444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Global Guaranteed Asset Protection (GAP) Insurance market is experiencing significant growth and is poised to expand further in the coming years. GAP Insurance, also known as Guaranteed Auto Protection or Guaranteed Asset Protection, is a specialized form of insurance that covers the difference between the actual cash value of a vehicle and the amount still owed on the auto loan or lease in the event of theft, accident, or total loss. This type of insurance provides financial protection to vehicle owners, ensuring they are not left with a significant financial burden if their vehicle is declared a total loss.

Meaning

GAP Insurance acts as a safety net for individuals who have purchased or leased a vehicle. It is designed to bridge the gap between the vehicle’s actual value and the outstanding balance on the loan or lease agreement. In the event of theft or a severe accident leading to total loss, traditional auto insurance policies typically only cover the actual cash value of the vehicle at the time of loss. This can often be lower than the amount owed on the loan or lease, leaving the vehicle owner responsible for paying the remaining balance. GAP Insurance protects against such financial risks.

Executive Summary

The Global GAP Insurance market has witnessed substantial growth in recent years due to increasing consumer awareness about the benefits of this insurance coverage. The market is driven by factors such as the rising number of vehicle purchases, the growing demand for auto loans and leases, and the increasing occurrence of accidents and vehicle thefts. Additionally, favorable government regulations and the availability of various distribution channels, including auto dealerships and insurance companies, have contributed to the market’s expansion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Global GAP Insurance market is characterized by intense competition among market players. Insurance companies, auto dealerships, and specialized GAP Insurance providers vie for market share by offering competitive pricing, innovative product features, and superior customer service. The market is influenced by factors such as changing consumer preferences, economic conditions, regulatory developments, and technological advancements.

Regional Analysis

The Global GAP Insurance market can be segmented into various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe dominate the market due to the high vehicle ownership rates, strong consumer awareness, and well-established insurance sectors. The Asia Pacific region is expected to witness significant growth due to increasing vehicle sales, rising disposable incomes, and growing awareness about insurance coverage.

Competitive Landscape

Leading companies in the Global Guaranteed Asset Protection (GAP) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Type of Coverage

By Distribution Channel

By Vehicle Type

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the GAP Insurance market can benefit in several ways:

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Global GAP Insurance market. The automotive industry experienced a downturn due to lockdowns, travel restrictions, and economic uncertainties, leading to a decline in vehicle sales. As a result, the demand for GAP Insurance was temporarily affected. However, with the gradual recovery of the automotive sector and the resumption of vehicle purchases, the market is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Global GAP Insurance market is expected to witness steady growth in the coming years. Factors such as increasing vehicle sales, the growing popularity of auto financing options, and rising consumer awareness about the benefits of GAP Insurance will drive market expansion. The adoption of connected car technology and the increasing demand for electric vehicles present additional growth opportunities. However, market players need to address challenges such as lack of awareness and price sensitivity to fully capitalize on the market’s potential.

Conclusion

The Global Guaranteed Asset Protection (GAP) Insurance market is witnessing substantial growth driven by factors such as increasing vehicle sales, growing auto financing options, and rising awareness among consumers. The market offers significant opportunities for industry participants and stakeholders. However, challenges such as lack of awareness and price sensitivity need to be addressed. Embracing technology, expanding distribution channels, and offering innovative product features will be crucial for market players to stay competitive and capitalize on future growth prospects. Overall, the future outlook for the GAP Insurance market is positive, with steady expansion expected in the years to come.

What is Guaranteed Asset Protection (GAP) Insurance?

Guaranteed Asset Protection (GAP) Insurance is a type of insurance that covers the difference between the amount owed on a vehicle and its actual cash value in the event of a total loss. This insurance is particularly beneficial for individuals who finance or lease their vehicles, as it helps protect against financial loss.

What are the key players in the Global Guaranteed Asset Protection (GAP) Insurance market?

Key players in the Global Guaranteed Asset Protection (GAP) Insurance market include companies like Allianz, Aon, and Zurich Insurance Group, which offer various GAP insurance products tailored to different consumer needs, among others.

What are the growth factors driving the Global Guaranteed Asset Protection (GAP) Insurance market?

The growth of the Global Guaranteed Asset Protection (GAP) Insurance market is driven by increasing vehicle sales, rising consumer awareness about financial protection, and the growing trend of vehicle financing and leasing. These factors contribute to a higher demand for GAP insurance among consumers.

What challenges does the Global Guaranteed Asset Protection (GAP) Insurance market face?

The Global Guaranteed Asset Protection (GAP) Insurance market faces challenges such as regulatory changes, competition from alternative insurance products, and consumer skepticism regarding the necessity of GAP insurance. These factors can hinder market growth and consumer adoption.

What opportunities exist in the Global Guaranteed Asset Protection (GAP) Insurance market?

Opportunities in the Global Guaranteed Asset Protection (GAP) Insurance market include the potential for product innovation, expansion into emerging markets, and the integration of technology to enhance customer experience. These factors can help insurers attract a broader customer base.

What trends are shaping the Global Guaranteed Asset Protection (GAP) Insurance market?

Trends shaping the Global Guaranteed Asset Protection (GAP) Insurance market include the increasing use of digital platforms for policy purchase and management, a focus on customer-centric services, and the rise of bundled insurance products that include GAP coverage. These trends reflect changing consumer preferences and technological advancements.

Global Guaranteed Asset Protection (GAP) Insurance market

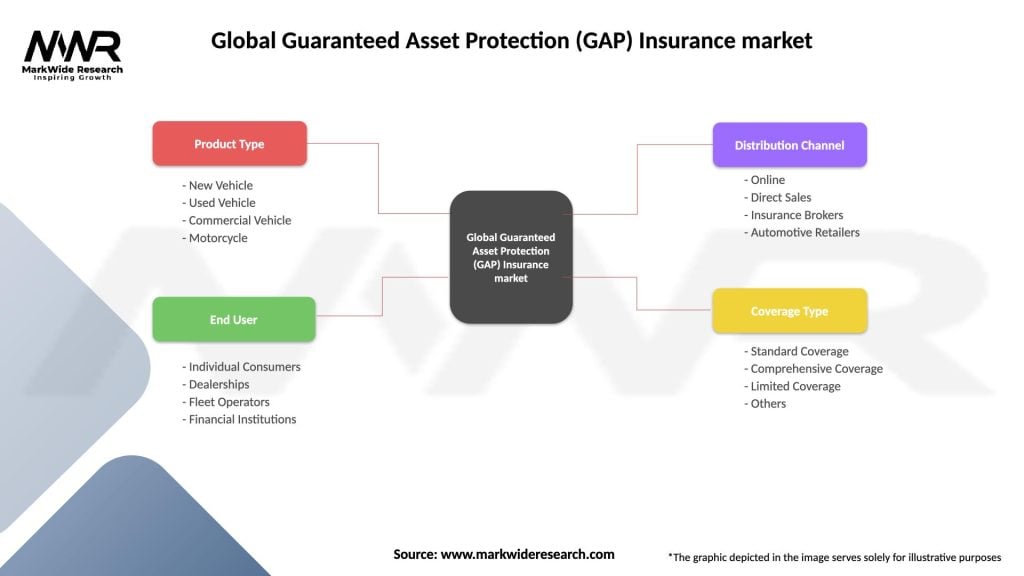

| Segmentation Details | Description |

|---|---|

| Product Type | New Vehicle, Used Vehicle, Commercial Vehicle, Motorcycle |

| End User | Individual Consumers, Dealerships, Fleet Operators, Financial Institutions |

| Distribution Channel | Online, Direct Sales, Insurance Brokers, Automotive Retailers |

| Coverage Type | Standard Coverage, Comprehensive Coverage, Limited Coverage, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Guaranteed Asset Protection (GAP) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at