444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Global Mobile Payment Technology Market is experiencing rapid growth, driven by the increasing adoption of smartphones, the rise of e-commerce, and advancements in digital payment technologies. Mobile payments have become an integral part of the consumer experience, enabling quick, secure, and convenient transactions for both consumers and businesses. The convenience of making payments through mobile devices, combined with the increasing demand for cashless and contactless transactions, is propelling the growth of mobile payment technologies.

With the increasing penetration of smartphones and improved internet connectivity, mobile payment systems are gaining traction across the globe, especially in emerging economies. Furthermore, the growing trend toward digital wallets, mobile banking, and peer-to-peer (P2P) payment systems is driving market expansion. Governments, financial institutions, and tech companies are focusing on developing and enhancing mobile payment technologies to ensure secure, efficient, and seamless transactions. This, coupled with the rise of mobile-first generations, is contributing to the continuous growth of the mobile payment technology market.

Meaning

Mobile payment technology refers to the use of mobile devices, such as smartphones, tablets, and wearables, to make financial transactions. These payments are processed through mobile apps, digital wallets, and mobile banking platforms. Mobile payments allow consumers to pay for goods and services via Near Field Communication (NFC), QR codes, or other digital means, bypassing the need for traditional payment methods such as cash or credit cards.

Mobile payment systems can be categorized into several types, including mobile wallets (e.g., Apple Pay, Google Pay), mobile banking apps, peer-to-peer (P2P) payment apps (e.g., Venmo, PayPal), and contactless card payments. These systems provide enhanced convenience and security for consumers, and they are rapidly becoming the preferred method of payment for both online and in-store transactions.

Executive Summary

The Global Mobile Payment Technology Market is growing at a fast pace, driven by technological advancements, increasing smartphone usage, and the growing trend of digital payments. The market is expected to continue its expansion as more consumers and businesses embrace cashless payment methods. With the increasing number of mobile wallet applications, digital payment platforms, and the integration of contactless payment methods, mobile payments are becoming a vital part of the global financial ecosystem.

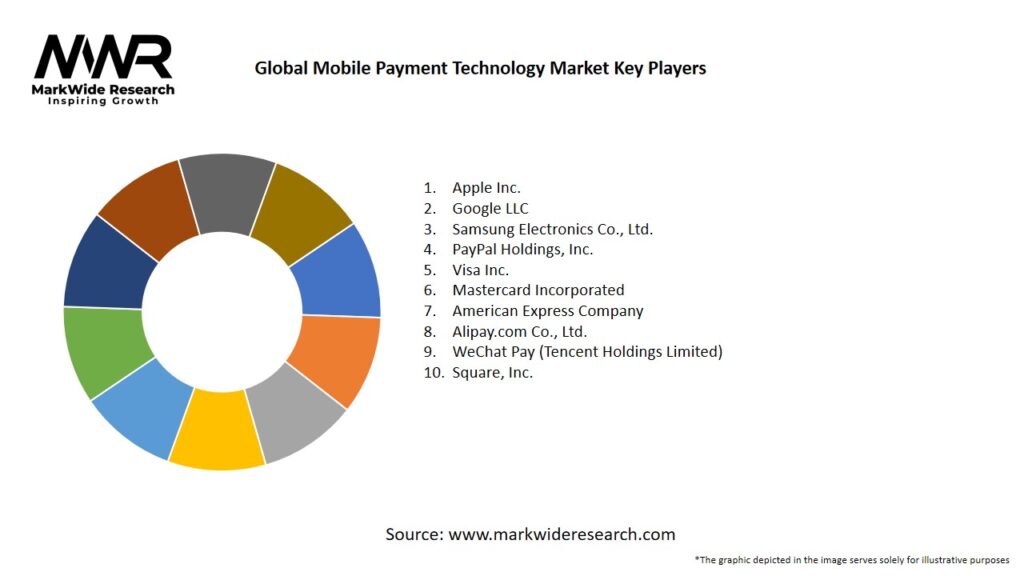

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Increasing Smartphone Penetration: The growing global smartphone user base, particularly in developing regions, is a major driver for the mobile payment technology market, enabling consumers to use mobile devices for financial transactions.

Shift Towards Cashless Payments: The global trend towards cashless and contactless payments, accelerated by the COVID-19 pandemic, has increased the adoption of mobile payment technologies across both consumers and businesses.

E-commerce Growth: The booming e-commerce sector is significantly contributing to the growth of the mobile payment market, with consumers increasingly choosing mobile payments for online shopping due to their speed, convenience, and security.

Security and Fraud Prevention: With increasing concerns about data privacy and security, advancements in biometric authentication, tokenization, and encryption are enhancing the security of mobile payment systems, thus boosting consumer confidence.

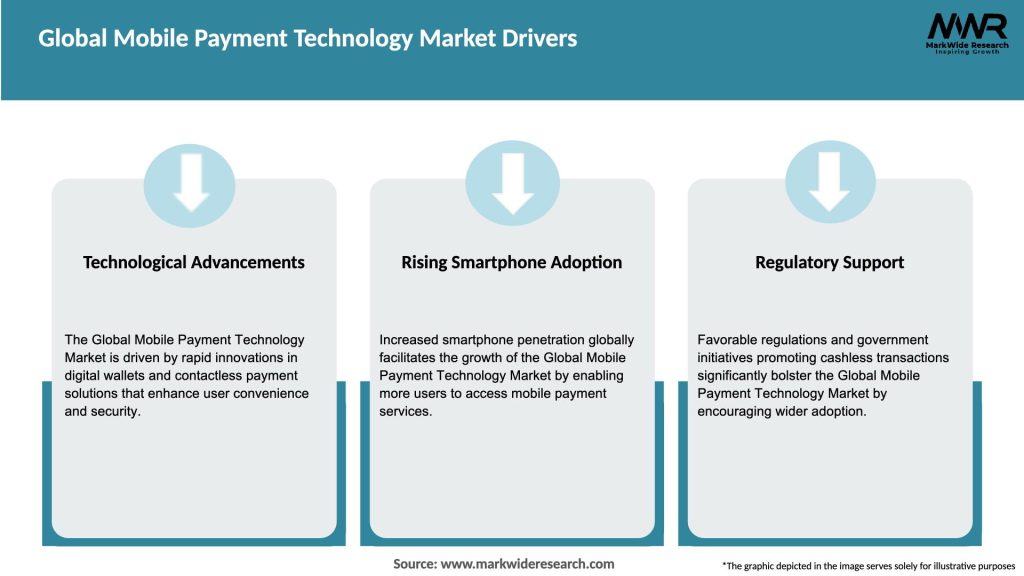

Market Drivers

Several factors are driving the growth of the Global Mobile Payment Technology Market:

Smartphone and Internet Penetration: As smartphones become more affordable and internet access becomes widespread, mobile payments are gaining traction in both developed and emerging markets.

Rise of E-commerce and Digital Transactions: The rapid growth of online shopping and digital services has spurred the demand for mobile payment solutions to facilitate quick, secure, and efficient transactions.

Contactless Payments: The increasing popularity of contactless payments due to convenience, especially during the COVID-19 pandemic, has driven the demand for mobile payment technologies.

Government Support for Cashless Transactions: Many governments and regulators are promoting the use of cashless payments by implementing policies that support digital payment infrastructure and security.

Enhanced Security Features: The introduction of advanced security features, such as fingerprint scanning, facial recognition, and tokenization, is enhancing the trust and security of mobile payments, encouraging wider adoption.

Market Restraints

Despite the growth prospects, the Global Mobile Payment Technology Market faces several challenges:

Cybersecurity and Fraud Risks: Mobile payment systems are vulnerable to cyberattacks, data breaches, and fraud. Ensuring secure transactions is a major challenge for the industry, and any significant breaches could harm market growth.

Lack of Standardization: The absence of global standards for mobile payments and the fragmentation of payment platforms across different countries and regions can limit market growth and create challenges for cross-border payments.

Consumer Awareness: In some regions, there is still limited awareness about mobile payment options and their benefits, which may slow adoption rates, particularly in less digitally advanced areas.

Technological Barriers: Although mobile payment systems are rapidly advancing, some regions still lack the necessary infrastructure, such as reliable internet access and mobile network coverage, to support seamless mobile payment transactions.

Market Opportunities

The Global Mobile Payment Technology Market presents several growth opportunities:

Integration with Wearable Devices: With the increasing popularity of wearable devices like smartwatches and fitness trackers, integrating mobile payment solutions into these devices presents a new opportunity for market expansion.

Emerging Markets: The rise in smartphone penetration and digitalization in emerging markets, such as Asia-Pacific, Africa, and Latin America, presents significant growth opportunities for mobile payment technology providers.

Blockchain and Cryptocurrency: The integration of blockchain technology and cryptocurrencies in mobile payments can enhance security, reduce transaction costs, and provide additional growth opportunities in the mobile payment market.

AI and Machine Learning: The use of AI and machine learning for fraud detection, transaction analysis, and personalized offers is a significant opportunity for mobile payment companies to enhance their services and differentiate themselves in the market.

Market Dynamics

The Global Mobile Payment Technology Market is influenced by various factors:

Technological Advancements: Ongoing innovations in mobile payment technologies, such as NFC, biometrics, and tokenization, are improving the speed, security, and ease of use of mobile payments.

Regulatory Frameworks: The increasing focus on creating secure and standardized regulatory frameworks for mobile payments is fostering consumer confidence and boosting market adoption.

Consumer Preferences: The growing preference for seamless, fast, and convenient payment methods, particularly among millennials and Gen Z, is accelerating the adoption of mobile payment solutions.

Partnerships and Collaborations: Collaboration between financial institutions, technology providers, and retailers is driving the growth of the mobile payment market, as it enables the development of integrated solutions and enhances payment acceptance.

Regional Analysis

The Global Mobile Payment Technology Market shows varied growth patterns across different regions:

North America: North America, especially the U.S. and Canada, is one of the leading markets for mobile payments, driven by high smartphone penetration, strong internet infrastructure, and high adoption of mobile wallets and digital payment platforms.

Europe: Europe is experiencing robust growth in mobile payment adoption, particularly in countries like the U.K., Germany, and Sweden, where contactless payments and mobile wallets are widely used.

Asia-Pacific: Asia-Pacific, particularly China, India, and Japan, is the fastest-growing region for mobile payments due to the rapid adoption of smartphones, the rise of mobile-first economies, and government initiatives promoting digital payments.

Latin America: The Latin American market is growing as mobile payment technologies gain traction in countries like Brazil and Mexico, driven by the increasing use of smartphones and mobile banking.

Middle East and Africa: The Middle East and Africa are emerging markets for mobile payments, with increasing smartphone penetration and growing interest in digital payment solutions among consumers and businesses.

Competitive Landscape

Leading Companies in the Global Mobile Payment Technology Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

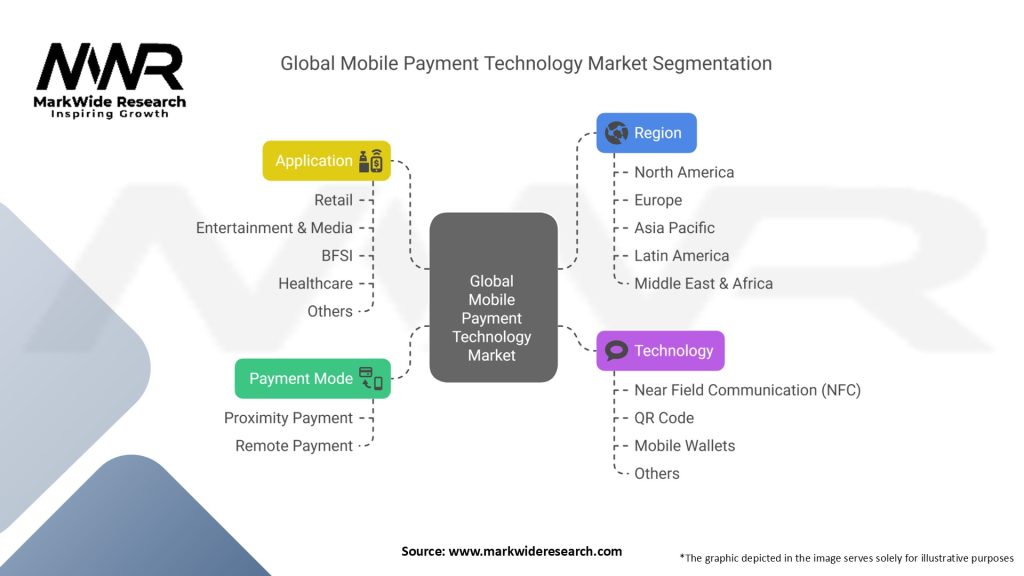

Segmentation

The Global Mobile Payment Technology Market can be segmented based on:

Payment Mode: Proximity Payments (NFC), Remote Payments (QR Code, SMS, Mobile Wallets).

Application: Retail, Hospitality, Healthcare, Transport, Others.

End-User: Consumers, Merchants, Financial Institutions, Payment Service Providers.

Category-wise Insights

Mobile Wallets: Mobile wallets like Apple Pay, Google Pay, and PayPal offer consumers the convenience of storing multiple payment options and using them for both online and in-store transactions.

Peer-to-Peer Payments (P2P): P2P payment systems, such as Venmo, Zelle, and WeChat Pay, allow users to send money to family and friends quickly and securely, contributing to the growth of the mobile payment ecosystem.

Key Benefits for Industry Participants and Stakeholders

Increased Customer Engagement: Mobile payment solutions enhance customer engagement by offering convenient, fast, and secure ways to make payments, improving customer satisfaction.

Cost Reduction: Mobile payments can help reduce transaction fees and administrative costs associated with traditional payment methods, making them attractive to merchants and service providers.

Enhanced Security: With advancements in encryption, tokenization, and biometric authentication, mobile payment solutions provide enhanced security, reducing fraud risks for both consumers and businesses.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Contactless Payments: The growing adoption of contactless mobile payments is a key trend, driven by consumer demand for faster and more secure transaction methods.

Blockchain Integration: Blockchain technology is gaining traction in the mobile payment sector, offering the potential to enhance security, transparency, and efficiency in transactions.

COVID-19 Impact:

The COVID-19 pandemic has accelerated the adoption of mobile payment technology, as consumers and businesses have turned to contactless payments to reduce the risk of transmission. The pandemic has also driven the adoption of mobile banking, as consumers avoid going to physical banks and ATMs. The COVID-19 pandemic accelerated the adoption of mobile payment technologies as consumers and businesses moved toward contactless, cashless transactions to minimize physical contact. This trend is expected to continue, with mobile payments becoming even more embedded in everyday consumer behavior.

Key Industry Developments

Partnerships and Acquisitions: Major players in the mobile payment sector are forming strategic partnerships to enhance their offerings and expand their market reach.

Innovation in Payment Technologies: Continuous innovation in mobile payment technologies, including AI-powered fraud detection and biometric authentication, is improving the security and user experience of mobile payments.

Analyst Suggestions

Focus on Security: Companies should invest in enhancing the security of mobile payment systems through encryption, biometrics, and other advanced technologies to foster trust and improve adoption rates.

Expand in Emerging Markets: Companies should focus on expanding their reach in emerging markets, where mobile payments are seeing rapid adoption due to increasing smartphone penetration and e-commerce growth.

Future Outlook:

The global mobile payment technology market is expected to continue to grow during the forecast period, driven by the increasing adoption of smartphones and mobile banking. The market is expected to be dominated by major players such as Apple, Google, Samsung, and PayPal, but there will also be opportunities for new players to enter the market.

Conclusion:

The global mobile payment technology market is experiencing rapid growth, driven by the increasing adoption of smartphones, the growing popularity of mobile banking, and the rise of e-commerce. While security concerns and lack of standardization are barriers to adoption, the market presents significant opportunities for companies that can overcome these challenges.

What is Global Mobile Payment Technology?

Global Mobile Payment Technology refers to the systems and processes that enable consumers to make payments using mobile devices. This includes various applications, platforms, and technologies that facilitate transactions through smartphones and tablets.

Who are the key players in the Global Mobile Payment Technology Market?

Key players in the Global Mobile Payment Technology Market include PayPal, Square, and Apple Pay, among others. These companies are at the forefront of developing innovative solutions that enhance mobile payment experiences for consumers and businesses.

What are the main drivers of growth in the Global Mobile Payment Technology Market?

The main drivers of growth in the Global Mobile Payment Technology Market include the increasing adoption of smartphones, the rise of e-commerce, and the demand for contactless payment solutions. Additionally, consumer preferences for convenience and speed in transactions are fueling this growth.

What challenges does the Global Mobile Payment Technology Market face?

The Global Mobile Payment Technology Market faces challenges such as security concerns, regulatory compliance issues, and the need for interoperability among different payment systems. These factors can hinder widespread adoption and consumer trust in mobile payment solutions.

What opportunities exist in the Global Mobile Payment Technology Market?

Opportunities in the Global Mobile Payment Technology Market include the expansion of digital wallets, the integration of blockchain technology, and the potential for growth in emerging markets. These factors can lead to innovative payment solutions and increased market penetration.

What trends are shaping the Global Mobile Payment Technology Market?

Trends shaping the Global Mobile Payment Technology Market include the rise of biometric authentication, the growth of peer-to-peer payment platforms, and the increasing use of artificial intelligence for fraud detection. These innovations are enhancing user experience and security in mobile transactions.

Global Mobile Payment Technology Market:

| Segmentation | Details |

|---|---|

| Payment Mode | Proximity Payment, Remote Payment |

| Technology | Near Field Communication (NFC), QR Code, Mobile Wallets, Others |

| Application | Retail, Entertainment & Media, BFSI, Healthcare, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Mobile Payment Technology Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at