444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global Off-the-Road (OTR) tires market is witnessing significant growth due to the rising demand from the construction and mining industries. OTR tires are designed to be durable and rugged, suitable for heavy machinery used in these sectors. This comprehensive market analysis provides valuable insights into the OTR tires industry, including market drivers, restraints, opportunities, key trends, and future outlook.

Off-the-Road (OTR) tires, also known as earthmover tires, are specifically designed for vehicles operating in challenging terrains such as construction sites, mines, and agricultural fields. These tires are manufactured with reinforced compounds and robust tread patterns to withstand rough surfaces, heavy loads, and harsh environmental conditions.

Executive Summary

The global OTR tires market is expected to experience steady growth over the forecast period. Increasing industrialization, urbanization, and infrastructure development projects in emerging economies are driving the demand for heavy machinery, thereby fueling the need for OTR tires. The market is witnessing technological advancements, such as the development of puncture-resistant and heat-resistant OTR tires, enhancing their durability and performance.

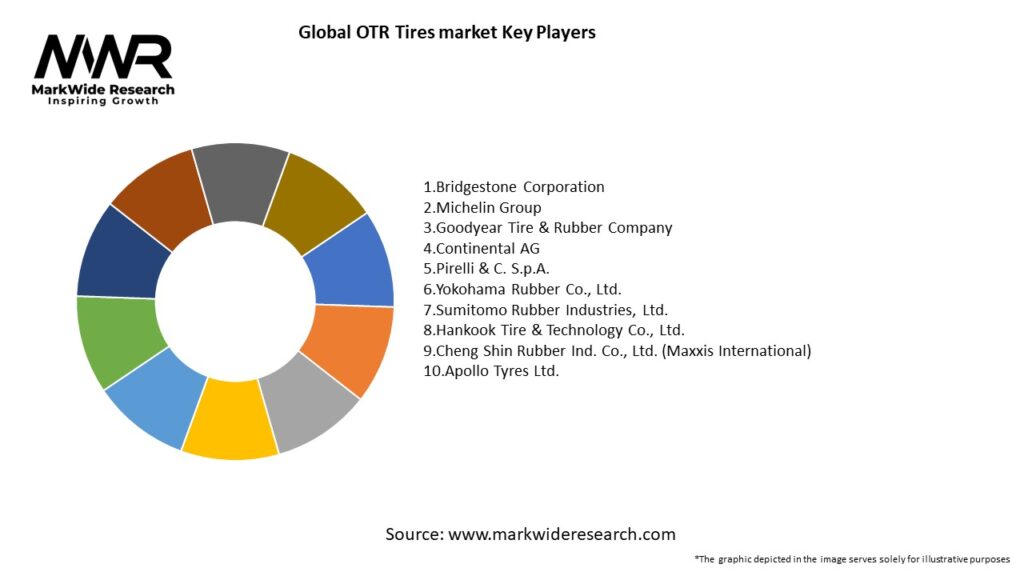

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global OTR tires market operates in a dynamic environment influenced by various factors such as economic conditions, technological advancements, industry regulations, and customer preferences. The market’s growth potential relies heavily on the construction, mining, and agriculture sectors, as well as government policies and investments.

Regional Analysis

The OTR tires market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific dominates the market due to the high demand for heavy machinery in countries like China and India. North America and Europe also hold significant market shares, driven by ongoing infrastructure development and mining activities.

Competitive Landscape

Leading Companies in the Global OTR Tires Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The OTR tires market can be segmented based on tire type, application, and region.

By tire type:

By application:

By region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact The global OTR tires market experienced a temporary slowdown due to the Covid-19 pandemic. Construction projects were delayed or halted, and mining activities were affected by disruptions in the global supply chain. However, as economies recover and infrastructure projects resume, the demand for OTR tires is expected to rebound.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global OTR tires market is projected to witness steady growth in the coming years. The demand for OTR tires will be driven by infrastructure development, increasing mining activities, and mechanization in the agriculture sector. Technological advancements, customization options, and sustainability initiatives will shape the future landscape of the market.

Conclusion

The global OTR tires market is poised for growth, driven by the construction and mining industries’ increasing demand for heavy machinery. Despite challenges such as fluctuating raw material prices and regulatory constraints, the market presents opportunities for manufacturers, distributors, and industry stakeholders. With a focus on sustainability, technological advancements, and customization, the OTR tires market is expected to thrive in the coming years, catering to the evolving needs of various sectors and contributing to global infrastructure development and economic growth.

Global OTR Tires market

| Segmentation Details | Description |

|---|---|

| Product Type | Radial, Bias, All-Terrain, Heavy-Duty |

| End User | Construction, Mining, Agriculture, Logistics |

| Vehicle Type | Trucks, Earthmovers, Forklifts, Agricultural Equipment |

| Distribution Channel | Direct Sales, Retail, Online, Distributors |

Leading Companies in the Global OTR Tires Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at