444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global field-programmable gate array (FPGA) market in the telecom sector is witnessing significant growth due to the increasing demand for advanced telecommunications services. FPGAs play a crucial role in the telecom sector by providing flexibility, scalability, and reconfigurability to meet the ever-changing requirements of the industry. These programmable devices have become an integral part of modern telecommunications infrastructure, enabling efficient data processing, high-speed communication, and improved network performance.

Meaning

FPGAs, or field-programmable gate arrays, are semiconductor devices that can be programmed and reprogrammed by end-users or designers after manufacturing. Unlike application-specific integrated circuits (ASICs), which are fixed-function devices, FPGAs offer flexibility and customization options, making them ideal for various applications in the telecom sector. With FPGAs, telecom companies can adapt to evolving technologies and market demands, ensuring their networks remain up-to-date and efficient.

Executive Summary

The global FPGA market in the telecom sector is poised for significant growth in the coming years. The market is being driven by the increasing need for high-performance and low-latency telecommunications networks. FPGAs offer a unique combination of flexibility, scalability, and performance, making them an ideal choice for telecom infrastructure providers. This report provides an in-depth analysis of the market, including key market insights, drivers, restraints, opportunities, and regional analysis. The competitive landscape, segmentation, SWOT analysis, and future outlook are also covered to provide a comprehensive understanding of the market.

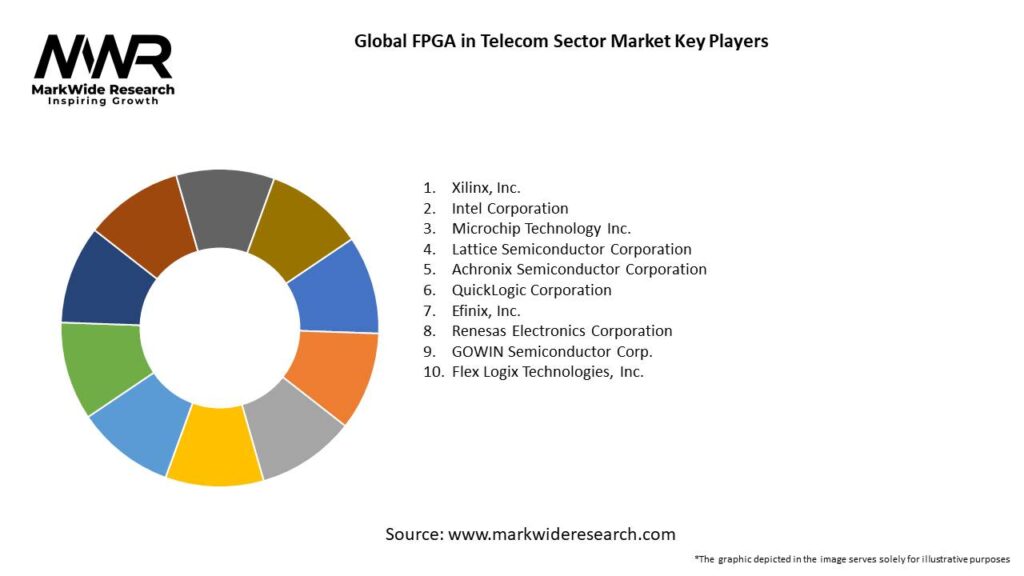

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The FPGA market in the telecom sector is characterized by intense competition and rapid technological advancements. Key market dynamics include:

Regional Analysis

The global FPGA market in the telecom sector can be segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region has its own unique market dynamics, influenced by factors such as technological advancements, regulatory landscape, and the presence of key market players.

Competitive Landscape

Leading Companies in the Global FPGA in Telecom Sector Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

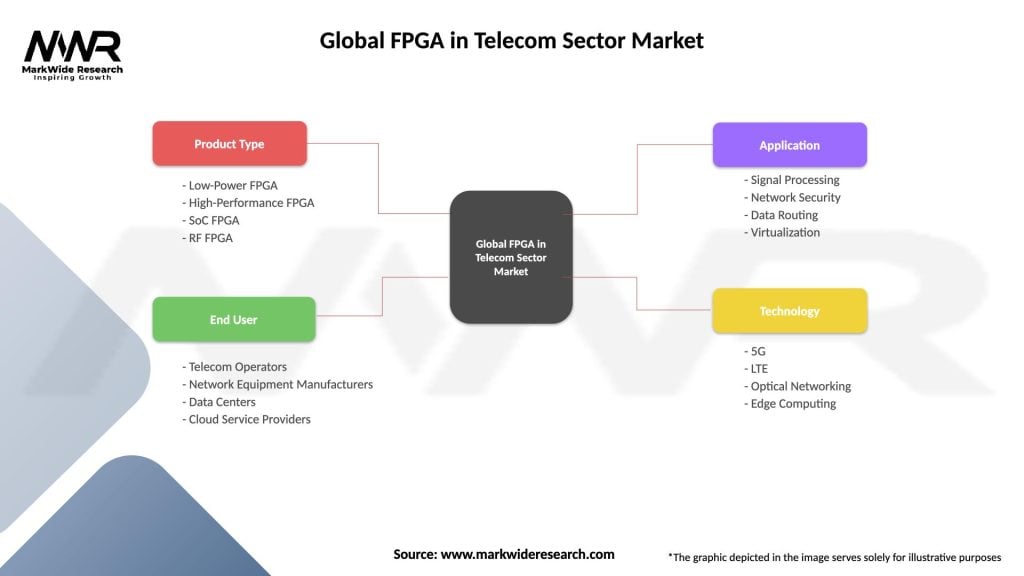

Segmentation

The FPGA market in the telecom sector can be segmented based on several factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the FPGA market in the telecom sector. While the initial phase of the pandemic caused disruptions in the global supply chain and manufacturing processes, the telecom sector witnessed an increased demand for reliable and high-speed communication services due to remote working, online education, and increased data traffic.

The pandemic highlighted the importance of resilient and robust telecom infrastructure, leading to accelerated investments in network upgrades and 5G deployment. FPGAs played a crucial role in meeting the increased demand for bandwidth and processing power during the pandemic, enabling telecom companies to maintain network performance and provide uninterrupted services.

However, the economic uncertainties caused by the pandemic resulted in budget constraints for some telecom companies, leading to delays in infrastructure investments. The impact of the pandemic on the FPGA market varied across regions, depending on the severity of the outbreak and the response of the telecom sector.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the FPGA market in the telecom sector is highly promising. The increasing demand for high-speed communication, the deployment of 5G networks, and the emergence of edge computing and IoT applications will continue to drive the adoption of FPGAs in the telecom industry. As the telecom sector evolves and embraces new technologies, such as 6G, artificial intelligence, and quantum computing, FPGAs will play a pivotal role in enabling efficient and flexible network infrastructure. FPGA manufacturers will focus on developing advanced solutions with improved performance, power efficiency, and security features to meet the evolving demands of the telecom sector.

Moreover, the collaboration between FPGA manufacturers and telecom infrastructure providers will drive innovation and accelerate the development of customized FPGA solutions tailored to specific telecom applications. Open-source FPGA tools and frameworks will further democratize FPGA development, fostering collaboration and enabling a broader range of developers to contribute to the FPGA ecosystem. In conclusion, the global FPGA market in the telecom sector is poised for significant growth, driven by the increasing demand for high-speed communication, the adoption of 5G technology, and the need for flexible and scalable network infrastructure. With their flexibility, performance, and reconfigurability, FPGAs are well-positioned to meet the evolving requirements of the telecom sector and enable efficient, reliable, and future-ready telecommunications networks.

Conclusion

The global FPGA market in the telecom sector is witnessing substantial growth and holds immense potential for the future. FPGAs offer unique advantages, such as flexibility, scalability, and high-performance data processing capabilities, which are crucial for meeting the evolving demands of the telecom industry. The market is driven by factors such as the increasing demand for high-speed communication, the adoption of 5G technology, the rise of network virtualization and SDN, advancements in FPGA technology, and the emergence of edge computing and IoT applications. While there are challenges to overcome, such as high development costs, complex design and programming requirements, competition from ASICs, and security concerns, industry participants can leverage the benefits of FPGAs to enhance their network infrastructure, improve network efficiency, and accelerate innovation.

What is FPGA in Telecom Sector?

FPGA, or Field-Programmable Gate Array, in the telecom sector refers to a type of hardware that can be programmed to perform specific functions, enabling flexibility and efficiency in telecommunications applications such as signal processing, network management, and data routing.

What are the key players in the Global FPGA in Telecom Sector Market?

Key players in the Global FPGA in Telecom Sector Market include Xilinx, Intel, and Lattice Semiconductor, which provide advanced FPGA solutions for various telecom applications, among others.

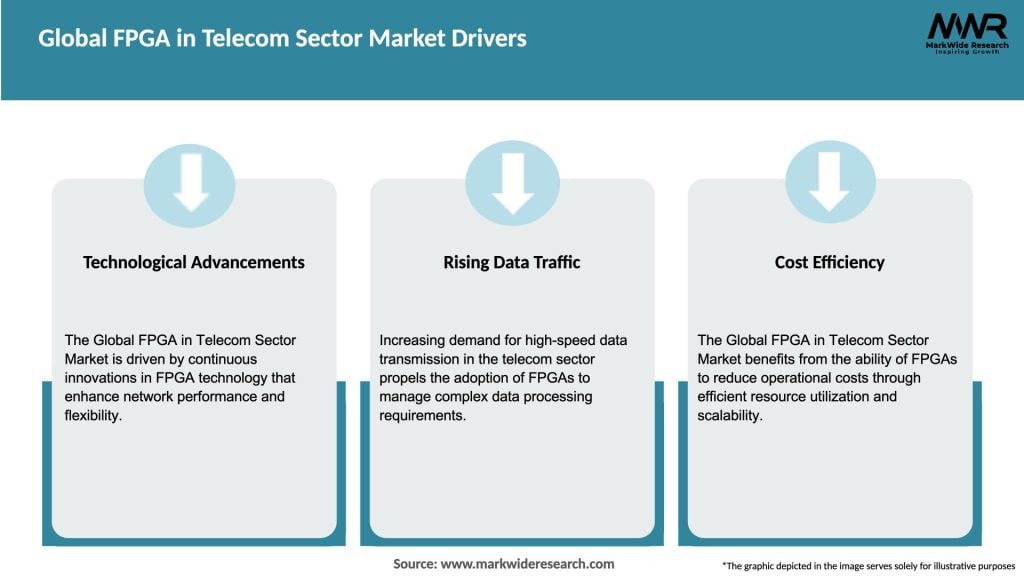

What are the growth factors driving the Global FPGA in Telecom Sector Market?

The growth of the Global FPGA in Telecom Sector Market is driven by the increasing demand for high-speed data transmission, the rise of 5G technology, and the need for efficient network infrastructure to support growing data traffic.

What challenges does the Global FPGA in Telecom Sector Market face?

Challenges in the Global FPGA in Telecom Sector Market include the high cost of FPGA development, the complexity of design processes, and competition from alternative technologies such as ASICs.

What opportunities exist in the Global FPGA in Telecom Sector Market?

Opportunities in the Global FPGA in Telecom Sector Market include the expansion of IoT applications, advancements in AI and machine learning integration, and the growing need for customizable hardware solutions in telecom networks.

What trends are shaping the Global FPGA in Telecom Sector Market?

Trends shaping the Global FPGA in Telecom Sector Market include the increasing adoption of software-defined networking (SDN), the integration of FPGAs with cloud computing, and the push towards more energy-efficient designs.

Global FPGA in Telecom Sector Market

| Segmentation Details | Description |

|---|---|

| Product Type | Low-Power FPGA, High-Performance FPGA, SoC FPGA, RF FPGA |

| End User | Telecom Operators, Network Equipment Manufacturers, Data Centers, Cloud Service Providers |

| Application | Signal Processing, Network Security, Data Routing, Virtualization |

| Technology | 5G, LTE, Optical Networking, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global FPGA in Telecom Sector Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at