444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global mobile C-arm market has witnessed significant growth in recent years, driven by the increasing demand for advanced imaging technologies in surgical procedures. Mobile C-arm refers to a medical imaging device that provides real-time X-ray images, enabling surgeons to visualize internal structures during surgeries. This market is poised for continued expansion as healthcare facilities strive for improved patient outcomes and enhanced procedural efficiency.

Meaning

Mobile C-arm is a portable medical imaging device that combines X-ray technology with a fluoroscopic image intensifier. It is used primarily in surgical settings to provide real-time imaging during procedures, allowing surgeons to visualize anatomical structures and guide their interventions. Mobile C-arms are highly maneuverable and can be easily repositioned, providing flexibility and accessibility in various surgical environments.

Executive Summary

The global mobile C-arm market has experienced substantial growth due to the increasing demand for advanced imaging technologies in surgical procedures. Mobile C-arm devices enable real-time imaging and visualization, enhancing surgical precision and patient safety. This report provides a comprehensive analysis of the market, highlighting key market insights, drivers, restraints, opportunities, and future outlook.

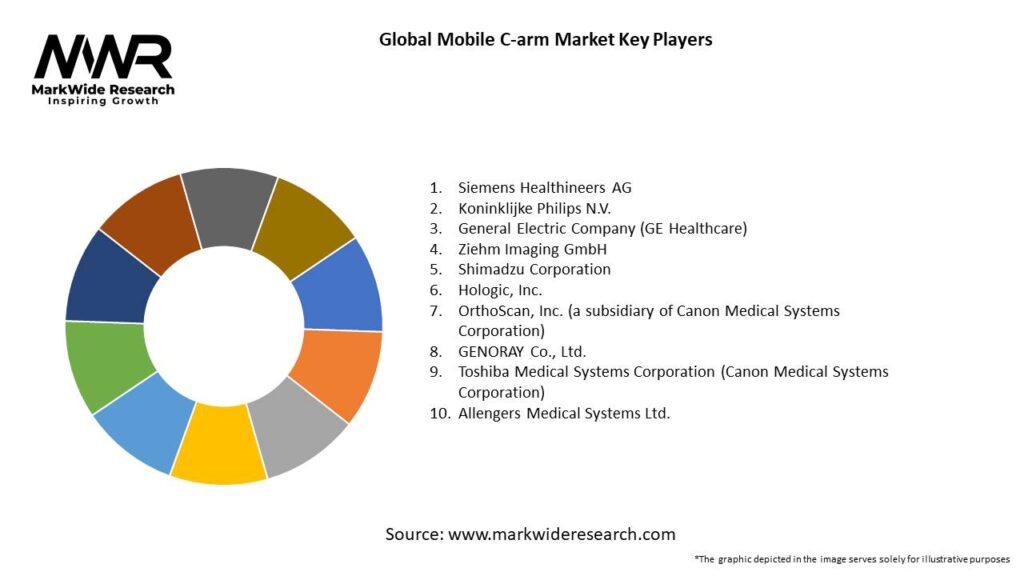

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The mobile C-arm market is driven by dynamic factors that shape its growth and trajectory.These dynamics include the increasing demand for advanced imaging technologies in surgical procedures, advancements in imaging technologies, the growing need for minimally invasive procedures, and the integration of mobile C-arms with robotics and navigation systems. The market is highly influenced by the emphasis on surgical precision, patient safety, and procedural efficiency in healthcare settings.

Regional Analysis

The mobile C-arm market exhibits regional variations in terms of adoption, market maturity, and healthcare infrastructure. North America currently dominates the market due to its well-established healthcare system, technological advancements, and high healthcare expenditure. The Asia Pacific region is expected to witness significant growth in the mobile C-arm market, driven by the increasing adoption of advanced surgical technologies, growing healthcare infrastructure, and rising healthcare spending.

Competitive Landscape

Leading Companies in the Global Mobile C-arm Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The mobile C-arm market can be segmented based on product type, technology, end-user, and geography.

By Product Type:

By Technology:

By End-User:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the mobile C-arm market. While the immediate focus of healthcare facilities shifted towards managing the pandemic, elective surgical procedures were postponed or canceled, impacting the demand for mobile C-arms. However, as the situation stabilizes, the backlog of surgeries is expected to drive the demand for mobile C-arms in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the global mobile C-arm market is promising, with continued growth anticipated. The increasing demand for advanced imaging technologies in surgical procedures, advancements in imaging technologies, and the adoption of mobile C-arms in emerging markets contribute to market expansion. Integration with robotics and navigation systems, advancements in mini C-arms, and the integration of AI technologies are key trends shaping the future of the market. Industry participants need to focus on cost optimization, radiation safety measures, clinical training and support, and collaboration to stay competitive in the evolving market.

Conclusion

The global mobile C-arm market is experiencing significant growth, driven by the increasing demand for advanced imaging technologies in surgical procedures. Mobile C-arm devices provide real-time imaging and visualization, enhancing surgical precision and patient safety. The market offers opportunities in emerging markets, integration with robotics and navigation systems, and the adoption in ambulatory surgical centers. Key players in the market are focusing on product innovation, technological advancements, and strategic collaborations. The future outlook for the mobile C-arm market is positive, with continued growth and advancements anticipated. Industry participants need to adapt to emerging trends, prioritize radiation safety, and focus on delivering cost-effective and technologically advanced mobile C-arm solutions to meet the evolving needs of healthcare facilities.

What is Mobile C-arm?

Mobile C-arm refers to a type of medical imaging equipment that provides real-time X-ray imaging for various surgical and diagnostic procedures. It is widely used in operating rooms, emergency departments, and outpatient facilities for its portability and versatility.

What are the key players in the Global Mobile C-arm Market?

Key players in the Global Mobile C-arm Market include Siemens Healthineers, GE Healthcare, and Philips Healthcare, among others. These companies are known for their innovative imaging solutions and advanced technology in the medical imaging sector.

What are the main drivers of the Global Mobile C-arm Market?

The main drivers of the Global Mobile C-arm Market include the increasing demand for minimally invasive surgeries, advancements in imaging technology, and the growing prevalence of chronic diseases requiring diagnostic imaging. Additionally, the rise in outpatient procedures is contributing to market growth.

What challenges does the Global Mobile C-arm Market face?

The Global Mobile C-arm Market faces challenges such as high costs of advanced imaging systems and concerns regarding radiation exposure for patients and healthcare providers. Additionally, the need for skilled professionals to operate these systems can limit their adoption in some regions.

What opportunities exist in the Global Mobile C-arm Market?

Opportunities in the Global Mobile C-arm Market include the development of new technologies such as hybrid imaging systems and the expansion of applications in various medical fields, including orthopedics and cardiology. Furthermore, increasing investments in healthcare infrastructure present significant growth potential.

What trends are shaping the Global Mobile C-arm Market?

Trends shaping the Global Mobile C-arm Market include the integration of artificial intelligence for enhanced imaging capabilities and the growing demand for portable imaging solutions. Additionally, there is a trend towards the development of more compact and user-friendly designs to improve accessibility in various healthcare settings.

Global Mobile C-arm Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed C-arms, Mobile C-arms, Mini C-arms, High-Frequency C-arms |

| End User | Hospitals, Surgical Centers, Diagnostic Imaging Centers, Orthopedic Clinics |

| Technology | Fluoroscopy, Digital Radiography, Computed Tomography, 3D Imaging |

| Application | Orthopedics, Cardiology, Pain Management, Urology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Mobile C-arm Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at