444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global point of sale (POS) terminals market has experienced significant growth in recent years. POS terminals are electronic devices used by businesses to process sales transactions, manage inventory, and perform various other functions. These terminals have become an integral part of the retail, hospitality, and healthcare industries, among others. The market for POS terminals is driven by the increasing adoption of digital payment methods, the need for efficient transaction processing, and the demand for enhanced customer experiences.

Point of sale terminals, often referred to as cash registers or checkout counters, are electronic devices used by businesses to complete sales transactions. These terminals typically consist of hardware components such as a computer, monitor, barcode scanner, receipt printer, and card reader. Additionally, they are equipped with software that allows businesses to track sales, manage inventory, and generate reports. POS terminals enable businesses to streamline their operations and provide a seamless payment experience to customers.

Executive Summary

The global point of sale terminals market has witnessed rapid growth in recent years, driven by the increasing adoption of digital payment methods and the need for efficient transaction processing. The market is highly competitive, with several key players dominating the industry. Key market trends include the integration of advanced technologies such as contactless payments and cloud-based solutions. The COVID-19 pandemic has also impacted the market, leading to a surge in demand for contactless payment options. Moving forward, the market is expected to continue its growth trajectory, fueled by advancements in technology and the expanding retail sector.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global POS terminals market is dynamic and influenced by various factors:

Regional Analysis

The global POS terminals market is segmented into several regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Each region has its own unique market dynamics, influenced by factors such as technological advancements, regulatory environment, and consumer preferences.

Each region presents unique opportunities and challenges for POS terminal providers. Adapting to local market dynamics, regulatory requirements, and consumer preferences is crucial for success in each region.

Competitive Landscape

Leading Companies in the Global Point of Sale Terminals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

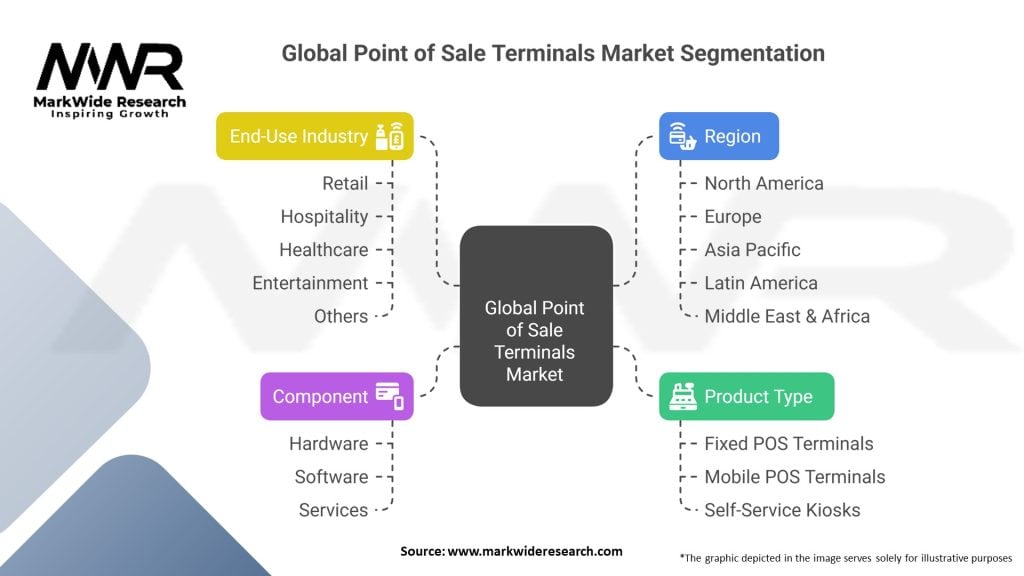

Segmentation

The global POS terminals market can be segmented based on several factors:

Segmentation allows businesses to target specific customer segments and cater to their unique requirements.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides a comprehensive understanding of the POS terminals market:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the POS terminals market. The crisis accelerated the shift towards contactless payments as consumers became more cautious about handling physical cash and cards. Businesses implemented hygiene measures, leading to increased demand for touchless payment options.

Moreover, the pandemic highlighted the importance of data analytics and remote management capabilities of POS terminals. Businesses sought solutions that could provide real-time data, enable remote operations, and adapt to changing consumer behavior.

The pandemic also brought challenges, such as supply chain disruptions and economic uncertainties, impacting the POS terminals market. However, the market showed resilience and adaptability, with businesses leveraging technology to meet changing demands.

Key Industry Developments

Advancements in biometric authentication have been a notable development in the POS terminals market. Biometric features such as fingerprint recognition and facial recognition are being integrated into POS terminals to enhance security and provide a seamless and secure payment experience for customers. Biometric authentication offers an additional layer of protection by verifying the identity of the user, reducing the risk of fraudulent transactions.

The integration of AI and machine learning technologies has revolutionized the capabilities of POS terminals. AI-powered algorithms analyze transaction data, customer behavior, and inventory patterns to provide valuable insights for businesses. Machine learning algorithms enable the terminals to adapt and improve over time, offering personalized recommendations and improving operational efficiency.

The rise of omnichannel retailing has led to the development of POS terminals that can seamlessly integrate with multiple sales channels. Businesses are adopting solutions that allow customers to make purchases in-store, online, or through mobile apps while maintaining a unified shopping experience. POS terminals are being equipped with functionalities to support omnichannel operations, such as inventory synchronization, centralized customer data, and order management.

With the increasing prevalence of data breaches and cyber threats, data security and compliance have become critical concerns in the POS terminals market. Terminal providers are investing in advanced security measures such as end-to-end encryption, tokenization, and adherence to industry regulations like the Payment Card Industry Data Security Standard (PCI DSS). Ensuring secure transactions and protecting customer data are top priorities for businesses and terminal providers.

Analyst Suggestions

Future Outlook

The future of the POS terminals market looks promising, driven by advancements in technology, the increasing adoption of digital payments, and the need for seamless customer experiences. Key trends such as contactless payments, AI-powered analytics, and biometric authentication are expected to continue shaping the industry.

The market is likely to witness further integration with emerging technologies such as blockchain, Internet of Things (IoT), and augmented reality (AR). These technologies can offer enhanced security, improved transaction speed, and immersive shopping experiences.

Furthermore, the market is expected to expand in developing regions, driven by the growing retail sector, government initiatives for cashless economies, and the increasing penetration of smartphones and internet connectivity.

Conclusion

The global point of sale (POS) terminals market has experienced substantial growth driven by the increasing adoption of digital payment methods, the demand for enhanced customer experiences, and the need for efficient transaction processing. POS terminals have become essential tools for businesses across various industries, including retail, hospitality, healthcare, and entertainment.

In conclusion, the global POS terminals market offers significant opportunities for businesses to streamline operations, improve customer experiences, and gain valuable insights. By staying abreast of industry trends, embracing technological advancements, and focusing on customer needs, businesses can thrive in this dynamic and ever-growing market.

What are Global Point of Sale Terminals?

Global Point of Sale Terminals refer to the hardware and software systems used by businesses to process transactions at the point of sale. These terminals facilitate payment processing, inventory management, and customer relationship management across various retail and service sectors.

Who are the key players in the Global Point of Sale Terminals Market?

Key players in the Global Point of Sale Terminals Market include Square, Ingenico, Verifone, and Clover, among others. These companies offer a range of solutions tailored to different business needs and sizes.

What are the main drivers of growth in the Global Point of Sale Terminals Market?

The growth of the Global Point of Sale Terminals Market is driven by the increasing adoption of cashless payment methods, the rise of e-commerce, and the demand for integrated payment solutions that enhance customer experience.

What challenges does the Global Point of Sale Terminals Market face?

The Global Point of Sale Terminals Market faces challenges such as cybersecurity threats, the need for continuous software updates, and the high costs associated with upgrading legacy systems to modern solutions.

What opportunities exist in the Global Point of Sale Terminals Market?

Opportunities in the Global Point of Sale Terminals Market include the expansion of mobile payment solutions, the integration of advanced analytics for better customer insights, and the growing demand for contactless payment options.

What trends are shaping the Global Point of Sale Terminals Market?

Trends shaping the Global Point of Sale Terminals Market include the increasing use of cloud-based solutions, the rise of omnichannel retailing, and the incorporation of artificial intelligence to enhance transaction security and customer engagement.

Global Point of Sale Terminals Market:

| Segmentation Details | Details |

|---|---|

| By Product Type | Fixed POS Terminals, Mobile POS Terminals, Self-Service Kiosks |

| By Component | Hardware, Software, Services |

| By End-Use Industry | Retail, Hospitality, Healthcare, Entertainment, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Point of Sale Terminals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at