444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global gold potassium cyanide market has witnessed significant growth in recent years. Gold potassium cyanide, also known as GPC, is a key compound used in the electroplating industry for gold plating applications. It is widely utilized in various industries, including jewelry manufacturing, electronics, and automotive, due to its exceptional properties and benefits. This comprehensive analysis explores the market dynamics, key trends, competitive landscape, and future outlook of the global gold potassium cyanide market.

Gold potassium cyanide is a yellowish crystalline powder that is highly soluble in water. It is formed by combining gold, potassium, and cyanide, resulting in a stable and easily manageable compound. GPC serves as a source of gold ions during the electroplating process, ensuring a uniform and durable gold coating on different surfaces. This compound is widely used in the jewelry industry to enhance the aesthetics and durability of gold-plated ornaments.

Executive Summary

The executive summary provides a concise overview of the global gold potassium cyanide market. It highlights the key market insights, such as market drivers, restraints, and opportunities, while summarizing the competitive landscape and segmentation of the market. The executive summary aims to provide a quick glimpse into the market analysis for industry participants and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Consumption Trends: Global cyanide consumption for gold leaching exceeds 80,000 metric tons annually, with potassium cyanide representing approximately 25% of total usage due to its efficacy in niche applications.

Price Correlation: KCN prices closely follow sodium cyanide pricing, with a typical premium of 10–15% reflecting higher raw material and manufacturing costs.

Ore-Specific Demand: High-silica and preg-robbing ore types often require KCN for superior dissolution rates.

Recycling Growth: Cyanide recovery units reduce fresh reagent requirements by up to 30%, making KCN more attractive in high-consumption mines.

Regulatory Impact: Adoption of ICMC protocols has risen above 70% of gold producers, influencing KCN handling and monitoring practices.

Market Drivers

High Gold Prices: Elevated gold prices stimulate new and expanded mining projects, increasing cyanide demand.

Gold Recycling: Growth in electronic waste recycling drives demand for KCN in secondary gold recovery.

Operational Efficiency: Faster leaching kinetics of KCN reduce contact times and energy consumption, appealing to high-throughput operations.

Cyanide Management Code: ICMC certification encourages suppliers and users to adopt safer supply chains and detox processes, broadening KCN acceptance.

On-site Production: Modular KCN plants at mine sites reduce transportation risk and ensure continuous reagent availability.

Market Restraints

Toxicity Concerns: Acute human and ecological toxicity of cyanide demands rigorous safety, limiting use in regions with stringent environmental policies.

Cost Premium: Higher production and handling costs relative to NaCN can deter price-sensitive operations.

Complex Logistics: Secure transport under UN Hazard Class 6.1 regulations increases logistical complexity and expense.

Alternative Technologies: Emerging non-cyanide leaching methods (e.g., thiosulfate, glycine) pose long-term threats to cyanide usage.

Regulatory Variability: Differing national permitting and disposal requirements complicate global supply strategies.

Market Opportunities

Detoxification Additives: Development of biocatalytic and chemical reagents to neutralize residual cyanide opens new service offerings.

Hybrid Leaching Circuits: Integration of KCN with cyanide-free pre-treatment steps can optimize recovery and reduce overall cyanide consumption.

Emerging Mining Regions: Expansion of gold mining in Africa and South America creates demand for KCN supply and support services.

E-Waste Recovery: Growth in mobile phone and electronics recycling for gold recovery utilizes small-scale KCN-based circuits.

Cyanide Monitoring: Real-time on-line cyanide analyzers present value-added opportunities alongside KCN sales.

Market Dynamics

Vertical Integration: Some miners secure KCN supply by investing in joint-venture cyanide production facilities.

Sustainability Mandates: Mine operators increasingly require zero discharge or full reclaim of cyanide, driving adoption of KCN with closed-loop systems.

Price Volatility: Fluctuations in raw material (hydrogen cyanide) supply impact reagent pricing and contract stability.

Technology Licensing: Proprietary cyanidation catalysts and detox technologies create differentiated value propositions.

Digital Traceability: Blockchain-based tracking of KCN batches enhances compliance reporting and stakeholder confidence.

Regional Analysis

North America: Mature market with robust safety oversight; KCN used primarily in specialized ore treatments and smaller metallurgical plants.

Latin America: Significant growth in KCN usage in large-scale open-pit mines in Peru, Mexico, and Argentina, often combined with NaCN in hybrid circuits.

Africa: Rapidly expanding gold sector in Ghana, South Africa, and Mali drives demand despite regulatory challenges.

Asia Pacific: Australia leads with advanced cyanide management practices; Southeast Asian artisanal and small-scale mines present growth potential with introduction of safer KCN.

Europe & CIS: Modest consumption focused on recycling plants and legacy mining operations; strict EU environmental directives limit expansion.

Competitive Landscape

Leading Companies in the Global Gold Potassium Cyanide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

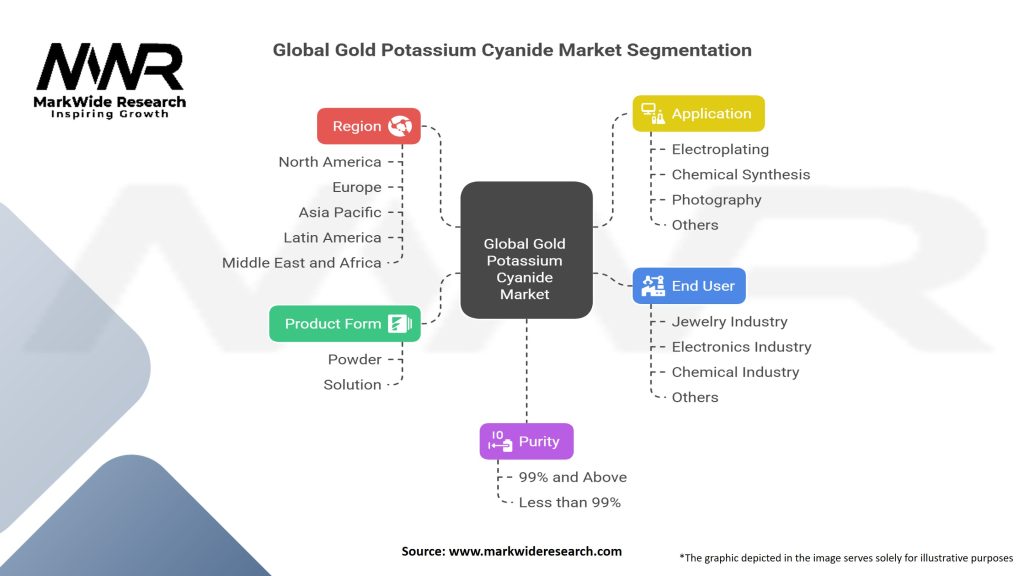

Segmentation

The global gold potassium cyanide market can be segmented based on product type, application, and end-use industry. By product type, the market can be divided into solid and liquid forms. In terms of application, the market encompasses gold plating, electroforming, and electroplating. The end-use industries for gold potassium cyanide include jewelry manufacturing, electronics, automotive, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The global gold potassium cyanide market experienced a moderate impact due to the COVID-19 pandemic. Disruptions in the supply chain, temporary shutdowns of manufacturing units, and reduced consumer spending affected the market growth. However, as economies recover and industries resume operations, the market is expected to regain momentum.

Key Industry Developments

Orica inaugurated a new on-site cyanide production plant in Western Australia (2022), capable of producing both NaCN and KCN with zero-emission hydrogen feedstock.

Cyanco launched a modular cyanide recovery skid unit (2023) enabling mid-tier mines to implement closed-loop cyanide circuits.

EOS Cyanide achieved ICMC recertification across its African operations (2021), expanding service offerings in Ghana and Tanzania.

Hue Daeng Cyanide introduced high-purity KCN flakes (2024) tailored for electronic scrap gold recovery, reducing impurities by 30%.

Analyst Suggestions

Future Outlook

The global gold potassium cyanide market is poised for steady growth in the coming years. Factors such as increasing demand for gold-plated products, advancements in electroplating technologies, and the expansion of end-use industries will drive market growth. However, market players need to address environmental concerns and adapt to changing regulations to ensure sustainable growth.

Conclusion

The global gold potassium cyanide market offers lucrative opportunities for industry participants and stakeholders. The market is driven by the demand for gold-plated jewelry, electronics, and automotive components. By embracing technological advancements, focusing on sustainability, and understanding market dynamics, companies can thrive in this competitive landscape. Continued innovation and strategic collaborations will be key to capturing market share and meeting the evolving needs of consumers.

What is Gold Potassium Cyanide?

Gold Potassium Cyanide is a chemical compound used primarily in the electroplating and mining industries for gold extraction. It serves as a source of cyanide ions, which are essential in the gold recovery process.

Who are the key players in the Global Gold Potassium Cyanide Market?

Key players in the Global Gold Potassium Cyanide Market include Cyanco, Orica, and Aurorra Gold among others. These companies are involved in the production and supply of gold potassium cyanide for various applications.

What are the main drivers of the Global Gold Potassium Cyanide Market?

The main drivers of the Global Gold Potassium Cyanide Market include the increasing demand for gold in electronics and jewelry, as well as the growth of the mining sector. Additionally, advancements in extraction technologies are boosting market growth.

What challenges does the Global Gold Potassium Cyanide Market face?

The Global Gold Potassium Cyanide Market faces challenges such as regulatory restrictions on cyanide use due to environmental concerns and safety issues. These factors can hinder production and increase operational costs for manufacturers.

What opportunities exist in the Global Gold Potassium Cyanide Market?

Opportunities in the Global Gold Potassium Cyanide Market include the development of safer and more efficient extraction methods and the expansion of applications in the electronics industry. Additionally, increasing gold prices may drive further demand.

What trends are shaping the Global Gold Potassium Cyanide Market?

Trends shaping the Global Gold Potassium Cyanide Market include a shift towards sustainable mining practices and the adoption of innovative technologies for gold recovery. There is also a growing focus on reducing the environmental impact of cyanide use.

Global Gold Potassium Cyanide Market:

| Segmentation | Details |

|---|---|

| Product Form | Powder, Solution |

| Purity | 99% and Above, Less than 99% |

| Application | Electroplating, Chemical Synthesis, Photography, Others |

| End User | Jewelry Industry, Electronics Industry, Chemical Industry, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Gold Potassium Cyanide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at