444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global gallium oxide market is witnessing significant growth and is expected to expand at a steady pace in the coming years. Gallium oxide, also known as gallium sesquioxide, is a wide-bandgap semiconductor material that has garnered immense attention in various industries due to its unique properties. It offers excellent thermal stability, high breakdown voltage, and low on-resistance, making it suitable for applications such as power electronics, optoelectronics, and sensors.

Meaning

Gallium oxide is an oxide compound of gallium, a rare element found in the Earth’s crust. It is primarily used as a semiconductor material due to its wide bandgap, which allows for efficient electron mobility. The compound has gained traction in recent years due to its exceptional properties and potential applications in various industries.

Executive Summary

The global gallium oxide market is experiencing robust growth, driven by increasing demand for power electronics and optoelectronic devices. The market is characterized by the presence of both established players and new entrants, creating a competitive landscape. Technological advancements, research and development activities, and strategic collaborations are shaping the market dynamics and driving innovation in gallium oxide-based products.

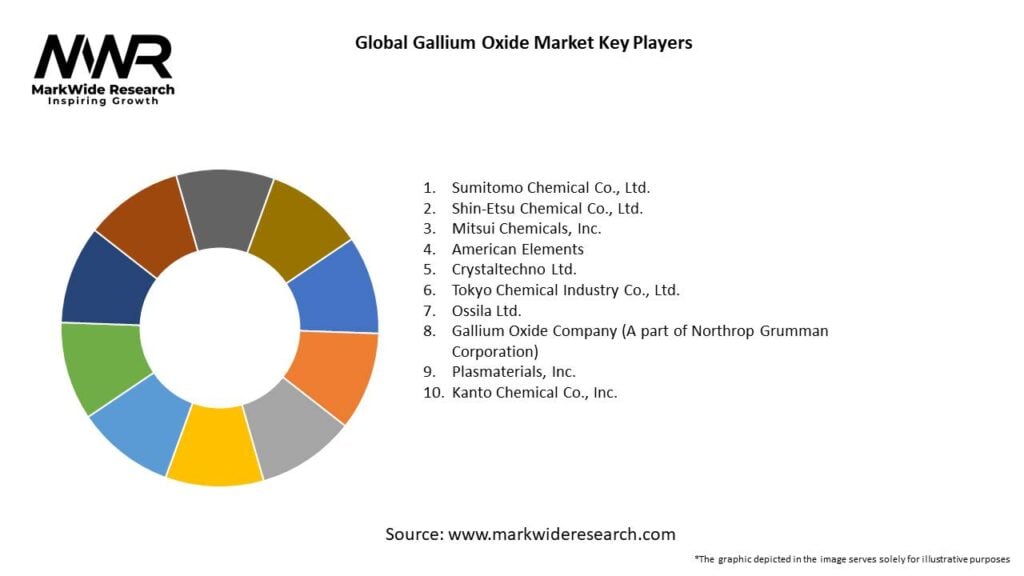

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The gallium oxide market is driven by several key factors:

Market Restraints

Despite the positive market outlook, there are certain challenges that hinder the growth of the gallium oxide market:

Market Opportunities

The gallium oxide market presents several opportunities for growth and innovation:

Market Dynamics

The gallium oxide market is driven by various dynamics, including technological advancements, changing consumer preferences, regulatory landscape, and competitive forces. These dynamics influence market growth, innovation, and the overall business environment within the gallium oxide industry.

Technological advancements play a pivotal role in shaping the gallium oxide market. Ongoing research and development activities aim to improve the performance of gallium oxide-based devices, reduce manufacturing costs, and expand their applications into new sectors. Innovations in fabrication techniques, such as metal-organic chemical vapor deposition (MOCVD) and molecular beam epitaxy (MBE), have contributed to the commercialization of gallium oxide-based devices.

Changing consumer preferences and the demand for energy-efficient and high-performance electronic products are driving the adoption of gallium oxide-based devices. Consumers are increasingly inclined toward products that offer superior performance, reliability, and energy efficiency. This trend has prompted manufacturers to focus on developing gallium oxide-based devices that meet consumer expectations.

The regulatory landscape also plays a crucial role in the gallium oxide market. Regulatory standards and certifications ensure the safety, quality, and reliability of gallium oxide-based devices. Compliance with regulations, such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), is essential for market participants to gain a competitive edge and meet customer requirements.

The gallium oxide market is highly competitive, with both established players and new entrants striving to gain a significant market share. Companies are investing in research and development activities, expanding their production capacities, and adopting strategies such as mergers and acquisitions to strengthen their market position. The competition fosters innovation, encourages product differentiation, and offers customers a wide range of options.

Regional Analysis

The gallium oxide market is analyzed across various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The Asia Pacific region dominates the global market and is expected to maintain its leading position during the forecast period.

Asia Pacific’s dominance can be attributed to several factors. The region is home to key semiconductor manufacturers, particularly in countries like China, Japan, and South Korea. These countries have a robust electronics industry and are witnessing increasing investments in advanced technologies. The growing demand for consumer electronics, electric vehicles, and renewable energy systems in the region drives the adoption of gallium oxide-based devices.

North America and Europe also contribute significantly to the gallium oxide market. These regions have a strong focus on technological advancements and innovationand host several prominent players in the semiconductor industry. The presence of well-established research institutions and favorable government initiatives further support market growth in these regions.

Latin America and the Middle East and Africa are emerging markets for gallium oxide. The increasing industrialization, infrastructure development, and investments in sectors such as automotive, aerospace, and defense are expected to drive the demand for gallium oxide-based devices in these regions.

Competitive Landscape

Leading Companies in the Global Gallium Oxide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The gallium oxide market can be segmented based on product type, application, and region.

By product type, the market can be segmented into:

By application, the market can be segmented into:

Based on region, the market can be segmented into:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the gallium oxide market can benefit in several ways:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of the gallium oxide market provides insights into the internal and external factors that impact the industry:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The gallium oxide market is influenced by several key trends that shape its growth and development:

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the gallium oxide market:

Overall, while the pandemic had temporary disruptions, the long-term growth drivers for the gallium oxide market remain intact, and the market is expected to recover and continue its growth trajectory in the post-pandemic period.

Key Industry Developments

The gallium oxide market has witnessed several key industry developments in recent years:

Analyst Suggestions

Based on the market analysis, industry experts and analysts make the following suggestions:

Future Outlook

The future of the gallium oxide market looks promising, with steady growth expected in the coming years. The increasing demand for power electronics, optoelectronics, and sensing applications, coupled with technological advancements, will drive market expansion. As research and development activities continue to enhance the performance of gallium oxide-based devices, cost reductions and standardization efforts will facilitate mass production and wider market adoption. Emerging applications in aerospace, defense, and renewable energy sectors present significant growth opportunities. The Asia Pacific region is expected to maintain its dominance in the gallium oxide market, driven by the presence of major semiconductor manufacturers and increasing investments in advanced technologies. However, other regions, such as North America and Europe, will also contribute significantly to the market growth.

Conclusion

The global gallium oxide market is poised for significant growth, driven by increasing demand for power electronics, optoelectronics, and sensing applications. Gallium oxide-based devices offer superior performance characteristics, including high breakdown voltage, low on-resistance, and thermal stability, making them ideal for various industries. Despite challenges such as high manufacturing costs and limited standardization, the market presents numerous opportunities for industry participants and stakeholders. Emerging applications in aerospace, defense, and renewable energy sectors, along with collaborations and partnerships, will drive innovation and market expansion. As the world recovers from the Covid-19 pandemic, the gallium oxide market is expected to regain momentum and continue its growth trajectory. Investments in research and development, cost reduction strategies, and market awareness initiatives will be crucial for industry players to capitalize on the market’s potential and stay ahead in the competitive landscape.

What is Gallium Oxide?

Gallium Oxide is a semiconductor material known for its wide bandgap properties, making it suitable for high-power and high-frequency applications. It is increasingly used in power electronics, optoelectronics, and UV photodetectors.

What are the key players in the Global Gallium Oxide Market?

Key players in the Global Gallium Oxide Market include companies like Nikkiso Co., Ltd., Kyma Technologies, and Nanosys, among others. These companies are involved in the production and development of gallium oxide materials for various applications.

What are the growth factors driving the Global Gallium Oxide Market?

The Global Gallium Oxide Market is driven by the increasing demand for efficient power electronics, advancements in semiconductor technology, and the growing adoption of gallium oxide in electric vehicles and renewable energy systems.

What challenges does the Global Gallium Oxide Market face?

The Global Gallium Oxide Market faces challenges such as high production costs, limited availability of raw materials, and competition from alternative semiconductor materials like silicon carbide and gallium nitride.

What opportunities exist in the Global Gallium Oxide Market?

Opportunities in the Global Gallium Oxide Market include the expansion of applications in high-voltage devices, the development of new manufacturing techniques, and the increasing focus on energy-efficient technologies across various industries.

What trends are shaping the Global Gallium Oxide Market?

Trends in the Global Gallium Oxide Market include the rise of electric vehicles, advancements in UV light-emitting devices, and ongoing research into the material’s potential for next-generation electronic applications.

Global Gallium Oxide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single Crystal, Polycrystalline, Amorphous, Thin Film |

| End User | Electronics, Aerospace, Defense, Renewable Energy |

| Application | Power Electronics, UV Photodetectors, High-Voltage Devices, Laser Diodes |

| Technology | Molecular Beam Epitaxy, Chemical Vapor Deposition, Liquid Phase Epitaxy, Sputtering |

Leading Companies in the Global Gallium Oxide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at