Compensation, Auto Insurance |

| End User | Corporations, Small Businesses, Government Entities, Non-Profits |

| Service Type | Claims Management, Risk Assessment, Underwriting, Consulting |

| Distribution Channel | Brokers, Direct Sales, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Property And Casualty Reinsurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at